The biggest oilfield service companies in the world are using 3D printers to make metal components for a growing number of tools and equipment.

This is a significant development. It shows how far the needle has moved since these companies first embraced 3D printing more than a decade ago for the rapid prototyping of plastic models. Though the early work is being done on a small scale it gives us the first look at the future of manufacturing in this industry.

“Like any technology that evolves quite rapidly, it has tremendous potential,” said Rustom Mody, the vice president of technical excellence at Baker Hughes. “It not only reduces the cost, it accelerates the innovation process, and at the same time it gives you more functionality.”

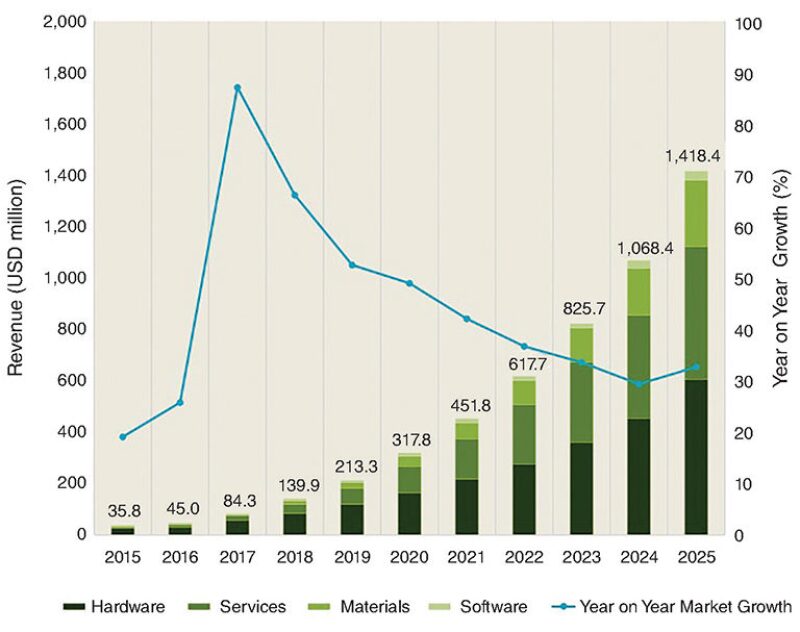

The ability to deliver that trifecta—cheaper, quicker, better—has made the trillion-dollar oil and gas industry the fastest growing user of 3D printing according to some market analysts.

In metallic 3D printing, powderized stainless steel and other alloys are melded together with high-precision lasers. Each layer is usually built from the bottom up, hence why many of the technology’s truest advocates prefer the synonymous term additive manufacturing to describe the process of 3D printing.

Those working in this field are understandably excited about its capabilities but they are also quick to point out a number of limitations that must be addressed before production-mode 3D printing becomes a more widespread practice.

This unfinished business is one reason not a single SPE paper has been written about the topic. As companies climb the steepest part of the learning curve they tend to treat their progress as a trade secret. But the ice is beginning to thaw as more 3D printed components head out into the field.

For now those parts are small—less than a cubic foot in volume. They cannot be structural or safety-critical, and companies have had precious little time to evaluate the long-term performance of the materials for things such as corrosion or high temperatures. Additionally, there are no industry-defined standards for printed metal.

But none of this has deterred the early adopters in the upstream sector who have found that printing with metal is ideal for such a specialized business. This means that even some of the current drawbacks have a silver lining.

By going small, a single 3D printer can make 10 or 20 units in a single day-long session. And what they lack in size, these parts make up for in sophistication as many are finding their way into rather expensive pieces of equipment.

The parts Baker Hughes is printing are going into a number of big ticket items including its downhole measurement, logging, and remediation tools. Schlumberger and Halliburton are making similar efforts in this emerging area.

The chief value drivers for each of them are the manufacturing efficiency 3D printing offers and the flexibility it gives companies to build something too convoluted to be made with conventional processes.

