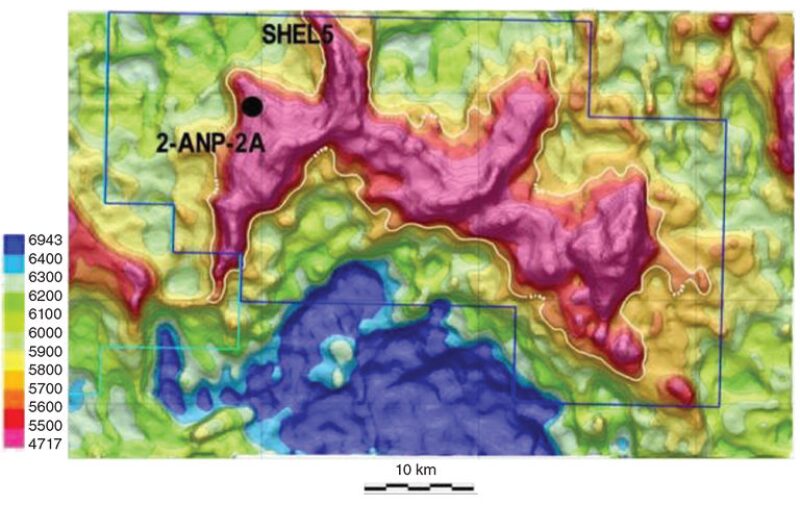

After oil prices plunged in 2014, the Libra discovery, which could be the largest in Brazil’s prolific pre-salt offshore play, looked like an iffy proposition.

“We worried at that time: Do we have a future for a deepwater project?” said He Baosheng, deputy general manager for subsea wells and facilities for the Libra project, during a panel discussion at the 2017 Offshore Technology Conference (OTC).

Petrobras’ chief executive officer (CEO) back then, Oswaldo Pedrosa, said the break-even price was greater than USD 55/bbl, but added that he expected oil prices would rise, making Libra profitable by 2019, when commercial production was expected to begin.

Since then the thinking has flipped. With the price of oil stuck around USD 50/bbl, now the goal for Petrobras and its four partners on Libra is to lower the break-even price to USD 35/bbl, said Fernando Borges, executive manager for the Libra project, adding “it is very important to have a low breakeven.”

“The goal is the ability to live with prices that are there now, and be happier if the price rises,” said He, who works for China National Offshore Oil Corp. (CNOOC).

They made those comments at a panel session where Petrobras and its partners rapidly ran through the many things they are working on to reach that break-even target. So far they are about three-quarters of the way to that goal, if their projected savings are realized when built.

At the top of Borges’ short list for reducing the breakeven are reducing capital expenditures and increasing production.

The break-even improvement from a 5% reduction in capital expenditures is larger, and provides much needed cash flow during development. But it is in the same neighborhood as a 1% increase in the ultimate recovery factor for oil and gas, he said.

Money-saving engineering ideas range from shrinking the size of water- and gas-processing units and reducing the number of subsea flowlines, to incorporating more kinds of data into subsurface studies aimed at minimizing the number of appraisal wells required.

The potential savings are in the billions, magnified by Libra’s huge scale. The initial plan requires more than four floating, production, storage, and offloading (FPSO) vessels to develop one-quarter of the field. Borges said, “Further drilling could justify more. But the scale also magnifies the potential pain if it becomes another megaproject plagued by cost overruns.”

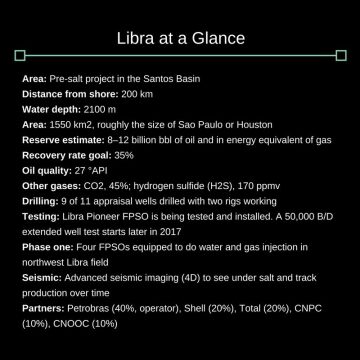

It is also a complex project, from the processing challenges posed by the high carbon dioxide (CO2) content in the gas to the number of companies working on in the project. Petrobras is in its normal spot in Brazil as operator of Libra with 40%, along with partners Shell and Total, each with 20%, and China National Petroleum Corp. (CNPC) and CNOOC, each with 10%.

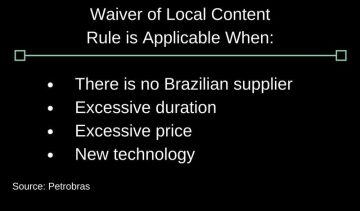

While the partners can offer a wealth of knowledge, it will require creating a corporate culture where experts from companies used to making the calls work to collaborate. And there is the third big item on Borges’ list, obtaining a waiver on Brazil’s strict local content rules that require a high percentage of expenditures inside Brazil.

Reaching the USD 35/bbl goal will require buying goods and services at the low prices found on global markets. To do that, Petrobras must convince Brazil’s National Petroleum Agency that the Libra project deserves a waiver of the local content rule that requires buying a large share of their goods in Brazil, where Petrobras says prices are far higher.

