Seizing on historic margins in domestic prices, North American oil and gas companies are increasing their efforts to use more natural gas and less diesel fuel to power their field operations. Until now, oil and gas companies have been ordering natural gas-powered rigs to qualify the technology through pilot programs in the field. However, “the inflection point” may have been reached, said Brad Bodwell, senior vice president of corporate and business development at Prometheus Energy. The company is one of the largest suppliers of liquefied natural gas (LNG) to the North American oil and gas industry and is entering a stage of “rapid growth” because of economic forces and major gains in domestic gas production. As the technology is evolving, so is its nomenclature. Operators and service companies are using two terms to describe engines that are fueled by a simultaneous injection of natural gas and diesel: “dual fuel” and “bifuel.”

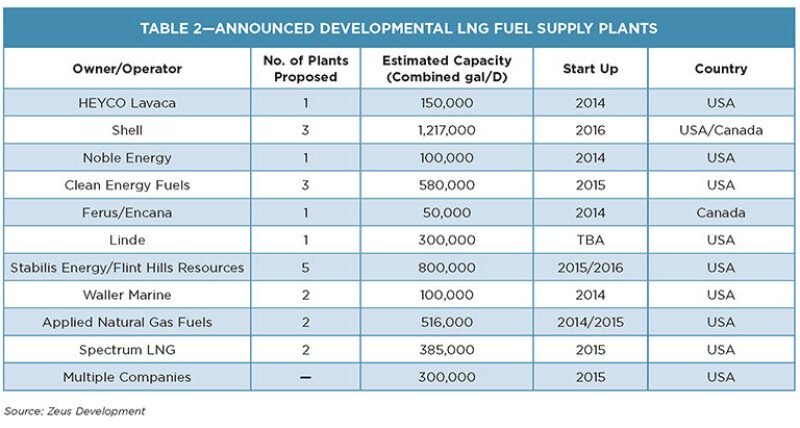

Prometheus fueled up its first natural gas-powered generator sets on a drilling rig for operator EnCana in the Haynesville shale in mid-2010. “Since then, we have grown at a rate of about 80% per annum in terms of volume that we ship to our customers,” said Bodwell. In 2013, Prometheus had access to about 500,000 gal/D of LNG and was supplying seven operators in the United States and Canada. In total, North American LNG facilities produced 800,000 gal/D in 2013. New LNG facilities under construction and expansions of older facilities will bring the available supply of LNG up to 1.1 million gal/D by year-end. With several more plants already funded and expected to come online after 2014, the daily supply of LNG is projected to soar to 2.6 million gal/D after next year.

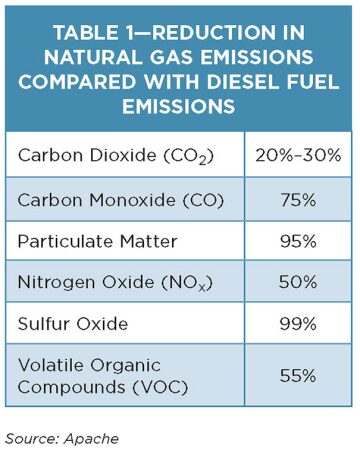

Bodwell estimates that natural gas is fueling as much as 7% of North America’s 1,100 horizontal drill rig fleets, but he predicts that share to soar to 50% within the next 2 years. There are environmental drivers as well since natural gas is the cleanest burning of all fossil fuels (Table 1). “You’re getting a fuel that is going to reduce your environmental footprint and, at the same time, it saves enough money that it pays for the cost of conversion,” he said. “So we don’t need to wait to achieve some sort of scale benefit or a government injection of capital into the industry to make it work. It is all stuff we know how to do.”

