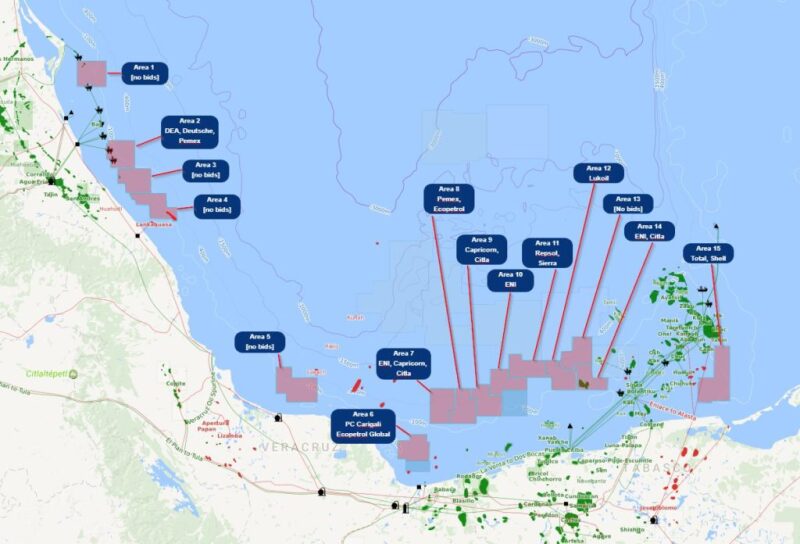

The first tender of the second round of Mexico’s oil and gas licensing auctions issued 10 awarded areas to more than a dozen different oil and gas companies. In addition to Mexican-headquartered companies, other winning firms represented hail from Russia, Malaysia, US, and the Netherlands.

Five locations received no bids, including some that were understood to be gas-rich and therefore a challenging investment due to the relatively low-cost gas imports coming from the US.

Under the terms of these production sharing agreements, the profits are to be split between the government and the operating companies. The minimum government take for this round of auctions was set between 20-25%.

But borrowing a theme seen throughout much of the first round of licensing, several companies overshot the base requirements by large margins. Four bids were won by promising the maximum of 75% of the profits to state coffers.

Only a single lease was awarded based on the minimum profit sharing terms of 20.1%—a block to be jointly developed by Mexican-national oil company Pemex and its Colombian counterpart, Ecopetrol.

Most of the areas to be developed through the results of this auction are between 200-225 sq. mile in area. The irregular shapes of the blocks reflects the Mexican government’s attempts to draw the lines around potential and known reservoirs, and to help speed the arrival of new production.

The largest block in terms of area encompasses 375 sq mi and was won by a consortium of Total and Shell and holds up to an estimated 496 million bbl of oil. The smallest block of 180 sq. mi. is to be leased by Italy-based Eni and Mexican independent Citla Energy and holds a potential 472 million bbl.

Area | Winning Bidder | Country of Company Headquarters | Block Size (sq. mile) | Reserve Estimate (Oil, millions of bbl) |

|---|---|---|---|---|

Block 2 | Deutsche Erdoel, Pemex | Netherlands, Mexico | 212 | 681 |

Block 6 | Carigali, Ecopetrol | Malaysia, Colombia | 216 | 516 |

Block 7 | Eni, Capricorn Energy, Citla Energy | Italy, United Kingdom, Mexico | 228 | 169 |

Block 8 | Pemex, Ecopetrol | Mexico, Colombia | 226 | 413 |

Block 9 | Capricorn Energy, Citla Energy | United Kingdom, Mexico | 217 | 571 |

Block 10 | Eni | Italy | 206 | 512 |

Block 11 | Repsol, Sierra Perote | Spain, Mexico | 206 | 949 |

Block 12 | Lukoil | Russia | 201 | 958 |

Block 14 | Eni, Citla Energy | Italy, Mexico | 180 | 472 |

Block 15 | Total, Shell | France, the Netherlands | 375 | 496 |