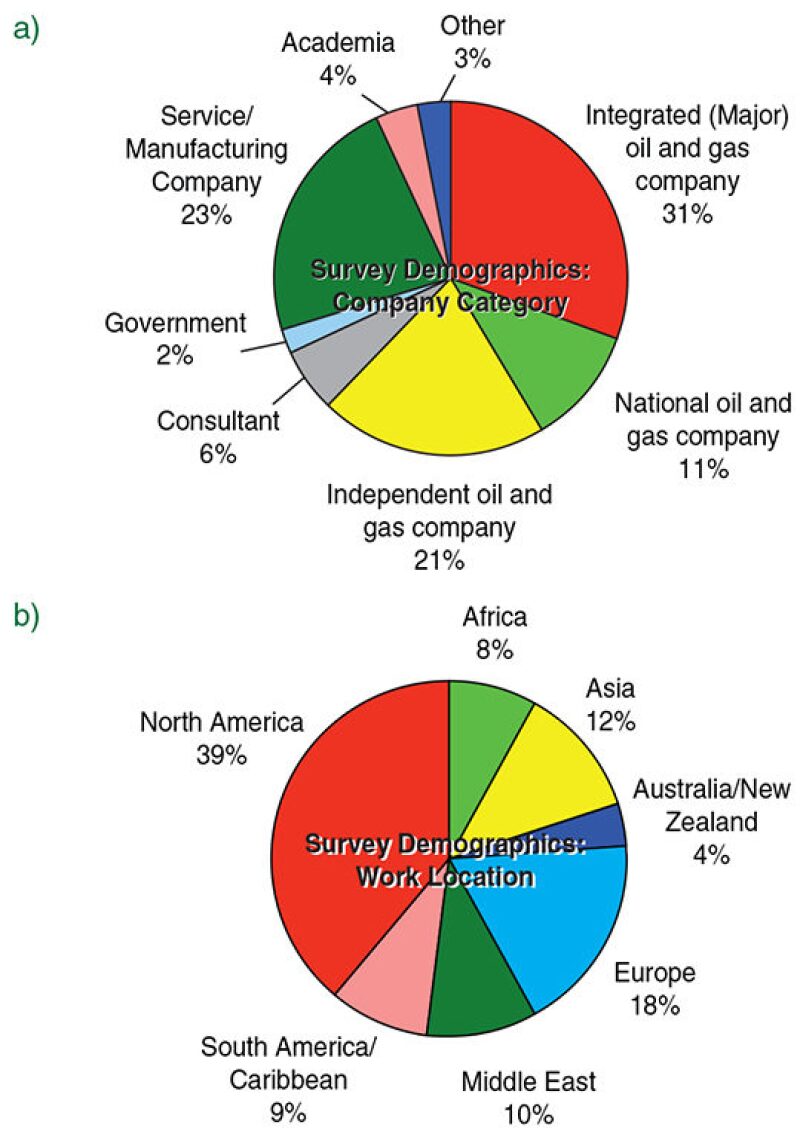

A total of 480 readers responded fully to the survey. As shown in Fig. 1a, the company category of the respondents included integrated (major) oil and gas company (31%), service/manufacturing company (23%), independent oil and gas company (21%), national oil and gas company (11%), consultant (6%), academia (4%), government (2%), and others (2%). Concerning work experience, almost two-thirds of the respondents have less than 5 years’ experience. The male/female ratio was 85/15. Most respondents were younger than 35. The answers strongly correlated with the primary work location, the data on which are shown in Fig. 1b.

Oil and Gas

Will oil and gas remain the major energy source for the 21st century?

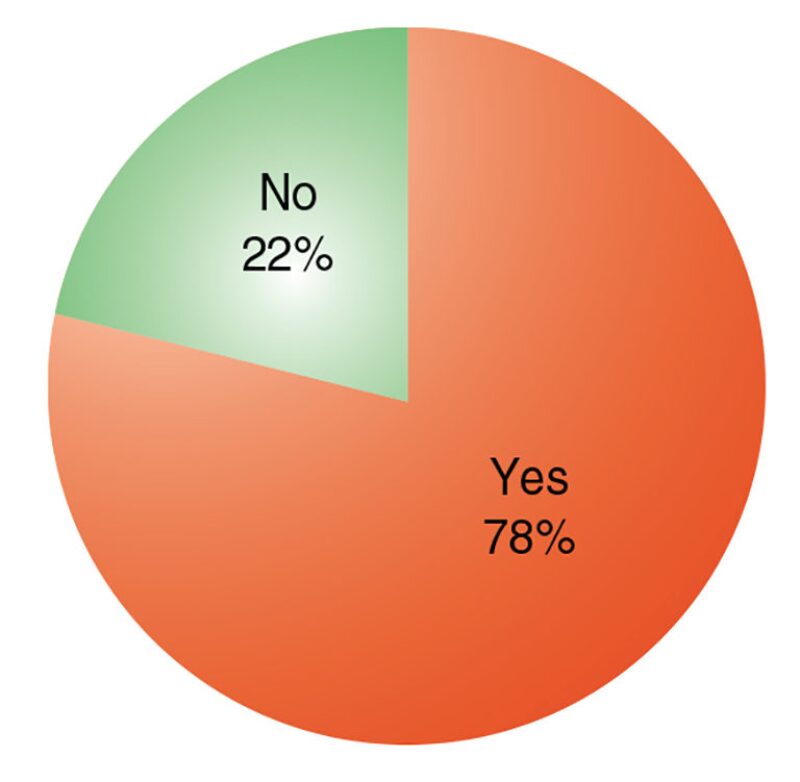

As shown in Fig. 2, 78% of the respondents answered affirmatively.

