A second look at the size of US shale formations is revealing they hold far more natural gas, and pushed a new name up near the top of the list: the Mancos Shale.

A recent reassessment of the formation in western Colorado concluded it holds 66 Tcf of shale gas that could be produced using current technology, making it second only to the prolific Marcellus Formation for unconventional gas in the US.

This elevates the profile of the formation, which the US Geological Survey (USGS) had previously estimated at 1.6 Tcf in 2003. The agency also recently upped its estimate for the Barnett Shale, doubling it to 53 Tcf.

“We reassessed the Mancos Shale in the Piceance Basin as part of a broader effort to reassess priority onshore US continuous oil and gas accumulations,” said Sarah Hawkins, a USGS geologist who was the lead author of the study. “In the last decade, new drilling in the Mancos Shale provided additional geologic data and required a revision of our previous assessment of technically recoverable, undiscovered oil and gas.”

Based on a growing body of data, the USGS is working on assessments of two Texas plays, the Wolfcamp in the Midland Basin, and the Eagle Ford Shale; and one in Colorado, the Niobrara in the Denver Basin.

For those drilling into the Mancos, the USGS evaluation confirms what they have been seeing.

“There has been drilling for the last 20 years and there is decades worth of drilling location left,” said David Ludlam, executive director of the West Slope Colorado Oil and Gas Association, who said the gas potential may well exceed 100 Tcf.

He said operators working there have dozens of successful exploratory wells in shale, but the current gas market does not justify development drilling. The gas sands there are commonly developed using slanted vertical wells from pad sites with multiple wells.

The USGS used data from 2,000 wells drilled since its last evaluation, as well as field work and research core analysis, to divide the formation into units with similar geologic and well production characteristics, Hawkins said. That work led to an estimate of technically recoverable reserves for the Mancos ranging from 34 Tcf to 112 Tcf, with a mean of 66 Tcf.

Glowing assessments of the gas in the ground are not fueling the sort of activity that transformed the Marcellus. Recently there were no rigs drilling in the Barnett, and 12 of the 16 wells working in Colorado were in the DJ Basin in the eastern part of the state, according to data by Energent Group, a provider of shale data.

The current dismal state of gas exploration in North America highlights the difference between the measure used by the USGS, which is the technically recoverable hydrocarbons that could be extracted using available technology, and reserves, which are the amount of hydrocarbons that can be profitably produced.

Gas prices have risen significantly, recently moving up to around USD 2.70/Mcf during the peak summer air conditioning season in the US, but that is still short of what is needed to stimulate drilling in gas-only formations.

“Not many of our companies want to be drilling when gas is USD 2.50 [per Mcf],” Ludlam said. But at USD 3.50/Mcf “the majority of our companies will be doing something.”

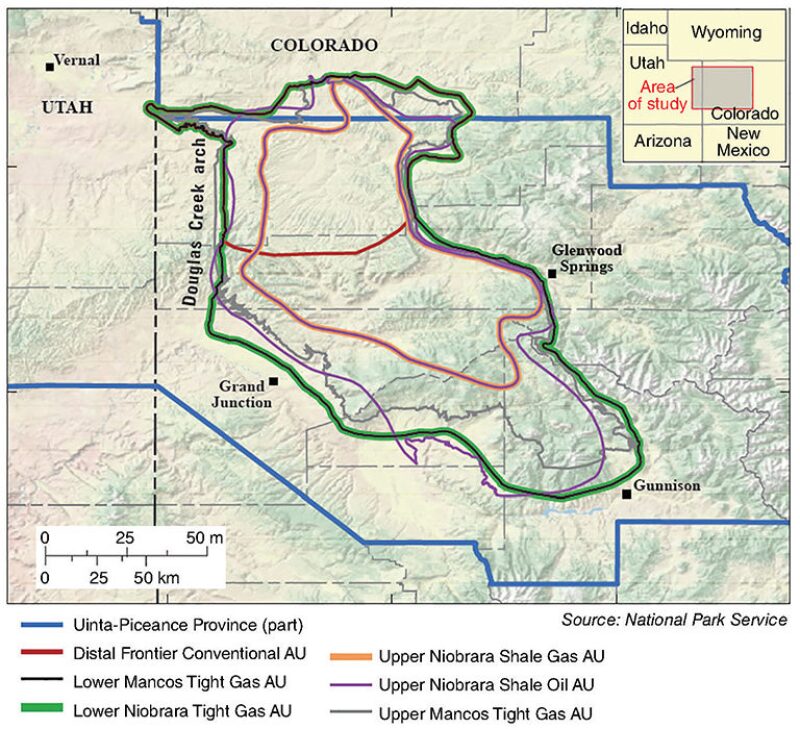

The Mancos evaluation broke the 4,000-ft thick formation into five units. The largest target is the Upper Mancos, a tight gas formation holding more than two-thirds of the gas the USGS estimates is in the ground. The smallest is the Upper Niobrara, which is the only oil-rich zone, covering 1 million acres with about 86 million bbl of technically recoverable oil.

The depth of the formation varies from as shallow as 3,000–5,000 ft to as deep as 13,000 ft, Ludlam said. While the USGS labeled three of the units as tight gas, and others shale, Hawkins said this was based on their geological history, and should not be considered an indicator of rock properties that could determine how wells are drilled and completed.

Others are now working on the more detailed maps and databases that will guide future development. “The assessment intervals defined by the USGS lump a lot of rocks together,” said Rex Cole, a geology professor at the Colorado Mesa University. Based on rock, mineral, and geochemical analysis going on at that school and at the Colorado School of Mines, he said, “A much greater amount of stratigraphic variability can be expected in each interval.”

While the Mancos rivals the Marcellus in size, it falls short on the market access available to the eastern formation that is close to New York and other major population centers.

As a result of the history of tight sands drilling in the Western Slope of the Rockies, the infrastructure is in place to gather and process gas from new wells, and the area also has access to east-west interstate pipelines, Ludlam said.

The West Slope Oil and Gas Association is seeking export markets for added gas production because supplies are plentiful in Colorado and elsewhere in the US.

Struggles with federal officials over environmental restrictions on drilling come with the territory. A large part of the area in the USGS survey is within four large national forests where development is managed by the US Forest Service.

After the USGS study concluded the Mancos held enormous gas reserves, the West Slope Oil and Gas Association and two other trade groups told the US Forest Service that it needs to revise a proposed environmental impact plan limiting drilling, because the new resources estimate shows the potential lost production is far higher than previously thought, Ludlam said.

For Further Reading

SPE-2014-1934603. Integrated Subsurface and Outcrop Sedimentological, Mineralogical, and Geochemical Characterization of Late Cretaceous Mancos Shale, Southwestern Piceance Basin, Southern Douglas Creek Arch, and Southeastern Uinta Basin, Colorado and Utah by Rex D. Cole and William C. Hood, Colorado Mesa University.

US Geological Survey. 2016. Assessment of Continuous (Unconventional) Oil and Gas Resources in the Late Cretaceous Mancos Shale of the Piceance Basin, Uinta-Piceance Province, Colorado and Utah, (accessed 01 July 2016).

US Geological Survey. 2016. USGS Estimates 66 Trillion Cubic Feet of Natural Gas in Colorado’s Mancos Shale Formation, 08 June 2016, (accessed 01 July 2016).