The outlook for US unconventional oil plays is increasingly negative with drilling activity down, production growth slowing, falling future price expectations, and a surging sense of uncertainty.

Those pessimistic observations about the US onshore business were reported by two regional federal reserve banks surveying oil industry experts from Texas to Colorado. They describe the pressing problems facing the business as engineers and geoscientists travel this week to the Unconventional Resources Technology Conference (URTeC) in Denver.

The agenda there is loaded with talks about deeply technical topics, including one on “abiotic transformation kinetics for surfactants.” That talk offers some interesting research on how those chemicals change in the reservoir, which could matter a lot to those considering whether pumping surfactants might offer a quick, cost-effective way to add cash flow by increasing oil production.

Those attending are part of the business once hailed as the shale revolution, which is now described as an investing disaster. Investors and lenders stopped pouring money into the unconventional business, because the cash flowing out of the wells never was enough to deliver a payoff for those who paid for the growth.

“The biggest impact has been the rapid and accelerating lack of investor interest in both conventional and unconventional oil and gas. The securities of oil and gas companies now sell at a fraction of what they once commanded. Huge losses in these shares hamper new exploration. It looks like another round of bankruptcies and mergers,” said an unnamed commenter in the quarterly report on the industry by the Federal Reserve Bank of Dallas.

The reality has been less dramatic. There have been a few acquisitions. Callon Petroleum recently bought Carrizo Oil & Gas in a deal valued at a modest premium to what Carrizo shares had traded for recently. But Carrizo shares were down 60% from what they were worth 12 months before, and the Callon shares offered in the all-stock deal dropped nearly 17% the day it was announced.

As unattractive as that might sound, more acquisitions are expected. Consolidation is needed to cut costs at companies that need to begin generating cash from operations to sustain their business.

The Callon-Carrizo deal promises to cut the cost per barrel by reducing overhead expenses—essentially the acreage of both companies will be managed for not a lot more than it cost one company to manage far less. The company also said it plans to reduce drilling and completion costs by developing large clusters of wells.

The success of those megapads will depend on how well the company manages the various technical challenges coursing through the URTeC sessions such as how to effectively develop ultratight rock by fracturing clusters of closely spaced wells.

Also on the agenda will be experts on the financial realities of the business. Robert Clarke, research director for Wood Mackenzie, talking about how faster-than-expected declines in older wells are likely to add to the pressure for more deals.

A study by the data and consulting company found that production from older Permian tight-oil wells has been declining at double-digit rates—decline rates that are often double what companies expected in production projections they shared with investors. “That means less cash flow. The faster decline rates will require more wells to fill that gap,” Clarke said.

Rather than pay to drill more wells to meet those projections, he said the companies will be looking for opportunities to acquire lower-cost barrels through deals.

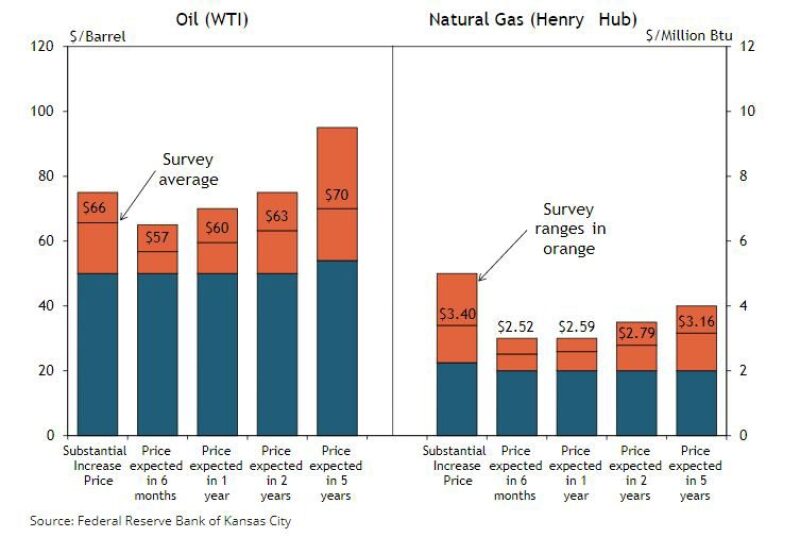

Oil industry experts surveyed by the Federal Reserve Bank of Kansas City said a sustained price of $66/bbl will be needed to justify drilling. The benchmark price of US crude was $10/bbl below that average recently (18 July), and those surveyed said it could take 5 years to reach that average.

The comments were even more pessimistic about gas. Gas prices will need to rise about 30% to reach the average level needed to sustain drilling growth, and those surveyed did not expect that to happen over the next 5 years.

Gas Shift

At a moment when the industry focus is on producing more oil, the Permian has become a booming gas play. Gas production is expected to rise by 4 Bcf/D in the Permian between May and December, according to another study by Wood Mackenzie that will be covered at URTeC.

There is a rising number of wells, whose production is tilting toward gas. The oil cut has dropped below 65% in the prolific Wolfcamp A and B benches, according to the consultancy.

