A more crowded Permian Basin means higher drilling, completions, and operating expenses for exploration and production firms, many of which have already spent billions of dollars over the past couple of years to gain core acreage positions in the region.

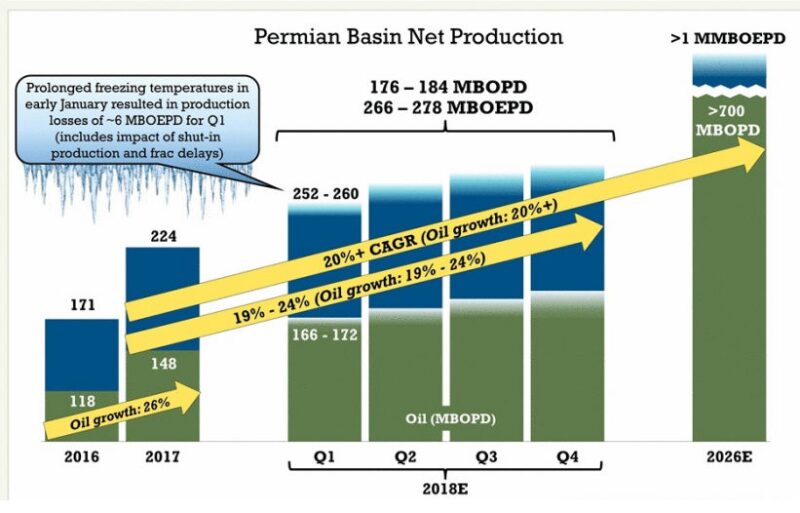

Confident in its ability to take on these cost increases is long-time Permian operator Pioneer Natural Resources, which traces its roots in the basin back to the early 1960s with predecessor company Parker & Parsley. The company is in the midst of a plan to increase its production to 1 million BOE/D by 2026 while divesting its non-Permian assets.

To help achieve this goal, Pioneer this year plans to run 20 rigs over its 750,000 gross acres in the Midland Basin, where the company is currently averaging more than 250,000 BOE/D. As it scales up activity, the company is leveraging vertical integration and focusing on sustainability to maximize long-term capital efficiency, explained Joey Hall, Pioneer executive vice president, Permian operations, during the SPE Gulf Coast Section’s recent Permian Basin Symposium.

The company entered the year expecting industrywide cost inflation of 10%–15%, a figure in line with projections by other operators such as Anadarko and Occidental. Through its vertically integrated operations, efficiency gains, and optimization, Pioneer believes it can offset those increases almost entirely.

Pioneer is operating seven of its own frac fleets and boasts 450,000 hp of stimulation equipment—though it has contracted one ProPetro frac fleet in a case it deems opportunistic, Hall said. It also owns a well services company, sand mines, and a midstream water company. The well services company offers workover rigs, pulling units, reverse units, hot oilers, water tanks, blowout preventers, construction equipment, and fishing tools.

“Every single day we are sourcing, through our own system, 400,000 bbl of water to support our frac operations,” he said. “A third of our sand is coming from our own mines. Every single day we’re sourcing 20 million lb of sand, which is the equivalent of 500 truckloads.”

While there are cultural differences between operators and service companies, “we find that it works to our benefit, particularly with [personnel] turnover,” he said. “The people who work in our service business love working with Pioneer because they feel like they’re part of the bigger picture. And, also, quite frankly, when things go down we don’t lay them off, and when things ramp up we don’t hire them back. We try to be steady as she goes,” a mantra carried across all of Pioneer’s Permian operations.

Capital Efficiency is Subjective

Tech Tip: In Pioneer’s experience, fluid volume, proppant volume, and fluid type make the most difference in moving EURs while controlling costs.

Hall noted that “capital efficiency can be somewhat subjective” depending on the people and organization. On a program level basis, for example, Pioneer measures it by comparing spending with barrels per day added. The investor community, however, looks at return on capital employed. But having “the lowest costs doesn’t necessarily equal the best outcome.”

When it comes to returns, Pioneer’s budget and planning group says the “key drivers” for the company, in order of importance, are oil prices, estimated ultimate recovery (EUR), cost, gas prices, and lease operating expenses, Hall said. In Pioneer’s experience, fluid volume, proppant volume, and fluid type make the most difference in moving EURs while controlling costs. Other measures that also have an effect include cluster spacing, stage length, flow rate, and sand type.

It’s also important, he said, that development is done over large swaths of acreage. Pioneer’s 750,000 acres are divided into eight area teams, which are constantly figuring out optimal stimulation, spacing, stacking and staggering, and sequencing. “Ninety some-odd percent of our wells that we drill are on a spacing pattern or on a staggering pattern … The only time we ever drill a one-off well is when we’re testing a new bench like our Wolfcamp D or Jo Mill or something like that,” he emphasized.

