Colorado oil production is surging to record levels, outpacing the other major producing US states in year-over-year gains on the backs of the steady-and-predictable Denver-Julesburg (DJ) Basin and overlapping Niobrara Shale.

As overall US oil output continues to surge, attention has been drawn to the Permian Basin and SCOOP and STACK plays. Operators have flocked to West Texas, southeastern New Mexico, and central Oklahoma to stake claims to land they believe will usher them into a new, leaner era for the industry. The expansive Permian alone, which covers more than 75,000 sq miles, has accounted for the bulk of US oil production increases and mergers and acquisitions over the last couple of years.

Although they are intertwined and together encompass parts of Colorado border states Wyoming, Nebraska, and Kansas, the DJ and Niobrara offer a fraction of the acreage and prospective resources of the Permian. But the existing acreage quality is high. Relatively few companies have large positions in the region, with leadership of many of those firms having earned their stripes with nearby competitors.

Mike Eberhard, chief operating officer of SRC Energy, previously known as Synergy Resources and one of the region’s largest pure-play firms, explained that the DJ is attractive because “it has a very good rate of return” due mainly to low well and takeaway costs, which makes it competitive with the other major basins. He previously served as completions manager for Anadarko Petroleum’s DJ Basin program.

“We have a very good infrastructure” in the region, he said. “We don’t have a lot of [midstream companies] going over the top of each other, trying to get into the next location. Most of the acreage out here is dedicated for midstream. Everybody kind of knows who has what, and we do development around that.” Meanwhile, “the service sector has been here since the ‘60s.” Denver also serves as a stable source of skilled workers, “so you’re not putting up man camps” like in the Bakken and Permian where labor costs and turnover can be high. “And we don’t make a lot of water with the wells. We don’t have a lot of disposal issues,” which are common in areas such as the Permian.

“The key is the big players—Anadarko, Noble, and PDC—feel the economics compete with the best shale economics anywhere and are continuing to drill,” said William W. Fleckenstein, former interim department head of Colorado School of Mines’ petroleum engineering department. Anadarko, Noble Energy, and PDC Energy also have core positions in the Permian. “Drilling has also improved, and a relatively low number of rigs is driving the increases in wellbores available for completions.” He explained that the basin’s predictability is exemplified through simple drilling, widespread use of monobore completions, demonstrated overpressure, good productivity, and few surprises such as structural issues with faults.

According to data from the US Energy Information Administration, Colorado oil production in December 2017 averaged 430,000 B/D, up 46% year-over-year, dwarfing increases in any of the major oil-producing states. During the same month, the state’s Baker Hughes rig count averaged in the mid-30s, up from the mid-20s a year earlier but markedly fewer than the rig counts of Oklahoma, North Dakota, and New Mexico, for example.

