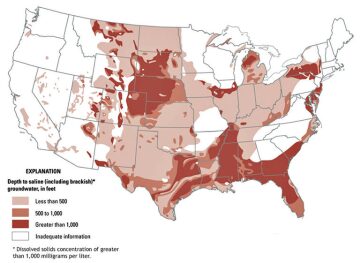

Although the oil and gas boom in the United States owes much of its success to the abundance of cheap sources of fresh water, the status quo is beginning to change. Groundwater remains the main source of water for most onshore exploration and production companies; however, they are increasingly investing in produced and flowback water-treatment technologies. Many of the same companies are also turning to brackish water sources in places where freshwater aquifers are becoming depleted, such as the Permian Basin that spans west Texas and eastern New Mexico. Brackish water, sometimes called fossil water, has less salt content than seawater, making it cheaper to treat, and is typically found in the same areas where hydrocarbons are developed.

The Fasken Oil and Ranch in Midland, Texas, relies on produced-water recycling and brackish water for nearly all of its oil and gas operations at its primary operating area. In August, a larger operator in the area called to buy produced water from Fasken, said Jimmy Davis, operations manager at the family-owned oil company.

The friendly request exemplifies the increasingly desperate water situation that oil companies are facing in the Permian Basin, one of the most productive onshore area in North America. “They are in a fix for water,” Davis said. “I am starting to hear that over and over. What we are doing out here as an industry is using water to frac, and we are in a drought-stricken area so you have to find other means than fresh water to meet those needs.”

Based on the number of inquiries and activity that he is seeing from neighboring companies, Davis said he predicts that over the next few years, a majority of Permian Basin operators will turn to brackish and produced water as their primary sources. “If you are going to continue to frac like we are, that is what you are going to have to do to sustain it,” he said.

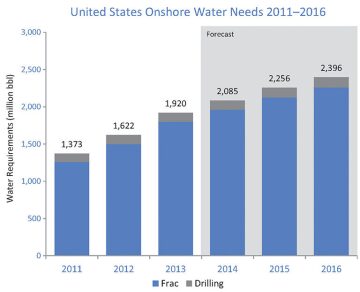

According to a market analysis report by Houston-based PacWest Consulting, onshore oil and gas companies in the United States spent USD 20.1 billion last year on water-management services. While only 4% of the spending was for water treatment, if projections hold true, then this year will mark the turning point. The report said that water treatment represents the smallest yet fastest growing segment of the water-management market with a forecast of 23% growth each year to USD 1.3 billion by 2016. “Prevailing drought conditions and long-term sustainability of freshwater sources is expected to steadily increase demand for treatment services,” the report concluded.

Pioneer Natural Resources, which estimates that it has more than 10 billion BOE of reserves in west Texas, finalized a deal in August with the cities of Midland and Odessa, Texas, to purchase between 340,000 and 360,000 B/D of municipal waste water. Neither of the two cities, which constitute the heart of the Permian Basin, treats its waste water for consumption, so Pioneer is not competing with the public for a freshwater source. A primary benefit of using municipal waste water is that it is essentially fresh water with only solids, biological matter, and traces of pharmaceutical chemicals that need to be removed.

Scott Sheffield, chairman and chief executive officer of Pioneer, told investors that his company will need up to 1 million B/D of water over the next 10 years. “This goes a long way to securing water sources that are non fresh,” he said in August. “Eventually, we want to be (using) over 75%—over the next several years—non fresh water sources.” To further supplement its water needs, Pioneer also recently began taking in almost 60,000 B/D from brackish wells for part of its Permian Basin operations.

Also in August, the Texas Railroad Commission, the state’s oil and gas regulator, hosted a water conservation and recycling symposium at which participating companies reported a collective water recycling capacity of 1.5 million B/D. The production companies that presented at the event included Pioneer, Apache, Laredo Petroleum, and Fasken.