Some points to support this belief include

- New exploration along with improved oil-recovery technology will increase oil recovery to almost 80%, making oil and gas the main energy source until 2070 to 2080.

- As new, cost-effective ways of storing and transporting natural gas develop, we will help sustain energy supply through the ability to tap into previously uneconomic resources that used to be flared off.

- Deepwater opportunities in the Gulf of Mexico and west Africa, combined with Canadian tar sands and enhanced oil recovery in the Middle East, will keep oil in the USD 60/bbl range. This is high enough to support these types of projects, but not high enough to make alternatives competitive.

Here are some comments from those who answered negatively:

- Demand will exceed supply, and the cost of oil will escalate the need for alternative-energy sources; this will cause more money to be invested in finding alternative sources of energy and will make these options look more economically viable.

- Global-warming effects will be the key driver for the world to look for cleaner fuels. A few countries have already started promoting the use of hybrid engines, and I see that as being the gradual transition to cleaner, alternative-fuel sources.

Peak Oil theory considers that we are reaching, or have already reached, the peak level of oil production with a global decline to follow. What effect will new technology and renewable-energy development have on the peak-oil timing?

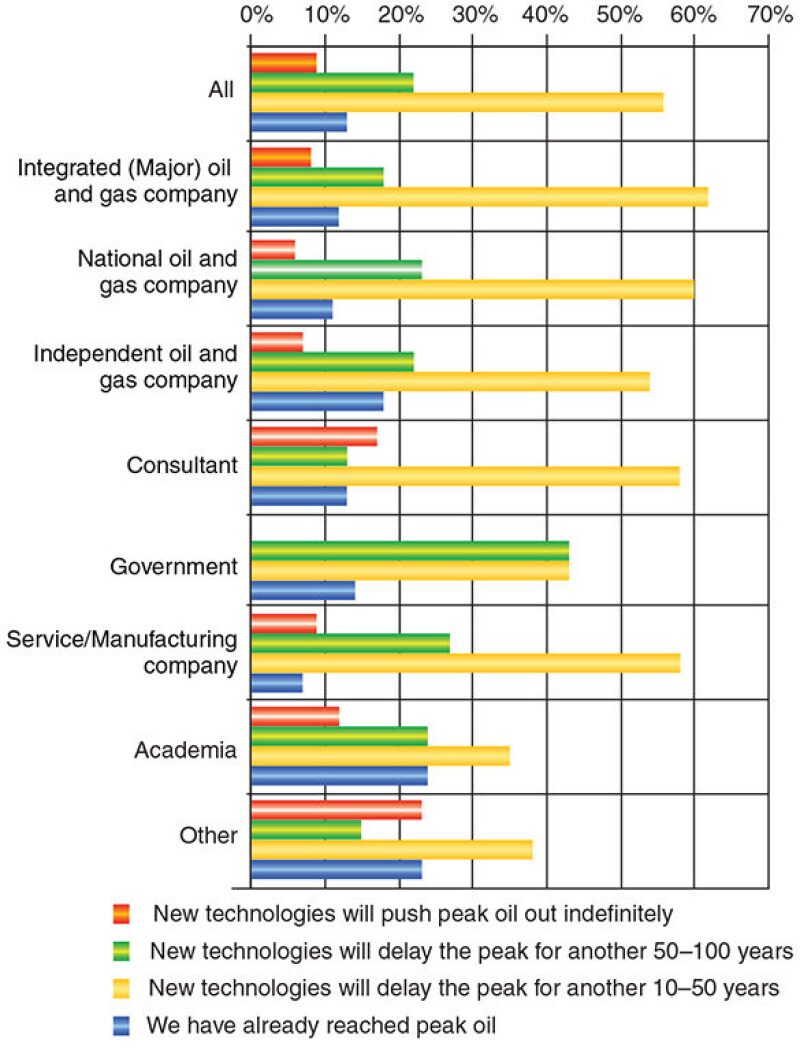

As shown in Fig. 3, only 13% of the respondents believe that we have already reached the peak oil. According to 56%, new technology will delay the peak for another 10 to 50 years, while 31% believe that it will delay the peak for 50 to 100 years. Interestingly, the confidence that technology can delay the peak for another 10 to 50 years cuts across all company categories.

Energy Mix

What energy source do you see primarily powering cars by each of the following dates: 2017, 2030, 2070, and after 2100?

