Continual change is an indisputable feature of the oil and gas industry. The industry that exists today bears little resemblance to the one that existed 40 years ago. Forty years from now, energy demand, consumption habits, technologies to produce and deliver energy, and regulations will again have changed in ways known and unknown.

One of the big drivers in the shift moving forward is climate change, and the downward pressure on carbon emissions needed to achieve goals outlined in the Paris Agreement, an intergovernmental climate deal aimed at taking steps to limit the increase in global warming. World energy demand will continue to rise, and fueling the world will require abundant resources from a variety of sources. The transition is already under way to diversify the fuel mix, and hydrocarbons remain in a position to meet the needs of a changing environment, whatever they may be.

The New Energy Landscape

In January, the US Energy Information Administration (EIA) released its 2019 Energy Outlook, a collection of modeled projections of what may happen in the energy sector given certain assumptions and methodologies. Its reference case projection is the agency’s best assessment of how US and world energy markets will operate through 2050, assuming improvement in known energy production, delivery, and consumption technology trends.

The outlook focused on US oil and gas production in the near term, but it also discussed the changing mix in energy sources expected to materialize over the next couple of decades. Renewable energy will become a larger part of the mix. Driven by solar and wind, renewables today make up nearly 20% of electricity generation, a change that has resulted in the overall carbon dioxide intensity of the electric power sector declining by 25% from the mid-2000s to today. EIA projects this downward trend to continue through 2050.

While increased renewable use has led to reduction in CO2 intensity in some areas, some are questioning whether that reduction is enough. During an EIA webcast panel discussing key findings from the outlook, moderator Jason Grumet, founder and president of the Bipartisan Policy Center, said that based on the scenarios outlined in the Paris Agreement and a report by the UN Intergovernmental Panel on Climate Change released last year, the energy industry will need to innovate to reduce emissions to levels needed to limit global warming.

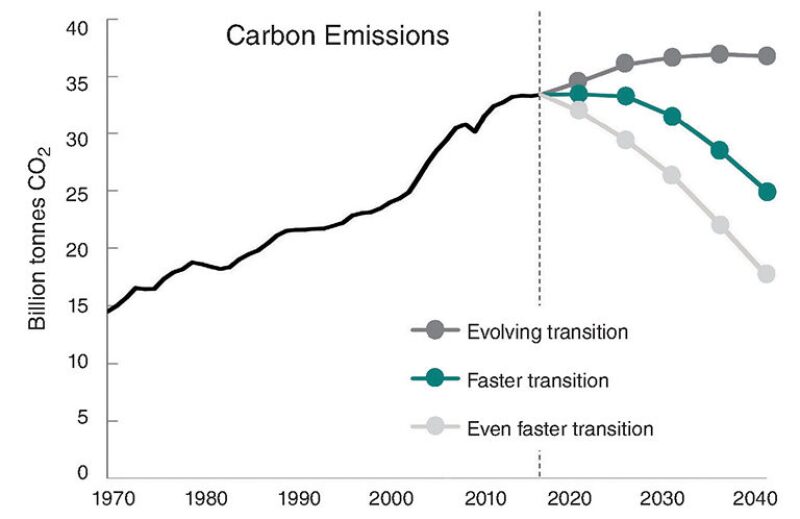

BP emphasized a similar view in its 2018 Annual Outlook. It examined carbon emissions from energy in three scenarios: an evolving transition, a faster transition, and an “even faster” transition where the power sector is almost entirely decarbonized in 2040. Emissions drop dramatically in the faster transitions, but continue to grow in the evolving scenario, increasing by approximately 10% by 2040. While this rate of growth would be far slower than the past 25 years, when emissions increased by 55%, it is much higher than the sharp decline thought necessary to be consistent with achieving the climate goals set in the Paris Agreement. BP said this “highlights the need for a more decisive break” from the past.

Another webcast panelist, Kevin Book, managing director of ClearView Energy Partners, said that innovation tracks in two ways relative to expectations. Incremental change tends to move faster and revolutionary change moves slower.