Prometheus delivers LNG to field operations in cryogenic trucks in which the natural gas is kept at –265°F (–162°C)—the temperature at which methane exists in a liquid state. As the drilling rig and hydraulic pressure pumps draw LNG from storage tanks, it is fed through a heat exchanger that allows the LNG to boil into a vapor state. The natural gas is then delivered into the combustion chambers of the engine at a specific temperature and pressure. Enough LNG can be stored on site to supply a drilling rig for about 3 days of operation. The amount of LNG needed per day for a fracturing spread varies with the number of hydraulic pressure pumps used on site and the number of stages completed each day. Dual fuel also adds a good measure of safety to field operations by reducing the number of times workers must fuel and refuel generators and pumps. Because less diesel is required, and none in the case of a dedicated system, the number of heavy trucks transporting fuel to the field over long distances can be reduced.

Rate of Adoption

With the industry’s commitment becoming clearer, the race is now on to construct more than 20 small-scale liquefaction plants across the US and Canada to supply the rapidly growing market. “The uptake rate that we have seen in the oilfield sector, with drilling rigs and frac spreads, is really the most impressive of all the industries we look at,” Thomas Campbell, an energy analyst at Zeus Development, said. The Houston-based consultancy that covers natural gas believes the onshore upstream sector is emerging as the first anchor customer for LNG providers in North America.

In some cases, a single hydraulic fracturing spread can consume as much as half a day’s supply of a merchant plant’s processing capacity, and this is creating the “demand ecosystem” that Campbell says is needed to justify the expansion of existing facilities and the building of so many new plants (Table 2). If consumption from the onshore industry can achieve critical mass, then analysts believe that other heavy industries such as rail, long-haul trucking, marine, and mining will make the switch too.

“The offsetting factor, the reason why everyone isn’t doing it, is the incremental cost,” Campbell said, on why more operators are not rushing to make the fuel switch. Dual fuel rig conversions can cost up to USD 300,000 and close to USD 1 million for a dedicated natural gas rig, according to Zeus’ market research. Additionally, companies must account for on-site storage and vaporization equipment, which can cost an extra USD 1 million for each drilling spread. Depending on the form of natural gas used, there are other costs factored in that can include the installation of a facility for compressed natural gas (CNG), processing equipment for field gas, and a return line for treated pipeline gas.

Zeus estimates that payback for incremental costs, which include the cost of conversion, storage, and vaporization equipment, on a dual fuel rig is a little more than 4 and a half years and about 4 years on a dedicated natural gas rig. Dual fuel fracturing spreads have an even higher rate of return. A single fracturing spread converted to run on 60% natural gas and 40% diesel can reduce fuel costs by as much as USD 1.6 million annually.

Gassing UpThe four forms of natural gas that can be used as an alternative to diesel fuel are compressed natural gas (CNG), liquefied natural gas (LNG), field gas, and pipeline gas. Each comes with advantages and disadvantages, which operators and service companies must carefully consider when selecting the system to use. The diesel fuel supply chain requires a pipeline network to transport crude, then a refinery to produce the fuel, and trucks to drive it back out to the wellsite. LNG and CNG have much smaller carbon footprints than diesel, but require processing facilities and over-the-road trucking as well. Above all other forms, field gas is the cheapest and generates the smallest carbon footprint, because it requires minimal infrastructure and transportation to deliver it to location. The flow of natural gas into a dual fuel engine is automatically controlled to ensure an optimal mix of gas, and diesel fuel is present in the combustion chamber. Ignition is triggered by the force of the engine piston’s compression of the diesel and natural gas, which results in enough heat and pressure to combust the fuels together. If for any reason the supply of natural gas is cut off to a dual fuel engine, then the engine will continue to run uninterrupted on diesel. The energy generated during the combustion of the fuel mix approximates the same level of energy produced by using 100% diesel. Dedicated drilling rigs designed to run solely on natural gas do not use compression ignition, but instead use spark ignition whereby a spark plug ignites the gaseous fuel. When burned, natural gas releases the fewest greenhouse gases of any other carbon-based fuel source including gasoline, diesel, and coal. While it depends on the type of engine and proportion of natural gas to diesel being consumed, the environmental benefits are significant and could be an important driver for the adoption of this technology in areas governed by strict emissions regulations. Natural gas-powered engines also run quieter than diesel-run engines. Some manufacturers report a reduction in noise levels by 10 dB and this could be an enabling factor in areas with noise restrictions. |