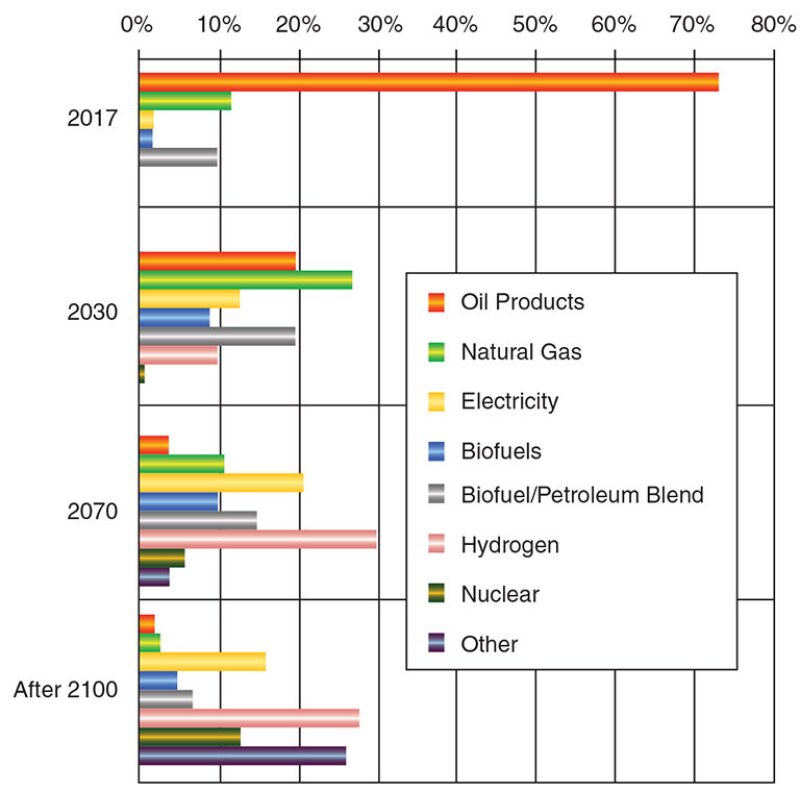

As shown in Fig. 4, respondents believe that oil and gas will dominate the automotive-fuel energy picture through 2030. While oil, natural-gas products, and biofuel/petroleum blends will represent 95% of the energy powering cars in 2017, this will fall to 67% in 2030. By 2070, more than half of the energy will be provided by hydrogen and electricity. After 2100, oil and gas will power only 5% of the world’s cars.

In conclusion, while young professionals believe that oil and gas will remain the principal source in the 21st-century energy panorama, the picture changes considerably if we analyze only the transportation market. Already in 20 to 25 years, respondents expect significant substitution of natural gas, electricity, hydrogen, and biofuels for oil.

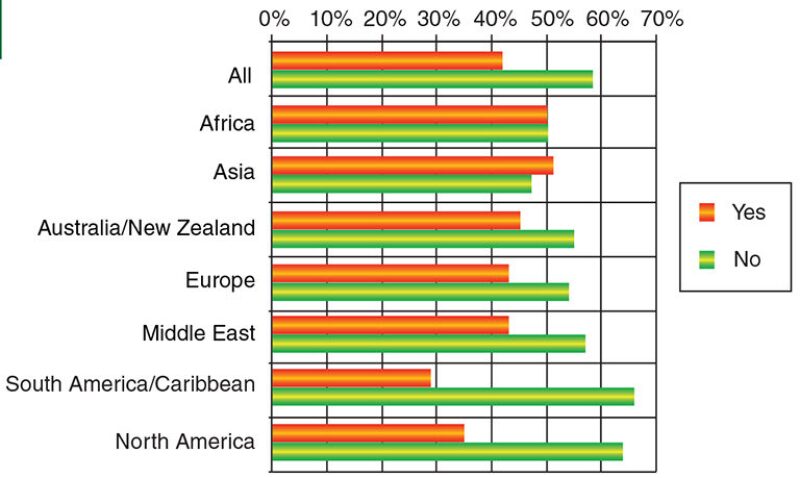

Do you think renewable energy (biofuels, solar, wind, hydroelectricity, and hydrogen) will supply at least 25% of the global energy demand within the next 20 years?

As shown in Fig. 5, only 42% of respondents believe that this will happen by then. Among the primary work locations, respondents in Africa and Asia see greater likelihood of achieving 25% global renewable-energy use than respondents in the North and South America region.

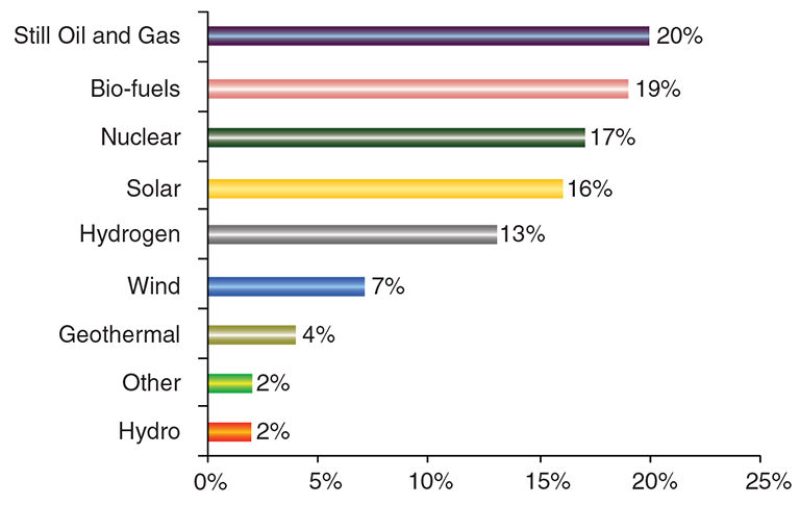

In which single alternative-energy source would you invest today?

