For an industry that is just over 50 years old, liquefied natural gas (LNG) has matured rapidly and is playing an ever-growing role in the global energy system. From the start of international trade in the 1960s, demand reached 50 MTPA in 1990, then 100 MTPA in 2000, and 240 MTPA in 2012, according to the Center for Liquefied Natural Gas (CLNG).

LNG has become the world’s fastest-growing gas supply source and is now part of an upheaval in the global energy market. Trade has quadrupled over the past two decades and is set to double over the next two. Consumption and share growth have set new records for three consecutive years. New markets for both demand and supply are developing rapidly. Liquefaction facilities and vessel fleets are expanding. Innovative and collaborative trade models are emerging. And, new technologies are being pursued to enhance LNG’s flexibility and competitiveness with other primary energy forms (Fig. 1).

LNG is not without risks. These range from project economics, fuel competition, and politics on a local, national, and global scale to partner priorities, marketing, and contractual arrangements. Given the growing world population, the rising demand for more energy, and the need to mitigate climate change, the consensus is that the long-term outlook is bullish. But, says industry technical advisor DNV GL, the sector stands at a crossroads, and the industry must adopt new thinking to address current and future needs of buyers, sellers, and consumers both globally and regionally.

What’s Behind the Growth?

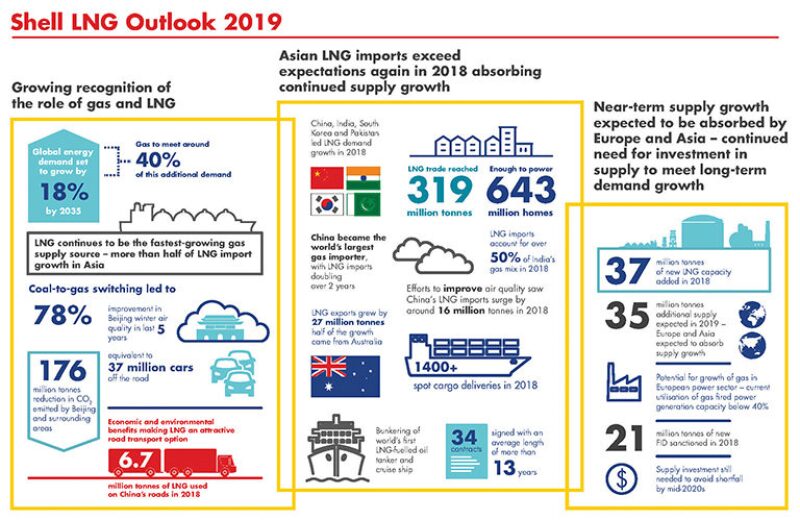

Three primary factors are behind the current wave of growth in LNG, according to the Shell 2019 LNG Outlook: the energy challenge, new countries choosing LNG for various reasons, and supply and demand.

The world’s current population of 7.6 billion people is expected to reach 8.6 billion in 2030, 9.7 billion in 2050, and 11.2 billion in 2100, according to United Nations estimates. Of today’s population, nearly one person in three either has no electricity or struggles with unreliable supplies. As the population grows and more people seek to improve their quality of life, Shell projects that, by 2070, the world is likely to use at least 50% more energy than it does today.

Natural gas has an advantage over other energy sources to meet current and future energy challenges because it is abundant, relatively clean, and cost-effective to produce. For these reasons and the role it can play in lowering carbon dioxide emissions, it is being touted as a bridge fuel to renewables as well as a foundational source of energy.