Drilling With Natural Gas

In a paper presented by Apache at the recent 2013 SPE Annual Technical Conference and Exhibition in New Orleans, the company outlined its experience using dedicated natural gas-fueled turbine generator sets, dedicated spark-ignited engines, and dual fuel engines. Dedicated units that run entirely on natural gas provide the most compelling economics in terms of fuel savings, but their inherent drawback is that they can only run on natural gas. Dual fuel engines give operators and service companies more flexibility in regards to supply, because they can use all forms of natural gas and diesel fuel simultaneously in the same engine.

Apache is operating four dual fuel rigs ranging from 1,500 to 2,000 hp in its central region, defined as western Oklahoma and the Texas Panhandle. All the dual fuel rigs are fitted with aftermarket conversion units and are running on LNG and diesel. With more than 10 wells drilled using the dual fuel rigs, Apache is averaging a greater than 50% reduction in diesel costs. “We’re burning, on average, less than 1,000 gal/D on a rig that used to burn around 2,000 gal/D,” said Sam Goswick, a rig engineering specialist at Apache and one of the paper’s authors.

The 1-MW turbine engines that Apache tested required a dehydration unit to scrub the gas of water prior to entering the engine, and performed well. The paper concluded that spark-ignited engines that ran on 100% natural gas “proved more efficient than the turbine,” but required more support equipment including a compressor, dehydrator, and other systems to remove and store heavy natural gas liquids. “The biggest advantage of this setup is that you are running 100% gas to these engines,” Goswick said, “so your diesel use goes to zero.”

Whereas diesel-fueled generator sets are known for their ruggedness and ability to withstand fluctuating power demands, dedicated natural gas-fueled generator sets require more attention. “These engines are a lot fussier than a diesel engine,” Goswick said, adding that natural gas engines need maintenance about twice as often as diesel engines.

The key challenge to overcome when using turbine and spark-ignited engines is achieving the proper engine loading. “Engine load” is a term used to describe the energy demand being placed on an engine relative to its capacity. To ensure that the dedicated natural gas engines are combusting the fuel properly, the engines require loading at 50% or more—apply too much load too quickly and the engines experience problems. “When you hammer them hard with the load, they will kind of hiccup and drop back on speed, which can eventually black your rig out,” Goswick said.

To prevent overloading the turbine engines, Apache reduced the acceleration and deceleration rate of the rig’s draw works to spread the “load spike” out evenly. To avoid loading issues with the spark-ignited engines, Apache used the rig’s two diesel engines when drillers needed a high transient load response for intensive operations, such as tripping pipe and hole cleaning. Even while running four engines at times, two on natural gas and two on diesel fuel, Apache saw a fuel cost savings of 85% versus an all-diesel operation. “The biggest problem,” regarding dedicated rigs, “is not having enough (natural gas) supply,” Goswick said. Apache is responding to supply issues by building its own high-volume LNG fuel stations, and overall natural gas processing capacity in the US and Canada is expected to more than triple by the end of 2014.

Apache was able to drill most of its wells using its dual fuel rigs, a fact that Goswick attributes to having a large supply of LNG on site compared with CNG and field gas. “We feel that the dual fuel setup is probably the easiest one to implement, but it doesn’t give you the highest savings possible,” he said. Field gas offers the best economics and requires the smallest amount of area on a drillsite; however Goswick said it is not going to be possible at every location and when it is, “it takes quite a bit of upfront planning and you have to have your gas supply in the area, in time for your operations for that to work.”

