Last year, BP theorized that peak oil demand could occur by 2030. In a major shift, the international major says that peak demand may have already happened.

This is according to BP’s newly published Energy Outlook 2020 which outlines different scenarios that the company has developed to imagine how the global energy transition will unfold.

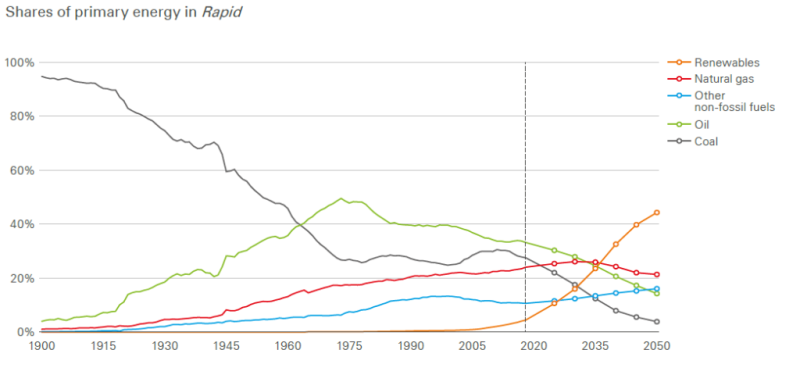

In two of these scenarios, a “rapid” transition case and a more aggressive “net-zero” case, the changing winds of the energy landscape coupled with the economic toll of the COVID-19 pandemic will mean that global crude demand never again surpasses 2019’s average of around 100 million B/D. Along these lines, the models suggest that 2019 could also mark the peak of carbon emissions from energy use.

To varying degrees both the rapid and net-zero scenarios assume that tighter government policies around emissions and increases in carbon pricing will accelerate the current growth trajectory of renewable installations. The biggest difference between the two is that the net-zero scenario expects energy consumers themselves will move the needle even more by changing their behaviors and energy-consumption preferences.

By 2050, these factors could lead global demand to be as low as 55 million B/D to 30 million B/D.

BP’s “business-as-usual” case holds as its underlying assumption that government policy, technology uptake/development, and consumer preferences will continue to evolve toward renewables at generally the same pace as we have seen in recent years.

Regardless, all three scenarios see the consumption of coal, oil, and natural gas dropping while the role of renewable energy is set to soar. The outlook highlights that fossil fuels accounted for 85% of primary energy demand in 2018 but that by 2050 they may represent only 65 to 20% of the share.

“This would be entirely unprecedented. In the modern history of energy, there has never been a sustained decline in the consumption of any traded fuel,” said Spencer Dale, the chief economist at BP.

As fossil fuels face diminishing demand, renewable sources of energy could all increase their share of the energy mix from 2018’s figure of 5% to between 20 and 60% by the end of the outlook’s 30-year time frame. Wind and solar are expected to represent the lion’s share of this growth. If that happens, Dale added that renewables would “penetrate the energy system more quickly than any fuel in modern history.”

BP’s outlook comes a month after the company announced during an earnings call with investors that it was attempting to shed its reputation as an international oil company andconstruct a new one as an integrated energy company that will spend $5 billion annually on low-carbon technologies while also setting a target to reduce its overall oil and gas production by 40% by 2030.

Dale, who has led the efforts to produce the Energy Outlook for several years, noted while presenting the company’s findings that they are not predictions and that all the scenarios outlined are “wrong.”

“We can’t predict the future,” he explained. “Moreover, we know we can’t predict the future.” Nonetheless, the outlook offers BP a way to understand a range of possibilities about the market uncertainty that lies ahead. The outputs then become key inputs into the company’s effort to craft a strategy that Dale said is “robust and resilient” in the face of these scenarios.

Under the “rapid” energy transition scenario, the world is on pace to see what BP describes as a “fundamental shift” in the global energy mix. Source: BP Energy Outlook 2020

The Long Tail of COVID-19

BP’s outlook implies that above all others, oil is the energy source that has been most-impacted by the ongoing pandemic that has claimed more than 900,000 lives worldwide since January. The virus’s lasting effect on global economic output may reduce oil demand by 3 million B/D in 2025 and 2 million B/D by 2050.

“The majority of this impact stems from the weaker economic environment, but there is also an assumed impact from the various behavioral changes trigged by the pandemic, as people travel less, switch away from public transport into alternative modes of travel, and work from home more frequently,” explained Dale.

COVID-19 is assumed in BP’s forward-looking scenarios to have a long-lasting impact on global economic activity and energy demand. Source: BP Energy Outlook 2020

In contrast to crude’s potential future, natural gas has a considerably more optimistic outlook in terms of demand. In BP’s rapid scenario for energy transition, gas continues to see consumption grow for at least the next 15 years. A chief driver will be the retirement or conversion of coal plants in Asia to run on cleaner-burning gas.

BP also foresees the potential for gas to become considered “a near-zero-carbon energy.” This will involve a substantial effort to power carbon capture use and storage (CCUS) projects with gas. The rapid scenario expects that by 2050 at least 40% of the world’s gas consumption would come from CCUS facilities. In the more aggressive scenario that figure rises to around 75%.

A major driver behind these hypothetical shifts will be the increasing pace of electrification, especially in the transportation sector. Dale also pointed out that as the components of the world’s energy system diversify, consumers of energy are expected to drive increased competition for market share.

In the rapid and net-zero cases, this will result in average annual investments in wind and solar buildouts rising to between $500 and $750 billion. “That is several times greater than recent investment levels in wind and solar, and also considerably higher than the levels of investment in upstream oil and gas in these two scenarios,” said Dale.

If countries around the world adopt stronger carbon-pricing strategies, e.g., swap and trade, carbon taxes, then the carbon intensity of field operations becomes an important factor in the economic viability of such projects. BP’s rapid case shows that as much as 2 million B/D could be at risk under such a scenario.

However, BP also points out that the ability of operating companies to lower the carbon profile of existing and future projects is difficult to predict. The outlook notes, for instance, that it should be possible to reduce emissions from onshore production sites through electrification. Natural gas operators could also lower their carbon-intensity profiles in the future by using more pipelines instead of transporting the product as liquefied natural gas, or LNG, which is a far more energy-intensive method of transportation.

BP’s Energy Scenarios Explained

The Rapid Transition Scenario (Rapid) posts a series of policy measures, led by a significant increase in carbon prices and supported by more-targeted sector-specific measures, which cause carbon emissions from energy use to fall by around 70% by 2050.This fall in emissions is in line with scenarios which are consistent with limiting the rise in global temperatures by 2100 to well below 2°C above preindustrial levels.

The Net-Zero Scenario (Net Zero) assumes that the policy measures embodied in Rapid are both added to and reinforced by significant shifts in societal behavior and preferences, which further accelerate the reduction in carbon emissions. Global carbon emissions from energy use fall by over 95% by 2050, broadly in line with a range of scenarios which are consistent with limiting temperature rises to 1.5°C, may drop as low as 30 million B/D by 2050.

The Business-As-Usual Scenario assumes that government policies, technologies, and social preferences continue to evolve in a manner and speed seen over the recent past. A continuation of that progress, albeit relatively slow, means carbon emissions peak in the mid-2020s. Despite this peaking, little headway is made in terms of reducing carbon emissions from energy use, with emissions in 2050 less than 10% below 2018 levels.

Access the entire report here.