John Bartos, the technology vice president of materials and modeling at Schlumberger, said the company is printing out a new housing for internal sensor arrays that is 30% of the weight and mass it would have been if it had been forged, which by the way, is not possible.

“The most important thing that 3D printing brings is design creativity,” he said. “It allows engineers to design without the constraints of design-for-manufacturing. In the old days, if you couldn’t weld it, cast it, turn it, or mill it, then you couldn’t make it.”

Halliburton is also printing metal components for downhole equipment and looking at subsea applications.

Much of this work is being done in Houston, but GE has begun printing out components for its oilfield gas turbines at a facility in Italy. The company has more than a dozen 3D printing facilities around the globe, but this is its first dedicated to the oil and gas business. Its potential expansion plans include printing parts for centrifugal pumps and artificial lift systems.

A True Enabler

Even though the service companies are in the earliest phase of 3D printing metal they have discovered that the technology has immediate impacts when used to make the right part.

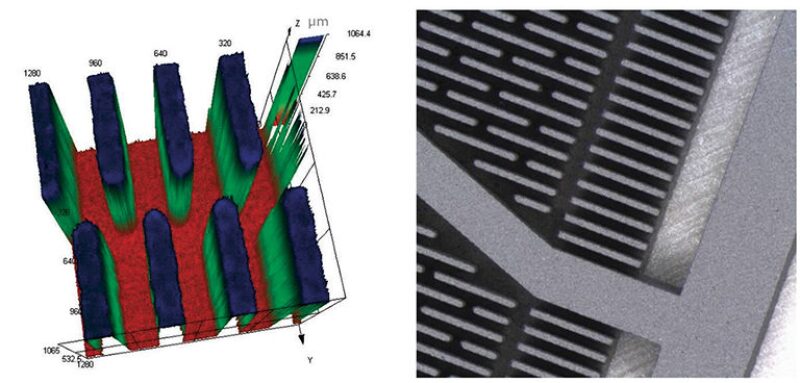

Baker Hughes looked to 3D printing to improve the screen on a downhole fluid analysis tool. Printing the screen gave engineers the ability to design a much finer mesh that enhanced its ability to filter out solids using the same footprint. That is important because it means the tool’s performance gains were achieved without necessitating a single other change to the overall design.

For one of the company’s logging tools, 3D printing was used to replace a two-piece component with a single piece. Printing this part reduced the time between when the tool is ordered to when it is delivered by 65%.

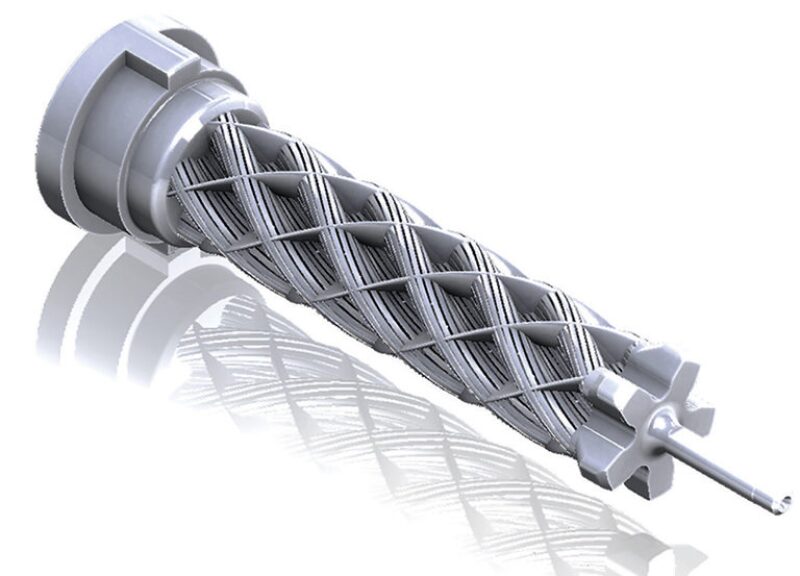

One of Halliburton’s most successful case studies is a hydraulic manifold that opens and closes downhole test valves. It may sound simple but this mechanism is far from it.

