This commentary has been prepared by the SPE Reservoir Advisory Committee (RAC) to provide high-level insights for the discussion on the potential consequences of long-term shut-ins on conventional and unconventional reservoirs. The RAC comprises 61 subject matter experts (SMEs) covering the domain of reservoir technical discipline. The views presented in the commentary are the opinions of the SMEs and do not constitute an official position of the SPE on the subject matter.

Orientation

From a completions, production, and facilities perspective, there are significant, and potentially devastating, effects for the long-term shut-ins of wells. Everything we leave in the well and the surface facilities will be subject to corrosion, deterioration, and other chemical/mechanical effects. Perforations and the well itself may become plugged and deformed and the pumps and bottomhole assemblies may be rendered dysfunctional due to the settlement of sand and other debris/contaminants. Moreover, scale buildup and wax and asphaltene precipitation in and around the wellbore are well-known potential problems during shut-ins.

The oil and gas industry has a very long history of well surveillance, well maintenance, and well remediation—but as an induction, we have not had any circumstances on the scale of the current situation. Simply put, we may not be able to bring these wells back on line without workovers and, in some case, restimulation. Furthermore, recompletions, restimulations, chemical treatments, workovers, etc. may not be viable solutions in many cases, particularly for poorly (and very poorly) performing wells, of which there will be many. The impact on supply chains may be/will be challenging in regards to the material, expertise, and timing to complete efforts for restimulation. These facts are indisputable, and have been recently documented in a JPT article by King and Garduno (2020) and in an SPE Live interview of George King by David Gibson (2020).

The purpose of this commentary is to address the consequences of long-term well shut-ins from the reservoir-performance perspective. It is also important to emphasize that this question has more critical implications—and far more unknowns and uncertainties—for unconventional wells than those for conventional wells. Therefore, while we will comment on the impact of long-term shut-ins for conventional reservoirs, we mostly focus on unconventionals in this article. The goal of this article is to engage the technical community in an effort to capture experience and expectations, as well as to provide guidance to the industry on issues and opportunities that may arise from large-scale shut-ins of wells on multiple scales (single well to multiwell designs), in particular for unconventional reservoirs.

Experience with Shut-Ins in Conventional Reservoirs

Long-term shut-ins of conventional reservoirs for years, and sometimes for decades, have occurred under extraordinary circumstances—such as war or civil unrest (e.g., Iraq’s invasion of Kuwait in 1990, Arab Spring Uprisings in early 2010s, and unrest in Nigeria from 2003 to 2007). In these cases, damages to the production facilities were catastrophic as the facilities had not been properly maintained, or as in the case of wars, the facilities and wells were destroyed. Other circumstances might be the deprioritization of an asset compared to a more prolific new discovery (this is more the case for national oil companies (NOCs); examples can be found in Mexico, Kuwait, and Saudi Arabia). However, from a reservoir standpoint, there were also benefits of long-term shut-ins, in particular, due to repressurization of the field and stabilization of the fluid contacts (Dujardin et al. 2011).

Wells in conventional offshore reservoirs are routinely shut in for moderate periods (< 1 month) due to maintenance, seasonal demand, and weather-related issues—and, in many/most cases, there seems to be no significant nor permanent reservoir damage. In cases of severe water or gas coning due to aggressive production rates, stopping or reducing production may help stabilize fluid contacts. Rate reduction is also often correlated with higher recovery but the net-present value usually suffers. There are exceptions reported in the literature (Lutes et al. 1977; Matthes et al. 1973; Huppler 1974) for high permeability, strong water drive reservoirs, such as those in the Gulf Coast and offshore Gulf of Mexico (GoM). There have been known cases of extended periods of 100% water production after long shut-ins in some GoM wells due to crossflow. It has been discussed that, even with limited withdrawals, water would invade the relatively high-pressure, high gas saturation pore space, trapping residual gas at high pressures and causing significant losses in recovery. In these cases, exceptionally high production rates have been suggested to outrun the water influx. Alternatively, some fields have been developed with moveable completions (e.g., the Akal field in Mexico) or gas injection has been used as a means of pressure support to maintain the gas/oil contact in place (e.g., the Yates field in Texas). Also, silica crushing and fines migration caused by weakening of natural bonding/cementing material and quartz overgrowth during repeated shut-ins have been known to cause some mechanical damage around GoM wells.