“If the evolutions are faster than we expect, the revolutions—the solid-state batteries, the nuclear fusion—they’re kind of 6 years away forever. That tendency locks us into solutions that are less the stuff of dreams and more a question of how you address different challenges, where they’re economic or climate-based. What it means is that solving these economic and environmental problems requires new and creative ways to work with what you’ve got,” he said.

Incremental change is not necessarily a bad thing. Book said the diffusion of technologies that mature and scale throughout networks already in place can lead to unanticipated paradigm shifts, citing the US’ rapid move toward energy independence as an example. Arshad Mansoor, senior vice president of research and development at the Electric Power Research Institute, made a similar observation. He said that production volumes and lower costs often drive the adoption of innovative solutions. For example, improvements in solar panel efficiency over the past 60 years have led to a dramatic drop in price. The cost to power the first silicon commercial solar cell in 1955 was more than $1,785 per watt (roughly $18,300 in 2018 US dollars), a far cry from today where the average price per watt ranges from $2 to $4. Solar power is projected to make up nearly half of renewable power generation by 2050 in the EIA Outlook.

The drop in solar cost over a 60-year period is an extreme case, but Mansoor said it shows how affordability and availability drives adoption. If consumers decide a new technology is better for them, industry will adapt.

“It’s hard to predict customer behavior. Who would have predicted that with a laptop and an iPhone, I would also need an iPad? But guess how many iPads or tablets have been sold. You go and look at the behavior of the people who have bought an electric vehicle and ask them if they will go back to an [internal combustion] engine car, they will probably say not. Most of them will stay with EVs. We are a firm believer that, at the end of the day, customers decide what they want for their purpose. It could be driven by costs, a desire for clean energy, or it could be driven by reliability,” Mansoor said.

Natural Gas Holds Leading Role

EIA projects natural gas taking an even greater share of US electricity generation by 2050, rising from 34% today to 39%, driven by projected low natural gas prices. In its reference case, the industrial sector will become the largest consumer of natural gas starting in the early 2020s. The use of natural gas will increase as a feedstock in the chemical industries, for industrial heat and power, and liquefied natural gas (LNG) production. Low natural gas prices will also drive a significant increase in gas consumption for electric power.

“I have no problem whatsoever with gas trending the way that it does from a policy perspective and a former regulatory background,” Colette Honorable, former commissioner of the US Federal Energy Regulatory Commission and current member of Reed Smith’s Energy and Natural Resources Group, said. “In fact, given the very strong onslaught of renewables that we’ll see, we need that gas, so that’s very encouraging to me.”

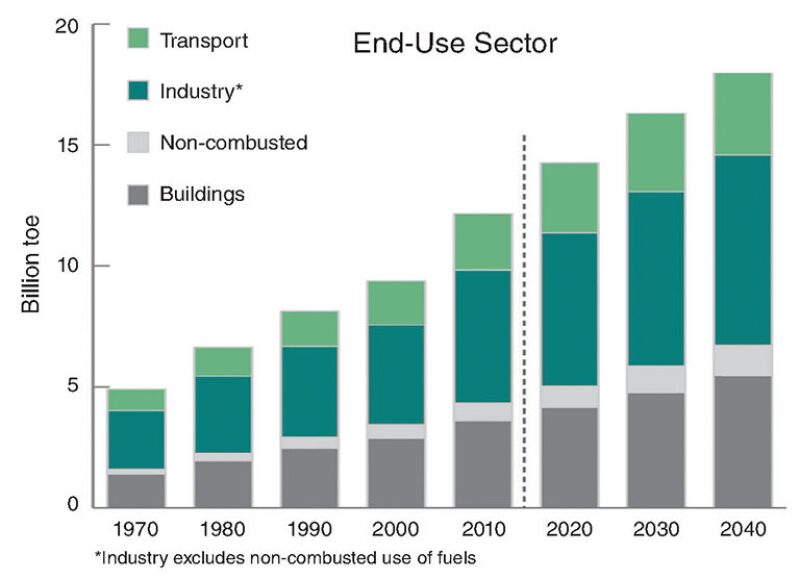

Both EIA and BP project a growth in global energy demand, offset by a decline in energy intensity as consumer products increase in efficiency. BP projected global energy demand growing by around a third by 2040, marking a significantly slower rate of growth than in the previous 25 years.

