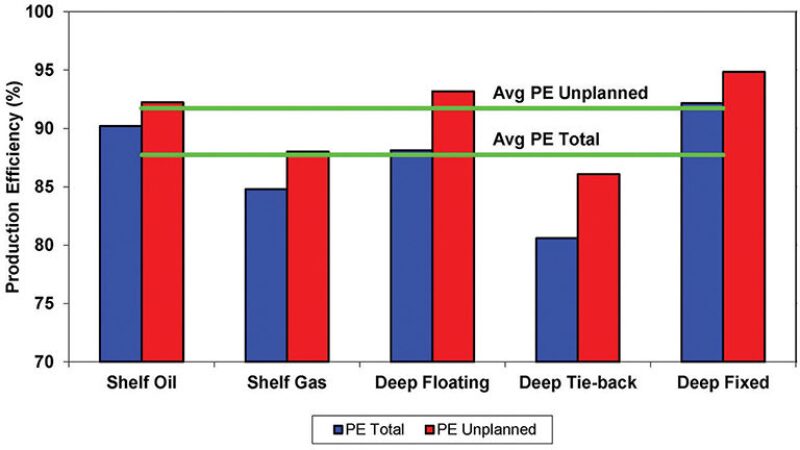

An analysis of 190 US Gulf of Mexico (GOM) producing assets in Ziff Energy’s field level operations database reveals significant opportunities for improving operating efficiency by reducing downtime. Total (planned and unplanned) production efficiency (PE) of these assets was found to be 88%.

Of the 12% production loss relative to potential (no downtime) production, 8% was a result of unplanned downtime, while 4% was either planned (i.e., accounted for in the company’s annual budgets) or a result of external causes, such as weather. This result indicates significant potential exists to increase production by reducing the frequency and duration of unplanned downtime (Fig. 1).

Economics of Improved Production Efficiency

The exploration and production (E&P) sector is historically a 10% to 15% rate of return business, which means that the last 10% to 15% of production is profit. If an operator could eliminate or reduce half of the 8% unplanned production loss, it could potentially double the rate of return from its assets. Because production loss management often can be done at small expense or investment, no other activity has the same potential to positively affect the bottom line. In short, production loss management is the best “margin lever” in the E&P business.