Past experience may not be a relevant predictor because the decisions regarding which wells to shut in is heavily driven by the specific conditions of the industry, market, reservoir or play, and the particular producer.

In contrast, except for extenuating circumstances, for most conventional onshore reservoirs, we are accustomed to relatively short-term shut-ins (pressure buildup tests, maintenance shut-ins, shut-ins after flowback, etc.). In many of these cases, if the pumps do not fail on startup, the reservoir can and will respond with increased rates, particularly if the wellbores and surface facilities are pickled to protect the exposed bare metal (it is becoming a common practice to pickle shut-in wells to reduce corrosion, scale, etc.). Historically, we have not monitored the reservoir (pressure) behavior during long-term well shut-ins primarily because these wells were shut in due to war or civil unrest or poor well economics, which did not offer any incentive (economically or even technically) to spend resources for further monitoring.

As noted by Jacobs (2020), historically we did not have sufficient representative historical data or experience to assess the reservoir-damage consequences of long-term shut-ins. With today’s surface and downhole sensors, however, the cost to perform falloffs and buildups should allow wide-scale monitoring. Dip-ins or activating the sensors near the end of the shut-in can provide further indications of performance changes due to skin (i.e., a pressure drop associated with some aspect of the well condition, not the reservoir). As an example, application for conventional reservoirs, pressure buildup data recorded during long shut-ins can be instrumental in understanding the dynamic connectivity in complex deepwater and faulted reservoirs particularly when jointly interpreted with time-lapse 4D data.

An area where potential implications of long-term well shut-ins may be detrimental is conventional enhanced oil recovery (EOR) projects. Thermal EOR projects, such as steam-assisted gravity drainage (SAGD), are likely to be the most affected by a reduction in injection due to the need to maintain the heat in the reservoir. Slowing injection and production allows for higher thermal losses and a less efficient process. Stopping steam injection causes cooling off the steam chamber around the well and resaturation of the steam chamber by oil, which leads to eventual oil blockage in the vicinity of the well. When steam injection is restarted after a long shut-in, oil production rate never reaches the level prior to shut-in (Farouq Ali 2016). This problem is more severe in heterogenous formations. In cold-flow heavy-oil production, separation of solution gas from foamy oil results in precipitation of heavy oil to block pore channels. Similarly, the collapse of wormholes (through which the oil is produced) due to halts in production is another potential damage mechanism.

Chemical EOR projects may also be affected by reduced or stopped injection, as, in many cases, the successful flood requires a salinity gradient to stay in the Windsor II range (surfactant forms a water-in-oil emulsion in the oil phase) for effective water/oil interfacial tension (IFT) reduction. Stopping or reducing injection may have the effect of losing the gradient or having influx dilute and transition to a Windsor II or Windsor I (surfactant forms an oil-in-water microemulsion in the aqueous phase) process where emulsions are formed; in some cases, causing a viscosity increase that effectively locks the oil in place. Solvent injection projects potentially could suffer the least, and may offer opportunities to optimize gas injection placement to more efficient patterns. Water-alternating-gas (WAG) cycles can be used to improve diversion of fast channels, and provided the maturity is sufficient, may help push slower processing zones. Artificial lift changes may be required to keep wells flowing efficiently, but as prices recover, returning to drier injection (longer CO2 and shorter water cycles) will likely maintain ultimate recoveries. In cases where water injection replacement is not possible, the reservoir faces a stark choice of injecting at reduced rate, and potentially losing pressure in the reservoir, reducing the sweep efficiency due to less pattern area above the minimum miscibility pressure (MMP), or shutting in barrels in the less efficient producer-injector pairs.

