Chemical enhanced oil recovery (CEOR) using polymers, surfactants, and alkalis is not an entirely new technology. Its application peaked in 1986 (Manrique et al. 2010). Following the oil price collapse that occurred in the mid-1980s, the number of significant new CEOR projects and the oil volumes involved have been small. However, with the recent sustained oil prices of the last several years and a few success stories, CEOR is staging a comeback.

In this article, the challenges and opportunities of these projects are discussed. The scope of this discussion is limited to topsides facilities in general and water treatment in particular. Design issues, whether onshore or offshore, are discussed from both the water injection side and the handling of back-produced polymer for disposal injection or for recycle.

Drivers for CEOR

CEOR involves flooding a reservoir with an alkaline/surfactant/polymer (ASP) combination, a surfactant/polymer mix, or a polymer-only injection. While CEOR can provide an increase in ultimate recovery (UR), there remains uncertainty in just how much of an increase will be obtained. The literature describes increases in UR from 0 to approximately 30% of oil originally in place for CEOR floods (Delshad 2010). The historical cost of chemicals for CEOR is relatively expensive. As a result of recovery uncertainty and relatively high cost, for nearly 20 to 25 years, the cost-to-benefit ratio has been relatively marginal and speculative.

Other factors are now coming together to provide what appears to be a push to CEOR. A significant fraction of world oil production is from mature fields. While there will continue to be price fluctuations, supply and demand volumes will inevitably drive up the price of oil in the long run.

For the past 25 years, most CEOR projects have been small. Nevertheless, many small projects, plus the larger projects in China and Oman, have contributed to an understanding of water/chemical/reservoir interactions. This has lead to an ability to formulate the chemistry for optimal recovery and reduced the uncertainty and risk in reservoir response. In the fields where it has been practiced, relatively encouraging results have been obtained, and a small but dedicated group of industry practitioners and academic experts are developing an understanding of reservoir response that can be applied globally.

The chemicals available have improved in effectiveness, and their costs have come down. IFP Energies nouvelles estimates the current cost for CEOR at USD 10–30/incremental barrel of oil, with polymer flooding at the lower end of the scale and surfactant flooding at the higher end.

Besides the purely economic factors, there are other factors. Until recently, implementation of CEOR has been mostly driven by the national oil companies (NOCs). This is particularly true in Oman and China. Most of the recent large-scale activity in CEOR has occurred in Petroleum Development Oman’s Marmul field (Al-Mutairi and Kokal 2011) and Chinese National Petroleum’s Daqing and Shengli fields (Chang et al. 2006; Nguyen et al. 2011; Ji-Cheng and Kao-Ping 2008; Yang et al. 2006). An NOC views the higher UR of CEOR as an added incentive because it demonstrates sustainable development and a commitment to long-term management of oil resources. Economic viability, of course, is taken into account, but on a relatively long time horizon.

Historically, interest in CEOR on the part of the international oil companies (IOCs) has followed strictly economic terms. But that situation is changing. Most of the major IOCs are under intense pressure to secure replacement volumes. Given that NOCs in general have 10 times the proven reserves of IOCs, one of the ways that an IOC can secure replacement volumes is to establish itself as the partner of choice among the NOCs.

CEOR is being readily adopted by a number of regional oil companies, with particular interest being demonstrated by operators in the moderately heavy oils of western Canada. In many of these applications, primary or secondary recovery has been under way for years. Without some form of enhanced oil recovery (EOR), recovery would be abruptly curtailed. In other cases, CEOR allows very aging fields to continue to be economically productive. Compared to steamflood or steam-assist gravity drainage (SAGD), a polymer flood requires less capital expenditure and, therefore, is an attractive alternative for moderate-viscosity (<2000-cp) oil. Also, polymer flood is attractive in cases where a steamflood would increase the H2S concentration to unacceptable levels.

These developments, together with the incentive of higher UR, are driving companies at least to consider the option of CEOR. A number of companies have CEOR projects that are progressing through the project maturation funnel. Currently, worldwide oil production supported by CEOR is about 400,000 BOPD. If even half of the development projects are implemented, there will likely be a fivefold increase in the number of facilities and in the barrels of oil involved in CEOR in the next 5 to 10 years.

Technical Challenges in Water Treating

Water treating challenges occur on both the injection side and the back-produced side. The injection water must be compatible with the formation rock material, formation water, and the chemical cocktail (polymer, alkali, or surfactants). In many cases onshore, choices are limited for the source of the water, and water treating must be employed.

