Unlike what happened during previous oil-price collapses, merger and acquisition (M&A) activity has been limited since prices started to fall in 2014. But the signs are that M&A activity may be building, and oil company management teams should think about which deal strategies they should pursue. The oil-price trend has historically been one of the most important determinants of how value is created in the oil and gas industry, and some M&A strategies that worked in the rising-price environment over the past 15 years may not work in today’s market. This article examines the industry’s M&A performance across cycles back to 1986 and identifies strategies that could help companies create value through the price trough, measured by total returns to shareholders.

Most commodities industries are prone to consolidation during the downside of the cycle, when supply surpluses accumulate, prices fall, and competition heats up. The oil and gas industry is no exception (Fig. 1 above). In the 1998 to 2000 price trough, more than 25 deals greater than USD 1 billion in value were executed in North America alone, including the BP-Amoco, Exxon-Mobil, and Chevron-Texaco megamergers. In total, this wave of deal making amounted to more than USD 350 billion in just over 2 years. It took another decade to match the same amount of deal volume in North American exploration and production (E&P).

Oil prices are recovering from a 12-year low in January (below USD 30/bbl) but remain well below the levels of most of the past decade. There are signs of rising M&A activity, even though few deals have been executed so far. Over the past year, bid-ask spreads have been too wide for deals to proceed. However, this could change, given the increasing signs of vulnerability among weaker players in the market.

First, industrywide leverage has risen significantly over the past 3 years, and it is particularly high for independent E&P companies with exposure to US shale production. This group’s leverage has spiked—with debt at nearly 10 times earnings before interest, taxes, depreciation, and amortization—indicating an increasing likelihood of restructuring for the most indebted players. Second, pricing hedges are beginning to come off. As a result, it is possible that there will be oil and gas companies available at distressed prices, either because they are in Chapter 11 (continuing to operate while restructuring their debt) or because their market valuations will sink to such low levels that they could be attractive acquisition candidates, even if the buyer has to reach an agreement with its bondholders as part of the deal.

Not Easy To Create Value

Companies will clearly want to be on the lookout for how to use this time of transition to strengthen their competitive position through M&A. Successful oil and gas M&A obeys many of the same rules as in any other industry, beginning with not overpaying. But oil-price volatility adds a unique element to the mix. Oil-price levels have a powerful influence on most aspects of the industry’s performance, as the profitability figures of the past year make clear, and M&A performance is no exception. The industry, therefore, should be careful about the lessons it takes from its M&A experience during the period of rising and high oil prices in the nearly 15 years to 2014.

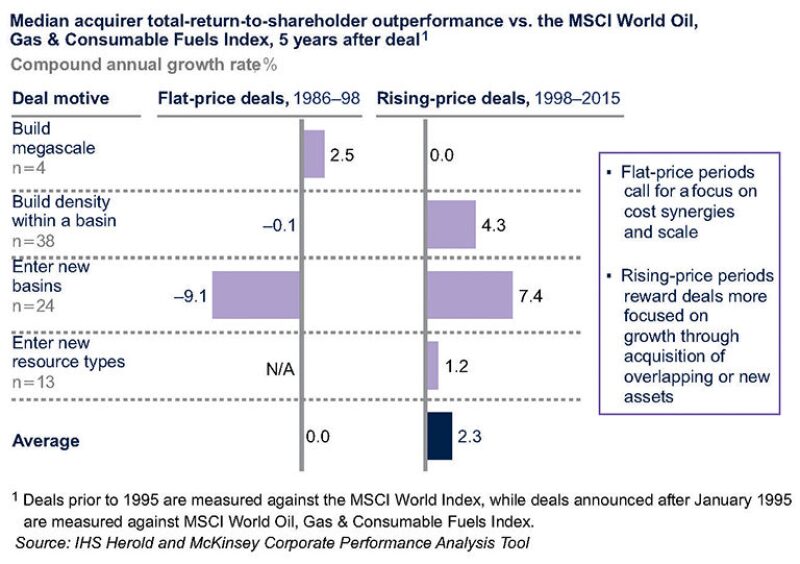

This view is supported by research on E&P M&A in the United States over the past 30 years. The research segmented deals into the four themes that characterize most deal activity—megamergers, increasing basin or regional density, entering new geographies, and entering new resource types. We contrasted the value-creation performance of the deal themes under the two main pricing environments in force during the period: low prices from 1986 to 1998, and rising prices from 1998 to 2014 (with the exception of 2008 to 2009).