Challenges and Opportunities of Shut-Ins in Unconventional Plays

At the heart of the recent shut-in discussions are the oil and condensate wells in unconventional plays—particularly those in slightly to significantly overpressured unconventional reservoirs (curtailment of gas production from unconventional plays is currently not a significant topic of discussion). Aside from wellbore, completions or surface facility issues, field observations have not indicated any significant change in water cut and gas/oil ratio (GOR) [in some cases, lower GOR was observed] after several months of shut-in and a significant flush oil production has been noted upon reopening these wells, which implies no well damage due to long shut-ins.

According to a recent report by RS Energy Group (2020), two-thirds of the wells which were shut in during the 2008–2009 and 2014–2016 industry downturns resumed production. The majority of these wells came back stronger initially and their longer-term production performance matched their pre-shut-in trends (or became comparable to those wells which had not been shut). The remaining one-third never returned to significant, let alone commercial, production.

What was once perceived as an 'unconventionals' revolution has become our most significant challenge as an industry.

At present, we still lack systematic data for long-term shut-ins of older vintage wells in unconventional reservoirs where there is significant pressure depletion and/or well performance issues related to the degradation of the completion (i.e., the created hydraulic fracture system). Rather, unconventional wells are typically put on artificial lift of some type(s) prior to the severe degradation of a given well’s decline and therefore such wells are inevitably shut-in or "plugged and abandoned" (P/A'd). As noted in the 2020 RS Energy report, past experience may not be a relevant predictor because the decisions regarding which wells to shut in is heavily driven by the specific conditions of the industry, market, reservoir or play, and the particular producer. We must also be cautioned that most of our current understanding is from rather cursory reviews of existing random data, which were not collected and processed with technical rigor and lack systematic review, diagnostics, and analysis.

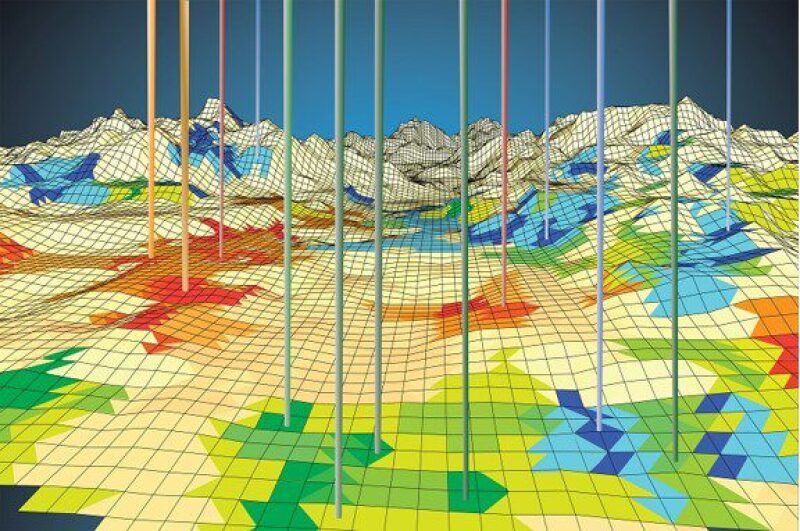

Unlike more visually identifiable effects of shut-ins on well completions and surface facilities, reservoir effects of shut-ins need to be deduced from measured responses, such as pressures, flow rates, GOR, water cut, etc., which can only be related to reservoir quality changes through modeling studies. Simulation results reported in a NITEC LLC (2020) Research Paper show no noticeable effect of shut-ins on Midland Basin wells after the high initial rates observed in all wells, which decline quickly with subsiding early transients. Wells in the Bakken Shale and the Three Forks Formation in the Williston Basin, on the other hand, may experience an additional boost in average pressures due to the entry of fluids from nonstimulated zones into the stimulated reservoir volume (SRV)—this is thought to be due to the (relatively) better reservoir quality in these formations. However, after the initial increase in performance post-shut-in, production performance follows the pre-shut-in production declines. Water cut is also expected to stabilize at or below pre-shut-in levels for wells in the Three Forks Formation, which are connected to Middle and Lower Three Forks through fractures.