The ionic composition of the injection water plays a crucial role in CEOR success. Clay swelling is well understood, and the water chemistry required to prevent it is now reasonably well established. Generally speaking, there must be sufficient divalent cations to prevent ion exchange and collapse of the clay structure. Therefore, the concentration of divalent cations cannot be below a certain threshold, which depends on the clay concentration and type.

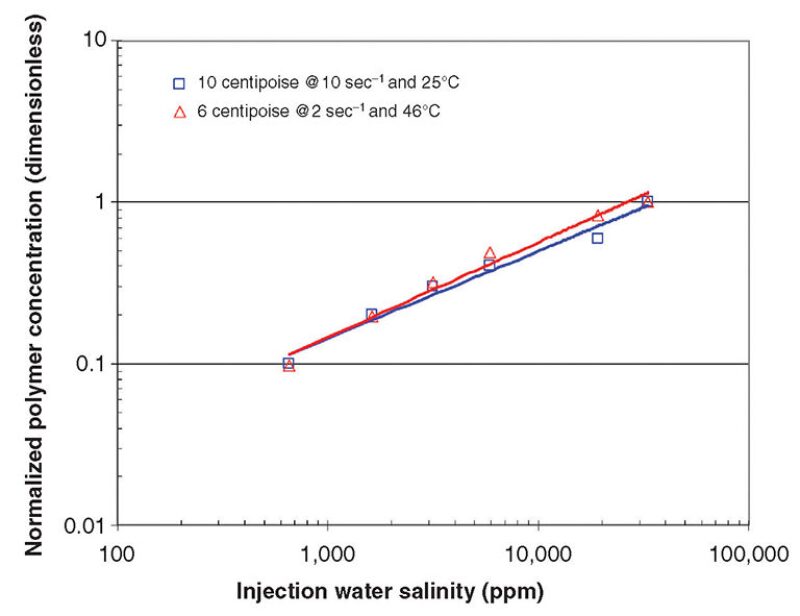

At the other extreme, in a polymer flood, the concentration of hydrolyzed polyacrylimide (HPAM) required to achieve a target viscosity increases as salinity increases, as shown in Fig 1. This is the well-known Flory theta solvent effect (i.e., the polymer unwinds in a compatible solvent providing high viscosity, and it balls up in an incompatible solvent, providing less viscosity). Thus, the cost of polymer increases as a function of the injection water salinity. Also, ferrous iron, sulfide ions, and oxygen cause the polymer to degrade and lose viscosity.

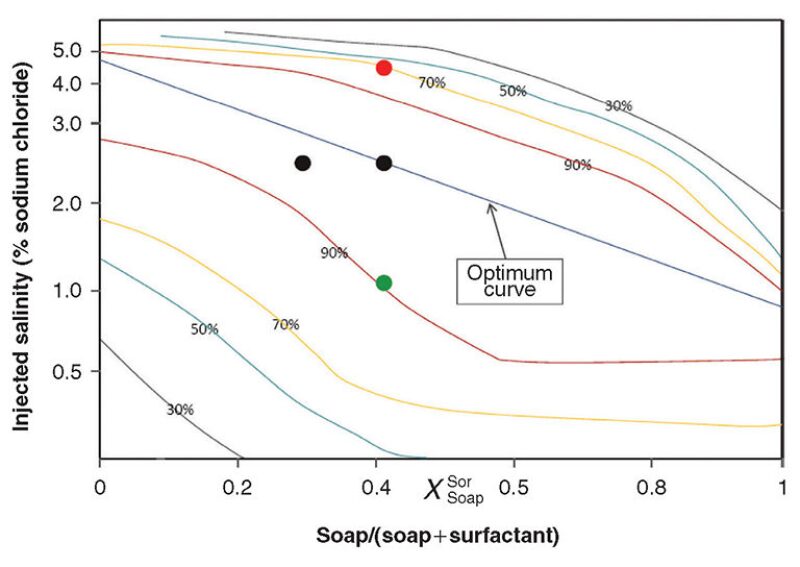

In a surfactant flood, injection water chemistry is even more of an economic issue because it directly affects reservoir response. The optimal salinity of a surfactant flood can vary greatly as a function of the surfactant chemistry and the reservoir dynamics. The objective is to achieve the lowest interfacial tension between the water and oil. Fig. 2 demonstrates a representative example of the relationship between salinity and surfactant concentration.

