Water management in shale plays is an extremely competitive business. Every cent counts. This is most evident in the Permian Basin where companies work tirelessly to minimize operating costs in order to contract new capacities and fill their capital-rich infrastructure. These players are under enormous pressure to evaluate every component of costs and wring out excesses. While traditional operating expenses (OPEX) are heavily scrutinized, a full picture of profitability in water management is gained only after comprehensively examining the unique aspects of their overall business model.

Traditional OPEX components in produced water management include labor, chemicals, consumables, infrastructure maintenance, transportation, disposal, solids handling, and power and other utilities.

Capital expenses (CAPEX) must also be considered in light of tradeoffs between CAPEX and OPEX. Water CAPEX is generally composed of infrastructure, including pipelines, disposal wells, ponds/storage treatment facilities, and associated utilities infrastructure; equipment; engineering, project management, and permitting costs; and land.

While all companies focus on these key expenses, another very significant cost driver emerges when the business model is more closely examined.

Midstream companies’ revenues originate from three primary sources:

- Handling fees. Operators pay companies to collect and dispose of their produced water/flowback on a volume basis, and disposal is usually to a saltwater disposal (SWD) well. Gathering fees are charged for pipeline collection and disposal fees are charged for volumes disposed into SWDs.

- Commodity-based margins. Companies separate skim oil from disposed volumes and sell oil. In some cases, ownership of the skim oil remains with the operator. Royalties and accounting costs must be considered as a component of the profitability of skim oil sales.

- Treatment fees. Instead of disposing to a SWD, companies can treat produced water/flowback and sell recycled water to operators on a volume basis.

The fact that recycling in the Permian is gaining in popularity due to local water scarcity, transportation costs, environmental stewardship, and/or SWD limitations creates additional opportunities for generating new revenue by increasing the volumes of water treated and associated water disposal/delivery fees.

Revenue Bottlenecks

As recycling is more readily adopted, revenues are becoming constricted by a number of factors including: pipeline capacity, treatment facility capacity, water quality fluctuations that cause upsets in facility operations, and transportation distances/location to fracturing sites.

One of the challenges in recycling produced water and flowback is the inherent variability of the produced water to be treated. Also, treatment standards vary wildly among operators, making it difficult for companies to develop centralized facilities to treat multiple source waters for different clients. Based on their revenue model, companies obviously benefit by maximizing disposal volumes to the fullest capacity of their SWDs, and recycling water both frees up disposal capacity in SWDs as well as generates additional revenue from the sale of the treated recycle water. But the efficiency of this financial scheme diminishes quickly when uptime at the recycling treatment facility decreases. This is where produced water quality fluctuations impact profitability.

To help assess process economics and better understand the importance of process robustness in current reuse operations, Water Standard, through its produced water subsidiary, Monarch Separators, performed an analysis of existing plant operations in the context of recent full-scale test results. The findings highlighted key differences in profitability that contradicted current process optimization efforts focused on individually reducing each operating cost component.

To better understand facility uptime in produced water recycling, it is important to assess the dynamics in produced water quality. Generally, operators specify treated quality levels for total suspended solids (TSS) or turbidity, iron, bacteria, hydrogen sulfide, and oil-in-water. The treatment schemes at facilities vary significantly, ranging from simple aeration and oxidant addition often followed by pond settling, to more rigorous treatment involving oxidant, coagulant, and flocculant addition with flotation and filtration processes. The more rigorous treatment achieves better overall treated water quality, which improves injectivity during hydrofracturing and helps to minimize long-term reservoir damage.

Many recycling facilities struggle to maintain treatment goals when large incoming produced water quality upsets occur. Equipment becomes overwhelmed with oil and solids carryover and throughput is either reduced or the system is shut down for maintenance. In evaluating current recycling facility operations, it became apparent that upset related downtime is a common occurrence, and the ability to achieve greater uptime was identified as the key criteria for economic success at most recycling facilities.