Simulated post-shut-in performances of wells in Delaware Basin show strong dependence on the vertical communication (NITEC LLC 2020). Without vertical communication, long-term performances of wells completed in shallower layers will be mostly unaffected by shut-ins. However, vertical communication may cause water to drain into deeper layers during shut-in and reduce the early water cuts after reopening. Wells completed in the deeper layers are less likely to show productivity change, but their water cut may increase due to the gravity segregation.

For Eagle Ford wells, NITEC LLC simulations do not indicate any performance changes after long shut-ins, unless very tight spacing complicates interference between wells located at structurally different elevations. An apparent danger might be the extended contact of frac or reservoir water with the bentonite content of Eagle Ford, which damages the conductivity around wells due to clay swelling.

Simulations for the Osage and Meramec Series Wells in the SCOOP and STACK basin (NITEC LLC) display similar results to Delaware and Eagle Ford wells. Interference effects may be magnified due to long shut-ins if the wells are connected by fracture networks. Wells completed in shallower layers may have reduced water cuts after reopening due to gravity drainage of waters to deeper layers during shut-in and the wells in deeper layers may experience slightly increased water cuts. Otherwise, due to slow recharging of the fracture network in the Osage Series of the SCOOP and STACK basin, no significant post-shut-in performance change should be expected. The results of the preliminary simulation study of NITEC LLC should be extended to include the level of depletion prior to shut-in to establish benchmarks for comparison.

Factors Affecting Reservoir Performance for Long-Term Shut-In Wells

Given the discussions above we present the following list of what factors/conditions may affect the reservoir performance following a long-term shut-in.

1. Geomechanics/Stress Environment (Unconventional Reservoirs). Formation damage due to geomechanical effects are usually observed when pressure drops in the system. One of the most highlighted problems is the damage to fracture conductivity due to fracture closure when fluid pressure declines. During shut-in, the pressure in the fractured zone around wells starts building up and, intuitively, long-term shut-ins are not expected to cause closure of fracture pathways. When the well is shut in, pressure in the fractures is less than the pressure in the matrix and flow from matrix to fractures continues until pressure equilibrates (Zoback et al. 2012). That is, fractures are supported with higher fluid pressure against closure. However, some scale buildup issues, sand settlement, etc. in the fractures may contribute to the process unfavorably. Moreover, due to the poroelasticity of fracture properties, the change of the effective stress state during a long shut-in may alter the conductivity (permeability) of fractures (Wu et al. 2017). Compaction effects are expected to be more important in gas reservoirs such as Haynesville but forced shut-in is not yet an issue in these areas due to gas prices.

2. Water Encroachment. Aside from gravity segregation of water from shallower layers to deeper layers through fracture networks and increased clay swelling due to longer exposure to injection water in some formations, water encroachment in some plays may lead to complex phenomena during long shut-ins. When the wells are shut in for a long time, water keeps moving into the fractures from contiguous formations. Considering the low pressure in the fractures of the SRV, there will be a competition between the water coming from other formations (or beyond SRV) and oil coming from the matrix to feed into the fractures. It is likely that water would be the winner in this process because it will move faster in fractures vs. oil trying to flow from the ultratight matrix. Eventually, when pressure stabilizes in the system, there may be more water in the fractures compared to pre-shut-in conditions. This may cause high water cuts when the wells are reopened but it is not necessarily formation damage. Another related concern is the wettability of the matrix. Most unconventional plays are mixed wet. If there is some affinity to water in the matrix pores, then water may imbibe into the matrix, pushing oil out from the matrix into the fracture system.

3. Fluid and Rock Effects. Due to complex rock texture, mineral composition, and multiscale heterogeneity of unconventional reservoirs, clay-related issues, wettability alterations, salinity differences, capillarity effects and imbibition may induce changes in the formation properties and characteristics during long shut-ins. Wettability is less likely to play a major role in oil-wet reservoirs, such as Eagle Ford, Marcellus, etc., compared to mixed wettability systems such as the Permian. Salinity difference between the injected and formation waters, as in the new wells in Bakken, are expected to have a positive osmosis effect. Natural imbibition, especially in heterogeneous multimodal carbonates and unconventionals, may act favorably during the shut-in, making oil available when wells are opened.

