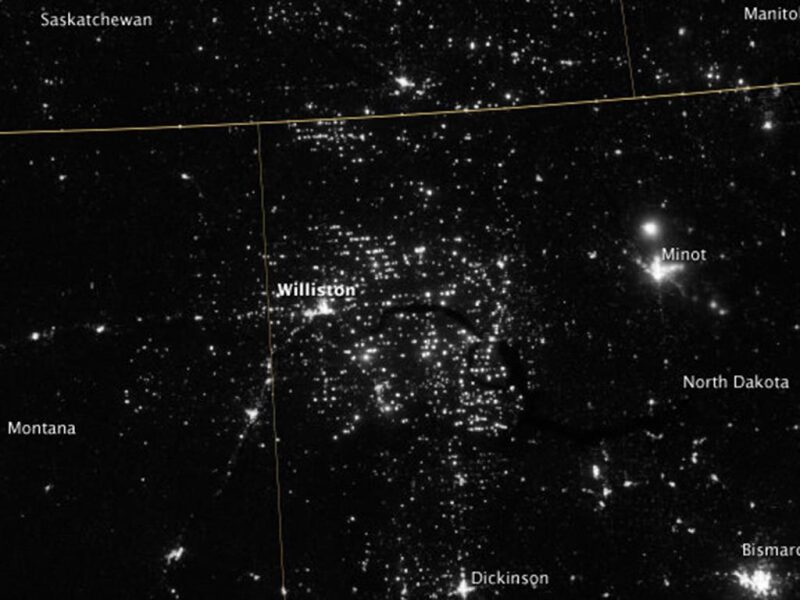

More than 21 billion bbl of light, sweet crude oil will be extracted over the lifetime of the Bakken and Three Forks shale plays, according to the latest projections from energy consultancy group Wood Mackenzie. The two plays are found in the United States’ prolific Williston basin and together produce approximately 1 million BOEPD. As production rises from the deeper Three Forks formation, the firm predicts that between 2020 and 2021, production from the Bakken Shale will reach its peak.

Despite the fact that production growth is slowing in the Bakken, Wood Mackenzie said there will be commercial opportunities throughout the basin for years to come. Reductions in drilling and completion costs and increased recovery rates are driving operators to explore less-rich areas of the Bakken. “It might not have made sense in 2010 to spend (USD) 13 million on a Bakken well that is only going to get about 300,000 BOE out of the ground,” said Jonathan Garrett, an upstream analyst at Wood Mackenzie who specializes in the Williston basin. “But flash forward to today; now it might make sense to spend (USD) 6 or 7 million on a well to get 300,000 to 350,000 BOE.”

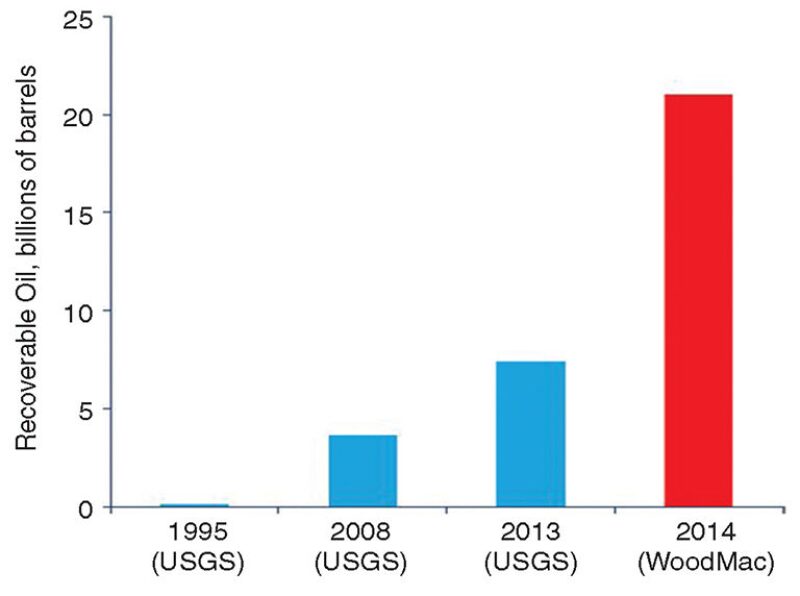

Garrett said new technology, better well completion methods, and tighter well spacing will lead to higher overall recovery rates from the two shale plays than previously thought. Last year, the US Geological Survey (USGS) estimated that ultimate production of light, sweet crude from the Williston basin would top out at 7.4 billion bbl. Wood Mackenzie said its reserve estimate was higher because operators will increasingly drill wells closer and closer together, a practice known as down spacing. “We looked at likely and proven operator down-spacing patterns throughout the play, whereas the USGS is of the mind that probably fewer than four wells per spacing unit into the Bakken and Three Forks will be the ultimate development pattern,” Garrett said. “We regard that as a bit conservative given the fact that we have seen much more dense projects throughout the Williston basin.”

In areas where the Bakken has been most developed, operators are increasingly turning their attention to the deeper Three Forks shale that is formed of multiple sections known as benches. Production rates from wells drilled into the uppermost bench of the Three Forks has been positive, but less-than-expected production rates from the lower part of the formation has downgraded the play’s outlook. Garrett said that because of this, “the footprint for commercial development of the Three Forks will be considerably smaller than previously expected.”

“There are pieces of the Bakken that are becoming more interesting,” he said. “But we really do think it will be offset by the smaller economic footprint of the lower benches of the Three Forks.”