Research shows that on balance, the oil and gas industry’s ability to create value from M&A has been mixed, and that value creation is particularly challenging when deals are struck during oil-price down cycles (Fig. 2). Of all the deals evaluated during the 1986 to 1998 period, only megadeals outperformed their market index 5 years after announcement. Periods of flat prices appear to call for a focus on cost synergies and scale. In contrast, in the 1998 to 2014 period when prices were generally rising, more than 60% of all deal types outperformed their market index 5 years after announcement. Not surprisingly, this kind of rising-price environment rewarded deals more focused on growth through acquisition of overlapping or new assets. However, with prices at low levels again, this historical perspective suggests we are back in less favorable territory for value creation through M&A.

Given that deal strategies that may have been successful over the past 15 years of rising prices may not be successful in a “lower for longer” oil-price world, what pointers do the historical data provide about which M&A strategies might be robust under all pricing scenarios?

It is useful to go back to the basics on how value is created in the oil and gas industry, and M&A’s role in it. In periods of a strong market and rising oil prices, growth is the dominant driver of value creation. However, in flat or depressed oil and gas markets, growth is fundamentally challenged. Improvements to return on invested capital, including cost reductions and raising capital efficiency, are usually more effective approaches to unlocking value. M&A in oil and gas typically creates value where it leads to reductions in costs and increases in capital efficiency, and where an acquirer brings superior insights on the value-generating potential of the purchased assets—with the influence of the oil price always in the background.

When we look in more detail at the historical record of the four categories of deal themes to see which insights might be applicable to future M&A strategies, we find these concepts repeatedly validated.

Megadeals. What underpinned the value creation achieved by the megadeals of the low oil-price period? Large mergers have historically created value through cost reduction at the corporate, region or country, and basin levels. Acquirers captured synergies, such as overhead reductions, and optimized the combined portfolios to favor the most competitive and capital-efficient projects. This resulted in significant improvement in returns on invested capital that in turn translated to shareholder returns in excess of the market index. Further, the expanded breadth of the combined company’s portfolio helped extend reach, which facilitated growth and diversified the risk of megaprojects. As oil prices rebounded and growth took off, this was rewarded in equity markets.

Take the merger of Exxon and Mobil announced in 1998. Its strong focus on executing a postmerger-integration program enabled the company to capture USD 10 billion in synergies and efficiencies within 5 years. Over the following decade the deal opened the path for significant growth. In the rising-price period, there were no megadeals to be included in our data sample. But a number of major acquisitions in the period used value-creation levers similar to the earlier period. Anadarko Petroleum’s acquisitions in 2006 of Kerr-McGee and Western Gas Partners for USD 23 billion created large-scale positions in the deepwater US Gulf of Mexico (GOM) and Rockies, each of which provided cost savings opportunities and growth potential.

Basin- and regional-density deals. The data show that deals that increased basin or regional density in a low oil-price environment created value more or less in line with the benchmark, while in the rising-price period, these regional transactions outperformed the benchmark. In principle, these deals facilitate cost-reduction opportunities because the acquirers are already established operators in the area. They know the geography and geology, the practices, and the people (internal and external) necessary to maximize production from these assets. In addition, they can capture synergies by cutting regional overhead costs, consolidating vendor contracts, and optimizing overlapping operations.

Chevron’s USD-18-billion acquisition of Unocal in 2005 highlights characteristics of a successful deal that increased regional density. In Thailand, Chevron consolidated acreage under the Unocal manufacturing model for drilling, which enabled it to significantly increase volumes and reduce costs. In the GOM, acquiring Unocal put Chevron in a position to move from exploiting individual wells to integrated hub development. This enabled Chevron to make much more efficient use of its capital, reducing costs.

