Houston-based ConocoPhillips is buying Concho Resources, instantly making it a huge player in the Permian, and pushing change in the shale sector ranging from corporate consolidation to promises by big US independents to focus on cutting carbon emissions.

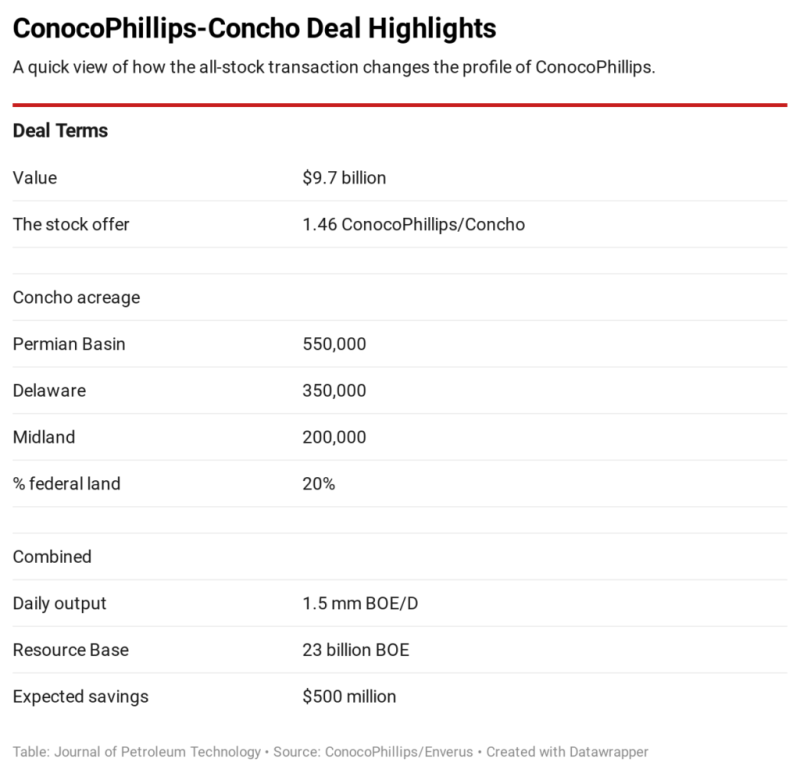

The all-stock deal valued at $9.7 billion will add Concho’s 550,000-acre position and an oil-production rate of at least 200,000 B/D to ConocoPhillips’s portfolio, which has had only a small position in the richest shale play.

In its announcement of the deal ConocoPhillips said the merger gives it a “massive, diversified and low-cost of supply resource base” that represents “years of high-value investments.”

The companies said their combined reserves base will be almost 23 billion BOE with an average cost of supply below $30/bbl WTI. The combined Lower 48 position will encompass 1.5 million acres which ConocoPhillips estimates to hold 17,000 potential drilling locations that are economic at $40/bbl.

During a call with investors on the heels of the announcement, ConocoPhillips’s Chief Executive Officer Ryan Lance described the US shale sector’s recent moves toward consolidation as “both necessary and inevitable” but stressed that this deal was not made out of desperation.

“Neither of us needed to do a transaction to fill a gap in our portfolio or to fix something,” he said, casting the deal instead as an example of a structural change in how shale portfolios should be run. Lance said leaders from both companies “believe our industry needs solutions that address lack of scale, poor returns, and increasingly, the challenges and opportunities of environmental, social, and governance matters.”

Concho’s Chief Executive Tim Leach will stay on with ConocoPhillips as a member of the board of directors. He is also set to become the executive vice president of ConocoPhillips’ Lower 48 business unit.

Founded in 2014, the Midland-based Concho became one of the largest Permian operators in 2018 when it acquired the smaller RSP Permian in an all-stock deal valued at $9.5 billion. Leach, who has led Concho since its founding, said the company’s success is owed to such “bold moves” and an ability to adapt to market conditions.

