Carlos Castañeda is hungry for more data and analysis from coiled tubing jobs, and the manager of coiled tubing engineering at Pioneer Energy Services said he also needs to know how his company’s work compares with the competition.

Pioneer is one of more than 25 companies relying on CoilData for real-time monitoring. The data and analysis can tell him which of his people is efficiently drilling out plugs left after fracturing and the ones who may need retraining.

What he does not have is a measure of how his company’s work compares with competing well-intervention companies because the data needed to do that are confidential.

“If you are an individual service company, you are looking at your pipe in isolation,” said Paul Brown, the CEO and founder of CoilData. He sees great value in the data he has collected from more than 155,000 jobs monitored over the past 10 years, but tapping it will require companies to decide if the competitive advantage of analysis based on industry benchmarks exceeds the value of the current level of confidentiality.

Recently he presented a rare multi-company look at how coiled tubing companies manage their most critical asset, coiled tubing strings. The paper presented at the SPE/ICoTA Well Intervention Conference and Exhibition showed significant differences in how much use companies got out of 3,700 tubing strings studied (SPE 194306). It raised the question: Are they leaving money on the table by prematurely retiring tubing strings that cost about $250,000 each?

The Bigger Picture

For those with no interest in well workover, it also raised a larger question about decision making. It showed how service company decisions vary widely when each company is operating in data isolation. Brown’s discussion of the results also showed how the available information on decision making can be limited and subjective.

Brown has a unique perspective based on a career where he used his software and analytical skills to create tools to gather, monitor, and analyze well interventions. He offers many reasons for why companies stop using strings of coiled tubing. But the study showed a significant number of examples where the string’s cumulative metal fatigue—an estimate used to predict the likelihood of failure—was so low it suggested the tubing could have been used longer without a significant risk of failure.

“They must have had a reason for doing it, but it might have been a bad reason,” he said. The qualifier “might” is required because only the company using the string can see what it looks like or know all the details about how it was used or abused.

Early retirements may be due to corrosion, high-pressure work that takes a toll on the tubing, or damage during jobs. Most often, retirement decisions are based on measures of how long a string was used, such as the number of feet it was run into wells over its life, or total hours of use. Brown said that based on his knowledge, and the data, modeling used to estimate metal fatigue does not appear to be a significant factor in the decisions.

Over the long term, Brown wants to use analysis like this to create a string-performance index, which will allow users to compare their tubing retirement decisions with an industry benchmark.

Castañeda said the CoilData study is a step in the right direction. “He has started something that needs to be developed,” he said. What he wants is more specific data reflecting differences among basins and looking at specific types of jobs.

More detailed analysis is possible if companies make it available. Brown said the study represented a “tiny percentage of data” stored by CoilData. But getting companies to disclose more is a tough sell.

Castañeda pointed out there are rewards for sharing information. The number of companies competing for coiled tubing jobs has grown, as has the pressure by oil companies to squeeze costs and use data to identify ways to improve service, reduce risk, and operate more efficiently. In other words, key performance indicators based on analysis of industry data.

When he started at Pioneer Services at the bottom of the oil price downturn, Castañeda said he was asked what it would take to succeed. The answer was performance levels on a par with the best operators. To make those comparisons, “efficiency metrics are needed.”

A Preferred Measure

Discussions about coiled tubing string life are serious business. After delivering his paper, Brown was invited for a long meeting with a pipe maker who complained that the average lifespan reported in the paper was well short of what his pipe is capable of achieving.

Brown explained his methodology and pointed out that most of the retired strings he looked at were used for jobs that are hard on tubing, such as drilling out the plugs after fracturing a long lateral where the pressure is high. Widely promoted records for coiled tubing use are often set on jobs that put less wear on the strings, such as pumping chemical treatments in lower-pressure wells, he said.

Still, he was sympathetic to arguments that users may be overly conservative when workovers are done using improved pipe built to last a lot longer. The three big companies making strings used in North American shale are making long-lasting quench-and-temper pipe. Those strings are heated and cooled twice, once rapidly cooled by quenching, and once allowed to cool slowly. The combination makes steel stronger yet still flexible.