The assembly has a complex design that starts as a cylinder on one side and ends in a rectangular shape on the other end. And to be activated, hydraulic fluid must be moved through an internal network of intricate flow paths.

“The only way we could have done it alternatively would’ve been to drill a bunch of holes in this thing and make it look almost like Swiss cheese, and then we’d have to use plugs,” said Charles Carder, a team leader for downhole test tools and sampling at Halliburton.

To be more precise, he said traditional manufacturing may have left up to 20 leak paths, which is doable, but not ideal on a downhole tool rated for pressures up to 25,000 psi. When dealing with such extreme conditions a device with zero o-rings becomes a much easier sell to oil and gas companies.

“From a reliability standpoint, plugs work and they’re good, but they can fail,” Carder said. “So if you can improve the reliability on anything that’s going into a well that cost them millions of dollars, I think they are readily accepting of it.”

He added that if the part was machined, not only would the cost be higher, but the scrap rate would be much higher due to its complexity.

Back to Nature

Something very interesting happens when engineers are freed from the conventional manufacturing restrictions and begin using supercomputers to guide the design process. The resulting parts sometimes tend to look less mechanical and much more like tree branches, bones, or even the exoskeletons of insects.

Mody said when a component is modeled for the best performance it should not come as a surprise that the computers are choosing organic designs. “Because when nature builds us a structure, it doesn’t take a big chunk and deplete it out,” he said. “It builds cell by cell as to what is needed.”

This biomimetic effect is achieved through a math-based design concept called topology optimization. Though this technique has been around for more than 25 years, there was no way to turn the conceptual designs into something real until 3D printing came along.

One example is an acoustic receiver inside Baker Hughes’ logging-while-drilling tool. The original design resembled the business end of a toothbrush with a number of straight, vertical prongs. The prongs were easy to machine and weld onto the faceplate, but there was a lot of room for the improvement of the component’s overall performance.

When engineers selected the piece as a candidate for 3D printing, the redesign was based on how sound waves move through the tool. This meant that each individual prong was engineered a certain way so instead of looking like the bristles of a toothbrush, they look much more like a bunch of wriggling worms.

Schlumberger is also interested in learning more about topology optimization and has teamed up with universities and commercial suppliers to exchange information.

Bartos said the reason why this approach works so well is that the computers are able to design geometries that place strength and integrity precisely where they are needed depending on whatever weight and stress parameters are used as inputs. In this sense, it appears that computers are better students of nature’s lessons on structural design than humans.

Some of the shapes look once removed from a biology text book, while others are best described as just plain goofy.

“But sure enough, they probably would work and the only way you could make the final embodiment is through printing—you could never machine it, you could never cast it,” Bartos said.

3D Economics

The limits of 3D printing do not only dictate the size of the components but also the economic rationale for what to make in the first place.

David Bourell is a professor of mechanical engineering and materials sciences at the University of Texas in Austin and is a renowned expert in the world of 3D printing. He said when it comes to selecting which parts to print, there are two important considerations: the part should have a complex geometry and a low production run.

“If it’s a cylindrical shaft with a hole in it, chances are pretty good that additive manufacturing is not the way to go,” he said. “But if you’re only making one part, then additive manufacturing is almost guaranteed to be really competitive. If you’re making a million, it’s virtually guaranteed not to be.”

There are certainly a lot of variables to consider, which is why he said the production range for 3D printing today could be anywhere between 10 to 100,000 units. But the rule of thumb to follow is that the more complicated a part is, the more economic it becomes to 3D print.

In conventional manufacturing the opposite is true. Before the first part is ever built, companies typically invest tens of thousands of dollars or more on a new tool set to fabricate it. That upfront spending model works for simple parts that sell in bulk, but it makes complex components with limited production runs more expensive.

What is really driving the cost of 3D printed parts today is not the feedstock but the price of the machines, which for the industrial sector range from the hundreds of thousands of dollars to more than a million.

