The upstream sector is witnessing comparatively more implementations of the industrial Internet of things compared with other sectors of the oil and gas industry. This is driven by the need to reduce operational risks and maximize returns from assets through digitalization, according to data and analytics company GlobalData.

GlobalData’s latest thematic report—Industrial Internet in Oil and Gas—reveals that the adoption of the industrial Internet of things would help companies in digitalizing oilfield operations and creating digital twins to reduce risk and optimize performance.

The industrial Internet of things has the potential to transform traditional processes and work flows and boost the technological capabilities of oil and gas firms. This could help them achieve two primary objectives. First, companies would be able to overcome operational challenges while venturing into new frontiers in search of hydrocarbon resources. Second, industrial Internet adoption will improve productivity and efficiency, thereby strengthening market competitiveness in a challenging environment.

Ravindra Puranik, an oil and gas analyst at GlobalData, said, “In general, adoption of the industrial Internet would make organizations more dynamic and adaptable to external factors. This concept is expected to play a central role in simulation and modeling of projects against different market scenarios, optimizing inventory levels, demand forecasting, decision support, and logistics optimization and setting up long-term objectives for an organization.”

Adoption of digital technologies has surged recently, largely as a reaction to the crash in crude oil prices. However, companies have been quite methodical in their approach to enabling this transformation and ensuring maximum possible value can be derived through implementations of the industrial Internet.

“This is particularly evident in the case of digital twins,” Puranik said, “wherein companies have chosen fields that have recently entered into production or are on the verge, to allow for the integration of advanced sensors and connectivity with oilfield infrastructure for remote monitoring and analysis. To highlight one such instance, BP created a digital twin of the Claire Ridge project in the North Sea, which started producing oil in 2018. The company was assisted by WorleyParsons in the creation of a digital replica of the field.”

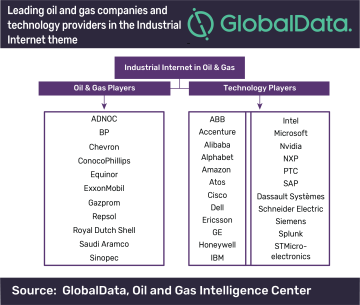

GlobalData’s thematic research identifies oil and gas companies—such as BP, Shell, Chevron, ExxonMobil, ConocoPhillips, Gazprom, Repsol, Equinor, Saudi Aramco, Sinopec, and ADNOC—as the major players in adoption of the industrial Internet in the oil and gas industry. These companies are assisted by technology providers such as Microsoft, IBM, Amazon, PTC, Cisco and Intel, which are gradually assuming leadership in delivering industrial Internet solutions to the oil and gas industry.