Strong development potential exists in the Upper Devonian Woodford Shale of the west-Texas Val Verde Basin with further prospective drilling targets lying above in the Barnett Shale, veteran industry geologist John Van Fleet told the SPE Gulf Coast Section’s Northside Study Group recently. Van Fleet gave a presentation on Kerogen Exploration’s Vista Grande Woodford project, which he served as the company’s new ventures advisory geologist before retiring last year.

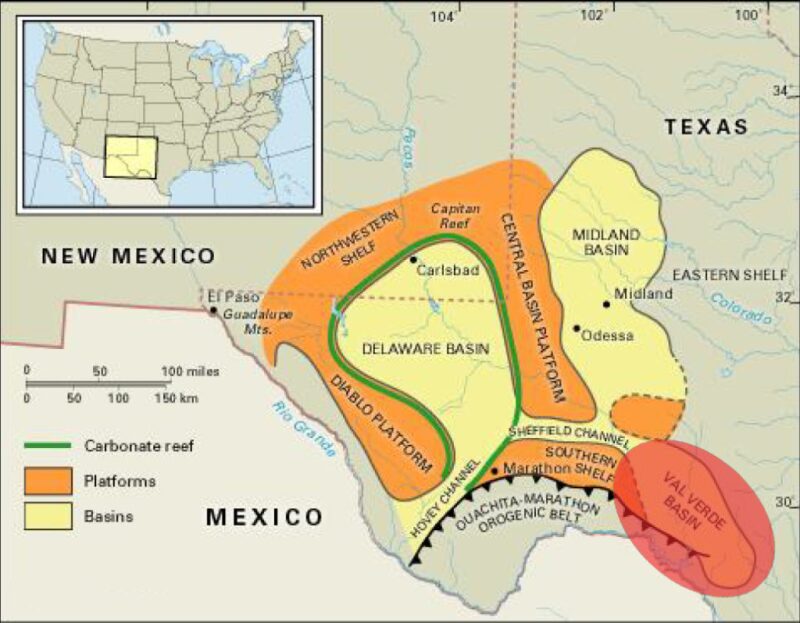

The Val Verde is a sub-basin of the Permian Basin that lies south of the Permian’s Central Basin Platform and north of the Ouachita Thrust Belt.

Kerogen’s Vista Grande acreage holds expected gross and net recoverable resources of 1.4 billion BOE and 1.1 billion BOE, respectively, according to an estimate by Morning Star Consultants. Van Fleet said that Kerogen’s prime area of interest was the wet gas window. However, the estimate included more than 4 Tcf of recoverable dry gas resources, which he described as “upside for when commodity prices recover.”

Three pipelines cross the prospective area and spare capacity is available to carry produced supplies to markets, Van Fleet said.

High-Quality Acreage

“The acreage that we have is all high quality,” he said. “But as any play will have, some is sweet spots and some is just very good. So what I want to emphasize today is there is in this play the potential for hundreds of wells—of drilling locations—that will take a long time to complete.”

Kerogen derisked the project by initially drilling three “science” wells. “We didn’t drill them as you might a development well,” Van Fleet said. “We did a lot of work to try and determine just what we were dealing with, and we believe that we have a discovery. We filed such with the [Texas] Railroad Commission.” The wells were

- Edwards 1H—a 3,500-ft lateral that proved the dry gas window and is producing approximately 1 MMcf/D of gas from only five of 19 hydraulic fracturing stages.

- University FA—drilled vertically into the wet-gas window but plugged and abandoned without being tested for production.

- ACU 37-1H—an 11-stage, hydraulically fractured 2,300-ft lateral that defined the play’s sweet spot for the Woodford and Barnett and proved the wet-gas window through testing. The well is producing 726 Mcf/D of gas and 78 B/D of oil similar in API gravity and BTU content to that in Apache’s recent Alpine High discovery in the Delaware Basin.

Fracture analysis has shown that the optimum drilling direction for Vista Grande laterals is southwest to northeast.

SCOOP, Cana/Woodford Analogs

Van Fleet noted two proven commercial-play analogs to Vista Grande, the SCOOP (South Central Oklahoma Oil Province) play and the Cana/Woodford play in Oklahoma’s Anadarko Basin. He also pointed out that Woodford Shale source rock is found in every producing formation in the Permian Basin.

“The learning curve being what it is, this is going to go from good to much better with time,” Van Fleet said.

Vista Grande appears likely to offer dual, stacked objectives in the Woodford and Barnett shales. Kerogen has highlighted sweet spots “for continuing tests of the wet-gas fairway,” he said. “So we know where we want to go.” That will include drilling in the Barnett, which Van Fleet called “an attractive target (that) just begs to be tested.”

While the most expensive science wells that Kerogen drilled reached costs of USD 16 million–20 million, most wells in the play could be drilled for USD 9 million with typical laterals of 7,000 ft and some up to 9,500 ft, he said.