“Due to the drought our state is currently experiencing, the importance of water conservation and scrutiny over water usage continues to grow, and the industry is doing their part in conserving this precious resource,” said Texas Railroad Commissioner Christi Craddick. “We know that industry technology in water recycling is changing the way energy is developed in Texas.”

In a subsequent press interview, Craddick said she expects some oil companies in Texas to end their use of fresh water within 5 years. “I think that’s not an unrealistic number, at least for the large companies,” she said.

Old Ranch, New Reality

Oil production from the Permian Basin was expected to reach 1.72 million B/D by September, an increase of 38,000 B/D from the previous month. And as the boom continues, so does the historic drought that began in 2010. The lack of rain and continued use of water for drinking, irrigation, and oilfield activity has left many west Texas aquifers at their lowest levels ever. The situation has caused many companies to rethink where they are getting their water from.

At the 101-year-old Fasken ranch, freshwater scarcity has been a fact of life since its founding in 1913. Oil was first discovered on the 165,000-acre ranch in the 1940s and remains the core business of the family-run company that also leases its land for cattle grazing. The family is noted as owning the 25th largest land holdings in the US, counting additional properties in south Texas. But recently, the company has made headlines for its decision last summer to begin ending its reliance on fresh water for its drilling and completion operations and invest in new water-treatment technology. For Fasken, profitability was not a driver.

“We wanted to discontinue using fresh water, mainly because there is not that much fresh water on the ranch,” said Davis. “We wanted to preserve what water we have for the future generations that will inhabit the ranch.”

To operate four drilling rigs and complete two hydraulic fracturing jobs each week, the work crews need roughly 19,000 B/D of water. Davis said his company is meeting almost all of the demand on two fronts: a leased system recycles produced water from the ranch’s nearly 450 operating wells, and a newly installed system, also leased, treats brackish well water from a formation found 1,100 ft to 1,500 ft deep.

So far, more than 50 vertical wells have been hydraulically fractured at the ranch using the recycled produced water with no reported problems. By the end of the year, the company expects that it will have reached its goal of zero freshwater use for all of its oil and gas operations. A small amount of fresh water is still used to support operations in the most remote part of the ranch. Companies that adopted water-treatment technology, such as Fasken, have discovered that the solution does not merely involve one system, but layers of treatment and filtration systems.

To reuse produced water, Fasken first treats it with chlorine dioxide, an iron-oxidizing agent, to aid in the separation of oil and water and control bacterial growth. The water is then run through an electrocoagulation system that removes any remaining solids before it is moved into settling tanks. After the heavier solids sink to the bottom, the treated water is stored in a 120,000-bbl capacity pit as it waits to be used for hydraulic fracturing.

The company pays a fee of about USD 1.50 to USD 1.75 per barrel of treated produced water to the equipment owner. Davis said that it is more expensive than fresh water, but not by much. However, the brackish-water system is treating water for less than half of what it costs to treat the produced water. He said this cost savings is leading the company to study how it can use brackish water exclusively. A recent switch to a more robust membrane unit makes it possible to use treated brackish water for cementing jobs that require very low salinity.

To treat the brackish water, the ranch uses a nanofiltration system that has also been used in Africa to treat water for human consumption. Nanofiltration is a membrane technology that is most applicable for fluids with low solid content and uses pores a little larger than the membranes used in reverse osmosis. The main contaminant that nanofiltration removes before the water can be used as a fracturing fluid is sulfites, which lead to scaling. A primary consideration with the brackish water involves the waste stream. About 25% of the water is rejected and must be pumped down a disposal well.

Fasken has a distinct advantage over some of its competitors in the area when it comes to water-treatment infrastructure. With more than 250 sq miles of contiguous land, the company runs its own pipeline network that brings produced water to the treatment site and it owns its disposal well. This eliminates disposal well costs, which Davis said are around USD 1 per bbl, and it means the company does not have to pay a third party to haul the water to a disposal site, which can cost between USD 85 and USD 100 per hour for a truck that can only carry 120 bbl at a time.