Reservoir souring is just as much of an issue with CEOR as it is with conventional waterflooding, and manipulation of ionic composition offers hope to minimize souring through injection of nitrate or reduction in sulfate concentration. Also, oxygen and biological control are persistent issues in any flood where the source water contains oxygen. Oxygen in a polymer solution can severely degrade the viscosity.

Water compatibility is determined by the potential for sulfate scaling of producer wells. If, for example, the injection water is seawater (high concentration of sulfate) and the formation water contains barium or strontium, then sulfate scaling will occur in the producer wells. This is the driver for installation of sulfate rejection membranes (SRMs). SRMs were first installed offshore for the Marathon South Brae field in 1988 to mitigate sulfate scaling. Since then, offshore installations were relatively few until about 2004 or so when the total barrels treated surpassed 2 million BWPD. Since then, uptake of this technology has been significant, with a current capacity of close to 10 million BWPD (Reyntijens 2012). As with other technologies, uptake appears to follow an S curve, which requires a critical mass of applications and experience before industrywide acceptance will occur.

Water treating techniques for achieving various water chemistries, such as sulfate removal, nanofiltration for divalent ion removal, reverse osmosis, and remineralization, are being practiced both onshore and offshore for the industrial, municipal, and agricultural sectors. Onshore applications include desalination of seawater for drinking and irrigation, steamflood, and, in a few cases, produced-water treating for surface discharge. The applications are wide ranging, and significant expertise is required to apply lessons learned from one application to another. Many of these applications use membrane technologies to achieve the desired water chemistry.

Membrane technologies require reliable pretreatment to prevent membrane fouling. Fouling is both a design challenge and a challenge for surveillance and operation. A rigorous monitoring and response program is required (Davis and Southwell 2007). When membranes become fouled, the permeate rate decreases. Other factors can decrease the permeate rate, so monitoring must be based on normalized performance indicators. Biological fouling, or biofouling, poses the most significant challenge (Henthorne 2010). Controlling biofouling is a function of biocide dosing—intermittent is far superior to continuous dosing for membrane applications—combined with conservative designs that reduce or eliminate conditions for biogrowth. However, monitoring by itself is insufficient. At an early stage of fouling, adjustments need to be made to the prefiltration system, biociding program, or chemical cleaning system (e.g., chemicals, dose, and duration). Operators must carry out a specified response when a key performance indicator exceeds a target. In most membrane systems, fouling is already well progressed before it is detected, and irreversible fouling can occur soon after.

Membranes (both hollow fiber and spiral wound) can also function as pretreatment in the form of microfiltration or ultrafiltration technology. These represent one of the fastest growing technologies in the water treating industry. Given the significant uptake curve for this technology both onshore and offshore, there is wide recognition of its importance, and adoption for use as pretreatment upstream of SRM packages is becoming widespread for new systems. Hollow fiber membranes are also being considered for oxygen removal. In this case, fouling susceptibility is the major unknown that might be obviated by placement downstream of an ultrafiltration or SRM system.

Recently, Total started polymer flooding the Dalia field in deepwater offshore Angola. On average, 8,000 BWPD are being injected using desulfated seawater from an SRM system. Polymer concentration is about 900 mg/L. A 750-kg bag of polymer is consumed every 1.5 days. An increase in daily oil production was seen soon after polymer injection. It is too early for back-produced fluids. Once the back-produced fluids contain detectable concentrations of polymer, the produced fluids will be routed to a disposal well (Morel et al. 2012). Other operators have larger offshore polymer flood projects under development.

For many polymer projects, treating back-produced CEOR fluids will be a challenge. One of the early deterrents to CEOR in the 1980s was the difficulty of separating and metering the oil. Reservoir response was essentially unknown for many applications because accurate oil-production rates could not be determined because of inadequately designed separation facilities. Designing the separation facility remains a challenge.

A polymer flood will result in back-produced water with at least twice and up to an order of magnitude greater viscosity compared to conventional produced water, depending on the polymer concentration and extent of polymer degradation. While this is significant, it can be taken into account in equipment design. Water viscosity differences are already well known in the industry, and equipment design models accurately account for the effect. The produced fluids in the Norwegian sector of the North Sea are hot and, therefore, have about half the viscosity of produced water in the deepwater Gulf of Mexico. This viscosity difference, from temperature alone (and not polymer), is adequately taken into account in water treating system design. Extrapolation to higher viscosity can likely be performed with confidence.

