Total advanced its global deepwater campaign 29 December with the launch of production from the Egina Field 150 km offshore Nigeria.

The Egina floating production, storage, and offloading vessel, which Total says is its largest ever, will be connected to 44 subsea wells and produce up to 200,000 B/D of oil. The field lies in 1600 m of water on Oil Mining Lease (OML) 130.

Total says the project was developed 10% under budget, resulting in savings of more than $1 billion, driven in large part by a 30% reduction in average drilling time per well. The French major's operating costs in Nigeria have been slashed by 40% during the last 4 years, Arnaud Breuillac, Total president, exploration and production, said in a news release.

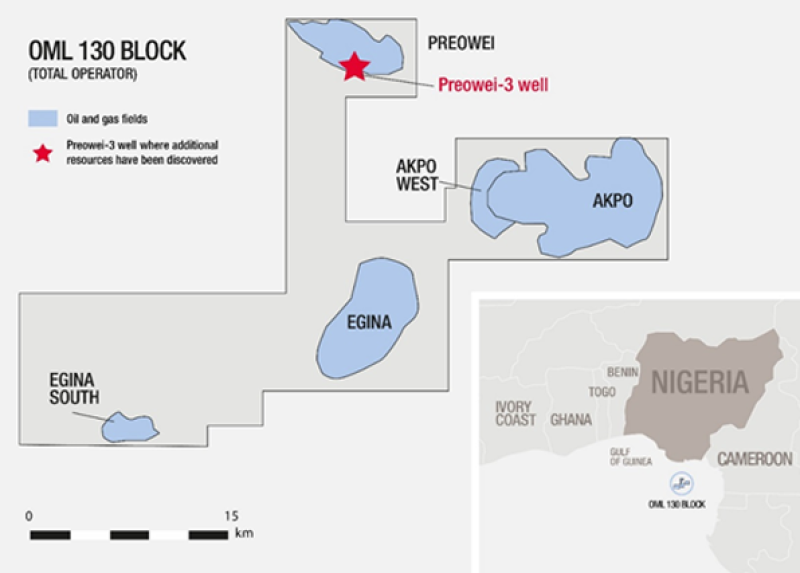

Efficiencies from the Egina project could be further leveraged via tieback opportunities from other fields in the area. Breuillac noted that “some upside potential nearby remains to be developed,” including a possible tieback of the Preowei discovery to the Egina FPSO, which the firm is currently studying. The Preowei field, also on OML 130, was assessed in 2017 and could add output of 70,000 BOE/D. A final investment decision (FID) on Preowei is expected to be made in 2019.

Discovered in 2003, the Egina Field is the second development to come online from OML 130 following the Akpo Field, where production began in 2009.

Total Upstream Nigeria Limited operates OML 130 with a 24% stake in a joint venture with state-owned Nigerian National Petroleum Corporation. Other interest owners are South Atlantic Petroleum, 15%; CNOOC E&P Nigeria Limited, 45%; and Petrobras Oil and Gas BV, 16%.

Growing West African Production Hub

Africa, along with Brazil and the US Gulf of Mexico, is one of three primary deepwater regions in which Total plans to tap into vast oil deposits to boost companywide output in the coming years. The firm’s Nigeria production averaged 267,000 BOE/D in 2017 and continues to gain momentum.

Other big projects brought on stream in West Africa over the last couple of years include Moho Nord off Congo and Kaombo off Angola. A second Kaombo FPSO on Block 32 is expected to start up this year, eventually bringing combined output to 230,000 B/D. The two FPSOs, which are converted very large crude carriers, will be connected to 59 wells from six fields.

On Block 17 off Angola, Total last May took an FID on the 40,000-B/D Zinia 2 project, the first of several possible short-cycle developments on the block. Additional FIDs were made later in the year on the CLOV Phase 2 and Dalia Phase 3 projects, with startups expected in the next 2 years. The projects will keep Block 17 plateau production above 400,000 B/D of oil until 2023, Total says.

The firm also in December added two exploration and production blocks in Mauritania’s deep waters. It will operate Blocks C15 and C31 with a 90% interest, with state-owned Societe Mauritanienne des Hydrocarbures et de Patrimoine Minier holding 10%. Total plans to drill an exploration well on its existing Block C9 in 2019.

Total’s positions in Mauritania, Senegal, Ivory Coast, and Nigeria make up half of its acreage in Africa.