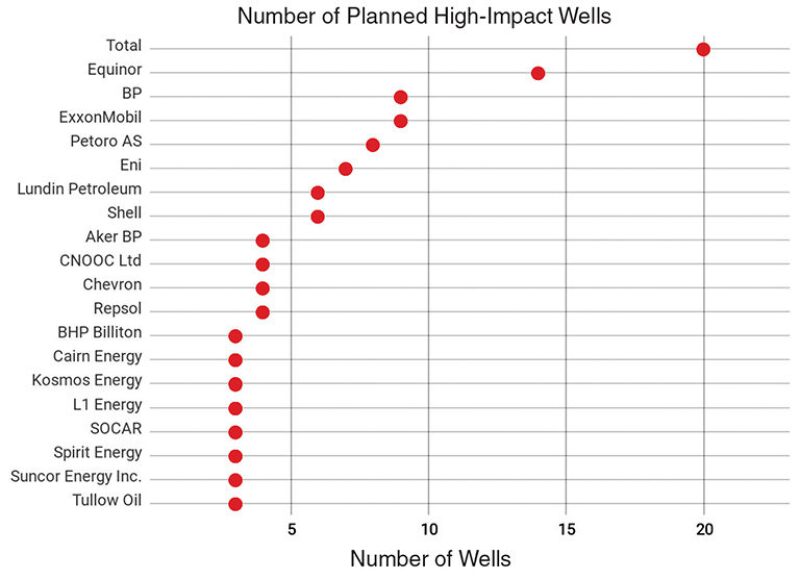

Could 2019 be a bumper year for offshore energy development? In just the first few weeks of this year, four discoveries in the UK North Sea and offshore Guyana and South Africa found 1.3 billion BOE—25% of the approximately 5.3 billion BOE high-impact volume discovered globally in the whole of 2018—according to Westwood Global Energy Group. Westwood has identified another 78 high-impact exploration wells either currently being drilled or planned for the remainder of 2019. The expected gross unrisked volume of oil and gas from the 78 wells is 23 billion BOE. More than half the wells are in deep water (Fig. 1).

The consensus among major energy consultancies is that offshore development in almost all areas of the world is making a comeback after the most recent industry downturn. Rystad Energy forecasts spending on offshore projects to outgrow that of onshore shale activities this year. Lifting the equivalent of 120,000 B/D of oil from the Permian Basin would require an investment of $12.8 billion, compared with $3.7 billion for the first phase of the Liza section of the Guyana project, according to Hess Corp. Chief Executive Officer John Hess in a recent Bloomberg article. Hess, which has assets both in shale and offshore, is a partner with ExxonMobil in Guyana.

Wood Mackenzie says that operationally and financially, “all lights are green” for oil and gas companies’ upstream development plans, including offshore development. And, although the International Energy Agency (IEA) reports that only the best projects are going ahead, the definition of “best” has been expanded by the fact that capital investment in some areas (i.e., the US Gulf of Mexico and Norwegian shelf) that once required a breakeven oil price of $60–80/bbl are now claimed to be robust at $25–40/bbl.

Better Economics

Lower costs and faster project delivery are transforming offshore project economics to the point where majors are now generating more free cash flow at $60/bbl than they were 5 years ago at $100/bbl, according to Wood Mackenzie. Applying lessons learned from the downturn, operators have reset portfolios by shedding higher-cost assets and investing instead in higher-return, lower-cost projects. The projects remain lean and phased, with the focus on keeping costs relatively low and cycle time relatively short for continued market sustainability. Executive pay for many operators is now linked more closely to returns than growth. The reset seems to be paying off with improved profitability and cash flow.

Wood Mackenzie points to three themes that have emerged as restricted budgets have driven a more focused approach to prospect selection.