4. Development pattern and order of shutting and re-starting. As noted above from NITEC LLC simulations, the units developed as a section/cube with multitargets (such as in Midland and Delaware) will have more vertical/horizontal connectivity and experience more water-related issues than the units developed with fewer wells. In units developed as a section/cube with multitargets (mainly new wells), not only the question of which wells to shut in but also the strategy to shut in (rotating shut in, shut in fully, shut in shallow formations first or formations that are in communication, outer wells, etc.) will play a critical role in post-shut-in recoveries. The experience with codevelopment well spacing in high-water-producing unconventional plays, such as Delaware Basin, has indicated a significant impact of the order in which the wells are brought on line on individual well performance. In many cases, the last well brought online was also the poorest performer with the highest water/oil ratio (WOR) and lowest cumulative oil production.

5. Condensate Issues. Condensate wells in unconventional plays are not known to be particularly prone to shut-in related problems. On the contrary, it has been indicated in the literature (e.g., Castelijns and Hagoort 1984) that increased reservoir pressure reduces the interfacial tension between condensate and vapor to release the trapped condensate near the fracture faces. Pressure levels to be reached during shut-ins are not expected to be high enough to activate this mechanism. Therefore, not much positive effect should be expected from pressure buildup during shut-ins. However, one caution may be about potential reduction of effective fracture conductivities due to segregation and drainage of heavier condensate into the lower sections of fractures. Other potential effects of long-term shut-ins on condensate wells remain to be explored.

6. EOR/ECR Projects. Currently, there is not enough data to assess the economic viability of EOR or ECR (enhanced condensate recovery) projects in unconventional reservoirs. Moreover, the mechanisms by which recovery enhancements are achieved are debatable (for the fluid in fractures, conventional EOR concepts may be applied; however, considering the fact that the real target of EOR is the light hydrocarbons stored in the extremely tight matrix, conventional EOR mechanisms are not fully capable of explaining any additional recovery). In general, CO2 injection is hampered by accessibility and economic concerns (even CO2 sequestration with government subsidy cannot save the current economic bottom line); and produced gases have been proposed as a viable alternative. If high GOR wells become the victim of shut-in programs, there may be repercussions on the gas injection projects.

Notwithstanding exceptions for individual cases, in light of the above discussion, we believe that reservoir fundamentals (petrophysics, geomechanics, phase behavior, reservoir pressure, etc.) provide a counterbalance to any negative conditions/issues that may arise from long-term shut-ins. Specifically, for wells which were not damaged and/or experienced significant pressure depletion prior to shut-in, we believe that minimal reservoir performance degradation should be expected due to shut-ins. On the contrary, we believe it is more likely that strong producing wells of recent vintage can be expected to return to prior production trends, if not actually experience significant and sustained production performance due to pressure recharge in the drainage volume during shut-in. The most probable exceptions to this expectation will likely be heavy-oil production, cases of anomalous phase behavior (e.g., asphaltene-prone cases), multizone completions, and cases of water invasion/imbibition (which we also recommend as an area for detailed study).

Which Wells Should We Shut In?

Of course, the key question on everyone's mind is: Which wells should we prioritize for shutting in—poor/weak performing wells or strong performing wells? For wells in conventional reservoirs (including offshore), the answer is straightforward: one should follow the established technical and economic criteria for a given installation and/or play. The challenge really lies in the case of unconventional plays. In addition to complex financial considerations (i.e., the cost of operations, "held by production" or lease provision considerations, operations agreements, price hedging, etc.), the criteria we typically use to label poor and strong performing wells based primarily on the observation (or expectation) of short-term recoveries are very likely to be part of the problem.