“With the recent market volatility, the global pandemic, and the shift in the way the market has come to value E&P companies, we recognize that our markets have once again changed and once again we’re taking action,” said Leach.

New Portfolio, New Priorities

Combining two companies with strong balance sheets is expected to deliver $500 million of annual cost savings, according to the announcement.

That will include the normal savings gains when eliminating overlapping management and administrative operations, and also allow a cost-saving shift in ConocoPhillips’s exploration and production program. The move will eliminate around $250 million in planned spending from its global new ventures program.

“This de-emphasis of ConocoPhillips’ organic-resource addition program is driven by the addition of Concho’s large, low-cost resource base,” the announcement explained.

ConocoPhillips’s Executive Vice President and Chief Operating Officer Matt Fox added during the conference call, “What we intend to do now is to really focus on the business units that have remaining exploration potential,” in areas including Alaska, Norway, and Malaysia. Going forward, he said these exploration programs would require a combined annual budget of no more than $150 million.

The promise of more low-cost barrels added via acquisition could spark more deals.

“Potentially overlooked is that ConocoPhillips will now reduce its exploration budget. If buying resources rather than exploring becomes a trend, the momentum for tight-oil consolidation stands to increase considerably,” said Robert Clarke, vice president, Lower 48 upstream, at Wood Mackenzie.

There is, however, a limited number of sellers with strong acreage and financials and buyers looking to expand in shale with attractive stock to offer.

“The relative scarcity of attractive deals may place additional pressure on some companies to get a transaction in place and lead to more activity in the near term,” said Andrew Dittmar, senior mergers and acquisitions analyst for Enverus.

ConocoPhillips is also expected to get more oil out of that acreage—hitting another critical need in the shale business—slowing the rapid decline rates.

For Concho, this factor was highlighted during the investor call as a major driver behind the merger. When asked directly why the company chose not to go it alone, Leach responded by saying, “The size and scale that we are today, with an underlying decline rate that approaches 40%, it’s hard to distribute cash back to the shareholders as rapidly we can in this new model.”

As Concho’s assets are added to the portfolio, ConocoPhillips expects only a modest increase in its decline rate from the current 10% to 12%, a figure it plans to maintain for the next 10 years with its broad asset base of high-decline, short-cycle shale assets and low-decline, long-cycle conventional projects.

“That's what we believe is the right sort of mix to be a sustainable company through the next few decades, [and] frankly through the energy transition,” said Fox.

Combined Expertise

The announcement plays up the technical and operation expertise of the two operators.

“As part of the planned integration, the company will adopt a ‘best practices’ approach that will share learnings and select best practices focused on the North American unconventional portfolio,” the announcement said.

Concho has operated more rigs in the Permian than ConocoPhillips, which means the seller has more experience in testing formations and completions designs in the region. As of August, Concho was operating more than 2,100 horizontal wells in the Permian compared to ConocoPhillips’ count of just 178, according to data aggregator ShaleProfile.

When it comes to maximizing ultimate recoveries from that Permian acreage, ConocoPhillips’ practices may dominate.

“ConocoPhillips has proven itself as a leader in shale technology. This can be seen in how its Bakken and Eagle Ford projects have progressed down the cost curve as well as how successfully it manages later-life shale declines,” Clarke said.

A focus on improved productivity will be a critical element in delivering on rich financial promises made to investors.

“The company will target an average reinvestment level of less than 70% of cash from operations to ensure sufficient free cash flow generation to fund compelling returns of capital to shareholders,” in the form of higher dividends and other payouts, the announcement said.

A Permian Premium

The deal was described as a definitive agreement, which had been approved by the boards of the companies. Shareholders still must vote on the deal, which executives from both companies predicted could be done by the first quarter of next year.

Each Concho shareholder will receive 1.46 shares of ConocoPhillips stock for each Concho share. That represents a 15% premium over the value of those shares as of 13 October.

"One difference is that this deal does include a moderate premium of 15% to Concho’s share price before rumors of a deal began to swirl on 13 October. That is in contrast to 2020’s other corporate deals, which have been for essentially no premium,” Dittmer said.

