Writing in the introduction to the 69th edition of the BP Statistical Review of World Energy, the company’s CEO Bernard Looney said, “As the world emerges from the COVID-19 pandemic, it feels like we are at a pivotal moment.”

Whether the world is indeed emerging from the pandemic remains to be seen, although there are encouraging signs. But, given the annual review’s comprehensive collection and analysis of global energy data through 2019, Looney’s declaration that this is a pivotal moment seems accurate. While some aspects of the findings offer encouragement that world energy is moving onto a more sustainable path, others underline the scale of the challenge to reach net zero.

“Net zero can be achieved by 2050,” said Looney. The zero-carbon energies and technologies exist today. The challenge is to use them at pace and scale, and I remain optimistic that we can make this happen.”

According to this year’s review, which highlights the global energy trends emerging prior to the pandemic, growth in primary energy consumption slowed to 1.3% in 2019, less than half the rate of growth (2.8%) for 2018. The increase in energy consumption was driven by renewables and natural gas, which together contributed three-quarters of the expansion. All fuels grew at a slower rate than their 10-year averages, apart from nuclear, which rose at the fastest level since 2004, with China and Japan providing the largest contributions to the increase. Renewables, which contributed their largest increase in energy terms on record (3.2 exajoules), accounted for over 40% of the global growth in primary energy last year—more than any other fuel—and their share in power generation (10.4%) surpassed nuclear for the first time.

Source: BP

On the other hand, 2019 marked the tenth consecutive year that the world set a new all-time high for energy consumption, and oil consumption grew to a new record Although carbon emissions from energy use grew by 0.5% in 2019, compared with 2.1% in 2018, they set a fourth consecutive new all-time high. Average annual growth in carbon emissions over 2018 and 2019 was greater than the 10-year average. Since the negotiation of the 1997 Kyoto Protocol to curb emissions, global carbon dioxide emissions have risen by 50%.

Rapid growth and improving prosperity mean growth in energy demand is increasingly coming from developing economies, particularly within Asia, rather than from traditional markets in the OECD. By country, China was by far the biggest driver of energy, accounting for more than three-quarters of net global growth. India and Indonesia were the next-largest contributors to growth, while the US and Germany posted the largest declines.

Natural gas consumption rose by 2% in 2019 as the share of natural gas in primary energy consumption rose to a record high of 24.2%. Natural gas production grew to a new record, with US production accounting for almost two-thirds of this increase.

Global coal production increased by 1.5%, led by increases in China and Indonesia. But global coal consumption declined by 0.6% and coal’s share of primary energy fell to its lowest level in 16 years. Coal demand in OECD countries fell to the lowest level in the history of the BP review, which dates to 1965. Despite this, total global energy consumption from coal was 27%.

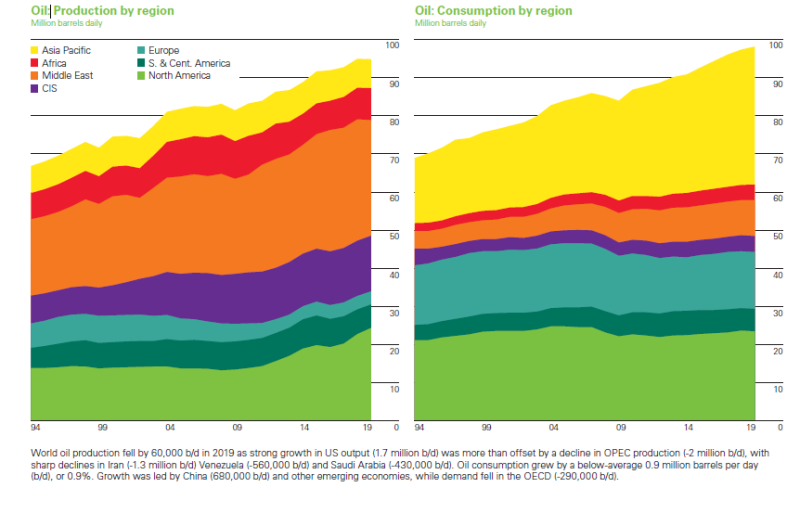

As an overall share of energy consumption, oil remained on top with 33% of all energy consumption. The remainder of global energy consumption came from hydropower (6%), renewables (5%), and nuclear power (4%). But global oil production fell for the first time in a decade, as growth in the US was more than offset by OPEC production cuts. Given the impact COVID-19 is having on the world’s energy markets, BP said it looks like 2018 may stand as the high mark for oil production for at least a couple of years.

Oil remained the dominant fuel in Africa, Europe, and the Americas, while natural gas dominates in CIS and the Middle East, accounting for more than half of the energy mix in both regions. Coal is the dominant fuel in the Asia Pacific region. In 2019 coal’s share of primary energy fell to its lowest level in BP’s data series in North America and Europe.

Souce: BP