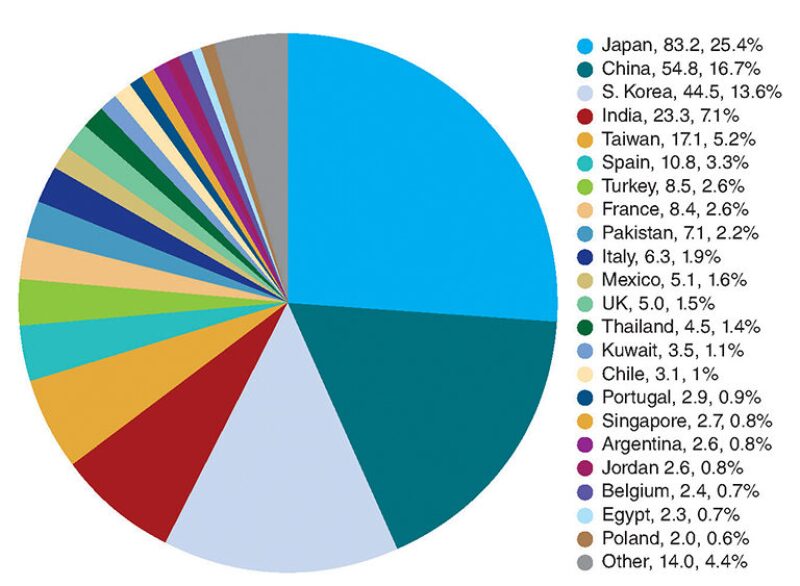

The number of countries importing LNG has grown from nine in 1999 to 42 in 2018, according to IHS Markit. Japan, China, Korea, Taiwan, and India together account for 70% of current global LNG demand, according to Wood Mackenzie (Fig. 2). Gas demand in Asia is expected to grow by approximately 150 Bcm over the next 5 years, with China accounting for more than 85% of it. Moderate gas consumption growth, mainly from India’s power and industry sectors, combined with declining domestic gas production, is expected to increase South Asian LNG import needs.

Both India and China have their own substantial gas reserves, but their ability to increase local production cannot match the increase in demand. LNG import facilities are relatively easy to set up near the main demand centers. Utility companies in both countries can switch to gas without major changes in infrastructure. Local LNG buyers can supply industries and households by tapping their regasified product into the local distribution networks. Thus, importing LNG provides a relatively quick, safe option to help these countries decrease pollution in large cities.

Europe, too, is importing more LNG as legacy fields decline and gas demand increases, both with industrial sector growth and in competition with coal in the power sector. While near-term LNG supply growth is expected to be absorbed by Europe and Asia, supply investment will continue to be needed to meet long-term LNG demand growth

Technology-Driven Opportunity

The technology for cooling natural gas to –260°F to convert it from a gas to a liquid, and reducing its volume by approximately 600 times, created a new industry. In 1959, the Methane Pioneer, a former World War II liberty freighter converted as perhaps the world’s first LNG tanker, demonstrated for the first time that LNG could be safely transported across the ocean. The tanker carried an LNG export cargo from Lake Charles, Louisiana, to Canvey Island in the UK. Now stranded natural gas reserves could be monetized by shipping gas in purpose-built vessels to new markets without indigenous resources.

International trade began in the 1960s, and Algeria constructed the first commercial LNG production and export facility. In 1969, exports from the Kenai Peninsula in Alaska to Japan launched a trade relationship that helped grow the Asian natural gas market into the largest demand center in the world. France, Belgium, Italy, and Spain joined the UK as destination markets. Even the US began importing LNG in the 1970s, and built and operated several LNG regasification terminals.

By the mid-2000s, technological innovations such as horizontal drilling and hydraulic fracturing kicked off the shale revolution that enabled the US to become the world’s top producer of oil and natural gas, and ultimately transformed the country from a potential LNG importer to the world’s third-largest exporter, behind Qatar and Australia.

More recently, new technologies have enabled both new supply developments and new markets for LNG. Floating storage and regasification units (FSRU) that reconvert LNG to gaseous form from an offshore receiving site rather than a permanently installed, land-based site, provide lower-cost, more flexible routes for supplying new geographical markets with fewer regulatory hurdles. They also offer a solution for redeploying regasification capacity as market demand shifts. According to Deloitte, they have played a key role in the transformation of the LNG industry from a slow-changing, long-term, counterparty contract-based market into a dynamic, short-term, trading-based market.

Floating LNG (FLNG) facilities allow access to more remote subsea natural gas resources. Small, modular liquefaction units make smaller resource developments accessible and economically viable. Demand-side technology advancements are creating new end uses for various modes of transportation as well as new power generation applications.

Balancing a Volatile Market

Speaking at the 2019 Offshore Technology Conference (OTC), Robert Ineson, IHS Markit’s executive director for global LNG, said, “LNG is a business that is transforming itself from a collection of projects to a market.” Balancing that market, he explained, presents a complex set of challenges.

Among those challenges is a current oversupply of LNG that has been described in terms ranging from “slight” to “awash.” According to Chevron Senior Advisor Greg Kusinski, the industry is in the final phase of a major LNG buildout initiated by Australia and now the US.