However, the presence of polymer changes two other key aspects of the produced water. First, it is known that at low concentration (<500 mg/L), HPAM polymer promotes coagulation and flocculation of oil drops. It is a common component of deoiling products used to treat produced water. At higher concentrations, though, the produced water viscosity and viscoelastic properties become dominant. The only information at this time is from theoretical considerations, which suggest that back-produced fluids containing polymer are more sensitive to shear—not shear thinning of the polymer, but oil/water emulsion tendency. In other words, for a given shear rate, a back-produced fluid containing polymer will have higher oil-in-water concentration and smaller oil drops. If this is indeed the case, back-produced fluids will be more difficult to deoil. As important as this question is, it remains largely unexplored. The literature describing field experience is ambiguous and unclear.

Second, polymer increases jetting of bubbles in a flotation unit. The bubbles tend to form jets, rising rapidly and causing secondary flow, making it more difficult to evenly disperse bubbles in the presence of polymer and significantly reducing the performance of a flotation unit. Perhaps this problem can be solved by better design of bubble distribution systems. After all, bubble distribution is an area of flotation design that has been steadily improving over the years. This is another question that remains relatively unexplored.

Perhaps all of these problems can be overcome by new equipment designs. The literature on the Daqing field suggests this may be the case, including an example of an innovative technology that has recently been installed to separate and recycle the polymer from the back-produced CEOR fluids.

One of the interesting developments in water treating back-produced fluids is in chemical treating of ASP fluids. In a recent application of hydrophilic/lipophilic deviation (HLD) theory, George Hirasaki and his group at Rice University (Pena et al. 2005) have identified cationic surfactants that act as strong demulsifiers to break ASP emulsions. Typical ASP back-produced fluids are composed of tight emulsions of small oil drops in water that are stabilized by the ASP chemicals. The chemistry of these demulsifiers is specific in the sense that only one particular compound seems to work with any particular ASP formulation. Nevertheless, when the proper chemistry is selected, settling time is reduced from 12 hours to 12 minutes (Nguyen et al. 2011). Apparently, the cationic surfactant demulsifier pushes the ASP surfactant away from the oil/water interface. From a high-level perspective, it is not a surprise that a chemical strategy is successful in treating such a chemically stabilized emulsion.

One of the avenues being pursued is to degrade the polymer in the back-produced fluids. Because the polymer is shear sensitive, mechanical degradation is an obvious idea. The key will be to degrade the polymer molecules without shearing the oil drops. There is some hope that this could be done. The size scale of the polymer molecules is on the order of nanometers, while the size scale of the oil drops is on the order of microns. Thus, two different size scales are involved. Further, the viscous stress required to degrade the polymer is less than that required to shear oil drops. Thus, a device that generates nano-scale viscous shear, while avoiding micron-scale turbulence, might do the job. High Reynolds number turbulent eddies must also be avoided because, according to Richardson and Kolmogorov (Davidson 2004), turbulence generates an energy cascade that inevitably leads to micro-scale eddies of the kind that will shear oil drops. Altogether, these requirements lead to ultrasound treatment as the best candidate. Such devices might be expensive for large volume flows; this remains to be determined.

Chemical degradation is also being evaluated. Typical polymers used in CEOR can be degraded using hypochlorite. Perhaps there are other treatments that would be possible. In proppant fracturing, the viscosifier polymers are designed for injection at high viscosity and backflow at low viscosity. This is required for optimal proppant placement. It is achieved in various ways, such as thermal or enzymatic degradation. Perhaps there is a similar strategy that could be used to lower the viscosity of CEOR polymers in back-produced fluids. Obviously, in this case, the polymer would need to maintain high viscosity through the reservoir and only become degraded during or shortly after back‑production.

In all of these water treating challenges, the devil is in the details. Seemingly small decisions can make the difference between a system that performs well with minimum operating expenses and high uptime vs. a system that is chronically difficult and costly to operate. Operators that suffer water treating problems often do not tally the real cost of those problems. The staff time required to solve water treating problems can be high and can put significant strain on the staff resources of an organization. In many cases, if communication between the reservoir chemist and the water treatment specialists could be in place from the time the CEOR cocktail formulation and water chemistry requirements are developed, it is expected that many of these consequential decisions could be addressed in the early stages of the project.

