The oil and gas industry is facing an invasion of data analytics startups who saw a wide-open gap in the market a few years ago when talk of big data first began.

Many of these young companies vying for attention from producers are focused on alleviating the headaches associated with artificial lift systems. There are also a number of software products designed to handle difficult computations such as production forecasting and reserve estimation.

Some are selling analytics as a way to combat the growing threat of cyber attacks. Other programs interpret human semantics to extract valuable information out of the entirety of a company’s document library.

Below is a closer look at what several of these analytics startups are offering to the industry—only there will be no deep dive into the layer cake of terminology that dominates this emerging software arena, e.g., artificial intelligence, machine learning, edge computing, etc.

Power of Integration

A sign of the industry’s accelerating uptake of analytics came in May when a number of the world’s largest producers made a USD-26 million investment in an industrial-focused analytics startup from Silicon Valley called Maana. The list of financiers includes the venture arms of Saudi Aramco, Chevron, Shell, and GE.

This may be a leading indicator of things to come because rather than focusing on any particular niche solution, Maana is a big-picture analytics platform. Able to reach between different silos within an organization, the program analyzes seemingly disparate sets of operational data and ties them all together.

Donald Thompson, cofounder and president of Maana, said such data integration is able to generate “new knowledge” that oil and gas producers can leverage to drive performance in the field.

“Most projects involve going and tackling a single isolated problem, but everything in a business tends to be highly interrelated,” he explained. “So the failure of an individual pump is very interesting to understand, but its impact on production schedules is also interesting … if one pump fails, how should you adjust all the other pumps in order to still meet your production requirements?”

Thompson, who pioneered knowledge- and semantic-based search engine tools during his 15 years at Microsoft, gave another example of an oil and gas project involving malfunctioning field sensors.

The sensors, managed by a remote monitoring team, were sending faulty telemetry alerts to the operator’s support center. Unbeknownst to the latter group, the sensors had received a software update which was responsible for the glitch. By being in between the monitoring and support team, Maana connected the dots and determined the root cause.

“Individual analytics projects within each one of those groups,” Thompson said, “would never have detected a correlation between the two groups and those are the type of things we’re enabling now.”

Pumping Up the Data

One of the biggest targets for analytics vendors is artificial lift because rods, pumps, and motors are relatively easy for the latest generation of smart software to interpret and predict.

Calgary-based Ambyint is one of those firms. The company feels it has an advantage over its peers because it is leveraging a decade of Canadian oilfield pump data gathered by its holding company and predecessor, PumpWell.

Ambyint was formed to market an improved predictive maintenance program that analyzes the symptoms that precede a pump failure. Such programs alert producers to the precursors of a pump failure days before a total failure occurs. This allows field maintenance programs to be scheduled with precision and efficiency.

The firm’s software can also automate pumping operations based on production targets or to stretch out the mean time to failure. Though clearly logical, this pairing of analytics and automation is in its infancy.

Nav Dhunay, president and chief executive officer of Ambyint, said producers who buy into predictive analytics must first become confident of its core features before taking that next leap.

“This industry is a bit conservative when it comes to technology adoption, so the last thing somebody wants to do is trust that a computer can make a better decision than they can—even though if you look at the majority of accidents that happen worldwide, they happen because of the human element,” he said.

Ultimately, he added, software will win the day as it becomes better than humans at managing oil and gas wells running on pumps This transition will begin through a semiautomated system Ambyint calls a “recommendation engine,” which requests that prescriptive actions be taken.

As production engineers accept more and more of those recommendations, “what we’re going to do is turn this thing into an autopilot where it will start making decisions for you,” Dhunay said.

Reading Between the Lines

Anyone with a smartphone has by now probably tried speaking to it to get directions, send a text, or run an internet search. Led by former oil and gas professionals who specialized in computer science, i2k Connect is trying to bring this natural language recognition technology to oil and gas companies.

But instead of spoken semantics, this company is teaching its software to understand written semantics. Moreover, it is trying to teach it oil and gas jargon using 15 different industry taxonomies.

“Companies run on data, and much of that data is in the text documents they create and store every day,” said Reid Smith, one of i2k’s founders. “Unfortunately, those documents are hard to find.”

To solve the problem, this startup’s intelligent software will pore over a company’s unstructured text files and add structure by autotagging each PDF file, email, slideshow, or Word document with a keyword. The end result is an internal search engine that mimics many of the features used by Google or Amazon.

The company is currently fine-tuning its language recognition platform in a partnership with the SPE, the gatekeeper to hundreds of thousands of technical papers that date back to the 1800s. Smith said: “It’s the best available content that could be imagined to train our system.”

The goal is to create an enhanced search capability across all SPE online content including the technical paper database, OnePetro. Content and papers will be categorized based on the i2k program’s understanding of their true context as opposed to only relying on keywords. Smith described it as “enriching the documents with subject matter expertise.”

That means, for example, technical papers from related topics will be tagged more accurately. A paper relating to production logging but that does not use that exact term within the document will still be tagged “production logging,” making it more visible in OnePetro searches on this topic.

Real-Time Processing

In August, real-time analytics firm SQLstream received a major endorsement of its platform when Amazon adopted it to become the engine behind a new web-based service for businesses. The San Francisco-based company is hoping to make a similar impression on oil and gas companies.

Named after the world’s most common computer language, SQLstream says its platform is able to process more than a gigabyte of data per second with a delay of only 5 milliseconds.