“Everywhere you look there is a lot of gas out of there,” Clarke said. The glut of US gas is likely to push the average price to the lowest level since 1998, according to the Short-Term Energy Outlook from the US Energy Information Administration, which recently lowered its expected price.

An extremely hot July and August could push the price up a bit, but that will be faint comfort to producers in the Permian and Bakken producing gas they cannot sell because gas production growth continues to exceed the increase in pipeline capacity.

One exasperated comment offered by the Dallas Fed said, “We need to start a conversation between industry and government about bringing back prorationing [daily production limits to raise prices] again. Nobody’s generating free cash flow.”

Tech Gap

Even in Texas, government leaders show no interest for a program modeled after the Texas Railroad Commission’s old production-control program, which was born when huge discoveries crushed oil prices in the 1930s and ended when US oil production was in decline.

In an era of cheap oil, gas survival will require being at the bottom end of the breakeven price range, which goes as low as $50/bbl for oil and $2.25/million Btu for natural gas, according to the survey by the Federal Reserve Bank of Kansas City.

There will be no lack of ideas on the crowded URTeC agenda and exhibit floor, but tight budgets will limit what is possible.

“I have not seen a ton of experimentation and R&D” over the past 6–9 months, Clarke said, adding that is likely a function of budgets with fewer dollars available.

Operators holding the line on standard services are also balking at the premium prices service companies need to charge to cover the research and development costs required to create new and improved products.

“Service companies are under pressure too. They are not selling solutions at prices they want to,” Clarke said. There needs to be a “bit of the meeting in the middle” to sustain technology development programs. Cooperative field-testing agreements will also be required to speed acceptance of good ideas.

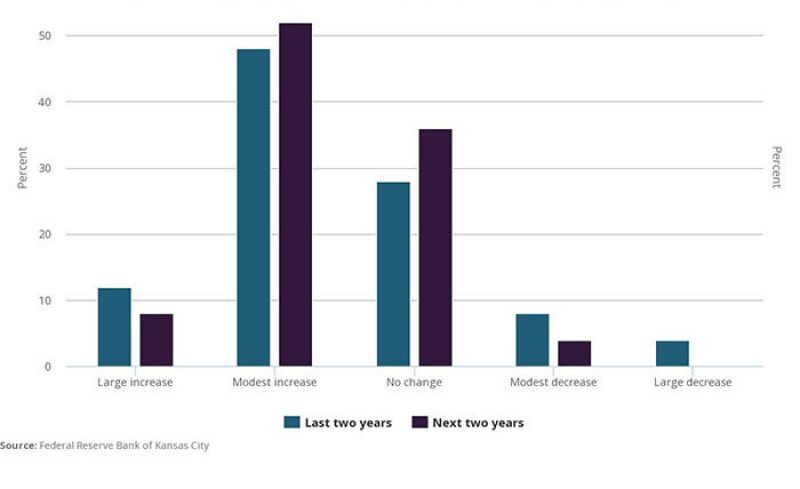

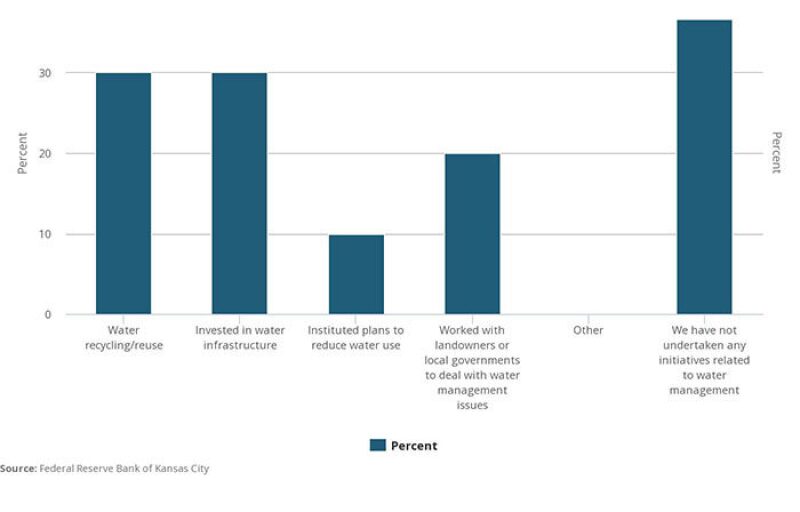

Innovation spending is hard to track. The Kansas City Fed offered two charts suggesting spending is limited for activities outside of drilling and completing wells.

They looked at two nonrevenue items—water management, software, and applications spending. Both offer opportunities to significantly lower costs and reduce risk, but they are not in the budget at many companies.

The survey found more than 35% of the companies “have not undertaken any initiatives related to water management.”

Only 10% of the companies surveyed by the Kansas City Fed reported plans for a large increase in spending on software, application development, and personnel over the next 2 years. While more than half predict a modest increase over that period, about one-third of the companies are holding the line on software spending or cutting it.

Doing things differently also requires preparing workers for change. “We have had two contracts canceled recently, which really hurt,” according to one comment to the KC Fed survey. It added, “Companies have had to revise downward their budgets for 2019 and they cut training.”