New plays in new basins. With little to no infrastructure and little service sector, frontier prospects need to be big enough to realize economies of scale and need to be brought on stream quickly. In addition to geology, fiscal terms and domestic political support also are important. Wood Mackenzie points to Guyana, Egypt, and Cyprus as deepwater plays with very high-quality reservoirs that have proved both productive and profitable at lower prices for ExxonMobil, Eni, and Eni and Total, respectively.

“Deepwater is only as good as the value it creates,” said Stephen Greenlee, president, ExxonMobil Exploration Company and vice president, ExxonMobil Corporation, at IHSMarkit’s CERAWeek conference in March. He recalled how the significant expenditures on deepwater exploration and “dismally low” success rates prior to the downturn created an environment in which investors were “suspicious” of their ability to grow their value in deep water.

Greenlee predicts a more optimistic near-term outlook if operators show they can maintain a consistently profitable portfolio, citing Guyana as an example.

“Guyana is completely competitive with anything that’s out there for us,” he said. “It has low breakevens and the ability to provide us with high-quality, profitable production growth by 2025. For us, that’s incredibly creative.

“I don’t think there’s anything that can affect the bottom line as much as a profitable deepwater project,” Greenlee said. “I know it’s a little bit contrarian, but I think we need to prove our ability to replicate these profitable projects, and only when we do that will the market be completely comfortable with us.”

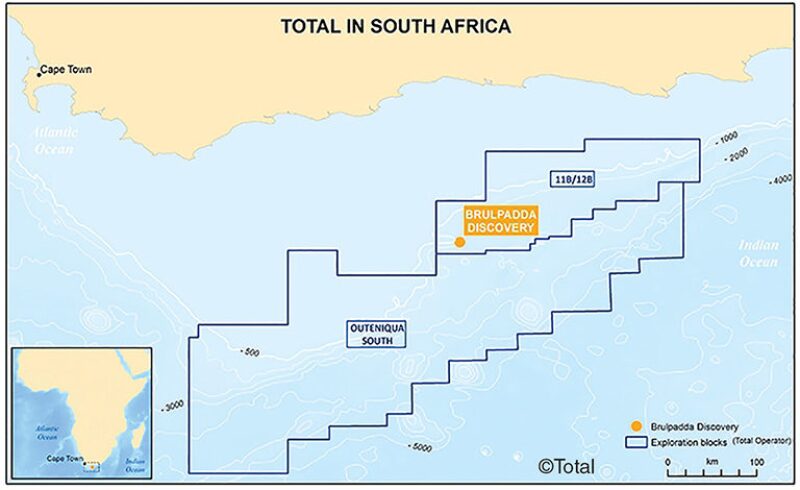

New plays in old basins. Total’s Brulpadda discovery in South Africa’s Outeniqua Basin has been cited as possibly the next great example of profitable new plays in old basins. The emerging Norphlet sandstone in the eastern US Gulf of Mexico is another good example, with an estimated 2 billion BOE, mostly oil, in an exceptional Jurassic reservoir. This and other plays in the area are behind the US Energy Information Agency’s forecast of increased production from 30 new fields going onstream during 2018, 2019, and 2020.

Brulpadda was one of Total’s biggest exploration targets for 2019. It is also an early validation of joint-venture partner Qatar Petroleum’s international exploration strategy, which is focused exclusively on high-impact deepwater prospects operated by majors.

“We’ve had a window of low oil prices and low capture costs, so it’s been a period of rebuilding our inventory, our approach to exploration, and making sure we deliver the successes that we anticipate,” said Kevin McLachlan, senior vice president of exploration at Total, speaking at CERAWeek.

“It’s really about making the unit costs work on a comparative basis so we can deliver long-term growth that’s profitable at a low oil price. If we see higher prices, great, then we’ll see higher returns, but it’s really about trying to make that portfolio, mature it, and drill it. Then we can hopefully deliver the long-term growth,” he said.

McLachlan said his company has “very high expectations” on its ability to deliver profitability to investors in deep water.

“It’s part of our DNA. It’s something we’re good at,” said McLachlan. Total has said it expects production from deep water to reach 500,000 B/D by 2020, contributing to more than 35% of its cash flow from operations.