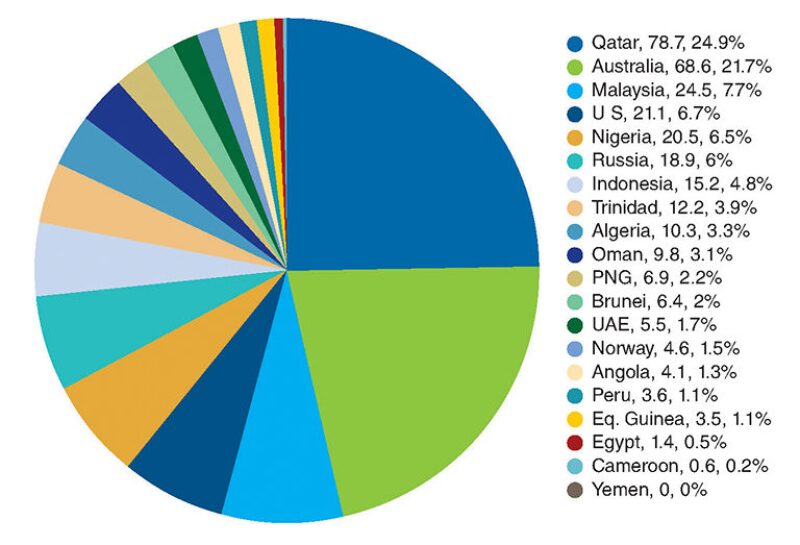

In addition to the LNG industry’s three leading suppliers (Qatar, Australia, and the US), Russia will likely emerge as the fourth pillar as it unlocks previously stranded gas in the Yamal Peninsula, according to IHS Markit. Mozambique is also likely to become a major supplier (Fig. 3).

The recent surge in liquefaction capacity and export facilities has prompted many industry experts to predict that the LNG market will be oversupplied until sometime between 2020 and 2025. This has spawned a buyers’ market where long-term commitments are giving way to more flexible contractual and delivery terms. Conversely, another rise in demand is projected to begin in 2025. With a typical LNG export facility requiring at least 5 years to develop, construct, and commission, new investment will be required in the next couple of years to satisfy future consumption.

Glimpsing the FutureThe 2019 World LNG Report, published in April by the International Gas Union, identified several factors that will affect the LNG industry throughout 2019 and beyond.

|

The Pricing Game

Throughout most of LNG trade history, the dominant market structure has been long-term, high-volume, point-to-point commercial agreements between large suppliers and large, mainly utility buyers, in developed economies. Twenty-plus-year contracts with prices linked to oil were the norm. Unlike oil markets, however, LNG markets and prices have remained regional for the most part.

East Asia has traditionally been the highest-priced market with the strongest link to oil prices. Europe has been in the middle, with oil price indexation tempered by the effect of competition with Norwegian and Russian pipeline gas supplies. The emergence of the US as an LNG supplier has been noted as a landmark moment in global LNG trade.

The delivered costs of US LNG provide an increasingly important reference point for global markets, given the flexibility of its destination-free supply and the liquidity and pricing transparency of the US market. “Henry Hub pricing is shaking up markets,” said Chevron’s Kusinski at OTC. That shakeup is driving a rapid shift to commoditization that is challenging traditional LNG business models.

To be competitive as consumer markets open, buyers are looking for more innovative pricing. Since 2010, spot and short-term cargoes of LNG have increased from 40 MTPA to almost 80, and now account for more than 25% of the LNG market, Kusinski said. “However, large-scale LNG projects still require multibillion-dollar financing, long development times, and credit-worthy buyers,” he said, explaining that producers, traders, and buyers are all navigating the global gas market’s transition from relatively fixed to fluid trade.

Watching Russia and China

As with all energy sources, the impact of politics on LNG suppliers, buyers, and users is ongoing and uncertain. LNG export from Russia is poised to grow significantly and could challenge Australia and Qatar for global leadership in liquefaction capacity. Opening the Arctic as a frontier LNG export region and technological advances that will make it possible to export through the Northern Sea route mean that LNG from Russia can reach northern European and Chinese markets more competitively. Conversely, projects such as the Altai Pipeline and Power of Siberia pipeline projects may drive gas-to-gas competition within the Russian export market that could slow further LNG project activity.

US-Chinese relations will certainly impact LNG trade between these two countries, and the current trade war could have long-lasting effects on project FIDs. China recently raised the duty on US LNG to 25% in retaliation for the US increasing its tariffs on $200 billion of Chinese goods.