“For this to work most efficiently, you have to have a big enough area to produce from,” Davis said. “For the smaller operators, this is hard to do because most times, we in the oil business may have a square mile or section of land leases here and then it could be 10 miles away to the next lease.”

Still Testing Technology

Richard Crawford has been involved in water treatment for more than 20 years and is a production engineer on Concho Resources’ freshwater-management team in New Mexico. He has helped review water-treatment technologies that will allow Concho, a producer of shale plays in Texas and New Mexico, to use produced water instead of fresh water for hydraulic fracturing. Echoing the convictions of Fasken, Crawford described his company’s efforts to find produced-water solutions as driven by its responsibility to local stakeholders and conservation, rather than by economics. “We are trying to be good stewards of the community” and the environment, he said. “That is really the big push behind this. If you are looking for a financial win, it is going to be tough.”

Crawford explained that of the long list of water technologies that he has worked with or researched, none is price-competitive to fresh water—that is when it can be found. “Fresh water is becoming rarer and more difficult to obtain,” he said.

Going down the list, Crawford said he has tested systems, such as mechanical vapor recompression, sonic ionization, and reverse osmosis membranes, and is now looking into forward osmosis. Each technology has advantages, just as each has its drawbacks. “Mechanical vapor recompression systems are great if you get a quality product,” Crawford said, “However, they are expensive, and it is a big piece of equipment. It is a full-fledged plant with a control room.”

The mechanical vapor recompression technology works by heating up the wastewater stream to the boiling point and uses a powerful vacuum to pull the water vapor into a heat exchanger in which it returns to its liquid state as clean water.

As Crawford pointed out, the downside of this technology is its size and complexity, which precludes it from being a truly mobile solution to offset hauling and infrastructure build-out costs. “They like to say it is mobile. But it has 10-in to 15-in flanges that have to hook up from one module to the next module to the next module. You are not going to move it by 4 p.m.,” if you begin at noon, he said. “My idea of mobile is, I want you (on or) off my site today.”

Some technologies are quite mobile however. Trailer-mounted electrocoagulation systems can be hooked up to special fracturing water tanks and become operational within a couple of hours. The business model for many oilfield water-treatment solutions is to charge a per-inlet-barrel fee. But the question that Crawford said vendors have trouble answering is what the real cost of treated water will be. He said some of the companies whose equipment he has tried advertised that the water can be treated for as cheap as USD 2 per bbl.

“That is on the inlet,” he said. “I do not care about that. I care about what comes out the backside.” For example, if 1,000 bbl of water goes into a treatment system and rejects 500 bbl as a waste stream, Crawford said he is only interested in the cost of the 500 bbl of usable treated water. Pricing the service this way will provide treatment companies with more incentive to improve recovery rates, he said.

Crawford also advises that before a company invests in water-treatment technology, it must have a plan for the disposal of its solid-waste stream. Calcium carbonates, sodium chloride, and sulfites are just a few of the substances that need to be removed from produced water, because they cause scaling tendencies and clogging problems downhole.

Other contaminants, such as radioactive isotopes of barium and strontium, can precipitate as solids from produced water. If concentrated through filtration systems, these normally occurring radioactive materials require hazardous disposal that can cost up to USD 550 per barrel.

Other methods of dealing with the solid waste include concentrating it into a slurry that can be taken to a disposal well site; others turn the waste into a cake that can be sold to cement plants for roadbed material. In one of its operations, Concho dilutes its concentrated waste stream with untreated produced water and injects it into a disposal well near its operations. Crawford said that when a disposal well is nearby, it improves the economics of a company’s water-treatment options.

The Future Looks Brackish

Dave Stewart, president and CEO of Stewart Environmental Consultants based in Fort Collins, Colorado, said many in the oil and gas industry are overlooking an enormous source of water from brackish wells. Stewart, who built Colorado’s first produced water treatment facility for reuse in 2001, said that the industry is suffering from increasing costs for freshwater usage and he expects this trend to only worsen.