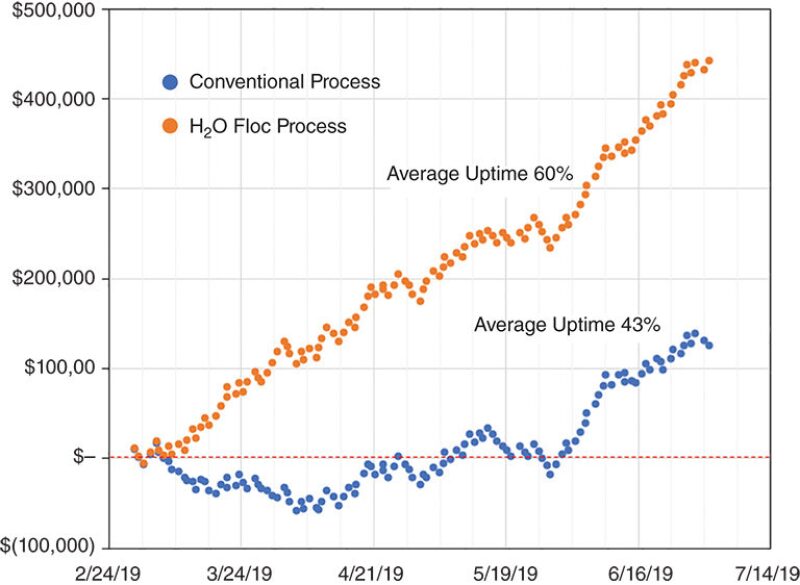

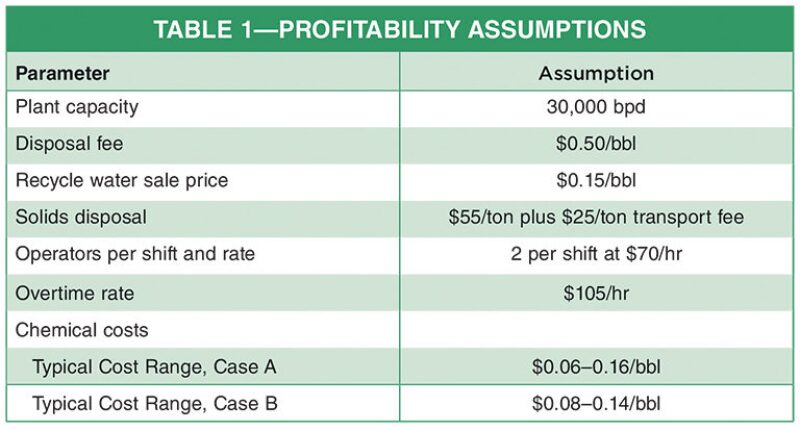

An overview of the economic analysis is presented in Fig. 1 and Table 1. The data represent approximately 4 months of operation at a 30,000 B/D facility. The current chemical treatment scheme (Case A) fails to perform when daily average water quality fluctuations are greater than 125% of the previous 24-hour period, while Case B represents a more robust chemical treatment that maintains treatment performance through inlet water quality fluctuations up to 300%. Water quality upsets (turbidity, oil, and iron) modeled in Fig. 1 represent that of a typical facility. This analysis is based on water fees collected on throughput: disposal fee $0.50/bbl and recycle sale $0.15/bbl.

In comparing uptime between Case A and Case B, the uptime at this facility shifts from 43% to 60% with an increase in cumulative profits from $126,000 to $443,000, demonstrating the value of applying a chemical treatment regime that can meet treatment goals through a wider range of upset conditions experienced by the recycling facility.

Conclusions

A novel business model improves efficiency and reduces risks across all stakeholders in the Permian Basin. Although the need for controlling costs is critical, our findings suggest that increasing uptime and providing a greater ability to manage water quality upsets will have a more significant impact on the financial success of midstream systems. By applying robust treatment solutions that address frequent plant upsets, overall profitability can be greatly improved at no additional operating costs in most cases. Produced water quality is unpredictable in nature, and therefore mitigating the risks associated with this uncertainty can only be addressed with robust solutions that are not dependent on specific water compositions to be effective.

Lisa Henthorne, senior vice president and chief technology officer at Water Standard and Monarch Separators, has more than 30 years of experience in the application of membrane technologies in seawater, brackish water, produced water, and municipal and industrial water reuse. She holds four US patents and multiple foreign patents in water treatment technology. She served on the nonprofit board of the International Desalination Association for 16 years, including as president, and currently serves as president of the Produced Water Society. Previously, Henthorne held research positions at the US Department of Interior, Bureau of Reclamation working both in the US and internationally.

Buddy Boysen, engineering and technology director at Water Standard and Monarch Separators, is a recognized expert in membrane and advanced water and wastewater treatment technologies. His work with Water Standard is focused on delivering these technologies to the oil and gas industry for use in secondary and enhanced oil recovery and produced water treatment, disposal, and reuse. Boysen serves on the board of the American Membrane Technology Association as well as the South Central Membrane Association.