In addition to that premium, Concho shareholders will own a piece of a larger operator that is not so dependent on the fortunes of the shale business.

Concho shareholders will be trading an all-Permian play for a company with diversified onshore operations in Alaska, Canada, and elsewhere around the world, with an enterprise value expected to total $60 billion.

On a pro forma basis, ConocoPhillips’s will have a debt load of around $12 billion and about $7 billion of cash on hand and short-term investments. With a credit facility of around $6 billion, the company reports a liquid asset base of nearly $13 billion and has only $2 billion in notes to pay over the next 5 years.

Net-Zero Ambition

Demands from investors for higher returns have reshaped the shale business since early 2019, as has the growing pressure to meet international standards for environmental, sustainability, and governance (ESG) by major investors.

The deal includes an unprecedented step in that direction by a US-based independent—a pledge by ConocoPhillips to curtail carbon dioxide emissions “with a newly adopted Paris-aligned climate risk strategy.”

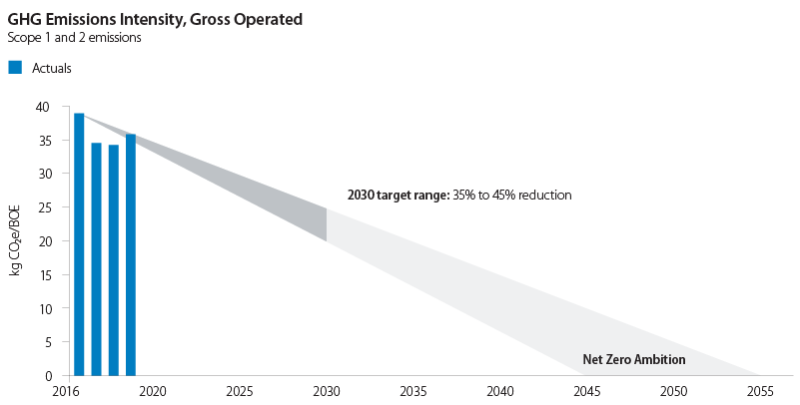

The company’s bid to address climate change hinges on an initial reduction of 35 to 45% in its Scopes 1 and 2 emissions by 2030. This expands upon the company’s earlier goal of a 5 to 15% reduction. The next major milestone is to become a net-zero emitter in these two categories between 2045 and 2055.

Scope 1 include all of the company’s emissions generated directly from their operations while Scope 2 entails the indirect emissions released by others to support those activities, e.g., electricity sourcing. Scope 3 emissions account for the full value chain which for an oil and gas producer mainly involves the greenhouse gases released by energy users.

ConocoPhillips’ boss Lance said that the operator will promote Scope 3 emissions reductions through its support for a US carbon pricing system and through its endorsement of the World Bank’s “Zero Routine Flaring by 2030” initiative that 40 other oil and gas firms have backed.

Fox said later during the investor call that the company is reviewing a number of ideas that may help it achieve its emissions targets, including the increased use of renewable energy and carbon-offset projects. The plan includes equipping a large portion of ConocoPhillips’s processing sites with permanent methane-detection systems which will help mitigate fugitive methane emissions.

Speaking specifically about how ConocoPhillips’s oil-sands development in Canada fit into its net-zero goal, he said the company is confident that through the adoption of emerging technologies “we will bring the emissions and density of oil sands down over time.”

Efforts include improving the steam-to-oil ratio with flow-control devices and using noncondensable gas and solvents to supplement steam injections. Fox said the company is also considering ideas for applying carbon capture, use, and storage technologies to its steam generators which represent the most carbon-intensive component of oil-sands operations.

ConocoPhillips reports that it has identified a number of initiatives and existing technologies that will help it cut its Scope 1 and 2 emissions by more than a third over this decade. Getting to net-zero was described the company as “aspirational” but it expects new technologies and carbon offsetting will make the goal possible to achieve. Source: ConocoPhillips