In order to reduce the per unit economics and print many more parts, Bourell said the build rates must be improved. He noted that metal components can take more than a day to complete—which only seems fast to the people printing them.

“If you talk about that kind of production rate to a manufacturing expert it gives them a heart attack,” he said. “They are talking about making parts in 5 seconds and you’re talking 30 or 40 hours and it’s just not tenable.”

What is needed is a way to move from a day-and-a-half to just half an hour. Bourell said people are working on it and when that becomes possible we might have to add a new term to the 3D printing lexicon: rapid additive manufacturing. For now though, the only way to accelerate production in a meaningful way is to simply buy more 3D printers which is exactly what many companies plan to do.

Better Metals Needed

The Achilles heel of printing metal is that the powdered alloys on the market today were developed mostly for the aeronautics and medical equipment industries whose material needs are quite different from the oil and gas industry’s requirements.

Whether something is designed for the surface, downhole, or the subsea environment, it must be able to tolerate a litany of harsh conditions that includes high pressures, high temperatures, corrosion, and dynamic forces.

The printed parts out in the field today have not been installed long enough to know how the materials they are made of will respond to some of those conditions. The service companies are well aware of this shortcoming and are carrying out extensive evaluations and validation studies to build confidence on the materials side.

One weakness that has been difficult to address so far is that while printed metal does just fine in terms of its compressive strength, it is lacking tensile strength. Bartos said that for this reason printed parts cannot have large overhangs and only noncritical components are suitable candidates.

“What I tell my engineers right now, tongue-in-cheek, is that anything you can dream about, you can make via 3D printing—as long as it’s not a structural component, a pressure vessel, or is required to be certified by any governing agency, which is everything we make,” he said.

In addition to their partnerships with academia, service companies are running their own programs to study the metals qualified for other industries and they are also looking into exotic new alloys that are untested. They have a long way to go but most of the experts seem confident that the advances they need in the way of materials sciences will come in due time.

Bartos added that 3D printing is constantly advancing its capabilities and that the large technology firms in the industry seem poised to dedicate more personnel and resources to foster its development.

“I think there are going to be particular areas where there will be absolute breakthroughs,” he said. “Once we overcome its current limitations, we will be able to do things in the future that we could have never done before by utilizing 3D printing.”

Remote Manufacturing

In May, GE announced the completion of an USD-11-million expansion to a 3D printing facility in Italy to produce end burners for its new line of turbine generators used for pipeline compression and power generation.

One of the most notable aspects of this development is that GE will no longer have to buy the end burners from a third party. If this becomes a trend, as many 3D printing aficionados expect it will, then it could be a major disruption to the business model of the small and spare parts makers in the oil and gas business.

Massimiliano Cecconi, a materials and manufacturing technology leader at GE, said the company is exploring ways to turn its field service shops into mini 3D printing facilities to make replacement parts and eliminate the need of maintaining a large inventory.

“This is going to change the supply chain architecture in the sense that we can start to think about localizing the production of spare components, putting it closer and closer to our customers,” he said.

But the industry is likely several years away from anything like that. One thing that must be addressed to see the expansion of the technology is the establishment of standards, which are needed to ensure that printed metal components live up to expectations. Cecconi said there are no approved standards from any of the major certification agencies and the process to establish them is still getting underway.

Since Cecconi began working with 3D printing, it is the first time he has ever had to develop new technologies while simultaneously drafting the procedures and processes on how to qualify them.

“Industry in general needs standards to be sure that we all speak the same language,” he said. “Otherwise we run the risk of developing technologies that will not be accepted, or it could take years to be accepted just because we speak different languages and we don’t have the capabilities to find a point of agreement with our customers.”