In Texas, the top oil and gas producing state in the US, almost 800 municipal water districts have implemented rationing policies for public consumption and many have stopped selling water to oil and gas companies altogether. Stewart said that scarcity and state-imposed restrictions on water usage in New Mexico mean that even brackish water is now fetching the same prices as fresh water, which can be as high as USD 3 per bbl.

“As the price goes up, you start getting farmers who stop using it for irrigation and start selling it” to oil and gas companies, he said. “Environmental groups and agricultural groups are going to fight that tooth and nail. But if you take brackish water, which nobody uses, then you avoid that argument altogether and at a price that energy companies are already paying.”

Brackish water may also be the best option in New Mexico because of its strict regulations regarding produced water, which is always treated as a hazardous material even if it is treated thoroughly. Spills of treated produced water are treated just like spills of untreated produced water and can incur fines of hundreds of thousands of dollars. The New Mexico Legislature is expected to vote on new rules that will further regulate how and where produced water treatment sites can be set up, and even what equipment should be used.

What Stewart proposes is that when companies drill a well for oil and gas production, they should consider drilling a brackish well to meet their water needs. Using inorganic aluminum-based and carbon silicate-based membranes, Stewart said companies like his are able to treat brackish water for oil and gas companies for as little as USD 0.20 to USD 0.10 per bbl. Although the figure does not include capital-recovery costs, Stewart said, “That is a very acceptable price for an energy company.”

Brackish water is cheaper to treat because it does not need to be cleaned up as much as produced water, which typically has much more solid particulates. Once the multivalent ions including scale-inducing iron or barium are removed, the solution goes through a nanofiltration system and is then ready for hydraulic fracturing use. Furthermore, Stewart pointed out that there are few regulations governing the use of brackish water, because only a few parts of the world use it for human consumption. “The brackish-water sources around the globe double our water supply,” he said. “Eventually, we are going to get into that from a municipal standpoint as well.”

Mining the Water

Stewart said one of his goals is to create zero-liquid-discharge plants in the Captain Reef basin that straddles southwest Texas and eastern New Mexico. The brackish water from the formation is saturated with gypsum and Stewart’s company is able to extract it and then sell the treated water to companies for hydraulic fracturing, as well as the gypsum.

The company also sells the brine water, a byproduct of the membrane process it uses, concentrated with sodium chloride, to industrial companies that can use it in other processes. Stewart said the key to this type of water-mining operation involves knowing the input qualities and commercial opportunities in order to use 100% of the fluids.

Texas A&M Pushing Industry to Adopt Water Technology

In an effort to guide the oil and gas industry toward water-treatment solutions, researchers from Texas A&M University have been holding a course on the challenges and technologies involved for the past 15 years. The faculty organizers said that since the shale boom began a decade ago, they have seen a marked increase in attention and experimentation from oil and gas companies. The two-day course is a research cooperative between the university’s faculty-run Global Petroleum Research Institute (GPRI) and its engineering experiment station.

David Burnett, director of technology at the GPRI, said his role as a researcher inclines him to select systems for the course that are on the cutting edge of water-treatment technologies. One cost-effective technology he has been backing for some time and is now seeing companies adopt is microfiltration, which is used to remove microorganisms and suspended solids from briny fracturing fluids. “If you remove the biologicals through microfiltration, you reduce your biocide costs by several tens of thousands of dollars, which pays for your filtration,” Burnett said.

Based on his research of the available technologies and surveys of operating companies in Texas, he is optimistic that many of them will stop using fresh water for hydraulic fracturing within 5 years. “The reason why is the regulations,” he said. “Texas has good communication among the regulators and operators and we have laws and regulations coming that incentivize water reuse and recycling, whereas other states do not.” Burnett added that he hopes that Texas will serve as a template for other states dealing with similar water issues because the pending regulations are likely to lower companies’ water costs and permitting costs, all the while eliminating competition for public resources.