Here we face the conundrum of large-scale shut-in programs. If we focus on the "reservoir side"—i.e., where poor or strong reservoir performance is due to reservoir quality, average pressure, drive mechanism, etc., and we assume that the reservoir performance will recover from the point where it was shut-in (and may potentially have a period of higher performance due to pressure buildup during shut-in), then older and poor-performing wells are the clear shut-in candidates due (obviously) to the differential between the oil price and operating costs. However; the consequences of preferentially shutting in lower-productivity wells should not be overlooked—there are so many of these wells which contribute considerably to total oil production; once shut in, these wells may never recover, and these reserves are effectively lost. In contrast, the newer and strongest performing wells will be in the accelerated production window and producing the best performing wells during a period of a prolonged low oil prices will likely result in significant lost revenue.

Impact of Long-Term Shut-Ins on Supply and Macroeconomics

If we delve deeper into the question from the standpoints of supply and economics, the fate of the ultralight crude and condensate producing wells will be tied not only to the market demand for gasoline, but also the continuing supply of heavy oil. The light-oil and condensate from unconventional wells yield mostly gasoline but are lacking in middle distillates. Even though the COVID-19 restrictions have temporarily reduced the demand for middle distillates, such as jet fuel, diesel, marine fuel oils, etc., the drop in the demand for gasoline has been more drastic. When economies reopen globally, gasoline and diesel used for personal transport should rebound more quickly than demand for kerosene used in jet fuel.

The other middle distillates used as bunker (shipping) fuel and trucking fuel (diesel) have historically been closely linked to global macroeconomic growth (or weakness) and those refined products have started seeing more pressure very recently and will depend heavily on unemployment numbers, government stimulus programs, and consumer confidence. The remaining refined product demand from petrochemicals and specialty products should also track closely with overall global macroeconomy. Combined with the specific characteristics and unit capacity by region in the US, these considerations lead to the question of how much of what quality crude production will have to be maintained in different regions (Enverus 2020). Although some predictions may be possible in terms of volumes, reflecting these predictions on well-level shut-in decisions will be a highly convoluted problem.

Some collateral effect of light-oil and condensate well shut-ins is expected from the US natural gas supply (Enverus). More than 50% of the natural gas production in the US is derived from associated-oil production. With declining activity and shut-ins, these associated natural gas volumes will also decline. To date, natural gas demand has not experienced as sharp a decline and although the winter in the northern hemisphere is several months away, demand for gas will increase in the winter (even with high storage inventories), and a reduced natural gas supply will not be sufficient to meet peak natural gas demand. This situation is expected to yield higher natural gas prices in the winter of 2020 and very likely into 2021.

Another example of the convoluted nature of shut-in decisions has been discussed by Feder (2020) for various Middle Eastern oil fields. For the prolific conventional fields in the Middle East, there is very little technical concern about shut-ins and startups. The challenge posed by the oil production cuts is the reduction of associated natural gas production, which is a critical necessity for electrical power (example uses include desalinization and air conditioning) and as a feedstock for the petrochemical industry in Saudi Arabia, the UAE, and Kuwait [collectively, these countries provide approximately 10% of the global ethylene supply with limited to no flexibility for alternative feedstocks (Feder). Lighter crudes yield more associated natural gas; and such crudes are also operationally less expensive to produce than heavier and sour crudes coming mostly from offshore fields. Feder quotes from Sadad Al-Husseini, a consultant and former senior executive at Saudi Aramco, that because Arab Light generates more export revenue than Arab Heavy, Saudi Aramco has often concentrated production cuts on heavy-crude production from offshore fields. This may lead to further oversupply of the market with lighter grades and deepening of the crisis for the North American unconventional production.

If the industry continues making its decisions as a reaction to short-term market behavior and current supply-demand fluctuations, there will be bigger crises in the longer term. We should not (and cannot) assume that after this current "perfect storm" of a global pandemic and ensuing economic crisis that "things will go back to normal"—there are longer-term implications on certain aspects of demand (less travel, more "work from home," as well as at least a near-term refocus on gas utilization). What was once perceived as an "unconventionals" revolution has become our most significant challenge as an industry; we now realize that some, if not most, of these wells in unconventional reservoirs are not/were not truly economic in a comparative sense. Wells in unconventional reservoirs tend to have accelerated early production, but have only a 1–5% recovery, and economics for unconventional plays are tied directly to commodity and service prices.