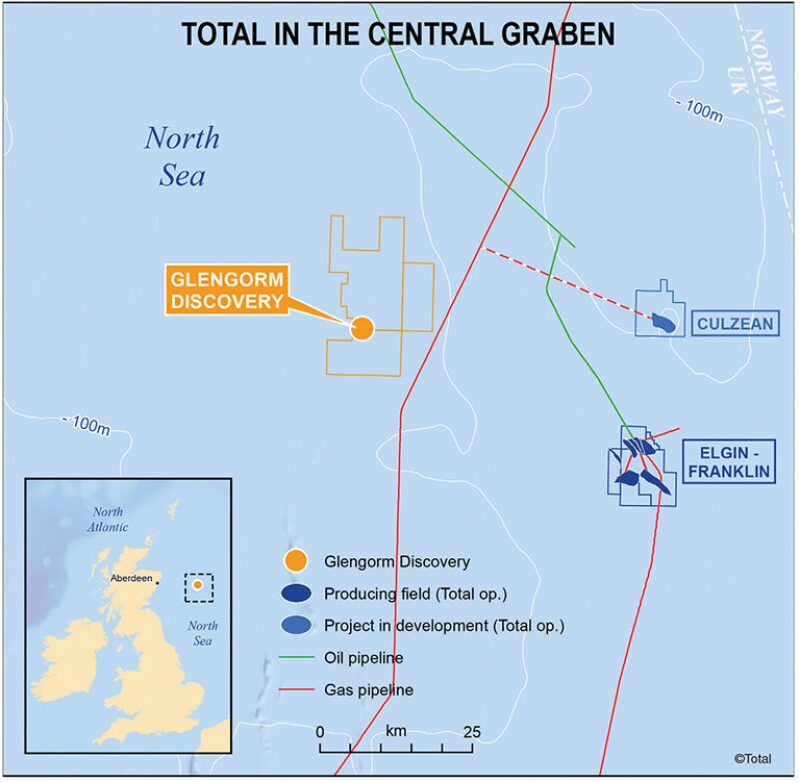

Old plays in old basins. The China National Offshore Oil Corporation (CNOOC) Glengorm discovery in the Central North Sea is an excellent example of a high-impact discovery from an old play in an old basin. At 250 million BOE, it is the UK’s biggest find since Culzean in 2008, and 25 times the size of the average UK find in recent years. But, smaller discoveries in mature plays also can be high-value barrels easily plumbed into nearby field facilities.

Guyana: The New Giant

Guyana has been compared to a new planet in oil’s solar system by Wood Mackenzie. Outside of OPEC, only 10 countries currently produce more than 1 million B/D: Canada, the US, Mexico, UK, Norway, China, Brazil, Oman, Russia, and Kazakhstan—the only new member in the 21st century.