The hands-on course offers vendors a chance to vet their technologies using testing systems available at Texas A&M. Carl Vavra, an assistant research scientist at Texas A&M, said that after a company called Clean Membranes was invited to present its fouling-resistant membrane in January, the company decided to carry out a pilot test with the university to evaluate its applicability for the oil field. “We have done some work here at A&M with that system and it looks very promising,” Vavra said, adding that the Clean Membrane technology is now ready to be tested in the field.

The university offers its mobile-testing unit and personnel on a commercial basis to companies that want to take their systems into the field where results often include variables not introduced in a laboratory environment. “We are really concentrating on the analytical side, which is very important,” Vavra said. “Especially when you are in the field, so you get real-time data and you are not waiting 2 weeks for the lab to tell you what you did 2 weeks ago.”

In addition to his work with the GPRI, Burnett is one of the directors of the Environmentally Friendly Drilling Program that has been promoting technology that reduces the environmental footprint of oil and gas companies since 2004. Over the decade, he said the industry has become very cognizant of environmental and water-management issues, and as a result, it has become more proactive than ever.

“That is the mind-set of the industry now, particularly from the people that guide and lead the industry,” he said. “We know we have to be a better steward of the environment, we need to be a good neighbor. Lowering the groundwater so far that someone’s well does not work is not being a good neighbor.”

Early Days for Forward Osmosis

An emerging technology receiving increased attention from the unconventional oil and gas industry is forward osmosis membranes. The combination of a forward osmosis system for advanced pretreatment and a reverse osmosis system has been shown to be a less energy-intensive process compared with a standalone reverse osmosis system. The process of forward osmosis involves moving water molecules from one side of a permeable membrane to the other using pressures as low as 10 psi—much lower than the 1,200 psi required for a high-recovery reverse osmosis system. The low pressure and inherent nature of osmosis allows forward osmosis to work with high-solid fluids and avoids membrane fouling that limits reverse osmosis.

Developed by research scientists from the Colorado School of Mines and membrane maker Hydration Technology Innovations, the Green Machine mobile unit uses forward osmosis technology developed specifically for produced and flowback water treatment. What sets it apart from other forward osmosis systems is that the membranes are so efficient that little to no pretreatment of the feed water is required.

The system was first commercialized in Louisiana’s Haynesville shale play to supply fracturing water from produced water. But it has since been mothballed by the company that licensed the technology, Emerald Surf Sciences. A company spokesperson did not specify a reason, other than to say the technology may have been ahead of its time.

The first Green Machine used only a forward osmosis system to produce a high-salinity solution that was diluted and used for fracturing. According to Hydration Technology Innovations’ website, this process is a water mass exchanger in which the forward osmosis membrane separates produced and fracturing flowback waste water from the high-salinity solution. Osmosis naturally causes the waste water to be concentrated by as much as 90%, leaving the fracturing water diluted to the desired salinity.

Despite the initial commercial setback, work is under way on the second generation of the Green Machine, which has received USD 1.7 million in funding from the Research Partnership to Secure Energy for America (RPSEA) and the United States Department of Energy. Whereas the first version of the Green Machine exclusively used a forward osmosis system, the second generation units will have conventional and proven reverse osmosis technology bolted onto the end of the treatment train.

Two newer units are being built and will be tested on a pilot scale in the DJ and Piceance shale basins in Colorado. Tzahi Cath, technical director of the project and a professor at the Colorado School of Mines, said the second generation Green Machines will be closed loop systems that provide highly purified water. “It is a very simple concept and process, without too many moving parts,” he said.

The membrane technology used in the Green Machine has been put through its paces, according to Cath. When all other technologies failed to treat a pharmaceutical company’s industrial waste water, the Green Machine technology performed strongly. When water from Utah’s Great Salt Lake was run through the machine for a company interested in extracting mineral resources from the water, the technology worked again, despite the high salinity. “We have tried a lot of different streams, and forward osmosis has worked great with relatively low clogging of the membrane,” he said.

A next step for the technology developers is to make a membrane that is more efficient yet thinner and stronger than previous generations. “It is tedious work of finding the right applications where forward osmosis works well,” Cath said. “But so far, with the oil and gas industry, it looks promising.”