A Fracturing Fuel

While the push to use natural gas began with drilling rigs, the demand for natural gas-powered fracturing pumps is rising even faster because fracturing fleets need a lot more fuel to operate than a drilling rig on a daily basis. In a hydraulic pressure pump, which can be placed on a skid or on a truck trailer, natural gas and diesel can be used to fuel the engines that deliver a highly pressurized mix of water, chemicals, and fracturing proppant into horizontal wells during stimulation operations.

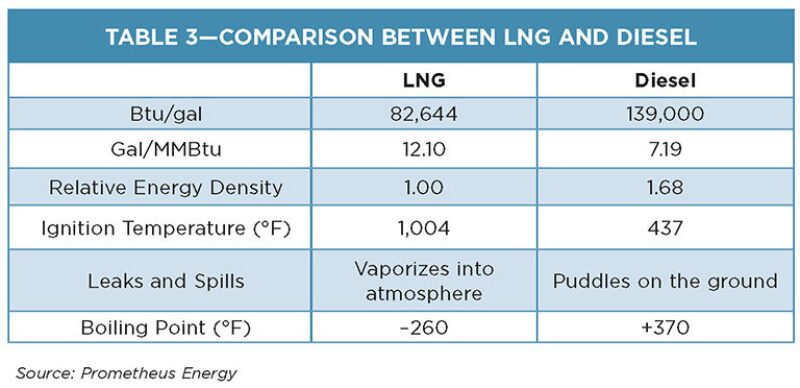

There are more than 8,100 pressure pumps in North America and the fuel consumption of a single fracturing spread, which can range from 10 to 24 pumps, is about 6,000 to 15,000 gal/D of LNG. One gal of diesel is approximately equal to 1.6 gal of LNG (Table 3). LNG is emerging as the natural gas fuel of choice for fracturing pumps, because it is more energy dense than CNG and can be supplied in larger and at more constant rates than field gas.

Baker Hughes, which uses the term “bifuel,” considers its technology and supporting economics to be well proven. This year, the company completed operations on 48 wells in North America using bifuel hydraulic pressure pumps, which generate 2,000 hydraulic hp and up to 15,000 psi for hydraulic fracturing and acid stimulation operations. Baker Hughes is operating fleets capable of operating at a ratio of 70% natural gas and 30% diesel fuel in the Marcellus shale, and in basins in Colorado and Utah. By the end of next year, up to 25% of the company’s pressure pumps will be able to run on natural gas—double the number of units available in 2013. “We have seen significant increases in demand from customers for our bifuel pumps this year,” Douglas Stephens, president of pressure pumping at Baker Hughes, said. “We are increasing our fleets in 2014 because this is the direction customers want to go.”

Based on the company’s finding, it is easy to see why. A presentation at ATCE estimated fuel-cost savings compared with diesel fueled pressure pumps on a fracturing job, ranged from about 20% for a diesel-CNG mix, to more than 40% for a blend of diesel and field gas, or gas delivered by pipeline. Actual costs for field gas use depend on the quality of the gas. The energy content of field gas varies. Some field gas must be treated to remove unwanted gases such as hydrogen sulfide or carbon dioxide, and gas with high liquids content can present operating problems.

“At the same time, there are parts of the country [United States] where we are developing associated gas where the quality is such that we can use it without a lot of scrubbing or cleanup in the field,” Stephens said. In a recent case, Baker Hughes fueled up with the operator’s pipeline gas and successfully completed 240 fracture stages in 18 wells, displacing more than 100,000 gal of diesel.

The next step for Baker Hughes’ engineers is to make the system more efficient. That means working with the pump manufacturer to upgrade the software that controls the gas injection system, fine tune hardware on the pumps, and improve the understanding of how it all works together. With a little more time and research, Baker Hughes hopes to increase the percentage of natural gas its bifuel systems can handle, but “without any compromise in horsepower,” Stephens said.