“We now are able to put 24 wells on one 6-acre pad, and we’ve designed the pad so that we can drill, complete, work over, and produce … Because if you’re not thinking about where you’re going to drill all these other benches long-term, you’re going to run out of surface or you’re going to miss part of the reservoir because of well interference issues,” he said.

Illustrating his point that merely lowering costs isn’t always the best solution, Hall presented a range of wells in Pioneer’s completions program that had incremental costs for stimulation ranging from $760,000 to $2.6 million, each of which resulted in solid productivity. “Even though those sound like large numbers and there’s a wide spread, in every single instance the economics were sound,” he said.

Pioneer has also learned that, as more water and sand are being added to wells, “you better exercise patience.” He said there were occasions when the company looked at wells’ 30-day and 60-day initial production rates and said, “Hey, I’m not sure this is going to work.” But after they flowed for 90 days, 120 days, or even 9 months, he said, Pioneer discovered they did in fact work.

Playing the Long Game

Pioneer’s goal of reaching 1 million BOE/D over the next several years requires a strong focus on sustainability—or staying “steady as she goes,” Hall reiterated. He said oil prices are rising but at some point will fall again, and, “if you want to run an efficient ship, the worst thing you can do is ramp up and ramp down and ramp up and ramp down.”

Hall said when the team faces a challenge, it asks, “What is this going to be like whenever we’ve got to do this on a multiple of four? What is this going to be like when we are producing a million barrels? What is this going to be like when we have 70 rigs out there?

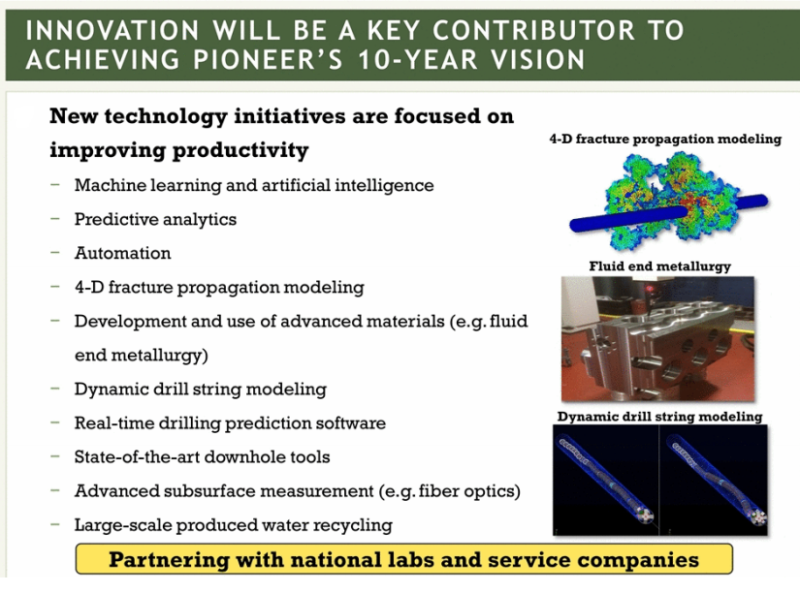

“And we ask ourselves everyday—can we do this in a sustainable way? And with many of the things we’re doing now and many of the things other operators are doing now, the answer is no,” he said. “So you better start looking at advances in technology and advances in the way you develop these fields, or you’re going to find yourself in a real bind.”

In field development, “Every company says, ‘We’re not going to overcommit on drilling rigs,’ and then we always do,” Hall said. Pioneer, which recently had a few rig contracts expire that were based on 2013 pricing, has started participating in contracts that are indexed on oil price.

Hall lamented the oil and gas industry’s slow movement on technological advancement. He mentioned as an example that Pioneer was “really big into rotary steerable” technology, but found out its cost is “too high” and reliability is “too low.” He said he tells service companies all the time: “Do you know that your rotary steerable spread rate is more expensive than the whole drilling rig?”

Looking elsewhere for answers, Pioneer has sought consultation on new technology from defense labs. It has approached automation companies that do modeling for cars and airplanes and asked them to look at drill string modeling.

While drilling is “beginning to take a backseat” to completions, Hall said he just wants drilling to be reliable. “My office looks out at Dallas Love Field, and when my drillers come in, I tell them to watch those 737s landing. Just think about how often those planes take off and land, and how in the aviation industry they just do not accept failure. But in the drilling community we accept failure every single day,” he said. “I’ve broken four [bottom hole assemblies] since this talk started,” he joked.