As shown in Fig. 6, no alternative-energy source stood out as the best investment choice for today. The 20% of respondents saying that they would stay with oil and gas were the largest single group. Biofuel, nuclear, and solar energy, in that order, received the most votes among alternatives.

Will nuclear energy experience a renaissance and move into a rapid growth phase globally?

This question showed great differences from country to country. On average, 54% of respondents said that nuclear power is likely to grow significantly in the near future. While the strongest agreement comes from Australia/New Zealand, Asia, and Europe (85, 68, and 58% “yes,” respectively), the strongest disagreement comes from South America and the Middle East (55 and 54% “no,” respectively).

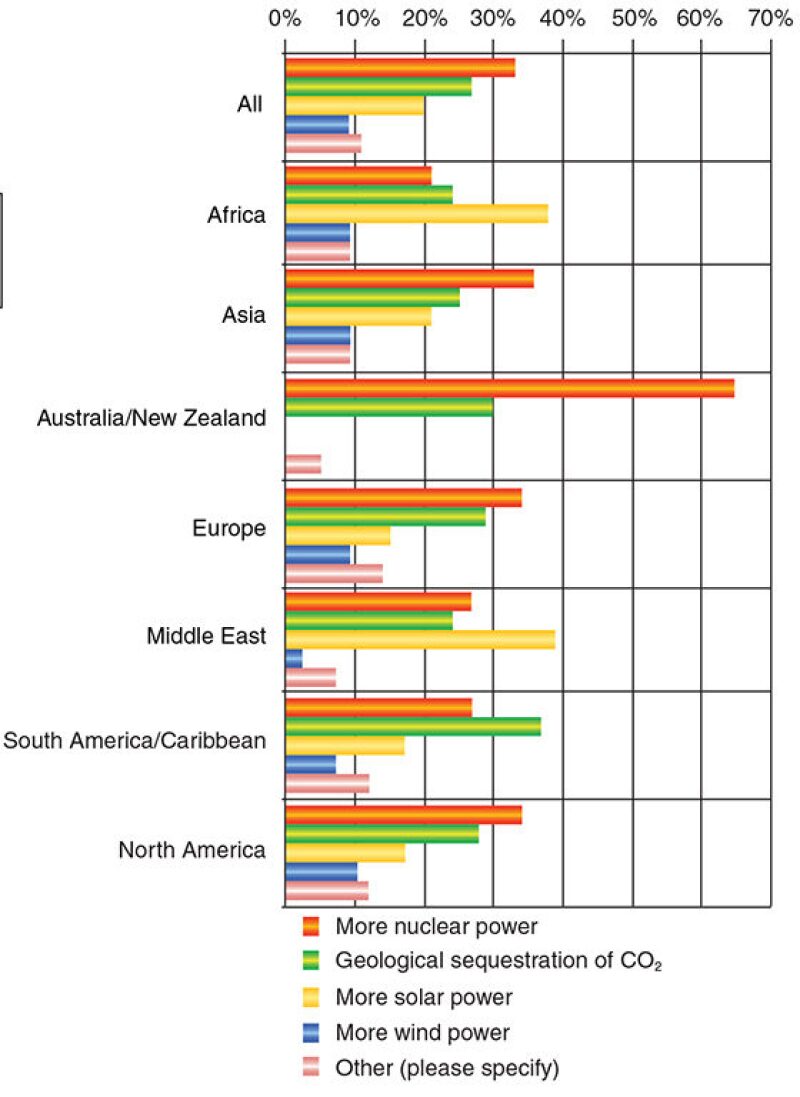

What do you think is the key to reducing CO2 emissions in generating electricity?

As shown in Fig. 7, 33% of respondents believe that it is more nuclear power. This was the popular choice among most primary work locations. Another 27% feel that the answer lies in the geological sequestration of CO2, while 20% favor the use of solar energy, and 9% prefer wind power. The remaining 11% offered suggestions such as better conservation, more-efficient CO2 removal at the source, hydroelectricity, reforestation, and stronger government regulations. By geographic region, respondents in the tropical and arid areas voted more for solar energy. Respondents in the most-developed regions, such as North America and Europe (57% of the whole survey population), favored nuclear power.

