Slumping upstream business activity in Texas, southern New Mexico, and North Louisiana worsened during the third quarter as oil markets remained volatile and operators continued to curb exploration and production (E&P) work, according to a survey of upstream executives by the Federal Reserve Bank of Dallas.

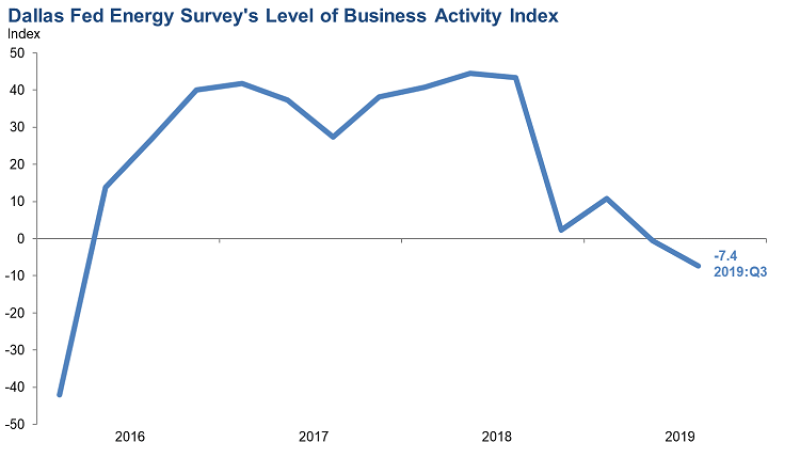

The Dallas Fed’s business activity index—a comprehensive measure of conditions facing energy companies in the US Eleventh District—fell to -7.4 from -0.6 in the second quarter largely caused by a rout of oilfield service firms, whose own index dived to -21.8 from 6.6. Negative readings indicate contraction.

Survey data suggest a large contraction in equipment utilization for oilfield service firms during the third quarter, with the equipment utilization index plunging 27 points to -24.0, its lowest reading since 2016, said the Dallas Fed. Oilfield service prices continued their slide as well, with the prices received for services index falling further to -18.5 from -12.1. Input costs continued rising but at a much slower pace, as the index plunged to 5.6 from 27.1.

Drilling and completions activity in particular has cooled in the largest hub of industry activity in the region and US, the Permian Basin of West Texas and New Mexico, where the count of active rigs by Baker Hughes dropped 76 units between the week ending 20 September and a recent peak in late 2018.

In a poll of the group of operator and service company executives, just 2% said they believe the US rig count has bottomed out, while the most common response, amounting to 28%, was that the slump would end in the fourth quarter. Another 23% chose next year’s first quarter, 20% picked second-quarter 2020, and the rest, 26%, said even later.

The group’s downbeat mood extended to its assessment of the US Energy Information Administration’s measurement of Permian drilled-but-uncompleted wells. Half of executives said their estimate was lower than EIA’s count of 4,000, with 23% saying much lower and 27% saying slightly lower. Analytics firm Kayrros, which was founded by a group that includes Antoine Halff, a former EIA lead industry economist, has also estimated the Permian DUC count to be much lower than EIA's findings.

"The EIA has no clue on their estimated number of DUCs, in my opinion," said one operator executive who participated in the survey. "What actually happens in the oil field is a smaller, 'spudder' rig goes out to the lease first and drills down to approximately 1,500–2,000 ft and sets surface pipe, moves on to the next well, and does the same thing over and over." These "spudder" wells are inflating EIA's DUC count, the executive posited.

Despite the overall decline in activity in the field, oil and natural gas production increased for the 12th consecutive quarter, according to the survey. The third-quarter oil production index was 15.7, down slightly from the second quarter. The gas production index fell to 6.5 from 13.4.

Less field work translated to lower upstream unemployment in the region, which declined modestly for a second quarter in a row. The aggregate employment index slid to -8.0 from -2.5, while the aggregate employee hours worked index declined to -2.4 from 3.1. Wage growth continued to slow, as the index for aggregate wages and benefits fell to 6.2 from 14.5, the Dallas Fed said.

The Dallas Fed Energy Survey is done quarterly to assess Eleventh District upstream business activity. Data from 163 firms were collected 11–19 September. Of the respondents, 108 worked for operators and 55 were with oilfield service firms.

Executive Comments

Part of the Dallas Fed survey includes soliciting comments from participating executives about the state of the business. Divided among operator executives and service company executives, remarks in this quarter’s edition lamented a lack of funding, difficult capital markets and oil markets, and shrinking margins.

Operators

“The capital markets remain problematic. Access to capital will crimp the industry. It feels like employment in the sector will be decently lower in the next 12 months.”

“The capital market has dried up for small E&P companies.”

“Unless there is a material pullback, the environment is static around $55/bbl and, even if your business is rock solid at this price, the capital markets aren’t functioning well, so it’s hard to move off of the ‘stuck’ or ‘static’ outlook.”

“We expect industrywide drilling-and-completion capex [capital expenditures] spending to be down by about 10% in 2020.”

“Over $130 billion of junk status bonds are coming due after 2020 over a 2-year period for those that got in the treadmill drilling business, with wells that decline 70% in the first year. How many [wells] does it take to maintain volumes, much less grow them? Shale is like any zone. It has sweet spots and not-so-good spots for production. Guess what got drilled first to game the private equity and pension funds and other obligated institutions to find a level of return to service obligations?”

“Overall sentiment is very negative due to low natural gas prices and lack of available funding for oil and gas exploration. Investors have been hard hit by catastrophic declines in the price of oil and gas securities. Additionally, many oil shale projects are failing to meet production projections. Oil service companies have no pricing power [and are] delivering services at rock bottom levels. Further cost declines will not be forthcoming. It seems no one has any money for oil and gas projects. Lack of Wall Street participation in oil is very apparent.”

Oilfield Service Firms

“US oil production is about to fall significantly. The rig count has declined dramatically from 1 year ago—down 170 rigs—and our customers are not completing wells in order to save cash flow. This all equals a big shift down.”

“The attack on Saudi [Arabian] oil facilities increased the price for the moment, but unless more dramatic things happen in the Middle East, I expect the price to fall back to current levels. If prices remain in the current range, there will be significant reductions in drilling and completion of Permian Basin horizontal wells. The industry is admitting what independents who drilled with industry partners early on figured out: You cannot make money drilling at this price structure.”

“Oversupply of hydraulic fracturing capacity and reduced activity by customers have put extreme pressure on pricing. Most hydraulic fracturing providers feel that the current pricing is unsustainable over the medium to long term.”

“Uncertainty created by E&P companies’ foggy outlook is creating significant challenges for oilfield services.”

“Competition is high for skilled field service personnel such as roustabouts and specialized oilfield truck drivers. Wages and benefits are at an all-time high, yet prices for our services are unchanged. Margins become smaller every year due to E&P [firms] tightening down on all aspects of their expenses.”