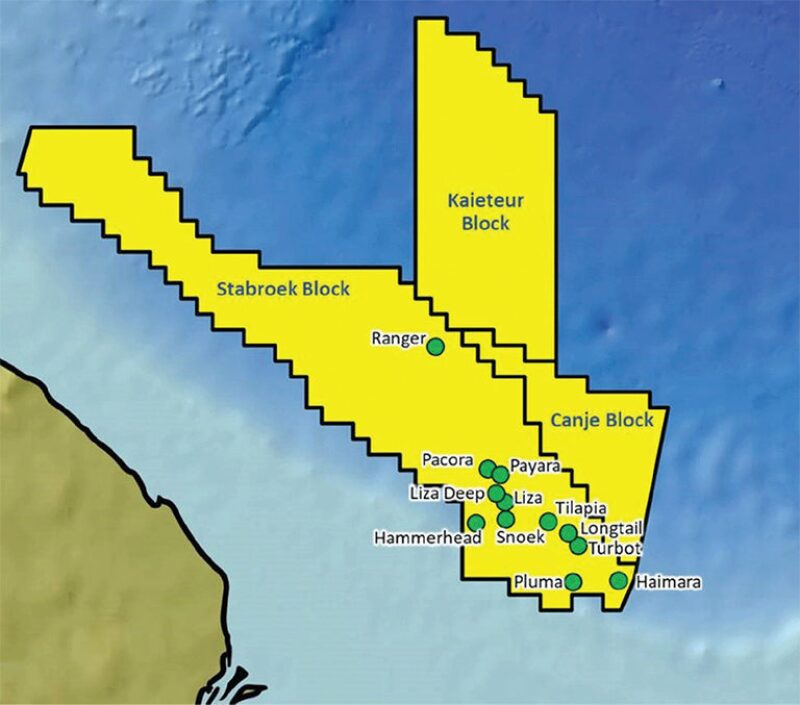

Guyana, with no upstream oil industry 4 years ago, could exceed 1 million B/D in the next decade. ExxonMobil has made 12 discoveries in the Stabroek Block alone since 2015, the last two—Tilapia-1 and Haimara-1—coming in the first 6 weeks of 2019 (Fig. 2). Gross recoverable resource on the Stabroek block alone is now estimated in excess of 5 billion BOE, most of it oil. The exploration success rate for commercial discoveries on the block is 82%, compared with the global industry average of under 20%.

The Guyana Basin is located in the western one-third of the wider Equatorial Margin and includes Suriname and French Guiana as well as Guyana. The remainder of the basin is in Brazil. The basin as a whole may hold another 8–10 billion BOE of reserves.

Although experts have issued caveats about extrapolating success from a handful of sweet spots, 42 international and national oil companies hold acreage in the Equatorial Margin, with Total, ExxonMobil, Anadarko, Hess, and Equinor the biggest players. Wood Mackenzie expects approximately 50 exploration wells to be drilled over the next 5 years. The last breakthrough play of similar scale was the Brazilian Santos Basin pre-salt.

An extremely aggressive development program aims to commercialize Guyana’s deepwater reserves in record time. ExxonMobil affiliate Esso Exploration and Production Guyana and its joint-venture partners, Hess Guyana Exploration and CNOOC-owned Petroleum Guyana, plan to use at least five floating production, storage, and offloading (FPSO) vessels to deliver more than 750,000 B/D by 2025. The partners say the size of reserves and reservoir quality underpin the economics, with project breakeven of less than $40/bbl.

The Liza Phase 1 development should begin producing up to 120,000 B/D in early 2020. Liza Phase 2 is expected to start up by midyear 2022. Pending government and regulatory approvals, sanctioning is expected in the first quarter of 2019 for the project, which will use a second FPSO designed to produce up to 220,000 B/D. Sanctioning of a third development, Payara, is also expected in 2019, and startup is expected as early as 2023.

Glengorm: New Life for UK North Sea

In January, CNOOC and partners Total and Euroil announced the largest oil and gas discovery in British waters since 2008, with Glengorm in the UK Central North Sea. Recoverable resources are estimated at approximately 250 million BOE, very close to those of the 258-million-BOE Culzean field. Drilled to 5056 m TD in 86 m of water, the well encountered net gas and condensate with a total net thickness of 37 m in a high-quality Upper Jurassic reservoir (Fig. 3).

“Glengorm represents an exciting new chapter for the UKCS that continues to yield new resources and opportunities despite its mature nature. With further appraisal and exploration likely to be undertaken, the Glengorm area will likely be an industry hotspot in the coming years,” said Rystad Energy principal Simon Sjøthun.

The mature area where Glengorm is located offers numerous infrastructure options. “Shell’s Gannet complex has the closest proximity to Glengorm, which would imply gas exports via the Fulmar pipeline to St Fergus, and liquids via Norpipe to Teesside. Alternatively, Total’s Elgin-Franklin complex and Culzean are also possible offtake routes with more aligned equity interests and stronger infrastructure longevity, albeit with a longer tie-back distance,” Rystad reported.