Suppliers do not agree. In January, a Brazilian court suspended bidding for a lease of an FPSO for future Libra development that was challenged by the Brazilian shipbuilders association, Sinaval. Reuters reported the judge issued an injunction on the round, which was open to international bidders. Petrobras has appealed.

Previously the court had accepted Petrobras’ argument that it deserved a waiver because local bids it received were 40% higher than its benchmark price based on global prices.

When asked about the status of local content rules during an OTC session, Fernando Coelho Filho, the minister of mines and energy, described the issue as a “sensitive point.”

While he recognizes the political downside of rolling back a rule passed during boom times to promote growth of Brazil’s oilfield service sector, he said things “are very different than when oil was going at USD 100–110/bbl and everything was possible.”

Diverse Brains

The five-company Libra consortium is the first of its kind in Brazil, bringing in corporate rivals such as Shell and Total that are leaders in deepwater development.

“The presence of the partners on the project teams is unprecedented in Brazil. They bring in new points of view,” Borges said.

It is a rich potential resource, but the value will depend on the companies’ ability to solve complex problems by working as a joint industry project. “This has been a challenging opportunity to integrate our work with partners,” Borges said.

At the OTC session, a slide summarizing the organization showed the 36 faces of those leading four major functional groups, plus a fifth area described as “cross-functional.”

Connections across disciplines are essential because revamping one aspect of the project will affect others, which may also be in flux.

One of the projects with that promise is the gathering of large amounts of data, including extra testing using downhole sensors and tracers tracking flow, to figure out how to drill the minimum number of appraisal wells in the most productive locations. This is expected to eliminate 460 days of drilling time and lower the break-even cost by USD 1.31/bbl.

The expectations created by this data-driven effort will define aspects of the development, from the design of the subsea production systems to the capacity of the processing lines.

The partners generated 243 ideas to reduce the breakeven and decided to pursue 49 of them, he said.

But there is a limit to the time allowed for a carefully staged process. Driving down the break-even cost will require compressing the period from discovery to production.

Time is valuable because a dollar earned sooner is worth more than one later; the partners want to begin generating cash flow early on to cover development spending, and low services and supply costs can be locked in now, if the designers have specified what is needed.

To keep things moving, changes will be phased in as the next three FPSOs come on line.

Early Involvement

Service companies often point out that their ability to significantly improve the design or execution of a project is limited because they are brought in too late to make significant changes.

The Libra project wants to the test the notion that if “vendors are involved early enough in the process they can optimize the design for better use of equipment and vessels,” said Orlando Ribeiro, Petrobras general manager of services and special operations for Libra. “We believe in those guys.”

Early involvement with subsea companies in the conceptual stage of the project would seek to reduce the cost of subsea work by 30% in capital spending, which could save USD 480 million, according to the OTC presentation.

“The ongoing engagement with technology providers will be intensified to get even more savings for projects,” Ribeiro said.

Establishing collaborative business relationships with firms doing engineering, manufacturing, and installation requires adapting the bidding process to comply with a law passed as part of Brazil’s crackdown on corruption, which complicates things.

Transparent bidding processes awarding work to the lowest bidder is a good choice if there is a defined job to do. But if the goal is finding a partner capable of changing the cost structure of a project, it is harder to create objective bidding criteria.

“We have had to do it competitively,” Ribeiro said, “It is very difficult to do.”

Libra Field at 35: Main challenges and solutions from Society of Petroleum Engineers

Gas Ideas

The number used to define the potential of the Libra field is the billions of barrels of light crude oil it is likely to produce.

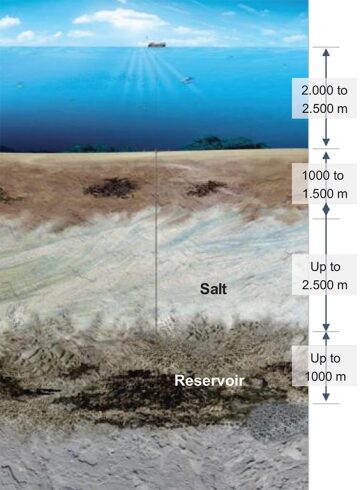

The number to use when describing the engineering challenges is the high gas/oil ratio (440 m3/m3 oil) and the fact that about 45% of it is in the form of CO2, which cannot be emitted because of environmental concerns, and there is some highly corrosive and deadly H2S in the mix.

While the Libra Pioneer was built to handle 50,000 B/D of oil, its deck space is crammed with equipment to process up to 141 MMcf/D of gas (4 million std m3/d).

Gas processing equipment “represents 70% of the topside weight, and area, and likely the cost as well,” Ribeiro said.

Routinely flaring or venting natural gas is not allowed, and there is no plan to build a pipeline 200 km to shore, so all natural gas not used to power the operation will be injected back into the field along with the CO2.