Conventional reservoir EOR projects and waterfloods are better suited for steady performance and under such conditions may achieve up to 65% recovery factors. Further, over the past 40 years there is a strong correlation between early stages of EOR startups and high oil prices. In contrast, many EOR projects have significant lead times and large early investments, which may contribute to further resistance in implementing EOR projects, as the risk and likelihood of payout decreases as the frequency of strong price swings increase.

Life After Long-Term Shut-Ins

The good news is the market is incredibly efficient at pricing in risk and adapting the realities of supply and demand. The US was the largest producer of crude and other petroleum products and natural gas through March of this year. Production will fall in the short term, but the US will continue to be the marginal supplier in the long term because of its supply flexibility. Production activity can be ramped up or down quickly, and this flexibility is a key part of balancing the global market. Commodity prices will recover from here and long-term prices above $50/bbl will return. In fact, prices are likely to return at higher levels than previously expected because of the increased risks presented by two price collapses in less than 5 years and the need for US operators to live within cash flow and generate positive returns. This will likely play out with a higher minimum acceptable rate of return (MARR) threshold. Operators and their investors will require a higher return to offset the increased risk before they drill new wells. This will result in higher commodity prices (Enverus).

For certain, the development of unconventional reservoirs is absolutely viable in a technical sense, but the ability to provide free cash flow and payout remain limited to operators in the very best parts of a given play (i.e., the so-called "sweet spots") and those operators who can manage debt and cost of services. To ensure a more stable unconventionals industry, we need to define productivity based not only on (early) transient production, but we must also assess economic viability based on the sustainability of longer-term production. As a summary comment, it is critical that we use this "once in a lifetime" opportunity to monitor these shut-in wells from a technical perspective using bottomhole pressure and temperature sensors, surface pressure monitoring, and conducting technical studies of well and field performance, as well as take this opportunity to perform maintenance and consolidation of surface facilities.

Despite concerns about the imperfections and shortcomings of production data analysis techniques [decline curve analysis (DCA) and rate transient analysis (RTA)], the current practice of unconventional resource development predominantly relies on information obtained from flowing data. Although pressure transient analysis (PTA), more specifically the analysis of pressure buildup (PBU) data, is typically superior to RTA methods for estimating reservoir properties, estimating average pressure, assessing well interference and drainage area issues, PTA methods are difficult to apply to well performance data from wells in unconventional (ultralow permeability) reservoirs due to the (extremely) long times required for the conditions of applicability to be rigorously met. In simple language, a PBU provides a sort of controlled "stress test" on the reservoir where the "test" is an isolated "event" as opposed to the continuous analysis of the entire production history (this is the definition of RTA).

In fairness, it should be noted that PTA is not simply the analysis of PBU obtained from pressure monitoring for a shut-in well. As noted above, for PTA to be successful, some restrictive conditions should be met (Anderson 2020). Data acquisition during shut-ins provides an opportunity for us to understand the system for better future development decisions, as well as to "view" well interference directly. Given that wells are to be shut in for a variety of reasons, we advise that consideration be given to "premodeling" a shut-in for an example well to assess the viability of obtaining good PTA results. We understand that such a process is idealized, but without some forethought (and premodeling), we believe that trying to analyze PBU data where there was no consideration to timing of the shut-in and no systematic plan for data acquisition will lead to poor interpretations and analyses, as well as nonunique results.