Glengorm was mapped decades ago, but remained undrilled until now. Previous license holders relinquished the prospect in 2014 because potential volumes were too uncertain. Renewed interest was driven by fiscal terms and better prospect evaluation stemming from advances in technology, including seismic definition.

Brulpadda: A Basin Opener

In February, Total and its partners, Qatar Petroleum, Canadian Natural Resources, and Main Street, announced the Brulpadda-1 gas condensate discovery in the deepwater Outeniqua Basin offshore South Africa (Fig. 4). “With this discovery, Total has opened a new world-class gas and oil play and is well positioned to test several follow-on prospects on the same block,” said McLachlan.

The 1-billion-BOE discovery, located approximately 180 km southeast of PetroSA’s Mossel Bay gas-to-liquids (GTL) plant, was described by Westwood Energy as the first frontier basin opener since ExxonMobil’s Liza offshore Guyana in 2015. Brulpadda represents a significant deepwater extension of a play that had been proven in shallow water in the 1960s.

“Even though the well isn’t an oil discovery, if Brulpadda proves to be anywhere near as big as the estimates, it will still be a game-changer for South Africa,” said Andrew Latham, vice president, global exploration for Wood Mackenzie. He cautioned that the area’s metocean conditions could present difficulties for development, but also pointed out that Total has knowledge and experience dealing with similar combined wind, wave, and climate conditions in the West of Shetland region.

The discovery could prove a catalyst to restart South Africa’s gas-to-power program, and could replenish gas supply to the Mossel Bay GTL plant.

Eastern Mediterranean: New Hot Spot

Introducing a panel on the Eastern Mediterranean at CERAWeek, IHSMarkit Chief Gas Strategist Michael Stoppard said the region has become “one of the hot spots, with some of the most exciting finds to be made around the world.”

“What makes it so exciting is not just the size of the volume of the discoveries, but also the implications for regional cooperation and government-to-government relations,” Stoppard said.

The Eastern Mediterranean Gas Forum (EMGF) launched in mid-January in Cairo as part of efforts to transform the region into a major energy hub. A development of political importance that is a direct result of the natural gas discoveries in the region in recent years, the inaugural meeting of the forum included representatives from Egypt, Israel, Greece, Cyprus, Jordan, Italy, and the Palestinian Authority.

The EMGF triggers the region’s official transition from oil dependence to gas production, and provides a forum between Eastern Mediterranean gas exporters (Cyprus, Egypt, and Israel) and European gas importers, with Greece and Italy as the conduits to Europe. The forum also represents the first time Arab states have embraced Israel in a regional alliance, continuing the recent trend of normalizing relations.

The intention to establish the EMGF was first announced in October 2018 at the summit of the leaders of Egypt, Greece, and Cyprus in Crete. The summit followed tripartite alliances that Egypt and Israel had each forged with Greece and Cyprus. It also followed a February 2018 deal by which gas is exported from Israel to Egypt.

Israel will start selling gas to Egypt this year. Under a $15-billion deal, Israel will export 7 billion ft3/yr for 10 years from its Leviathan field to Egypt, where it will be processed before delivery to international markets.

Aside from parlaying the recent gas discoveries, the forum counters Turkey’s growing assertiveness in the Mediterranean arena and the concern it arouses in the region. It also supports Egypt’s desire to become a regional energy hub, based on its gas liquefaction facilities.

Cyprus, Greece, and Israel agreed in December to begin the construction of a 2,000-km pipeline that links the Eastern Mediterranean Sea to the European Union via Greece. Construction of this EU-funded, US-backed, EastMed pipeline is expected to take approximately 6 to 7 years with a cost of approximately $7 billion.

Coming together on the CERAWeek panel, energy ministers from Egypt, Israel, Cyprus, and Greece emphasized that with the region’s gas discoveries mounting and supplies in Europe depleting as demand grows, the EMGF will play a key role in providing a bridge fuel for a renewables future while reducing dependency on Russian imports.