Brown pointed out that users paying a premium price on a major piece of equipment are not likely to stop using it “without a good cause.” The revenue added from extending the life of a tubing string has to be weighed against the risk of a lost customer if an older string fails in the hole. Castañeda said that, “All the ‘attaboys’ can be wiped out by one ‘aw shucks.’”

The wave of new types of high-performance pipe coming on to the market also brings back memories of some new and improved products, Brown said.

One maker of quench-and-temper tubing, Global Tubing, reported at the well intervention conference that within 2 years of its introduction of quench and temper, that product represented 90% of its sales (SPE 194255). While the paper reported that its customers were using its premium strings longer, it noted that “there is room to push the limits toward extracting the full fatigue life,” from both conventional and quench and temper pipe.

See a Pattern?

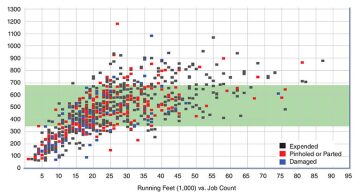

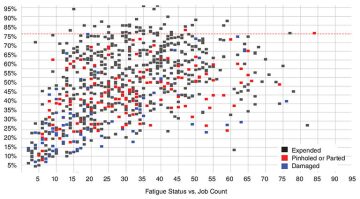

The two charts (Figs. 1 and 2) displaying the number of jobs done by the retired strings of tubing and the wear based on different variables—one based on use and the other on fatigue modeling—show that most coiled tubing strings are retired based on use.

The y axis in Fig. 1 tracks total tubing use based on a common benchmark—running feet. That measure counts the forward progress on all of a string’s jobs over its life. A large percentage of the squares are clustered in the band centered on the mean running feet at retirement.

In Fig. 2, the y axis represents cumulative metal fatigue. It is hard to discern any pattern in the chart tracking total metal fatigue at the time each tubing string was retired. Brown said that the chart indicates that fatigue modeling is not commonly used for retirement decisions. A close look shows many examples where the fatigue modeling suggests the pipe has more jobs left in it.

Fatigue modeling got a lot more attention early in Brown’s career when coiled tubing failures were far more likely. Now, most operators are making retirement decisions based on usage measures, such as running feet or the time used. He understands why they do it. This type of measure is used to set fees, and the direct link to revenues makes it easy for managers to calculate the return on investment for each string.

Still, the range on the running feet chart is relatively wide for this large-diameter pipe—from 400,000 ft to 700,000 ft. There are also a significant number of strings retired below and above the band.

Tubing now can dependably reach limits set by users using running feet or hours of work. But the study suggests that based on the fatigue, the limits set by service companies may be well short of what improved strings now are capable of achieving. A high percentage of the dots on the chart tracking fatigue life show strings were retired before they reached 50% of their fatigue life. The CoilData paper noted that a large number of early retirements “would be a cause for concern.”

A paper delivered at the conference by Global Tubing also concluded that retirements were commonly made with more than half of a string’s fatigue life left.

Running feet is often a poor measure of wear. It was designed when tubing was used for in-and-out jobs such as acidizing. However, this measure of progress does not count the back-and-forth movement common in jobs such as drilling out plugs, which adds to fatigue. It also does not reflect the impact of pressure.

For example, many operators require that when drilling out plugs, the coiled tubing company periodically pull the string back hundreds of feet to thoroughly flush out the cuttings, which can cause costly problems. Others avoid those interruptions by focusing on thorough cleaning while drilling. In a long horizontal well with 60 plugs to remove, short tripping could consume 20% of a string’s fatigue life, Brown said.

The Real Reason?

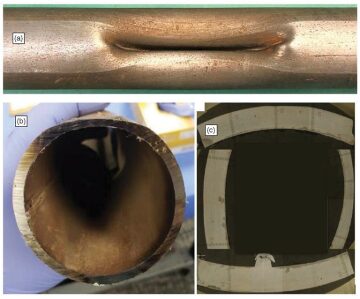

Coiled tubing strings are not just retired due to old age. They are run into wells 2 miles or more for hard jobs in a harsh environment with hazards ranging from corrosive fluids that can thin the pipe walls or create holes, to cuttings that can causes dents or cracks that lead to failure.