Opportunities in Water Treating

In addition to the technical challenges mentioned, there are significant opportunities as the industry implements CEOR projects. While the technology is complex and knowledge in this area is specialized, the commercial barrier to entry is not high. Relatively few patents remain in effect. Few if any intellectual property barriers exist. The main barrier to entry is expertise.

Deep expertise in water treating is required. If history is a guide, NOCs and IOCs will look for this expertise from the consultants, chemical suppliers, equipment suppliers, academia, and the engineering consultant companies. Pockets of expertise are developing.

Selecting appropriate technology and designing an integrated process requires expertise. There is a wide variation in the level of expertise available from the engineering firms. Most do not have the expertise required to select and design systems that not only perform well but also are simple to operate. On the other hand, some engineering companies have established an industry niche by providing expertise together with engineering. Such companies are notable in that they send staff to workshops and encourage staff to publish papers. They offer consulting in addition to engineering. Such companies add significant value to a project.

Knowledge of how to design CEOR water treating systems is certainly specialized, but credible expertise is available. Many of the experienced international service providers have recognized the opportunities in this area for several years. The most successful of these companies are those that have specialized in water treating and have developed deep expertise in all three areas critical to water treating: chemistry, equipment, and process lineup.

Chemical companies are pursuing the opportunities vigorously. This is not a surprise. Obviously, CEOR involves intense chemistry and, therefore, offers a market opportunity. There is another reason that is perhaps less obvious. Chemical suppliers have a first-row seat at the game. Upstream chemical suppliers typically employ 10 times the number of field staff compared with almost every other oilfield services provider on an equivalent revenue basis. Field services are the main value driver for chemical providers, and they see the field problems firsthand. The top-tier upstream chemical suppliers are very effective at capturing the challenges of water treating and developing new products.

On the equipment side, the situation is a bit different. The major equipment suppliers see an opportunity to sell more sophisticated water treating equipment (i.e., those with greater process intensity) to onshore CEOR projects. Given the difficulty of treating back-produced fluids, settling tank residence time becomes impractical. Therefore, it makes sense to use hydrocyclones, flotation, and nutshell filters. It appears though, based on pilot and field tests, that the equipment performs only about half as well as hoped. Shear thinning, higher oil concentrations, smaller drops, and bubble jetting make these fluids more difficult to treat than expected. For onshore applications, this merely means that twice the capacity must be installed. However, for offshore applications, this poses a significant problem because of the limited space and weight available for water treating.

Overcoming these problems may require development of new technology and possibly a fundamental understanding of the back-produced fluid properties. Not only would this be expensive, but there are relatively few laboratories, test sites, and people who can do the work. The equipment suppliers feel that there is not a large enough market to justify a large effort, and they may be correct. Such companies tend to have a keen sense of the cost and potential market for developing new technology. While CEOR will clearly increase in volume, it may not capture more than a few percent of the total global water treating market. The offshore market will be even smaller. In which case, push from resource holders may be required rather than technology pull from the equipment companies to provide new technology.

It is encouraging that expertise is developing in the consulting, services, and supplier sectors. However, this will likely not be enough. As the NOCs and IOCs begin to take ownership for water, they are beginning to realize that in-house expertise is required as well. A key to a successful project is a high level of expertise among all partners.

Summary and Conclusions

While there is significant interest and activity in water treating for CEOR, activity does not equal progress. Despite recent improvement in the strategy of IOCs, there is a long road to travel. As indicated, water treating in the oil industry is complex and governed by thorny subjects such as colloid chemistry and interfacial science. A fundamental understanding of most oilfield water treating issues does not exist. There is very little reliable data about how and why certain equipment performs well or does not. Books and review papers are scarce. Few academics are working on the problems. There are few standard methods or industry nonprofit institutions to manage information, dictate standard testing procedures, or recommend industry guidelines relative to water treatment in the oil industry. Compounding this situation, the number of people who can bridge the gap between the science and the application is relatively few and actually decreasing with time as the industry demographics mature.

It is too early to say how all of this will work out. The industry may find clever ways to handle the back-produced fluids. If not, an expensive development effort may be required. No one can really say for sure at this time. One fact is clear: CEOR is yet another development to add to the list of oil industry challenges where water treating expertise is required, including heavy oil steamfloods, hydraulic fracturing for tight gas and tight liquids, coal seam methane, sour hydrocarbons, and hydrate control. The list is already long and is having an effect on the cost and speed with which hydrocarbons can be brought

to market.

As always, we hope that this article has provided some food for thought. Debate on this or other water treating issues is welcome.

