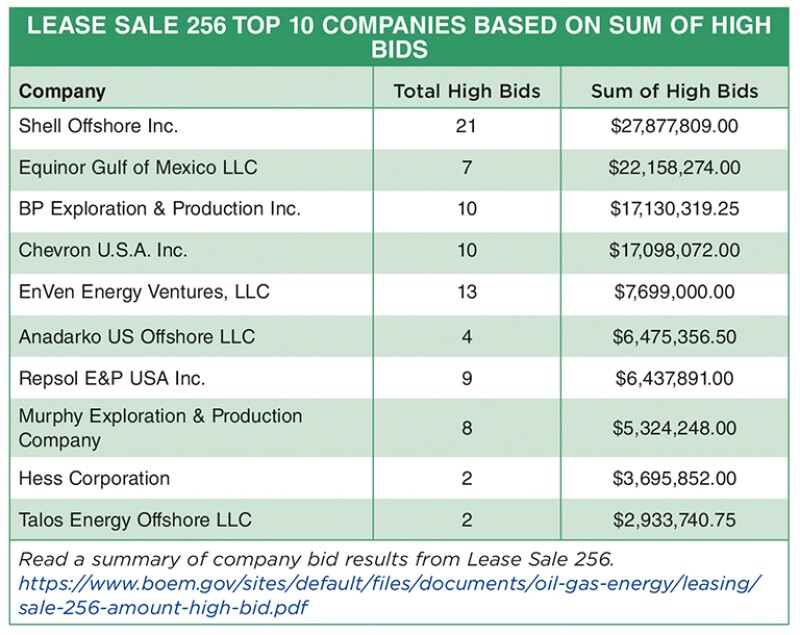

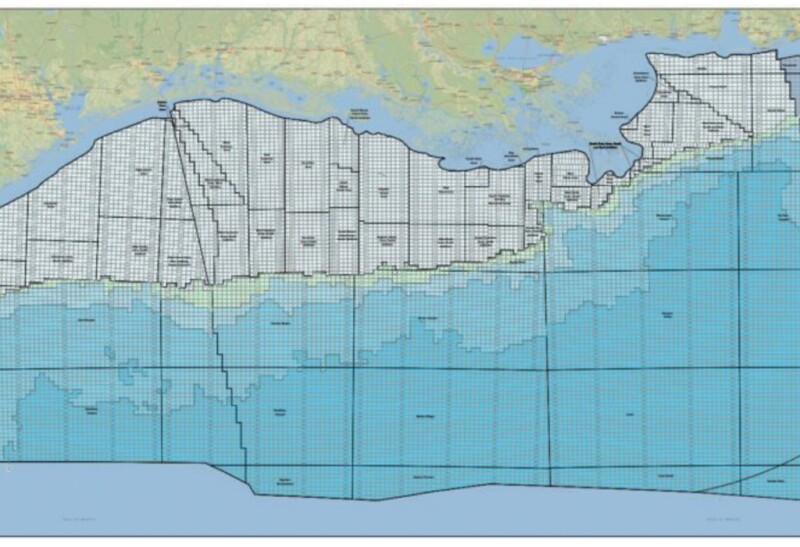

Regionwide US Gulf of Mexico (GOM) Lease Sale 256 generated $120,868,274 in high bids for 93 tracts in federal waters. The sale on 18 November featured 14,862 unleased blocks covering 121,875 square miles.

With $27,877,809 spanning 21 high bids, Shell Offshore Inc. took the top spot among 23 competing companies. A total of $135,558,336 was offered in 105 bids.

Among the majors, Shell, Equinor, BP, and Chevron submitted some of the highest bids. Each company claimed high bids of over $17 million, signaling the GOM remains a priority in their portfolios.

Last year was a record year for American offshore oil production at 596.9 million bbl, or 15% of domestic oil production, and $5.7 billion in direct revenues to the government. Offshore oil and gas supported 275,000 total domestic jobs and $60 billion total economic contributions in the US.

“The sustained presence of large deposits of hydrocarbons in these waters will continue to draw the interest of industry for decades to come,” Deputy Secretary of the Interior Kate MacGregor said.

Still, as Mfon Usoro, senior research analyst at Wood Mackenzie, noted, “Although bidding activity increased by 30% from the March 2020 sale, the high bid amount of $121 million still trends below the average high bid amount seen in previous regionwide lease sales, proving that companies are still being conservative with exploration spend.”

Although the Bureau of Ocean Energy Management has proposed another regionwide GOM lease sale in March 2021, Usoro predicted that Lease Sale 256 “could potentially be one of the last lease sales.”

“With the Biden administration set to inaugurate next year and possibly ban future lease sales, a massive land grab might have ensued,” he continued. “But companies are constrained by tight budgets due to the prevailing low oil price. Additionally, companies in the region have existing drilling inventory to sustain them in the near term. The best blocks with the highest potential reserves are likely already leased. As a result, we do not expect a potential ban on leasing to materially impact production in the region until the end of the decade.”

This was the seventh offshore sale held under the 2017–2022 National Outer Continental Shelf Oil and Gas Leasing Program; two sales a year for 10 total regionwide lease sales are scheduled for the gulf.