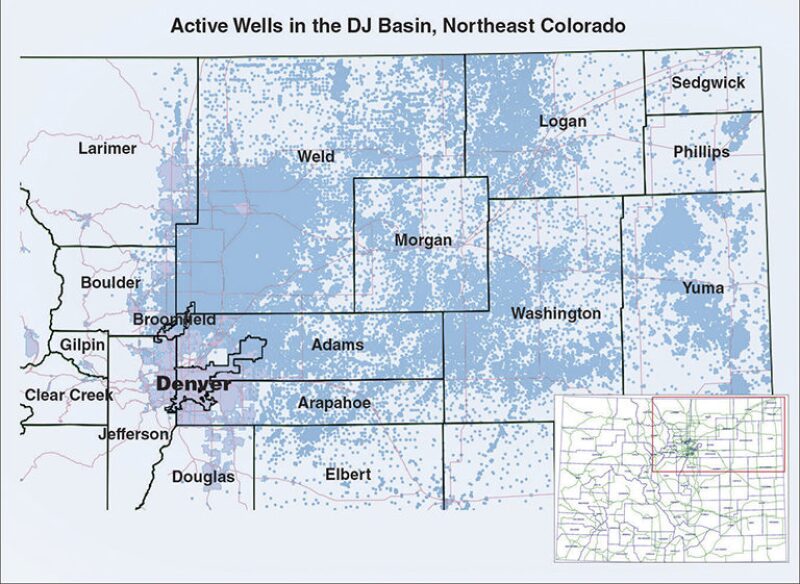

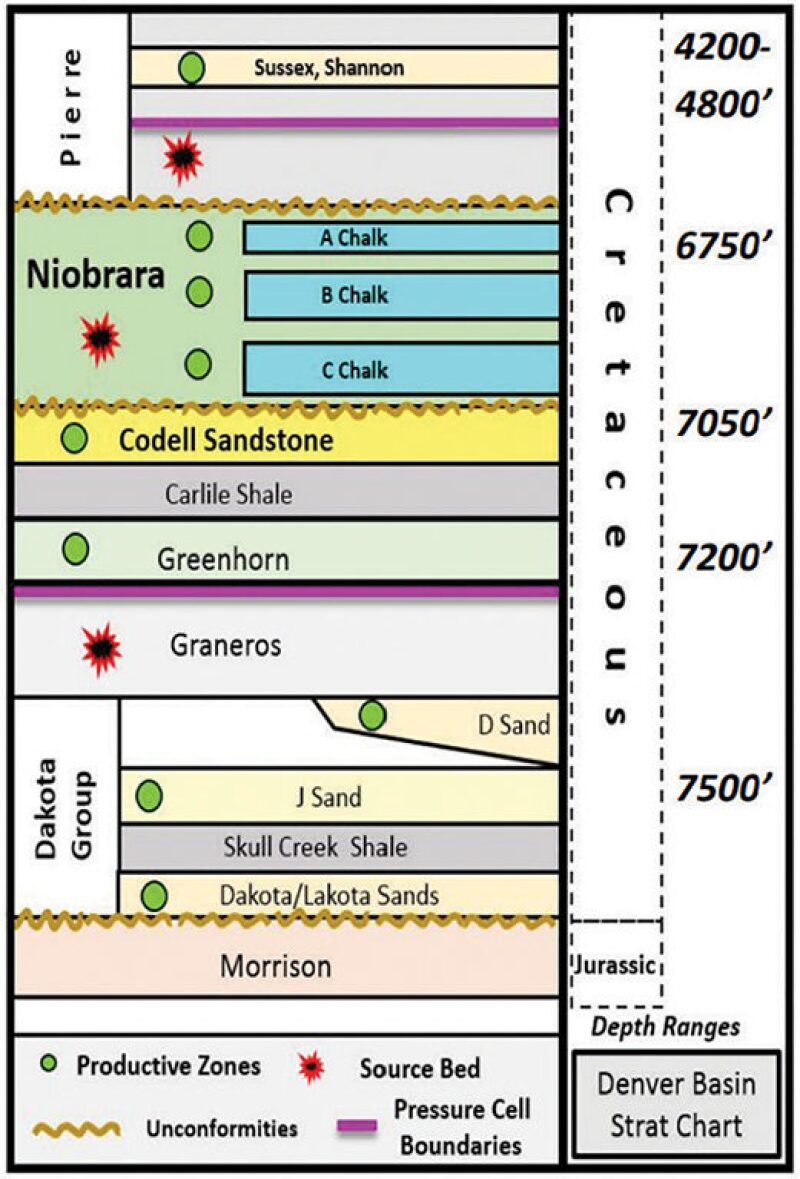

Operators are targeting the Niobrara A, B, C benches and Codell formation, which are mostly in the DJ. Much of Colorado oil and gas development, including in the prolific Wattenberg field, has been just north of Denver in Weld County, but the area north of there has been drawing increased interest in recent years.

“One of the trends that we have been looking at for some time now is a push toward more development at the northern part of the play—basically around the state line between Wyoming and Colorado,” said Pablo Prudencio, Wood Mackenzie upstream analyst, US Lower 48. “This area has been less developed relative to the rest of the play, but we see that there’s some potential, and we expect activity to start heating up [there].”

