Attacks on two of Saudi Arabia’s biggest oil and gas facilities have removed 5.7 million B/D of crude from world markets—more than 5% of global supply.

On 14 September, a combination of drones and cruise missiles were launched from unknown origin. In all, there were 19 confirmed strikes on oil and gas processing facilities operated by Saudi Aramco at Abqaiq and Khurais.

The disruption was labelled by energy analysts as the largest ever in terms of volume. Traders responded by sending Brent crude prices up by as much as 19.5% at the opening bell, the biggest increase since the breakout of the Gulf War in 1991. The price shock later moderated to about a 10% increase through the session as analysts try to piece together the ramifications of the outage.

“The world is not even close to being able to replace more than 5 million B/D day of Saudi Arabian exports,” said Bjørnar Tonhaugen, head of oil market research at Rystad Energy. “The market’s reaction to Saudi Arabia’s importance, in the new era of US shale, will now be put to the test.”

The US Energy Information Agency (EIA) notes that with a capacity of 7 million B/D, the Abqaiq facility is the largest of its kind in the world and represents a “vital part of Saudi oil infrastructure.” The plant is the processing hub for most of Saudi’s exports before they are sent via pipeline to the kingdom’s major port cities.

Yemen’s Houthi faction claimed responsibility for the attacks while US officials have linked the attacks to Iran. Saudi has yet to officially assign blame. Iran denied involvement. A statement released by the Houthis said that more attacks could be imminent.

No fatalities were reported from the explosions, and Saudi Aramco said in a press statement that emergency crews were able to contain all the fires caused by the projectiles.

The aerial attacks come amid growing tensions in the Middle East. In June, Iranian air defences shot down a US Navy drone over the Strait of Hormuz—the famous choke point for about a fifth of global crude production. In the weeks prior, the US had blamed Iran for mine attacks of four tankers in the Persian Gulf.

The most recent attack is not the only one in the Abqaiq facility’s history. In 2016, al-Qaeda was blamed for twin suicide bombings on the perimeter of the facility.

Satellite imagery highlights the location of damaged infrastructure at the Abqaiq oil and gas plant in Saudi Arabia. Source: US government/Digital Globe.

The Effect of a Prolonged Outage

Prior to the attacks, OPEC held a spare supply capacity of about 3.2 million B/D, according to the IEA. Most of that capacity—2.27 million B/D—belongs to Saudi Arabia but it is unknown how much of that was affected by the strike. Aramco reported that it has resumed crude loading operations at its export facilities.

Aramco officials have not given specific timelines for when the damaged facilities could be operating at normal capacity but various reports estimate the repairs could take weeks. Because of the attacks, The Wall Street Journal reported that Aramco officials are considering postponing the state-owned company’s initial public offering.

Analysts with Wood Mackenzie said storage inventories will not be able to account for the loss of supply for very long and that, “A geopolitical risk premium will return to the oil price.”

Rystad concluded that a rise in oil prices could be limited thanks to Aramco’s large cache of crude storage facilities that are located around the world. The key factor is time. If the outages last longer than 10 days, the situation “will be critical,” said Tonhaugen.

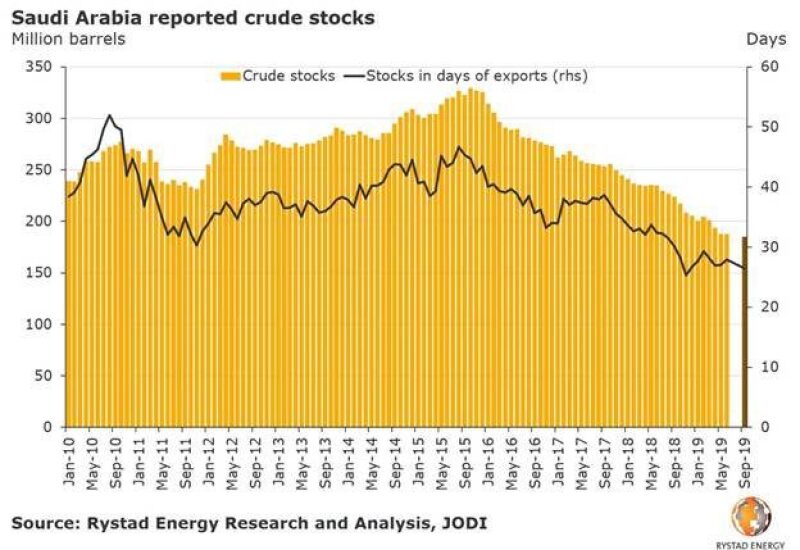

He pointed out that Saudi Arabia already has reduced its crude stocks to its lowest level in a decade—making it difficult to make up for the current interruption. Rystad pegs current inventories at around 185 million bbl, which represents about 26 days of current outflows. The figure is down by 40% since 2015.

Rystad also noted that while US producers will not be able to quickly fill the supply gap, citing tanker logistics and export facility bottlenecks, it does see a short-term opportunity for the US to boost exports by about 1 million B/D. That would increase outbound shipments from 3 million to 4 million B/D. “Other countries with available capacity to increase exports by a few hundred thousand barrels per day each include UAE, Russia, Kuwait, and Iraq,” said Tonhaugen.

The biggest impact on the global crude market will be felt first by Asian buyers. Saudi Arabia sends about 72% of its exports to Asian countries, led by China, South Korea, Japan, and India, according to Wood Mackenzie.

“The impact and the next course of action will depend on the duration of the outage,” said Vima Jayabalan, a research director at Wood Mackenzie. “Saudi Arabia has enough reserves to cover the shortfall over the next week, but if the outage extends, then filling the gap with the right type of crude quality could be a challenge.”

Mohammed Barkindo, the secretary general of OPEC, told Bloomberg News that it is too early for OPEC members and Russia to consider increasing output to make up for the outages in Saudi Arabia.