Pre-COVID-19 forecasts were blown out of the water and nearly made moot quickly in the first quarter of this year. Attempts to form long-term forecasts are stymied by uncertainties until some degree of stabilization returns to the oil and gas industry. The recent meteoric oil price dive plus the pandemic narrowed the window for defining “long term” with confidence.

For example, Fatih Birol’s comment, “We see early signs of a gradual rebalancing of oil markets. It is still gradual and it is still fragile,” might be interpreted as cautiously optimistic. The executive director of the International Energy Agency (IEA) also tweeted upon the release of the agency’s monthly report in mid-May … “the picture is still very bleak for the industry. After ‘Black April,’ the heaviest demand destruction may be behind us, but huge uncertainties remain. We now forecast global oil demand will fall by 8.6 mb/d in 2020.”

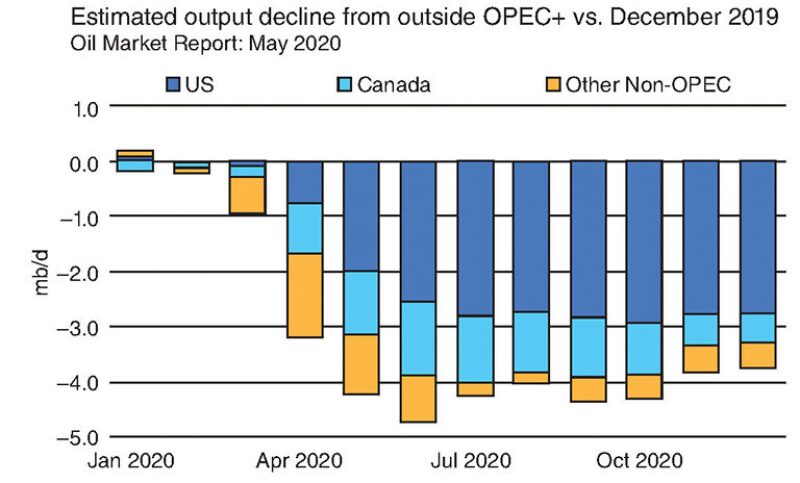

Global supply remains excessive but is being dialed back. In what previously would have been an unexpected twist, the US will be the single largest contributor to the historic drop in crude supply, a decline of 12 million B/D by the end of the year.

The shale operators, who not so long ago were producing at record levels, are now the primary drivers in decreasing global production largely by rapidly shutting in their wells, especially in the Permian and Bakken.

Non-OPEC producers will account for nearly one-third (approximately 4 million B/D) of the global supply drawdown. The US is forecast to rein in the majority (about 3 million B/D)—surpassing Saudi Arabia’s expected supply cuts, including its recent further reduction of 1 million B/D (bringing its expected daily production to 7.5 million instead of 8.5 million). Canada, Norway, and Brazil are also pulling back production.

Global supply may continue to outpace demand as lockdowns ease and consumption of oil and gas picks up in travel and individual and industrial activity, the duration and timing of which is unpredictable.

Although Brent and West Texas Intermediate crude prices remain down more than 50% year to date, they have rebounded from the recent fast and furious drops. The level of the rebound, however, does not yet come close to recovery across the industry. Over the short or long term, the definitions of recovery will be recalibrated to a changed “normal.”