Rising levels of CO2 emissions and intensifying concerns over climate change have convinced many that the oil and gas industry is set to be quickly phased out from the global energy system.

There is another camp, though, that has reimagined CO2 emissions as the source of the industry’s salvation.

Realizing such a rosy picture hinges in large part on the industry’s ability to defy its own history by massively expanding the niche area of enhanced oil recovery (EOR) amid an oil-price depression.

By investing more in EOR—specifically of the CO2 variety—the industry would be answering the world’s increasing demand for greater carbon sequestration, use, and storage (CCUS) capacity.

Nothing short of a grand-scale effort will cut it. But in return for taking ownership, both the industry’s market share and its license to operate may be buoyed against the rising tide of alternative energy options and international policies aimed at limiting fossil-fuel usage.

Among those championing this line of thought is Sally Benson, the co-director of Stanford’s Precourt Institute for Energy. As Benson explained during the opening panel discussion at the SPE Improved Oil Recovery Conference, climate-change mitigation and continued oil production are not necessarily mutually exclusive.

“And here’s where CO2 EOR is particularly important,” she said. “If we could, for example, double the amount of CO2 that’s injected for every barrel of oil that’s taken out, we have carbon-neutral transportation fuels.”

The chief takeaway Benson offered is that rather than being considered an existential threat, carbon dioxide emissions should instead be part of “an existential strategy” for the long-term survival of the oil and gas industry.

One of the oil and gas producers evolving toward such an end is Occidental Petroleum (Oxy). The Houston-based operator is renowned in the industry for its 40-year legacy of CO2 EOR; however, almost all of that CO2 has come from natural reservoirs.

Industrywide, an estimated 70% of the CO2 injected for EOR is geologically sourced and then reinjected into a different reservoir, which means its usage does nothing to curb over-all emissions.

As Oxy looks to the future, it is redirecting a big portion of its efforts to capturing CO2 from industrial facilities across the US. Among the boldest of these initiatives is Oxy’s proposal to build the “Midwest CO2 Superhighway.”

Brian Owens, the senior vice president of Oxy’s US Rockies business unit, described the superhighway as a “cross-industry endeavor” that will take CO2 from a mix of industrial plants in the interior US and move it hundreds of miles south to aging oil fields in the Permian Basin of Texas where EOR infrastructure already exists.

“This project is a major undertaking to acquire a new CO2 pipeline—spanning seven states—that has the potential to reduce the United States’ total emissions by 4% through the carbon capture and sequestration of 40 million metric tons of CO2 each year,” Owens said at the conference this summer.

Converting those figures to more familiar metrics for those in the oil and gas industry, he added the peak injection rate of the superhighway pipeline could be as high as 2 Bcf/D—roughly equivalent to removing 7 million passenger cars from the roads each year.

The “Ambition Gap”

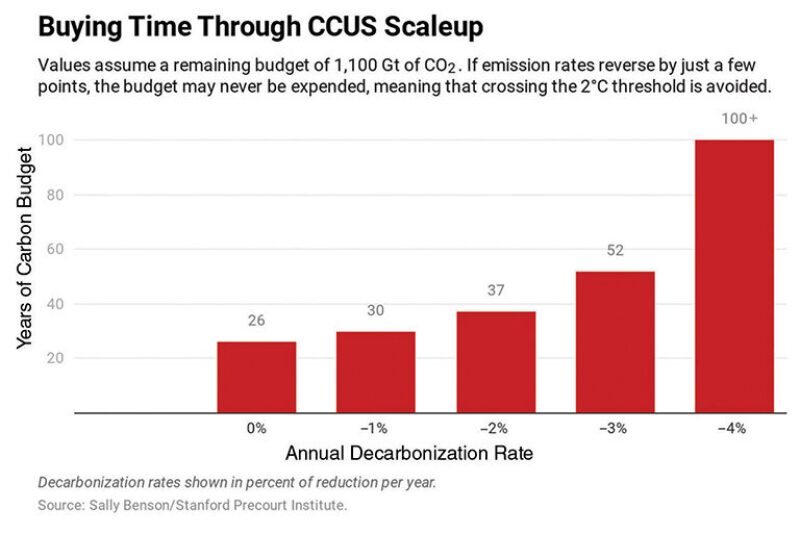

In recent years, global CO2 emissions have risen at an annual rate of around 1 to 2%. Under one interpretation of the so-called “carbon budget,” if the rise in average global temperatures is to remain below 2°C as compared with pre-industrial levels, then the current growth rate in emissions can continue for about only another 26 years.

But if the trend could somehow be reversed and net emissions actually decreased at an annual rate of 3%, then the carbon budget lasts beyond 50 years. Make that a 4% decrease and the budget’s burn rate crosses the century mark—which would mean “we’ve essentially solved the problem,” of surpassing the 2°C threshold and invoking the worst effects of climate change, said Benson.

