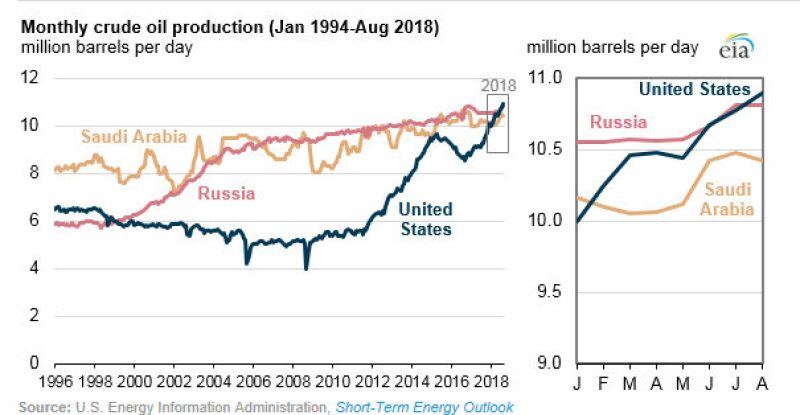

The US has “likely surpassed” Russia as the world’s largest oil producer, according to a US Energy Information Administration report.

While that is a point of pride for US producers, over the next year US energy users likely will be hoping for more competition at the top as tighter supplies are expected to drive up oil prices.

The US reached the top due to a multiyear surge in production from unconventional plays at a time when Russia and Saudi Arabia limited production growth to shrink excess inventories of crude and push up prices.

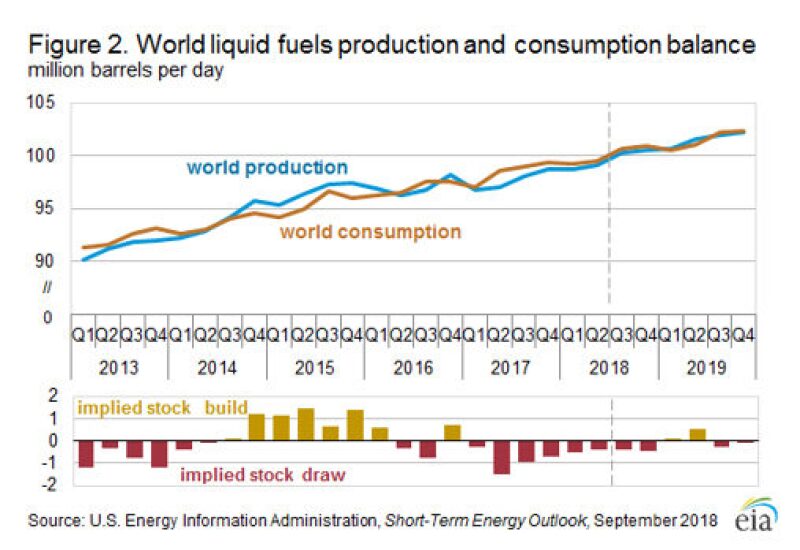

Supplies could grow tighter next year unless other big oil producing countries increase their output. In a separate report, the EIA said US sanctions on “Iran are taking hold earlier than previously forecasted.” Based on tanker tracking data, Iranian exports are 19% lower than they were during the first seven months of 2018. The EIA estimates production there is down 200,000 B/D. It estimates total production from OPEC countries is down by 100,000 B/D.

US production estimates show significant growth for this year and next, but not as much as previously predicted by the EIA. Limits on pipeline capacity out of West Texas are limiting growth in the Permian Basin.

That gridlock, plus a lower growth estimate for the Gulf of Mexico, means the US production rise in 2019 will be 200,000 B/D less than originally expected. While the US added 1.3 million B/D in 2018, bringing its total production to 10.7 million B/D, next year output is expected to grow by only 800,000 B/D.

The EIA’s short-term outlook has swung from concerns about demand in August to worried about supplies in September. The oil market reaction to such swings could increase in the coming year because oil supply and demand are once again closely aligned. That marks a change from recent years when the supply glut put a damper on prices, even when there were supply shocks such as major production declines in Venezuela.