LNG will increase the global availability of gas, with supply more than doubling due in large part to exports from the US and Qatar—BP projected that those two countries will account for almost half of all global LNG exports by 2040. EIA said that, after LNG export facilities currently under construction are completed by 2022, US LNG export capacity will increase even further, and Asian demand growth will allow US natural gas to remain competitive there in the short term. After 2030, additional suppliers are projected to enter the global LNG market, including Mexico, and this may make additional US export capacity uneconomic.

In the short term, liquids will still play a role in the energy mix, but projections on the extent of that role vary from source to source. In its World Energy Outlook 2018, the International Energy Agency (IEA) writes that oil markets are soon to enter a period of renewed uncertainty and volatility, including a possible supply gap in the early 2020s. IEA projects a rise in oil consumption in coming decades due to rising petrochemicals, trucking, and aviation demand, but meeting that growth in the near term will require a doubling of approvals of conventional oil projects from their current levels. Without such an increase, US shale production would have to add more than 10 million B/D between present day and 2025, which the IEA said was “a historically unprecedented feat.”

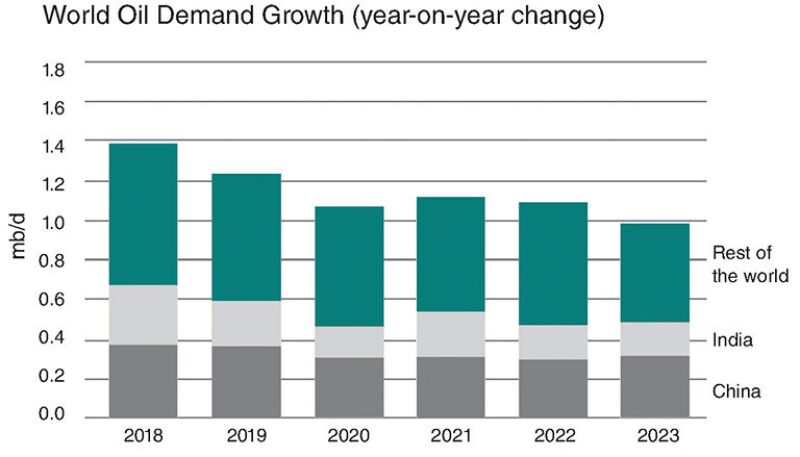

The IEA forecasts non-OECD (Organization for Economic Cooperation and Development) countries dominating global oil demand growth over the next 4 to 5 years. The pace of growth is projected to slow down to 1 million B/D by 2023 as other energy sources become more prevalent. The IEA cited China, which has implemented stringent fuel efficiency and emissions regulations in an effort to tackle poor air quality in its cities. A rising number of electric buses and LNG-fueled trucks in China should slow oil demand growth significantly.

The EIA projects the US becoming a net energy exporter in 2020 in large part to significant increases in crude oil and natural gas plant liquids. US dry natural gas production will increase as a result of continued development of tight and shale resources, which EIA said will account for nearly 90% of dry natural gas production. Across all of its cases, onshore production of natural gas from sources other than tight oil and shale gas, such as coalbed methane, will generally continue to decline through 2050 because of unfavorable economic conditions for production. If gas is playing a major role in the energy mix moving forward, oil will have to play a role as well.

“The role of gas is decidedly linked to the abundance of crude that will come out in the right market and policy circumstances because it’s associated gas. Also, high prices mean that, when we think about what we want out of energy in the US, low pump prices might start to lose their economic appeal. An export-focused producer nation needs more out of the ground and into the world to produce that greener, cleaner gas-based mix,” Book said.

In the future, BP said the global fuel mix will be the most diversified ever seen, and abundant and diversified energy supplies will make for a challenging marketplace. Honorable said that the industry will be equipped to handle whatever comes its way.