In closing, we also need to comment on water disposal wells, which are a critical component of production capacity for unconventional reservoirs. There is a strong indication that most shut-in wells will return to production with significantly higher water cuts than pre-shut-in period, at least initially. Therefore, we should be concerned about our water injection capacity and the quality of the injection targets. Unfortunately, water injectors usually have little to no information from an aquifer characterization perspective. As comment, we are not particularly concerned about the ability of operators to dispose of produced water in the short term, but we believe that water disposal warrants consideration in the near term after production resumes, but more importantly, in the longer term when field developments are maximized in the next 5–10 years, depending on the specific play. This is a good opportunity to use the shut-ins (i.e., pressure "fall-off" tests as these are known in injection wells) to estimate basic reservoir properties and to optimize injection target development strategies.

In conclusion, there are useful data/information from past experiences, as well as abundant collective knowledge/experience in the industry at present to face the current reservoir challenges of long-term shut-ins. However, it is wishful thinking to expect these prior data and experiences to provide answers/solutions without further detailed case-specific data acquisition and study.

References

Anderson, D. 2020. Leveraging the Combined Benefits of RTA and PTA During Market-Induced Production Shutdown. JPT.

Agarwal, R.G., AI-Hussainy, R., and Ramey, H.J. Jr. 1965. The Importance of Water Influx in Gas Reservoirs, JPT (November): 1336–1342; Trans., AIME, 234.

Castelijns, J.H.P. and Hagoort, J. 1984. Recovery of Retrograde Condensate from Naturally Fractured Gas-Condensate Reservoirs, SPEJ (December): 707–717.

Dujardin, B.O., Matringe, S.F., and Collins, F. 2011. Practical Assisted History Matching and Probabilistic Forecasting Procedure: A West Africa Case Study. Paper SPE 146292, presented at the 2011 SPE Annual Technical Conference and Exhibition, Denver, Colorado, 30 October–2 November.

Enverus 2020. COVID-19 Oil and Gas Fundamentals Update, accessed 12 May 2020, www.enverus.com.

Farouq Ali, S.M. 2016. Effect of Steam Injection Interruption on SAGD Performance. Paper SPE 179853 presented at the 2016 SPE EOR Conference at Oil and Gas West Asia held in Muscat, Oman, 21–23 March.

Feder, J. 2020. Saudi Arabia Faces Challenge in Balancing Deep Oil Cuts With Need for Gas, JPT.

Huppler, J.D. 1974. Scheduling Gas Field Production for Maximum Profit, SPEJ (June); 279–294; Trans., AIME, 257.

Jacobs, T. 2020. The Great Shale Shut-In: Uncharted Territory for Technical Experts, JPT.

King, G.E. and Garduno, J. 2020. Managing Risk and Reducing Damage from Well Shut-Ins, JPT.

King, G. E. 2020. Better Practices for Well Shut-In and Startup, SPE Live Interview by Gibson, D.

Lutes, J.L., Chiang, C.P., Rossen, R.H., and Brady, M.M.1977. Accelerated Blowdown of a Strong Water-Drive Gas Reservoir, JPT (December): 1533–1538.

Matthes, G., Jackson, R.F., Schuler, S., and Marudiak, O.P. 1973. Reservoir Evaluation and Deliverability Study, Bierwang Field, West Germany, JPT (January): 23–30.

NITEC LLC. 2020. Impact of Temporary Well Shut-Ins on Unconventional Reservoir Performance, NITEC LLC Research White Paper by Firincioglu, T., Basbug, B., Freeman, M., Sarak, H., and

Petunin, V. Accessed 23 May, 2020.

RS Energy Group. 2020. Shut-In Showdown Part 2, Learning from the Past. Accessed 19 May 2020. www.rseg.com.

Wu, W., Reece, S.J., Gensterblum, Y., and Zoback, M. 2017. Permeability Evolution of Slowly Slipping Faults in Shale Reservoirs, AGU Geophysical Research Letters, ID: 10.1002/2017GL077506.

Zoback, M.D., Kohli, A.H., Das, I., and McClure, M. 2012. The Importance of Slow Slip on Faults During Hydraulic Fracturing Stimulation of Shale Gas Reservoirs, Americas Unconventional Resources Conference, Pittsburgh, Pennsylvania, 5–7 June 2012.