Jonathan Garrett, research director on Wood Mackenzie’s Lower 48 team, noted the area is “quite rural” and “unexplored,” meaning, “in terms of upside, you’ll see a lot more in that area as opposed to the more developed spots. Obviously the Wattenberg area—the Wattenberg core—and the extension are known as a fantastic part of the play. But in terms of what’s new and what’s next for the Niobrara, that northern section is something worth tracking.”

Fleckenstein said EOG Resources “is having success north of the Colorado border with Wyoming, and that is filtering down into Colorado as well. Bill Barrett just merged with Fifth Creek, a private company, with much of the acreage south of EOG’s Wyoming acreage, and Bill Barrett is ramping up activities as well. The acreage is north of the Denver metro area and is rural, avoiding the issues with urban encroachment, is easily developed with long laterals, and is amenable to shared surface facilities and pad drilling.”

Anadarko’s Colorado Evolution

Anadarko, alongside Noble, serves as one of two big independents with core acreage in the state. “The DJ Basin is one of our most important assets because of our tier-1 position, mineral-interest ownership, extensive infrastructure, and knowledge of the basin that’s been under development since the 1970s,” said Carrie Horton, Anadarko vice president of DJ Basin development.

Horton traced back Anadarko’s genesis as a leading operator in the basin to the firm’s 2000 acquisition of Union Pacific Resource and its more than 5 million acres across Colorado, Utah, and Wyoming. The acreage’s land and mineral rights were granted to Union Pacific Railroad by the administration of President Abraham Lincoln in the 1860s in an effort to encourage investment in a transcontinental railroad.

“This land grant acreage gave us a strategic advantage, enabling us to become one of the largest minerals-interest owners in the tristate area,” she explained. “That means our working interest is 100%, we don’t have to lease the land from other parties, and we receive about a 35% uplift in the net present value of our wells.” Another milestone in the company’s evolution in the basin came through an acreage swap with Noble in 2013, which cored up its position in the Wattenberg. “This created environmental benefits by consolidating infrastructure, which enabled us to be more efficient, take trucks off the roads, and more effectively utilize pipelines for transporting our product and water,” she said.

Horton, who has been with Anadarko since 2000, said “the DJ Basin’s geology is also fascinating. We have multiple stacked intervals of formations—the Niobrara, Codell, and J Sand, to name a few. Those intervals work very well because of the thermal anomaly that goes along with it in this region creating higher-value oil deposits and associated natural gas.”

Anadarko’s acreage on the basin still holds more than 2 billion BOE of recoverable resources even after decades of production, she said. “The increase in estimated resources began to take shape when we began implementing a more consistent horizontal drilling program back in late-2012.” Anadarko’s average DJ Basin production in the third quarter of 2012 was just more than 90,000 BOE/D. In the third quarter of 2017, it was 232,000 BOE/D, an increase of almost 160%. In December 2017, the company’s oil sales volumes surpassed 100,000 B/D of oil, up almost 20% over the previous quarter.

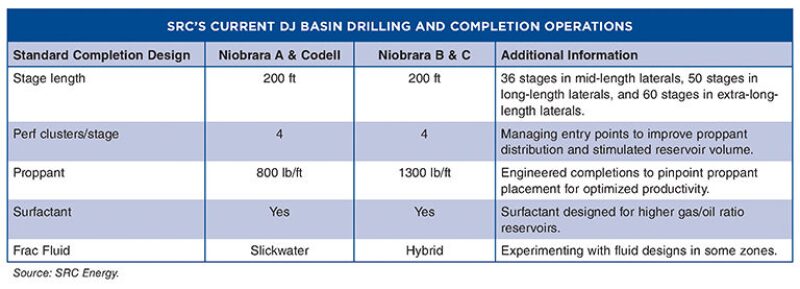

Horton touted the company’s completion design implemented in 2017 that increased its estimated ultimate recovery to 690,000 BOE/well in the contiguous core, an increase of more than 20% over the previous type curve. The design involves “higher fracture stimulation intensity driven by increased fluid volumes and tighter stage spacing. Early results indicate significant production gains and uplift to NPV. This design essentially uses shorter stages, which means we are getting more fractures per well, therefore breaking up the reservoir rocks better and tapping further into those resources.”