Company strategies

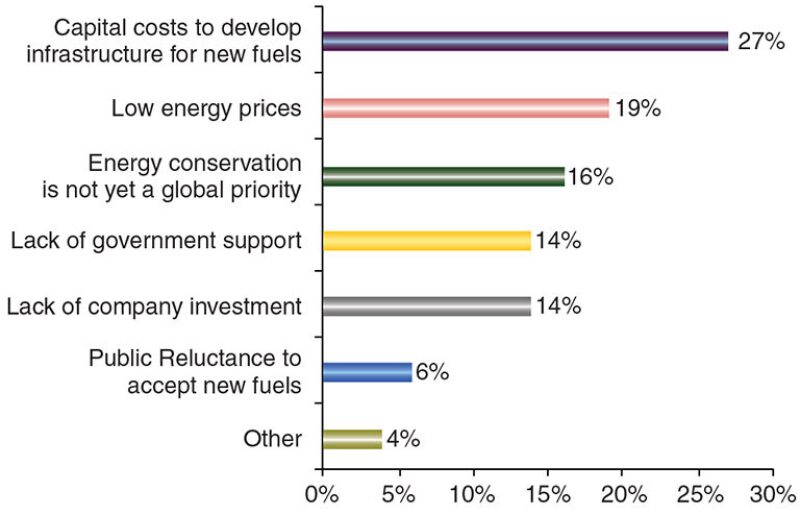

Why has renewable energy been slow to develop?

There are various reasons. As shown in Fig. 8, 27% of respondents believe that the high capital cost of developing new fuel infrastructure is the primary explanation. A further 19% cite low energy prices, while 16% say that energy conservation receives too low a global priority, 14% blame insufficient company investment, and another 14% cite a lack of government support. According to others, demand simply has not been strong enough.

Which group will lead the way in alternative-energy technology development?

Among respondents, 36% believe the “integrated oil and gas companies” will be the leaders, followed by 26% indicating “new companies” yet to be formed and 22% selecting existing renewable-energy companies. The remaining 16% feel that government research laboratories will lead the way. It seems significant that companies not yet formed were viewed as the future pacesetters by more than a quarter of the respondents.

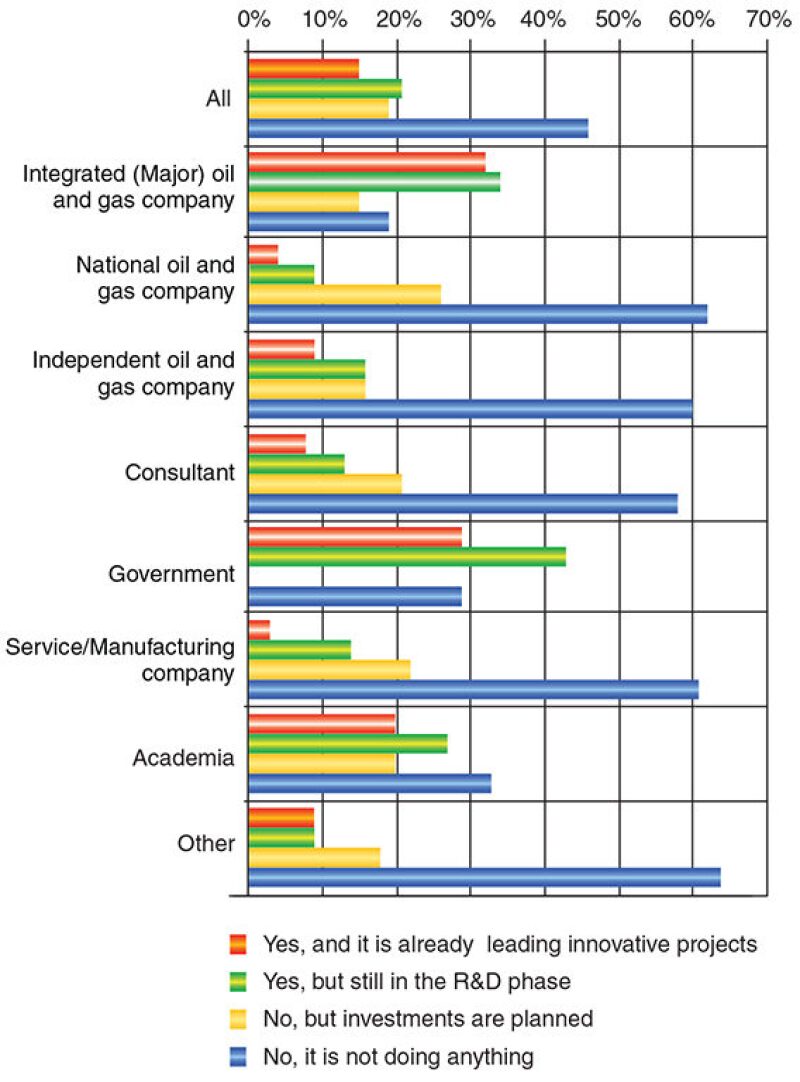

Is your company investing enough in alternative energy?

As shown in Fig. 9, 46% of respondents said that their company is not doing anything, and 18% said that investments were planned, though nothing yet had been done. Another 15% said that their companies were already implementing innovative projects, and 21% said that they were still in the R&D phase. Of those whose organizations are already implementing these projects, 34% were from the majors, 29% from the government, and 20% from academia. Those answering that their organizations have not done anything include 88% of respondents from the national oil companies, 83% of those from the service/manufacturing companies, and 76% of those from the independents.