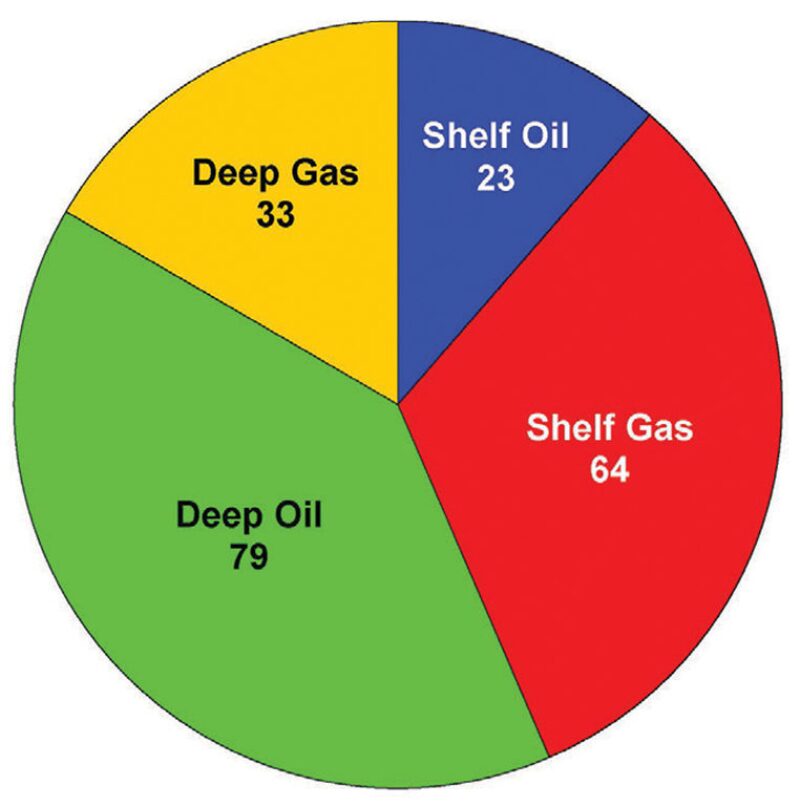

Based on 5-year (2008–2012) average of GOM production of 1.39 million B/D of oil and 5,932 MMcf/D of gas, the additional annual production from recovery of all unplanned losses in the GOM could reach 102,000 B/D of oil and 582 MMcf/D of gas respectively (Fig. 2). The annual value of the recovered oil alone (without considering gas) would exceed USD 3 billion/yr. Deepwater represents almost 80% of unplanned oil losses. Shelf gas, which accounts for more than half of total gas produced in the GOM, accounts for two-thirds of the unplanned gas losses.

Uptime Reliability Metrics

Ziff Energy has defined a family of metrics to assess uptime reliability. To determine production loss, an estimate of production capacity called predicted production capacity (PPC) can be used. Total production loss is the volumes of lost production due to all reasons. The total loss is derived by comparing actual annual production with PPC and consists of the following components:

- Planned loss: Production loss because of scheduled downtime for repairs and maintenance or new well/facility tie-ins. An event is “planned” only when it is included in the annual budget. It should be noted that improvements in planned downtime are possible if the duration and frequency of planned events can be reduced resulting in improved production efficiency.

- Unplanned loss: Production loss because of equipment/facility failures or operational upsets.

- External loss: Production loss caused by external reasons, which are further broken down into midstream downtime, market limitations, and weather restrictions.

Total production efficiency is actual production as a percent PPC for a year. Unplanned production efficiency, the single most important measure for operators, is the percentage achieved when planned and external downtime are disregarded.

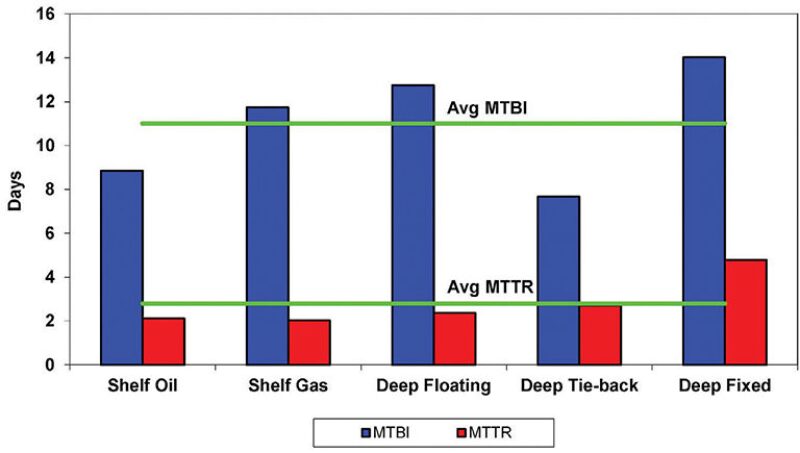

Two other metrics measure the frequency and duration of downtime. Mean time between incidents (MTBI) is the average time between unplanned downtime measured in days. Mean time to recover (MTTR) is the average time measured in days for production to return to prior levels. Downtime caused by external factors, such as midstream downtime, market limitations, and weather is excluded from MTBI and MTTR calculations.

Fig. 3 shows MTBI and MTTR for various types of GOM assets. The weighted average MTBI for all the studied GOM assets was about 11 days; however, shelf oil assets and deepwater subsea tiebacks had more frequent downtime than other types. Deep floating assets recover in about the same as shelf assets, (i.e. about 2 days).