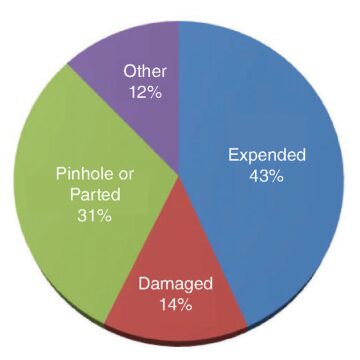

The top reason given for retirements provided by CoilData users was “expended.” That category covers tubing that has reached the end of its useful life. In second place was signs of wear such as pinholes due to corrosion. The number of coiled tubing strings retired due to damage that happened during a job was only about 14%.

“I find that hard to believe, but that is what people are reporting,” Brown said while presenting the study. “You have to be a little careful on interpreting it. Some people might be a little defensive” about admitting that tubing was damaged. “The tendency is to say it was high fatigue rather than they damaged the pipe,” Brown said.

In contrast, the Global Tubing paper estimated damage as the cause for about 40% of retired pipe. That estimate was based on its interpretation of data voluntary provided by CoilData users. The wide range of damage estimates is the subject of a long-standing debate in the business, Brown said.

Proving that damage is under-reported is hard. Only the coiled tubing company can physically examine strings. Post-mortems on strings that are miles long are rarely done. With older pipe it is easier to say it was “expended” than to spend time and money studying whether damage by the operator shortened its life, Brown said.

Early string failures are more likely to be studied because they are likely to lead to a complaint with the manufacturer. A detailed failure analysis is required to determine if a string was defective or the damage was done by the user.

Real-time monitoring cannot observe many forms of damage in progress, which could be small events eventually leading to larger damage. Brown said pipe makers complain about customers spooling out large-diameter pipe through old reels built for smaller-sized tubing leading to damage.

No Disclosures Allowed

CoilData is small compared with giants such as Halliburton, Schlumberger, and Baker Hughes-GE, or to NOV’s Cerberus monitoring service. But its location of customers in the US and Canadian shale business concentrates its data in an active, changing segment of exploration and production. On a busy day, it can be helping customers track more than 50 jobs in progress.

Castañeda would like to know what that database can tell him about how those jobs are performed. Is the fatigue added by short-tripping justified by the reduced risk of a stuck pipe because the flushing removed all the cuttings?

But customer confidentiality agreements limit how specific Brown can be. There are a few exceptions. Some customers agree to provide certain data on pipe performance directly to the maker of that pipe to ensure that problems are quickly detected.

CoilData’s users gave Brown permission to study about 3,700 of the retired strings in its database of more than 5,200. Brown’s study was limited to questions that were sufficiently general to avoid revealing the activities of any specific client.

But increasingly the oil companies paying for the jobs are able to see a bigger picture. While they are not CoilData customers, they can gain access to real-time feed if the service company doing the job approves the request.

That makes it possible for larger operators to compare how multiple coiled tubing companies are performing. One big independent oil company has asked Castañeda to push CoilData to significantly increase the types of data in its feed.

CoilData is courting oil companies as members. “The charges for it (the service) are nominal. The advantage is tremendous (because) the operator can look at what multiple service companies are doing,” on its wells, said Carlos Torres, a business development advisor for CoilData.

Brown wants to get more value out of his database by creating more and better performance benchmarks. Perhaps even combining it with data from the bigger companies. But that requires cooperation, which is hard because “everyone wants to know that, but no wants to contribute to it.”

For Further Reading

SPE 194306 An Analysis of Coiled Tubing Performance by Paul Brown, Brian Gunby, CoilData; Carlos Torres, Upstream Consulting

SPE 194277 Remote Monitoring and Modeling of Coiled Tubing Operations in Real Time by Paul Brown, Brian Gunby, CoilData; Carlos Torres, Upstream Consulting

SPE 194255 In-Line Quench and Temper Technology Applied to CT Improves Safety and Reliability in Extended Reach U.S. Shale Operations by I.I. Galvan, G. McClelland, E. Gagen, Global Tubing; et al.