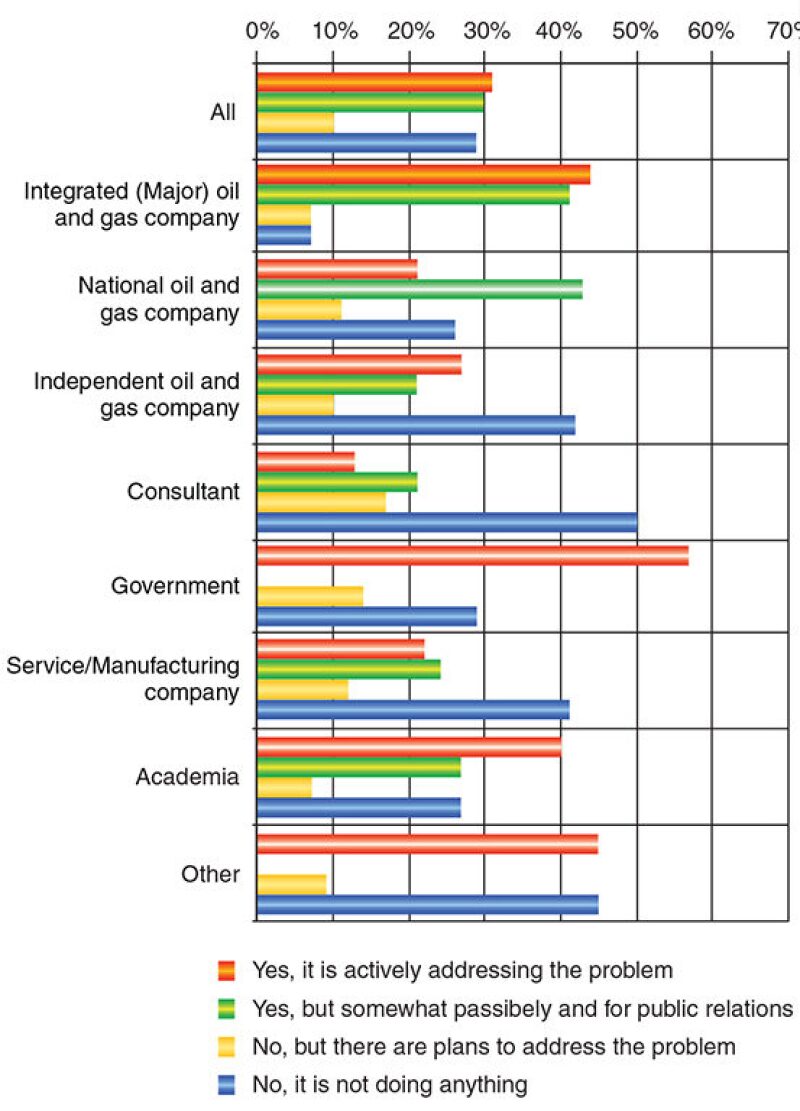

Is your company addressing the problem of climate change?

As shown in Fig. 10, only 31% of respondents said that their company is actively addressing this, while another 29% indicated that their employers are somewhat passively addressing the problem, possibly with a primary focus on the public-relations value. Of those whose companies have not addressed the problem, 10% said that they are planning to and 29% said that their employer is not doing anything. Those indicating that their employers are actively addressing the problem included 57% of respondents from government, 44% of those from the majors, and 40% of those from academia.

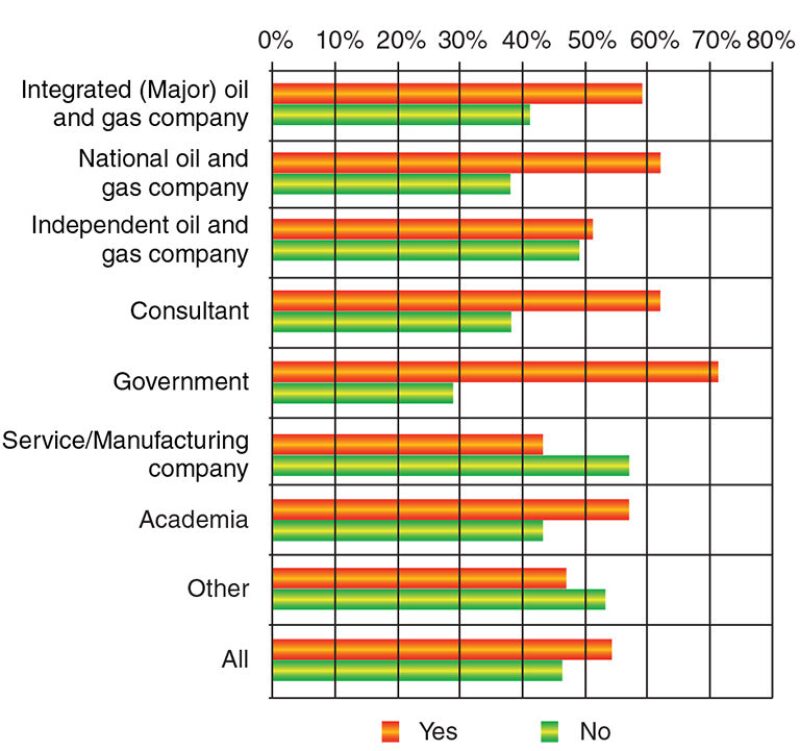

Do you think that many of today’s major oil companies are investing in renewable energy primarily to generate positive press and manage public perception?