The task at hand is nothing short of monumental. The carbon budget amounts to about 1,100 gigatons (Gt) of CO2. Global CCUS capacity (which excludes naturally sourced CO2 for EOR) is currently just 39 megatons (Mt) per year, or 0.039 Gt.

Referring to the difference here as the “CCUS ambition gap,” Benson said capacity is growing by about 8% a year. To start closing the gap and add decades of time to the carbon budget, she said an additional 1 to 5 Gt each year is needed, requiring a doubling or tripling of current efforts.

From Benson’s perspective, there are two potential outcomes with regards to CCUS and both will define the industry’s next chapter.

“In one case, CCUS scales slowly,” she said, adding that, “We don’t have carbon-neutral oil for example, and as a consequence, policy support is weak and CCUS gets to be seen as an option of last resort.” This scenario does not mean CCUS never gains momentum, as Benson said, “we’ll get there, one way or another,” even if that means the oil and gas industry has little involvement.

The alternate reality she outlined is decidedly more mutually beneficial.

Here the oil and gas industry takes part in a rapid buildout of CCUS capacity that leads to annual growth rates as high as 20%. This results in carbon-neutral petroleum products that can be marketed on a widespread basis to energy consumers. In turn, the public coffers of government are more likely to open wider to help oil and gas companies fund the expansion of CCUS capacity.

Owens, the lone operator representative on the panel, called on the industry to evolve while reminding that 20 years ago words like “nanodarcy” equated to zero pay from the reservoir. Then came the North American shale revolution and several million B/D of tight oil.

“Whatever we know and are doing today won’t be enough in the coming years,” he said of current efforts around CCUS. Asking conference attendees to reflect on the world’s solidifying views on climate change, he continued, “We are engineers, we like to solve problems—let’s solve this. Carbon-neutral hydrocarbons, that’s a solution to a worldwide concern.”

Carbon-Neutral, But Not for Long

Oxy’s CO2 superhighway may be more aspirational than it is inspirational. It exists today only in paper form. No public timetable for its development is available. And yes, there are plenty of reasons to be skeptical that such projects will ever break ground in the short term.

At the top of that list is the fact that EOR operations relying on industrial-sourced CO2 traditionally need high commodity prices to be profitable.

This rule of thumb came into full force back in May when the world’s largest post-combustion CO2 EOR facility, known as Petro Nova, shut down due to the crash in oil prices. Initially cast as a major success story, the plant in its first 10 months of operation captured 1 million tons of CO2 and increased oil production at a field some 80 miles away by 1,300%.

Located at a coal-fired power plant outside of Houston, the CCUS project may start back up again only when oil prices rise to between $60 and $65/bbl—the point at which capturing and transportation costs are covered. Worth noting, Oxy’s plan targets mostly ethanol refineries which emit up to 99%-pure streams of CO2, making them among the cheapest industrial sources.

Even when the economics are aligned, another problem facing CO2 EOR developments is that while they may be carbon-neutral upon startup, or even carbon-negative, such status is fleeting.

It is estimated that at least 99% of the CO2 used in EOR remains in the formation forever. Despite this, the carbon-intensity of the operation itself and the inevitable combustion of the produced oil will one day turn the field into a carbon-positive asset.

Seyyed Hosseini, a research scientist with the University of Texas’ Bureau of Economic Geology, shared at the conference the results of a case study he did to show how development strategies heavily influence the speed at which CO2 EOR fields transition to carbon positive. The difference from the least-effective method to the most-effective was found to be around 20 years.

How the carbon footprint is measured also plays a big role.

Lax accounting will always elongate the carbon-negative period. But if the strictest measurements are made, ones that take the full carbon life cycle of an EOR project into account, then a 20-year span of carbon-negative production becomes more like 5 or 8 years.

“Clearly, we need to store more CO2 to achieve carbon neutrality over the time of these projects,” said Hosseini, who proposed that oil and gas companies consider integrating non-EOR storage into their CO2 EOR programs. “This will allow us to store larger volumes of CO2 and deal with economic uncertainties around the project.”

Geologically speaking there are a few different schemes that might make sense, including using formations stacked above or below the producing reservoir. Regardless of the strategy, ample exploration is required to characterize both the potential and the risks of failed seals or leakage of the storage target.

Does CCUS Cost Too Much?

With an estimated cost of $15 billion, the CO2 superhighway would boast a budget comparable to that of two or three oil and gas megaprojects put together.

The topline figure underscores one of the most-important considerations when trying to weigh the growth potential of both large-scale EOR and CCUS. Without government support, the superhighway and other projects like it have not much of a chance in coming to fruition.