Such processing capability is at the upper limit of what today’s systems can handle and more than an hour faster than processing giant Hadoop, said Damian Black, the company’s chief executive officer. He described the platform as a “universal mechanism for transforming any form of input, in any format, arriving at any time, into any output format.”

This streaming data technology can be applied to just about anything using SCADA—supervisory control and data acquisition—systems. In modern oil fields it is hard to find anything not running on SCADA.

The SQLstream platform’s flexibility includes a user-friendly interface that Black said requires no specialized training to master. Guided by the program’s recommendations, users can build custom apps in minutes and establish rules that could be used to control automated field equipment.

With the back-end programming doing the heavy-lifting, users can change their minds and modify how data are analyzed or visualized on the fly. All modifications take effect immediately and without so much as a simple reboot.

Black stressed that up until just a few years ago, such app development for real-time data was the domain of very expensive software consultants that needed weeks to deliver.

“I like to draw the analogy with spreadsheets,” he said. “Spreadsheets changed the way that people analyzed data, utterly. They are so easy to use and you can do complex formulations and build financial models. We’re doing the same thing now for big, fast data, except I think this is even easier to use than a spreadsheet.”

Disruptive Pricing

Troy Ruths founded his namesake startup Ruths.ai in 2013 after earning his PhD in computational biology from Rice University in Houston. While working as a self-described “data monkey” for Chevron before graduating, he realized the potential of analytics to become a central component of the oil and gas business going forward.

But something was missing—a marketplace where producers could buy these applications without going through the cumbersome process of vendor selection.

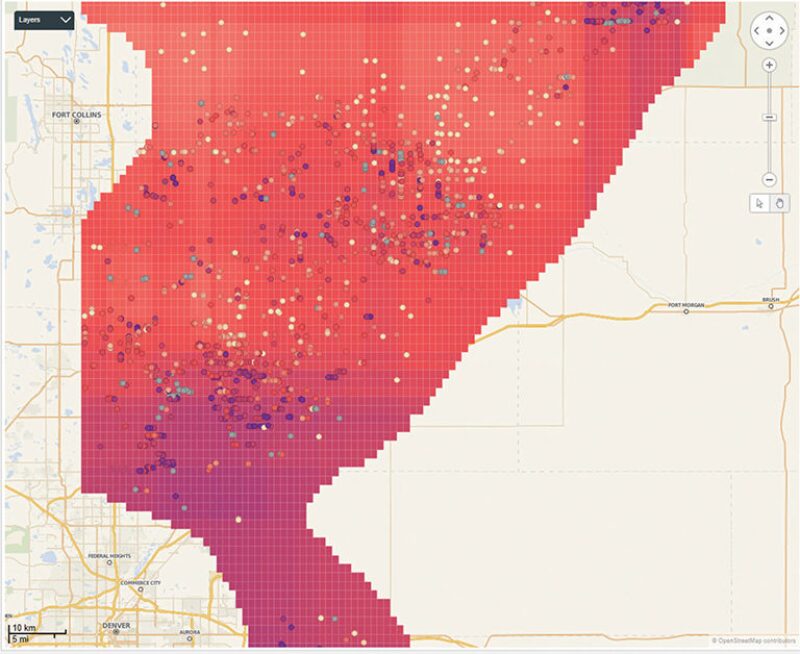

So Ruths.ai created an exchange where it sells analytics apps it developed along with those created by other software developers. Today the exchange hosts more than 80 programs designed for geoscience, play-wide analysis, production operations, and other areas.

Many of these apps can be downloaded for a few hundred dollars and only a handful cost more than USD 1,000. Ruths said his intent is to disrupt the current pricing model for these products to make his exchange stand out amid an increasingly crowded field.

“These prices are an order of magnitude less than the competing counterparts out there, and what we are trying to do is lower the bar so more people can have access to these types of solutions,” he explained.

One of the apps enables operators to quickly analyze workover candidates and generate economic models for each potential job. This is an example of a task that might take hours of research for a single engineer to complete for an entire field.

When using this program, as the cursor is dragged across a field map, the calculations are completed almost instantaneously. “You just give it the three pieces of data that it needs—workover history, production, and well location—and then it will go through and calculate the uplift factor-ratios for each job,” Ruths said.

He added that tools like this also allow operators to find answers to important questions. Why are some wells doing worse than others? Is it a completion problem, or a problem with the reservoir? Are there any clear trends that show why one part of the field is producing better than another?

Cyber Analytics

SparkCognition is another company specializing in predictive maintenance and has deployed its system with an airline manufacturer and the two largest operators of wind turbines in North America. It recently inked an agreement with Flowserve, the world’s largest maker of oilfield valves, which is marketing the system as a way to avoid complete failures.

The Austin, Texas-based firm has also developed a cyber security analytics application that is being used by cyber antiterrorism authorities and as a fraud detection system for banks. This may be an interesting area to watch since the oil and gas industry is one of the most frequent victims of cyber attacks and espionage.

Philippe Herve, vice president of solutions at SparkCognition, said the cyber security product can be used as a standalone service, or it can be married with the firm’s predictive maintenance software to add an extra level of assurance.

“When an asset is starting to misbehave, is it because we have a failure on it or is it because someone has attacked it,” he asked. “If something goes wrong, you need to know why.”

Herve added that unlike conventional antivirus software, which base their defenses around past attack methods, analytics-based security platforms actively monitor a company’s networks for anomalies that may indicate when something or someone has invaded a secure system.

The SparkCognition software also runs constant internet queries to find new threats. When it discovers one, or detects an ongoing attack, the program automatically sends alerts and written reports to security experts to brief them on the situation.