As shown in Fig. 11, 59% of the respondents believe this to be the case, and that belief is strongest among consultants and employees of the majors and independents. Of note, 62% of the young professionals working for major oil companies gave thi

Do you think it is the petroleum industry’s responsibility to educate the public about energy?

Among respondents, 89% feel that it is the petroleum industry’s total (36%) or partial (53%) responsibility to educate the public about energy. Only 11% believe that it is not the industry’s responsibility.

Energy and Careers

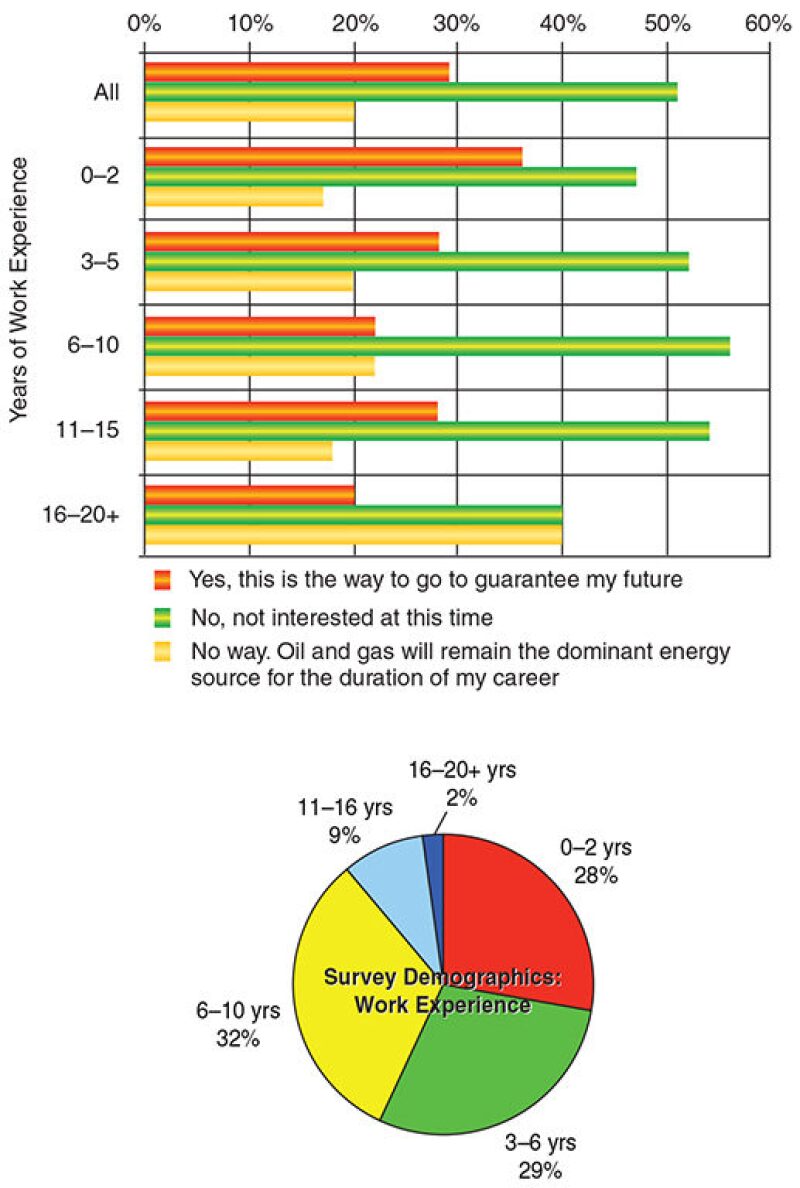

Would you consider changing your career to specialize in renewable energy?

As shown in Fig. 12, 71% of respondents said that they would not be willing to make such a career change, while 29% felt it was a way to guarantee their future. By levels of work experience, those willing to make the career change comprised 36% of respondents with 0 to 2 years, 28% of those with 3 to 5 years, and 28% of those with 11 to 15 years.

Would you consider taking a 2-year “broadening assignment” in renewable energy?

A total of 60% of the respondents said they would be willing to consider taking such an assignment to prepare for tomorrow’s opportunities. This response came from 77% of the females surveyed and 57% of the males. Less than 10% of all respondents answered with a firm “no,” indicating that they do not want to risk weakening their oil-and-gas skills in a context of probable growth in petroleum demand.

To a similar question centered on the interest in alternative-energy R&D, 59% of respondents showed a positive inclination to participate in such activity. Those from academia and government showed the most interest (more than 85% answering affirmatively), while those working for independent oil and gas companies showed the least interest (less than 50% answering affirmatively).