Complexity and Production Losses

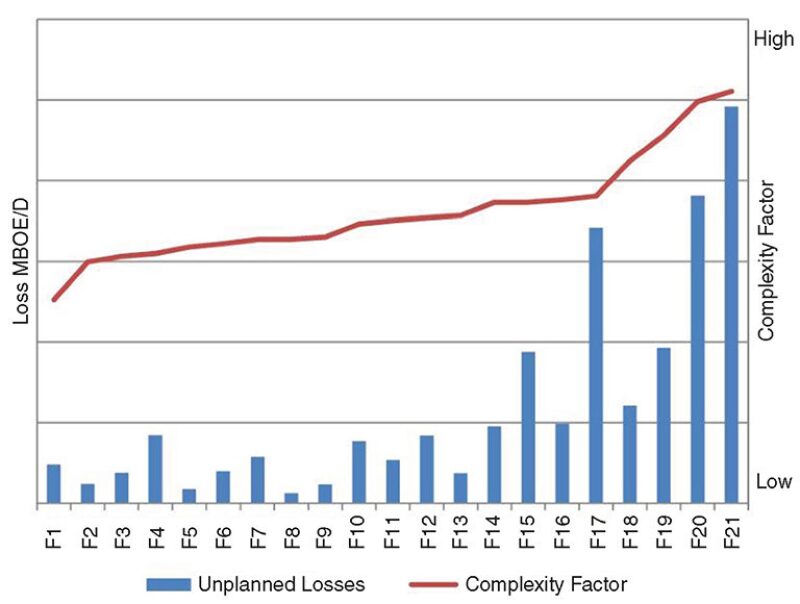

We have found unplanned production losses are generally related to the size and complexity of offshore deepwater production facilities. Ziff Energy has developed a complexity factor (CF) to analyze the impact of complexity on production uptime reliability. Formed by the scores of a number of factors, the CF index reflects various aspects of a facility’s size and processes. The factors include processing capacity, production train counts, counts of major equipment (e.g., generators and compressors), and other elements.

As can be seen from Fig. 4, unplanned production losses of deepwater facilities are significantly correlated with their CFs. Notice, however, that several of the more complex deepwater facilities achieved unplanned losses well below those of equally or more complex facilities. This would indicate their management of production losses is better than their peers’.

Production Loss Management

Leading operators have implemented production loss management practices and programs designed to identify and eliminate systemic causes of downtime, and suboptimum production performance. Production loss management encompasses a variety of specific tasks and disciplines that identify and address underlying problems and solutions to production shortfalls. These same efforts often lead to insights that not only increase production, but also uncover opportunities to reduce expenses. Other times, increased expenditures are needed to reduce downtime.

Production loss management processes and practices involve root cause failure analysis, production budgeting, and loss measurement and reporting, as well as monitoring of daily production, deferrals, losses, and causes of downtime.

Benchmarking of similar types of operations allows operators to quantify their unrealized production potential and thereby assists with establishing achievable and stretch targets for performance improvement. Operators should formulate an action plan for reducing production lost to unplanned down time with a business case to gain organizational support for implementing the plan. Operators should also embed the essential production loss management elements, processes, and disciplines throughout their organization through training, coaching, and bringing proven techniques and tools to blend into the client’s existing processes.

Richard M. Tucker is vice president of marketing and client relations at Ziff Energy and has more than 35 years of experience providing consulting services to the energy industry, both upstream and downstream. Previously, he was a vice president at Petroleum Information Corporation (now IHS Energy), responsible for managing a number of commercial energy databases used by natural gas producers, pipelines, marketers, and local distribution utilities. He earned a degree in economics from Western Maryland College (now McDaniel College).

Tom Straub, SPE, is an executive associate at Ziff Energy and has more than 30 years of upstream operations experience with major oil companies. He has held management responsibilities throughout North America and internationally, both onshore and offshore. He earned a mechanical engineering degree from the University of Nebraska.

Shuqiang Feng is a project manager at Ziff Energy specializing in upstream oil and gas field development and the oilfield service market. Feng earned an MSc degree in petroleum mechanical engineering from the University of Petroleum, China, and an MBA in finance from Tulane University.