The United States’ liquids-rich shale experience has been dominated by three major plays: the Eagle Ford Shale in south Texas, the Permian Basin in west Texas, and the Bakken Shale that straddles North Dakota and Montana. But in the future, smaller plays will represent an increasing share of development and production.

“In terms of new discoveries, the best fields in our view have been picked over, are producing, and in development mode right now,” said Brandon Mikael, an upstream analyst of the Lower 48 US states at Wood Mackenzie.

“In terms of new discoveries, the best fields in our view have been picked over, are producing, and in development mode right now,” said Brandon Mikael, an upstream analyst of the Lower 48 US states at Wood Mackenzie.

As a result, Mikael said companies are turning to “niche plays” such as the Springer shale, one of the target formations of the newly emerging South-Central Oklahoma Oil Province (SCOOP). To add some perspective, Wood Mackenzie, a research consultancy group that specializes in the oil and gas industry, said the Springer shale ranks between 30th and 35th in term of its production value among the 200 shale plays that it has identified in North America.

Leading the charge in the area is Continental Resources, followed by two other independents, Marathon Oil and Newfield Exploration. In September, Continental told investors that it controls 118,000 acres in the “oil fairway” of the Springer shale discovery, which it said is 67% oil and 84% liquids overall. After drilling its first 11 producing wells, the company said it “derisked” 46,000 acres, which it estimates holds 127 million BOE.

Continental said that its early production numbers are comparable to its wells in the Bakken Shale, where it is the second-largest producer. Based on its analysis, Wood Mackenzie estimates that production in the Springer shale will increase from 3,600-5,000 B/D this year to between 40,000 and 60,000 B/D in 5 years.

The relatively modest production projection means that the Springer shale “is not going to be an Eagle Ford,” Mikael said. Located in the heart of Oklahoma’s oil and gas producing area, and approximately 40 miles from Continental’s headquarters in Oklahoma City, the Springer shale offers logistical benefits that will help create value for the company.

And because of its existing holdings in the underlying Woodford shale, a target formation in the SCOOP, Continental does not have to lease more land, build many new facilities, or set up field offices in the area. Mikael characterized it as “an incremental layer of production and value” that will help to offset future declines from the company’s Bakken production.

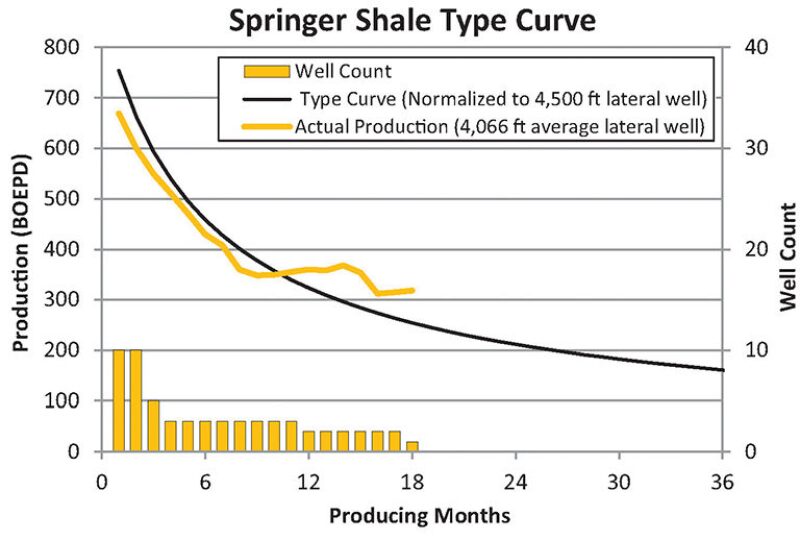

One of the keys to realizing the Springer shale’s potential will be “well repeatability,” which has not been achieved in the early exploration phase, Wood Mackenzie said. Continental released production details of its first 11 wells drilled in 2013 and this year, showing a high degree of variability. Three wells had initial production rates less than 600 BOEPD, while five averaged more than 1,000 BOEPD. The best well drilled so far came on line in January 2013 with an initial production rate of 2,038 BOEPD. Its production rate in August was 363 BOEPD, with a cumulative production rate of 293,000 BOE spanning 20 months.

Another key to success in the Springer shale will be achieving shallow decline rates, which has been elusive to most shale plays in North America. Continental’s production data shows that it has been able to slow the decline rate after approximately 7 months of production. Mikael said Continental might be choking back well production, instead of bringing the wells on “at full bore,” which has been a contributing factor to steeper declines in oil production from horizontal wells.

As to why the company is tamping down the flow, Mikael said, “It is unclear at this point. Is that because of a reservoir, a geologic, or production optimization reason, or is that more of a testament of the limitations of the gathering system?” Wood Mackenzie said that close monitoring of Continental’s production data will be required to verify the company’s “bullish” outlook for the Springer shale.

There have been some early challenges in exploring the Springer shale as shown by one wellbore collapse and another well that was abandoned half way through drilling, Mikael said. To overcome these problems, he said that companies will rely on the experience of their engineers and a host of new technologies that have come of age during the first decade of the shale revolution.