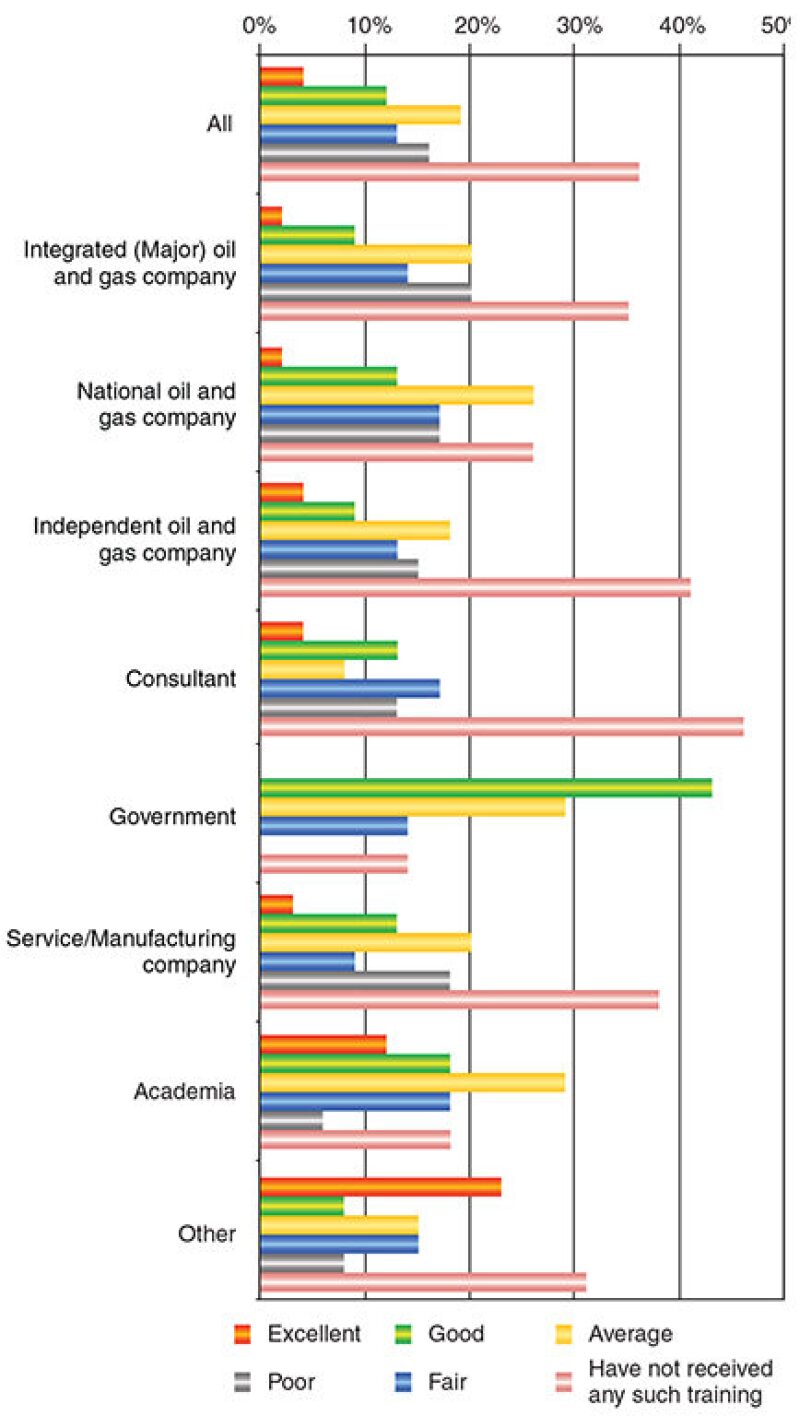

How do you judge the training you have already received in alternative energy?

As shown in Fig. 13, 36% of respondents indicated that they have received no such training, and 48% rated the training they have received as ranging from “average” to “poor.”

Do you feel it is your personal responsibility to educate the public about energy?

A total of 84% of the respondents feel that it is their personal responsibility to do this, although only 31% now do so actively. Those calling themselves active in this capacity comprised 33% of the male respondents and 17% of the females.

Should SPE incorporate “renewables” into its technical disciplines?

The very large majority (80%) of respondents answered “yes,” and this affirmation cut across categories such as gender, age, work experience, and work location. Those giving an affirmative answer included 100% of respondents from academia, 87% of those from national oil and gas companies, and 86% of those from government.

Conclusions:

Energy is a word hidden behind most of our daily habits and that strongly influences our attitudes in many ways. It is the engine of our economies, and a lack, change, or reduction of energy could cause severe, unexpected disruptions in everyday life. The young industry professionals surveyed are aware of the importance of the sector in which they work. They are confident that oil and gas will remain the primary energy source of this century and the primary transportation fuel for at least the next 25 years. However, despite the different opinions on the rate of transition to new transportation fuels, the majority of those surveyed believe that alternatives such as hydrogen, biofuels, and electricity will become the leading sources by 2070. These developments will help to solve the problem of CO2 emissions. Most survey respondents would continue to invest in oil and gas because they are confident in the progress of technology to maximize reservoir recovery and increase the number of discoveries. However, with an eye to the long term, they would be willing to take a 2-year assignment in renewable energy—a subject in which most of them received poor or no training and that they believe has yet to be tackled and studied sufficiently by their companies.