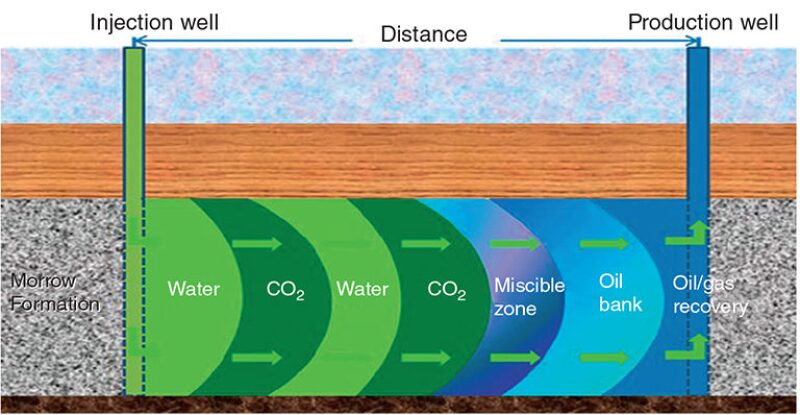

While that requirement adds cost and complexity, there is a big potential upside as well. Gas injection may enhance the ultimate production significantly because CO2 can free oil normally left behind on reservoir rock.

Libra presents a first test of using CO2 injection offshore for enhanced oil recovery, and it is rarely used in a new field. Normally alternating injections of CO2 and water are used to extend the life of old depleted reservoirs.

Subsurface experts are working on projects to maximize the benefits of the alternating injections.

Facility engineers are considering two new ways to remove the remaining water in the processed gas before reinjection. By allowing more water to remain in the gas that will be injected, they are able to consider new ways to dehydrate it, which could reduce the weight of the units by 1,500 tons and save 210 m2 of deck space. Those methods are:

- Membrane separation using a molecular sieve

- Chemical removal using the triethylene glycol process.

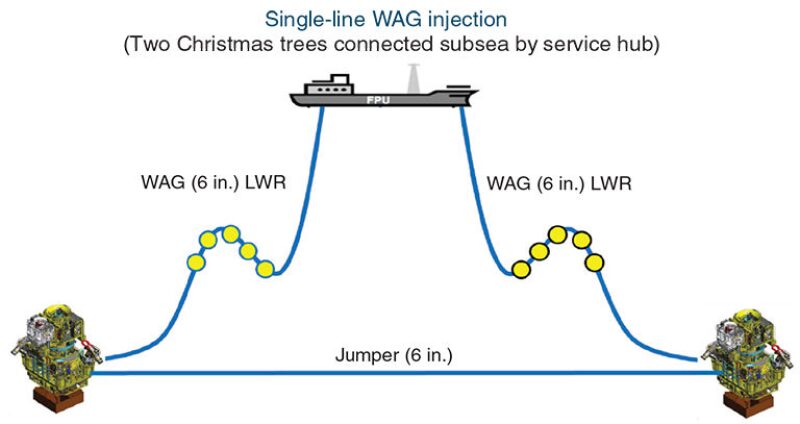

Injecting both water and gas using the same line, rather than through separate lines, and eliminating one umbilical for every two wells, is expected to save about USD 300 million. Each well will have one line alternating between injecting water and gas, with well pairs connected by a jumper that allows a pigging device to run through both of them to maintain the flow.

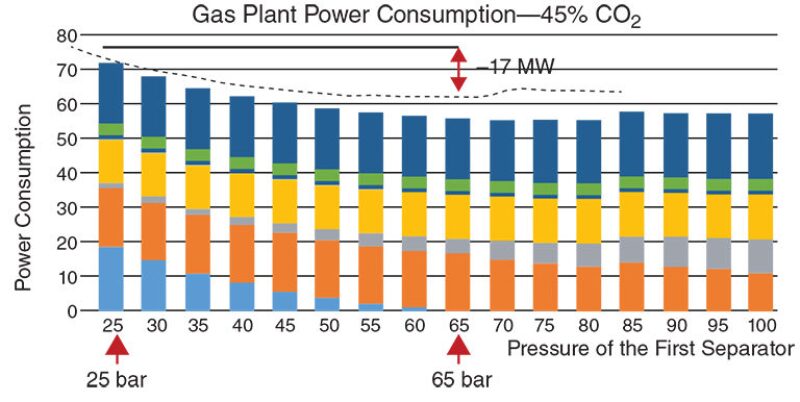

More than doubling of the pressure in the initial gas separation unit to 55–65 bar, from 25 bar, reduces the number of processing modules by one, lowering power consumption by 17 MW when processing the high-CO2 gas stream. This allows smaller electric generators, saving 1,500 tons in weight and reducing its footprint. “The weight reduction of 1,500 tons is very important to use on a fully loaded FPSO,” Ribeiro said. The greater efficiency may well be used to increase the processing capacity.