The drop in crude oil prices caused by the COVID-19 pandemic will reduce the combined free cash flow of 96 floating production, storage, and offloading (FPSO) fields which have produced more than three-quarters of their original resources at just $2.20/bbl this year compared with $11.10/bbl in 2019. Rystad Energy added 40% of those FPSOs will end 2020 with a negative cash flow.

Given the company’s base case oil price outlook, with prices recovering next year and into 2022, free cash flow will climb back to 2019 levels but will quickly return to a decline as mature fields see production stagnate, threatening the profitability of many FPSO assets.

In addition to field economics, other challenges may also add to FPSO operator concerns, such as continued risk of unplanned production shut-ins from the pandemic and supply cuts, which could result in several late-producing FPSOs being shut down for good.

Rystad noted fields using leased FPSOs are in the worst position, with around 70% of late-producing assets estimated to have net present values below zero. This puts not only operators in an uncomfortable position, but also FPSO suppliers, who are faced with two possible outcomes:

- FPSO contracts can be renegotiated for a lower day rate in order to bring lease operating expense down, thereby improving the field’s net present value (NPV).

- Lease contracts can be terminated early.

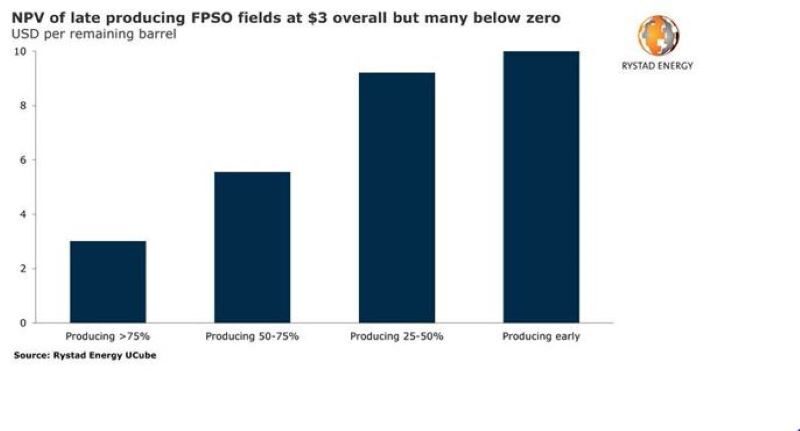

Rystad’s analysis is positive overall, but the company said of the 96 FPSO fields that have already produced more than 75% of their original resources, 30%–40% of those are estimated to have negative NPV. The NPV for late-producing fields with leased FPSOs is currently estimated at -$2.90/bbl while the overall figure for all FPSOs stands at $3.00 per remaining bbl.

Upcoming FPSO sanctioning is at a minimum and few opportunities remain for FPSO suppliers to find new work and redeploy their vessels. Consequently, suppliers may be forced to accept day rate reductions in order to keep their vessels working.