3D Printing an Enabler for Subsea Composite Technology

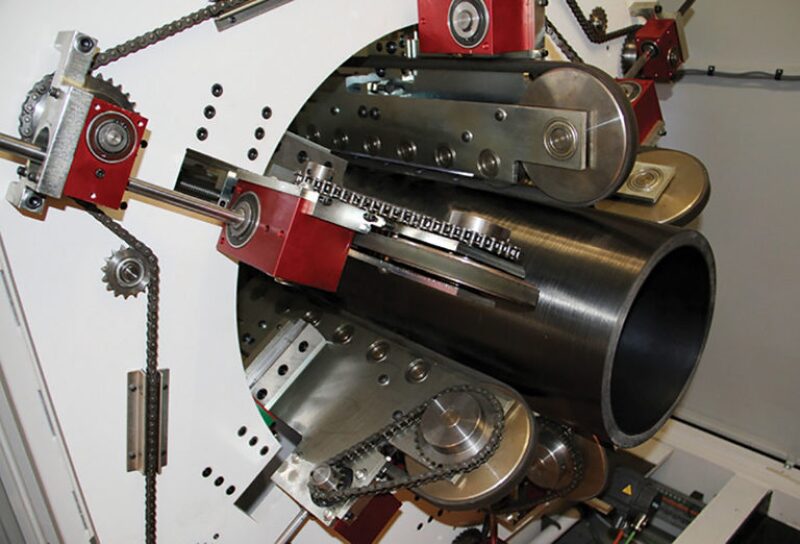

Not everything has to be printed out of metal to have a positive impact. This includes a 10,000-ft-long hydraulic line for subsea well stimulation and acid treatments that will be delivered this winter to a service company in the Gulf of Mexico.

Two things make this piece of gear stand out. First, as the longest hydraulic line in the world it will be able to reach the deepest wells in the gulf. Secondly, it is the single largest structure ever 3D printed out of polyetheretherketone, a specialty thermoplastic referred to as PEEK that is one-tenth the weight of steel.

Magma Global built the hydraulic line at its 3D printing facility in Portsmouth, UK. Founded in 2009, the company is notable in its own right because it is one of the few firms in the industry that can be considered a pure play additive manufacturer.

Charles Tavner, the commercial director at Magma Global, said without 3D printing technology the ability to build such long composite tubulars would be nothing but a pipe dream.

“People have known for probably 20 years that composites would be able to offer some quite large performance advantages,” he said. “But the challenge with composites has always been the quality control process, which meant you got variability. That penalizes you—it is not acceptable in a high-integrity situation like that of a subsea riser.”

Gaining control over the process through 3D printing not only means quality can be assured, it means standards can also be applied.

Along with PEEK, raw carbon fibers and high-performance glass round out the composite material recipe Magma Global uses in its products that also include umbilicals, jumpers, and flowlines. The composite material is laid down on the production line and then welded together by a laser to make the final product.

The introduction of more PEEK composites made via 3D printing may be one of the best options for driving down costs in the struggling offshore sector, just as they have done for the aeronautics industry. Coveted for its light weight and stronger-than-steel characteristics, PEEK components have been installed on more than 15,000 aircraft to improve fuel efficiency.

In addition to the benefits of being light- and fatigue-resistant, PEEK is attractive to the subsea sector because it is noncorrosive and stands up to harsh chemicals. The material also lends itself to making large-diameter tubular designs that are smooth enough to achieve high flow rates without suffering a pressure drop due to friction.

In the case of the hydraulic line, selecting composite materials over flexible steel pipe will allow service companies to deploy smaller, and therefore less expensive, vessels for stimulation jobs. On a rig or floating platform, a switch to composite flowlines would have an even greater knock-on effect as it may enable companies to shrink the size requirements of everything from the mooring lines to the host facility.

Tavner said operators focused on improving the shrinking margins of offshore developments should take notice of the convergence of 3D printing and composite material technology.

“What the industry has been trying to do is extract oil from smaller reservoirs in harder to reach places, and so inevitably the cost of doing that goes up,” he said. “In a very buoyant market, there isn’t much that would drive you away from just welding a bit more steel or doing it the way you did it last time. But I think in the current market, people are much more interested and willing to do something different.”

To meet growing demand the company plans to add four new 3D printing production lines to its fabrication facility by the end of the year and is looking at expanding its product offerings to include new systems such as a subsea coiled tubing unit.