Energy activity stabilized somewhat during the third quarter of 2020, but job cuts continued, according to the Federal Reserve Bank of Kansas City.

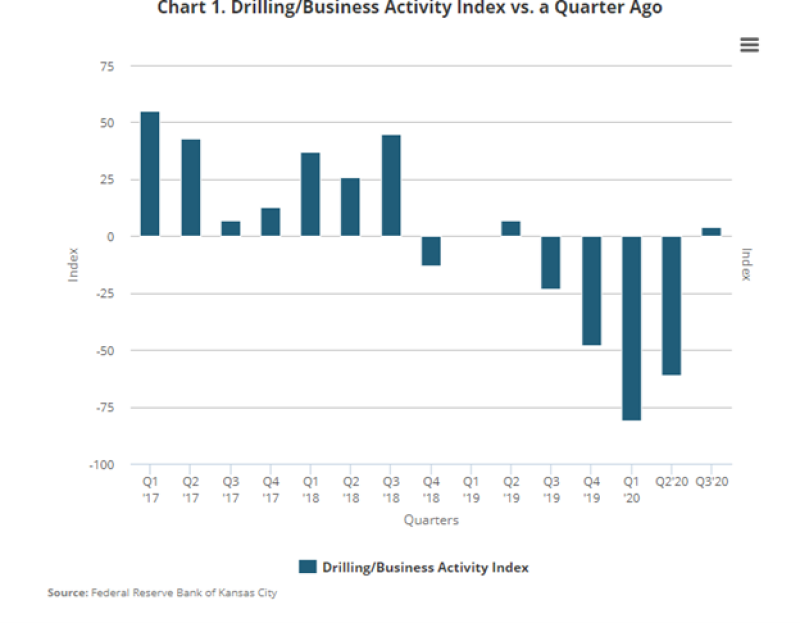

“District drilling and business activity rose slightly in Q3 from historic lows earlier this year, but revenues, employment, and capital expenditures continued to decline,” said Chad Wilkerson, Oklahoma City branch executive and economist at the Kansas City bank (Fig. 1).

“Over a quarter of firms surveyed expected global oil demand to return to pre-COVID levels by Q2 2021, but the majority of contacts don’t expect oil demand to rebound fully until 2022 or 2023,” he said.

Fig. 1—Business activity index vs. a quarter ago.

Survey Question Results

Among information gathered from special survey questions were the following:

- $49/bbl—average oil price needed to be profitable across the fields in which respondents are active (range $35–$65/bbl).

- $3.12/MMBtu—average natural gas price needed to be profitable across fields in which respondents are active (range $1.75 to $4.00).

- $43, $47, $53, and $60/bbl—expected WTI prices in 6 months, 1 year, 2 years, and 5 years

- $2.62, $2.71, $2.84, and $3.28/MMBtu—expected Henry Hub natural gas prices in 6 months, 1 year, 2 years, and 5 years

Firms were also asked about expectations for future global oil demand. Around 27% expected global oil demand to return to pre-COVID levels by Q2 2021. However, nearly 60% didn’t expect global oil demand to return to pre-COVID levels until 2022 or 2023. Over 55% of firms anticipated a large increase in both mergers and acquisitions as well as defaults and bankruptcies for the energy sector through 2021. Another one-third of firms expected more defaults and bankruptcies with little change in mergers and acquisitions through 2021.

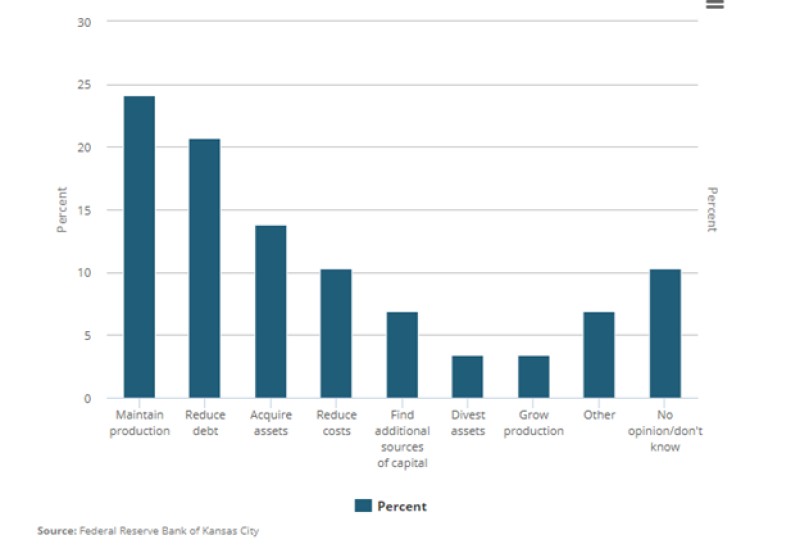

When asked about their primary goals over the next 6 months, 24% said maintaining production is their highest priority, and 21% were focused on reducing debt. Only 14% said acquiring assets is their primary goal (Fig. 2).

Comments Reveal Pessimism

A number of verbatim comments by survey respondents painted a dark picture. “Without a doubt this is the most difficult cycle I've experienced in my 30-year career,” said one respondent. “Current and projected cash flow does not provide a good opportunity to grow production … we either tread water and grow slowly or identify new sources of capital,” said another.

Other comments included the following:

- “M&A is difficult due to the number of companies with high leverage on the buyers’ side.”

- “Bankrupt companies are just restructuring and there is very little new capital available.”

- “The longer it takes for the economy to recover, for people to get out and start spending, the more difficult it will be for companies to survive.”

- “Demand will stay weak through Q1 next year. There is not enough drilling going on and we will need investment. Public companies have to pay dividends.”

- “Production declines everywhere will be 15–20%.”

The Kansas City Fed's quarterly Tenth District Energy Survey provides information on current and expected activity among energy firms in a region that includes the western third of Missouri; all of Kansas, Colorado, Nebraska, Oklahoma, and Wyoming; and the northern half of New Mexico.

Fig. 2—Maintaining production and reducing debt are the highest short-term priorities of most firms.