The objective of this paper is to develop and demonstrate an efficient work flow that will help stakeholders make better decisions in the area of completion planning. The work flow uses information from fracture modeling, production-data analysis, and project economics to quantify the relationship between the key input parameters of the well completion (pumping rate, proppant, and fluid pumped) and expected profitability expressed in net-present-value (NPV) terms.

Introduction

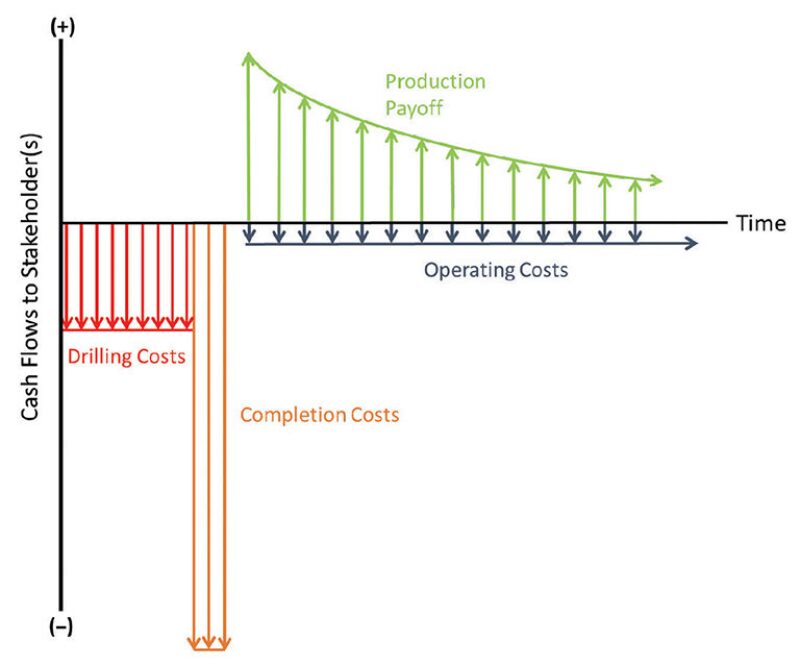

Over the past decade, completion costs have risen because of longer laterals, higher pressures, and an increase in stages and in fluid and proppant pumped. As completion teams continue to see economic production from larger completions, it is safe to assume that the cost of completions will remain high relative to total well cost. While drilling costs are generally spread out over weeks or months, completion costs are highly concentrated at the end of the development phase.