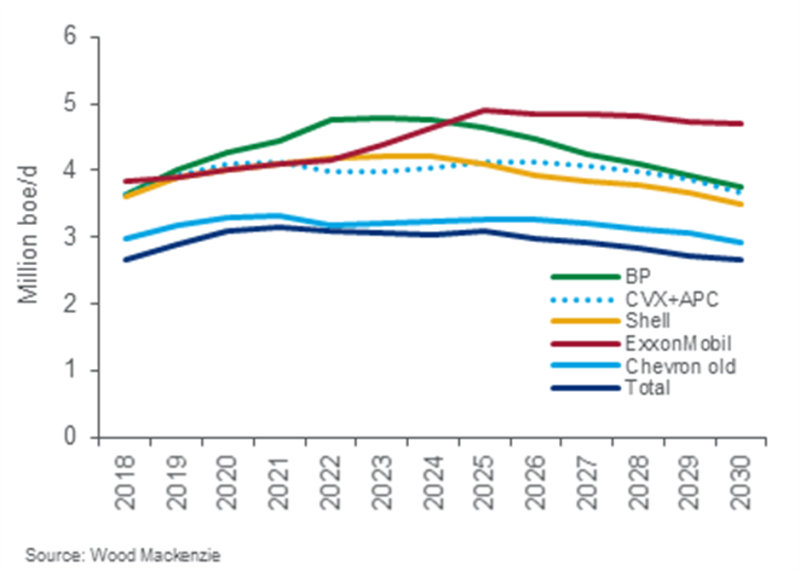

Chevron announced Friday that it will acquire Anadarko for $33 billion in a cash-and-stock transaction with an enterprise value of $50 billion. The acquisition, which is expected to close in the second half of this year, will catapult Chevron from the fourth-largest-producing major to the second largest and place it in the ranks of the ultra-majors, according to consultancy Wood Mackenzie.

“This transaction builds strength on strength for Chevron,” said Chevron Chairman and CEO Michael Wirth. “The combination of Anadarko’s premier, high-quality assets with our advantaged portfolio strengthens our leading position in the Permian, builds on our deepwater Gulf of Mexico capabilities, and will grow our LNG business. It creates attractive growth opportunities in areas that play to Chevron’s operational strengths and underscores our commitment to short-cycle, higher-return investments.”

“The strategic combination of Chevron and Anadarko will form a stronger and better company with world-class assets, people, and opportunities,” said Anadarko Chairman and CEO Al Walker. “I …believe Chevron’s strategy, scale, and operational capabilities will further accelerate the value of Anadarko’s assets.” As of year-end 2018, Anadarko had 1.47 BOE of proved reserves, making it one of the world’s largest independent exploration and production companies.

The company will continue be led by Wirth as chairman and CEO, and will remain headquartered in San Ramon, California.

Biggest Deal Since 2015

According to Wood Mackenzie, the Chevron purchase of Anadarko is the biggest upstream deal since Shell and BG in 2015. “Chevron now joins the ranks of the ultra-majors, and the big three becomes the big four,” said Roy Martin, the firm’s senior analyst, corporate analysis. “ExxonMobil, Chevron, Shell, and BP are now in a league of their own.”

“The deal will also see Chevron assert itself even more as the leader in low-royalty assets in the US Lower 48,” said Lower 48 research director Robert Clarke. “Chevron should truly outperform on cash flow and payback metrics for tight oil.”

Consultancy Rystad Energy also saw the deal as favorable to Chevron.

“This acquisition represents a golden opportunity for Chevron to achieve a more leveraged capital structure that is better suited for the lower risk energy projects of the future,” said Jarand Rystad, Rystad Energy founder and chief executive. “Energy giants recognize that they need to invest more in the shale sector and in renewable energy. At the same time, due also to the lower cost of capital prevalent today, it makes sense for modern E&P companies to favor higher leverage and lower equity share, and instead use debt capital to fund investments and operations, while enhancing shareholder value through share buybacks and higher dividends.”

According to Chevron, the Anadarko acquisition will significantly enhance Chevron’s already-advantaged upstream portfolio and further strengthen its leading positions in large shale, deepwater, and natural gas resource basins. Additionally, Western Midstream Partners, of which Chevron will now take a 55% stake, will strengthen the company’s position by building its presence in what Wood Mackenzie refers to as the “midstream rush,’” from which it says Chevron has been noticeably absent.

Wide-ranging Benefits

According to Chevron, Anadarko’s assets will enhance its portfolio across a diverse set of asset classes, including the following.

Shale and tight gas. The combination of the two companies will create a 75-mile-wide corridor across the most attractive acreage in the Delaware basin, extending Chevron’s leading position as a producer in the Permian.

Deep water. The combination will enhance Chevron's existing high-margin position in the deepwater Gulf of Mexico, where it is already a leading producer, and extend its deepwater infrastructure network.

LNG. Chevron will gain another world-class resource base in Mozambique to support growing LNG demand. Area 1 is a very cost-competitive and well-prepared greenfield project close to major markets.

Additional substantial benefits should accrue from the following, according to Chevron:

Operating and capital synergies. The transaction is expected to achieve run-rate cost synergies of $1 billion before tax and capital spending reductions of $1 billion within a year of closing.

Accretive to free cash flow and earnings per share. Chevron expects the transaction to be accretive to free cash flow and earnings per share one year after closing, at $60/bbl Brent.

Opportunity to high-grade portfolio. Chevron plans to divest $15-20 billion of assets between 2020 and 2022. The proceeds will be used to further reduce debt and return additional cash to shareholders.

Increased shareholder returns. As a result of higher expected free cash flow, Chevron plans to increase its share repurchase rate from $4 billion to $5 billion per year upon closing the transaction.

The transaction has been approved by the boards of directors of both companies and is expected to close in the second half of this year. The acquisition is subject to Anadarko shareholder approval. It is also subject to regulatory approvals and other customary closing conditions.