References

Al-Mutairi, S.M, and Kokal, S.L. 2011. EOR Potential in the Middle East: Current and Future Trends. Paper SPE 143287 presented at the SPE EUROPEC/EAGE Annual Conference and Exhibition, Vienna, Austria, 23–26 May. http://dx.doi.org/10.2118/143287-MS.

Ayirala, S., Ernesto, U., Matzakos, A., Chin, R., Doe, P., and van Den Hoek, P. 2010. A Designer Water Process for Offshore Low Salinity and Polymer Flooding Applications. Paper SPE 129926 presented at the SPE Improved Oil Recovery Symposium, Tulsa, 24–28 April.http://dx.doi.org/10.2118/129926-MS.

Chang, H.L., Zhang, Z.Q., Wang, Q.M., Xu, Z.S., Guo, Z.D., Sun, H.Q., Cao, X.L., and Qiao, Q. 2006. Advances in Polymer Flooding and Alkaline/Surfactant/Polymer Processes as Development and Applied in the People’s Republic of China. Paper SPE 89175. J Pet Technol 58 (2): 84–89. http://dx.doi.org/10.2118/89175-MS.

Davidson, P.A. 2004. Turbulence: An Introduction for Scientists and Engineers. Oxford University Press, USA.

Davis, R.A., and Southwell, G. 2007. Practical Considerations in Ensuring Cost Minimization in the Design and Operation of Sulfate-Removal Systems. Paper SPE 109129 presented at the International Oil Conference and Exhibition in Mexico, Veracruz, Mexico, 27–30 June. http://dx.doi.org/10.2118/109129-MS.

Delshad, M. 2010. SPE Training Course on Chemical Enhanced Recovery, Houston, 2–3 November.

Henthorne, L. 2010. Trends in Pretreatment for Seawater Reverse Osmosis. Water Conditioning and Purification 52 (11): 22–24.

Hirasaki, G. 2010. Introduction to Consortium on Processes in Porous Media Consortium, Rice University, 3 May.

Hirasaki, G.J., Miller, C.A., Puerto, M. 2011. Recent Advances in Surfactant EOR. SPE Journal 16 (4): 889–907.

Ji-Cheng, Z. and Kao-Ping, S. 2008. Considerable Potential Remains After Daqing Polymer Flood. Oil & Gas J. 106 (35): 61–66.

Manrique, E., Thomas, C., Ravikiran, R., Izadi, M., Lantz, M., and Romero, J. 2010. EOR: Current Status and Opportunities. Paper SPE 130113 presented at the SPE Improved Oil Recovery Symposium, Tulsa, 24-28 April 2010. http://dx.doi.org/10.2118/130113-MS.

Morel, D., Vert, M., Jouenne, S., Gauchet, R., and Bouger, Y. 2010. First Polymer Injection in Deep Offshore Field Angola: Recent Advances on Dalia/Camelia Field Case. Paper SPE 135735. Oil and Gas Fac. 1 (2): 43–52.

Nguyen, D., Sadeghi, N., and Houston, C. 2011. Emulsion Characteristics and Novel Demulsifiers for Treating Chemical Induced Emulsions. Paper SPE 143987 prepared for the SPE Enhanced Oil Recovery Conference, Kuala Lumpur, 19–21 July. http://dx.doi.org/10.2118/143987-MS.

Pena, A.A., Hirasaki, G., and Miller, C. 2005. Chemically Induced Destabilization of Water-in-Crude-Oil. Ind. Eng. Chem. Res. 44 (5): 1,139–1,149. http://dx.doi.org/10.1021/ie049666i.

Reyntijens, K. 2007. Sulfate Removal: History and Future Outlook. Oral presentation made to SPE/EDS Joint Workshop on Desalination in the Oil and Gas Industry, Rome, 5–7 March.

Yang. F., Yang, X., and Li, J. 2006. Daqing pilot shows effectiveness of high-concentration polymer flooding. Oil & Gas J. 104 (9): 49–53.

John Walsh is SPE Technical Director for Projects, Facilities, and Construction and a chemical process engineer at Shell.

He can be reached at John.M.Walsh@shell.com.

Lisa Henthorne is senior vice president and chief technology officer with Water Standard. She holds three US patents and has multiple patents pending in water treatment technology. Much of her present work is focused on developing customized water chemistries to enhance oil recovery in low salinity and chemical enhanced oil recovery.