Entering new basins. This theme entails entering new basins within a company’s existing resource type—such as a shale producer entering new North America onshore basins or a GOM deepwater operator expanding to foreign offshore basins. Our data show a clear contrast in performance between the two pricing environments, with the most successful deals occurring during periods of rising prices, and decisively the most value-destroying in flat or depressed prices. By their nature, such deals offer few cost-reduction opportunities, as there are limited synergies in operations for the acquirer to tap. In a rising-price environment, however, a lack of cost synergies may be offset by the overall value created by higher and expanding margins coming from top-line growth.

Examples of successful deals abound from the past 15 years—Encana’s USD‑2.7-billion acquisition of Tom Brown in 2004, which established its gas-production position in a number of new basins in the US Rocky Mountains and Texas. On the other hand, an example of what can go wrong during the flat price period is Burlington’s USD-3-billion acquisition of Louisiana Land & Exploration in 1997. The acquirer expanded in areas including Louisiana, the GOM, Wyoming, and overseas, but overpaid for mature assets, with no opportunities for synergy capture to help returns.

Entering new resource types. This theme is typically a portfolio expansion strategy, such as an onshore producer seeking to add offshore operations or a company with conventional operations entering unconventional gas and shale oil basins. Our data set does not have examples of such deals during the period of depressed oil prices. There have been a number of value-creating deals in the rising-price period, but there are also a number of examples of companies encountering difficulties even in this environment.

Implications for M&A Today

“This is the sixth downturn of my career” is a familiar refrain in our conversations with senior industry executives. However, much has changed in the industry since the last downturn, with the ranks of the major companies radically thinned, while the shale oil boom, in combination with plentiful credit, has launched hundreds of mom-and-pop producers to create a whole new branch of the industry. As the industry works to find its bearings, here are five guidelines to help oil market participants.

- Be clear on the strategy. Companies should define their rationale for M&A activity as part of their corporate strategy before focusing on deal sourcing. Investment themes should seek to achieve a strategic imperative and complement a company’s competitive edge. There are a number of different deal types that may be appropriate, such as asset transactions, mergers of equals, or a series of small bolt-on acquisitions.

- Identify value through rigorous due diligence. Many executives place too much emphasis on looking at simply whether a transaction is accretive or dilutive of the acquirer’s earnings per share, or on basing deal value on market multiples. Instead, they should conduct a due diligence process focused on a granular understanding of the assets’ resource potential, the target’s business model and operations, and value potential under varied market scenarios.

- Focus on identifying cost and capital synergies up-front. Regardless of the strategic intent underlying the deal, in today’s price environment executives should work hard to identify opportunities to cut costs and improve capital efficiency. All deals are likely to present the opportunity to create value through overhead cost reduction at the company, region, basin, and field levels.

- Do not bid away the value in the deal process. Winning acquirers establish a rigorous deal process with clear decision stage gates, as well as a clear understanding of important risks or upside opportunities. This approach allows companies to avoid overpaying, forfeiting potential value. In addition, good acquirers are less likely to waste resources on deals that were previously deemed in the market to be unattractive and focus solely on objective measures of value creation.

- Plan postmerger integration early and execute rigorously. Winners make critical decisions about integration governance and value potential well ahead of close. They also make beating, not just meeting, the value-creation pro forma target results part of the postmerger plans and associated management incentives. They do these while recognizing that oil and gas is a people business, and winning the hearts and minds of key employees at their acquisition targets is essential to success.

Bob Evans is a consultant at McKinsey & Company’s New York office, concentrating on growth strategy and corporate finance. He earned a BCom and an LLB from the University of Sydney, and an MBA from Harvard University.

Scott Nyquist is a senior partner at McKinsey & Company’s Houston office. During his 30 years with McKinsey he has led its global oil and gas practice and its sustainability and resource productivity practice. Nyquist earned a BSc in chemical engineering from the University of Michigan and an MBA from Harvard University.

Kassia Yanosek is an associate principal at McKinsey & Company’s New York office, concentrating on portfolio strategy and corporate finance. Before joining McKinsey, Yanosek was a private equity investor in the energy and industrial markets, and worked in corporate strategy for BP. She earned a BA from the University of Virginia, an MPA from Harvard University, and an MBA from Stanford University.