Coring Up for the Long Term

Despite spending more than $1.5 billion to enter and expand its position in the Permian’s red-hot Delaware Basin in 2016–2017, PDC continues to direct more than half of its capital expenditure (capex) to its Wattenberg field assets, with production there up more than 30% year-over-year, Fleckenstein noted. PDC is increasing “the lengths on their laterals, and that is positively impacting their economics. Also, I believe the operators are going to more stages and closer spacing with more proppant, and that is also impacting their economics. It is a similar story with all the companies, and enough 30% [year-over-year] production increases drives the state’s production.”

PDC solidified its commitment to Wattenberg early this year when it acquired 8,300 net acres, 240 gross drilling locations, and 30 operated drilled-but-uncompleted wells in the Prairie area from Bayswater Exploration & Production for around $200 million in cash. PDC also exchanged acreage with another Wattenberg firm to consolidate its position in the Plains area.

Those deals were among several struck by big operators in the region during the second half of 2017. In December, SRC closed on its purchase of 30,200 net acres just south of the company’s existing acreage in Weld County from Noble for $568 million in cash. That deal, the second between the firms involving Greeley Crescent acreage since 2016, provided SRC more than 600 gross locations supporting mid- or long-lateral design, multiple development pads already permitted, and high working interest throughout the acreage.

For sellers like Noble, those deals represent a larger trend across not only the DJ-Niobrara but Lower 48 as a whole given new economic realities, Garrett said. “If you want to do something, whether it be accelerate your development program or do a deal, instead of going to the capital markets to get the funding, it looks as though interest should be in noncore asset deals,” he said. Meanwhile, buyers such as SRC seek more contiguous core acreage.

In the case of SandRidge Energy’s nixed $750-million acquisition of Bonanza Creek Energy and its 67,000 contiguous net acres in the DJ’s oil window, Garrett said “it appeared as though doing a deal of that size so close to the emergence from bankruptcy as opposed to focusing first on drilling great wells and creating value,” combined with the valuation “looking a bit rich,” was off-putting to activist investor Carl Icahn, who successfully lobbied against the deal gaining shareholder approval.

Bonanza Creek’s appeal to SandRidge may have been underpinned by Bonanza’s higher estimated ultimate recoveries (EUR) and decreased costs from optimized well designs, said Maggie McDaniel, Wood Mackenzie senior research manager. As with many of its fellow operators in the region, Bonanza continues to test heavier proppant loading and tighter spacing.

In a deal involving former management of Bonanza Creek, the merger of Bill Barrett and Fifth Creek Energy is expected to close in the first half of this year and includes 81,000 net acres in the oil-weighted northern rural areas of the DJ. Fifth Creek has reported “some really impressive” initial production rates of more than 1,000 BOE/D, and “that has really raised the profile” of an area that is part of the Chalk Bluff subplay, McDaniel said. She estimates wells drilled there break even at $45/bbl, which is “why I think you’re seeing an increased interest in the Niobrara. As [oil] prices come up a bit, the Niobrara is becoming less marginal and more competitive with some of the other areas of the country.”

Purple Politics

Colorado is one of the more unique states politically in the US. The “purple state” has a strong mix of Democrats, Republicans, Libertarians, and Independents. There is also a strong divide between the urban and rural portions of the state. While cities such as Denver may generally be unsupportive of the industry, Weld County, where most of the state’s oil and gas activity has been concentrated historically, is overwhelmingly pro-industry.

William W. Fleckenstein, former interim department head of Colorado School of Mines’ petroleum engineering department, said Coloradoans have become more aware of the positive economic impacts of hydraulic fracturing, for example, but there is also “a tremendous number of people who are moving to Colorado” from states without oil and gas operations or an understanding of the industry. The outcomes of the upcoming statewide elections, which includes the governor’s race, could swing legislative sentiment one way or another. Current Gov. John Hickenlooper, a Democrat who once was an oil and gas geologist, has reached his term limit.