Oxy is quick to highlight that each of the more than 50 industrial sites identified as possible feeders of the superhighway are eligible for tax credits that the US government bolstered in 2018.

Known as the 45Q tax credit, this US-specific incentive hands companies a $50 tax credit for each metric ton of CO2 they inject exclusively for permanent storage. For EOR, each ton of injected CO2 earns a $35 credit.

If Oxy follows through with its plans, this public investment will help recover the $10 billion needed to retrofit dozens of cement and ethanol plants with capturing technology and the additional $5 billion it will take to build the network of pipelines.

Benson acknowledged the financial hurdles associated with funding industrial-scale CCUS. But she also argued that these capital requirements should be placed in context with the ultimate cost societies around the globe assume in underwriting renewable sources of electricity and electric vehicles.

The cheapest option in the oil and gas industry involves using natural sources of CO2 to support EOR operations. Each ton of natural CO2 costs around $40 per ton, but again, this gas was already sequestered and is simply being relocated.

With current US tax credits applied, the CO2 captured from cement plants for EOR jumps to $70 per ton. Notably, this is about the same as the cost of utility-scale solar projects in California when government incentives are factored in. The unit price increases to $110 when sourcing CO2 for EOR from combined-cycle natural gas power plants but this too is relatively affordable when placed next to alternative energy subsidies and tax credits.

When the totality of government funding is accounted for, the average cost to mitigate a single ton of CO2 emissions via renewable programs in the US is around $130. The figure comes from a 2019 study by the Energy Policy Institute at the University of Chicago which analyzed the hidden costs of state-level renewable portfolio standards. On the high end of the spectrum, the study found each ton of abated CO2 in the US can cost up to $460.

“So, is CCUS too expensive? I say absolutely not,” Benson said when citing the study. “The challenge is that the incentives that will help scale this out have not yet materialized.”

A study from the National Petroleum Council (NPC) done last year, cited by Hosseini in his remarks, proposed that the US government bolster the tax credits to $110, more than triple the current tax credit for CO2 EOR in the US.

If lawmakers carried this through, the NPC said it would result in a major wave of CCUS investment in the US. While not exclusive to CO2 EOR, the report projected that a $110 credit would result in up to 400 Mt of added annual CCUS capacity in the US over the next 25 years—enough to capture an estimated 20% of US industrial emissions.

As for the operator’s burden, both Benson and Hosseini brought up the industry’s long experience with produced-water disposal. In the US alone, more than 3.2 billion tons of oilfield-produced brines and municipal water are injected into more than 150,000 disposal wells annually.

For high-cost operators working on the margins, produced-water disposal can sometimes be the difference between a profitable barrel of oil and one that comes at a loss.

Hosseini noted another recent study that found that the fees across the US range between $0.50 and $2.50/bbl of produced water injected—this doesn’t include separation or transportation costs.

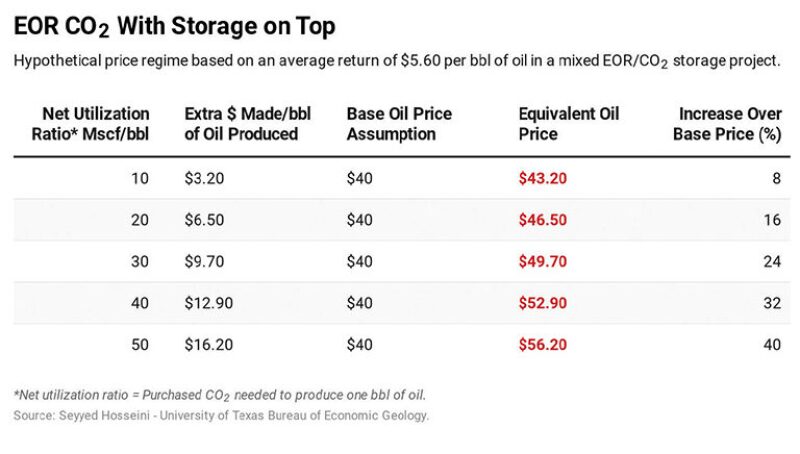

In contrast, disposing of CO2 through EOR has the potential to increase the value of each barrel of oil produced. Based on current oil prices of around $40/bbl and current tax credits for CO2 EOR in the US, Hosseini said the return for each EOR barrel could be around $4.60.

In a mixed scenario—where some CO2 would be used for EOR and some for permanent storage which is rewarded with the higher tax credit—the potential economic boost is greatest.

Hosseini’s research shows that in this circumstance operators could expect to earn $3.20 by injecting 10 Mscf of CO2 for every barrel of crude that flows up—an 8% increase in each barrel’s ultimate value. If ramped up to 50 Mscf for every produced barrel, then the operator could expect a payback of more than $16.