The Colorado Oil and Gas Conservation Commission in February approved strengthened rules for design, installation, maintenance, testing, tracking, and abandoning of flowlines after a 3-month review of an April 2017 home explosion in Firestone that killed two men. The incident resulted from a cut flowline at a nearby Anadarko wellsite and prompted the firm to shut in more than 3,000 vertical wells for inspection and repair. Ryan Duman, Wood Mackenzie senior analyst, said, “I think [Firestone] showed how opaque some of that data and information is” with regard to locating and mapping flowlines. “And the fact of the matter is, there have been tons of horizontal and more vertical development over the past 50 years, so as you see suburbs push farther out, it is only a matter of time where you start building on top of old facilities for midstream.”

The encroachment of oil and gas operations on population centers has been a source of anxiety for many residents. Some groups have advocated for a fivefold increase in the state’s setback rule to 2,500 ft, which gubernatorial candidates have opposed. “I think, personally, that it is only a matter of time before that setback rule gets lengthened out to 2,500 ft,“ Duman said.

Providing an operator’s perspective, Mike Eberhard, chief operating officer of SRC, said his company is continually working with regulators to determine how best to work in certain areas. Regarding industry regulations and best practices, “Where Colorado is today, the rest of the nation is going to be in 3 to 5 years,” he said. “So we just have to continue to be good neighbors, continue to listen to the stakeholders, and do what is right. And if we weren’t optimistic [about the political outlook], we would not have just spent another half-billion dollars on acreage.”

Leveraging Economics, Efficiencies To Boost Output

Along with the STACK, the Niobrara has shown the most improvement in breakeven prices among the major US basins, said McDaniel, as DJ operators “are really pushing” EUR and spacing assumptions. Prudencio said the Niobrara has a range of breakeven prices from the upper $30s/bbl in the most productive acreage to more than $50/bbl in other areas.

“But one thing that stands out to us is that if you take the average breakeven for the entire play and you compare it with the average breakevens for the other plays, the Niobrara is remarkably competitive,” he said. “It’s pretty much second only to the Permian if you use this type of analysis. Another interesting data point is we have modeled that about 70% of the resource breaks even below $50[/bbl].”

As for oilfield service costs, “while we were trending down, up until probably the first part of last year or the end of 2016, things are starting to pick back up,” Garrett said. “But we are nowhere near where we were at the peak. So those productivity gains have risen quite quickly, and despite the fact that you see costs pick up a little bit, you can still comfortably drill and complete a well in the Niobrara for less than $4 million depending on where you are and who you are. I think that has really supported the economics there.”

Ryan Duman, Wood Mackenzie senior analyst, said, “One of the things we have seen over the past year, especially in the DJ, is that cycle times for operations have been falling precipitously, with some operators regularly talking about single-digit cycle times for their extended-reach lateral programs—so like 4 to 6 days to drill a 7,000-ft lateral, which is pretty phenomenal and allows you to churn out a whole lot more wells with the current rig count vs. needing, say, 50 or 100 [rigs].”

Eberhard said that while it “used to take 20 days to drill a well, we are getting [it] done in 8 days. Just using the rigs we have here the well count has gone up, even though we have gone to longer laterals. So we are completing a lot more lateral feet than we used to … You have had pretty much a step change going to the monobore completions, with most everybody out here doing that.” And almost all of the acreage is held by production. “There’s 20,000 vertical wells that tie up pretty much everything out here, so there’s not a run to capture acreage” like in the Permian where there’s a certain “one-upmanship” between operators, he said.

SRC in 2018 plans to drill and complete 116 wells—all medium- or long-length laterals, or those around 7,500 ft and 10,000 ft, respectively. With full-year capex at $480–540 million, the firm’s full-year production guidance is 48,000–52,000 BOE/D, about half of which will be oil.

Regarding Colorado’s completions uptick, October state data showed the number of active wells increased by about 1,000, Duman said, noting that Anadarko reported that it dramatically increased the number of wells it turned in line. Operators had a more back-half-of-the-year weighted completions schedule in the DJ, which is why Colorado’s production increase gained particular traction from summer 2017 forward.

Duman expects completion activity this year to continue to outpace rig additions as companies have voiced their top priority of operating within cash flow. “Right now we are expecting 70,000 B/D of growth” in oil production from December 2017 to December 2018, he said.