Unplanned capacity downtime due to equipment problems in onshore and offshore oil and gas production facilities translates not only into decreased volumes of sales product, but also the potential for interrelated equipment or process slowdowns or shutdowns. Compared to the US industrial average downtime ranging from 3% to 5%, the oil and gas industry’s estimated downtime ranges from 5% to 10%, indicating that improvement is needed in reliability and maintenance (R&M) of facilities, equipment, and processes.

Robert MacArthur, head of ABS Group’s asset and maintenance optimization practice, said, “I have been on offshore platforms that were in a crisis mode of operation, running at 30% unplanned downtime.”

He estimated that the oil and gas sector may also fall short in another key performance indicator (KPI)—assets meeting their engineered life expectancy. The industrial sector’s assets last approximately 65% of their expected life on average. “Midstream and downstream asset life expectancy is about 65%, but offshore is estimated to be somewhat lower,” MacArthur said. Although there is no specific KPI for offshore asset life expectancy, the marine corrosive environment likely affects the asset longevity.

Effective management of R&M in production facilities can be challenging for many reasons: the complexity of global operations; remote, isolated facilities; limited or poor-quality legacy data from which to build a meaningful database; and inability to amalgamate existing databases.

Attaining the Highest Production Capacity at the Lowest Cost

To appreciate just how far R&M initiatives have come, consider that 20 to 30 years ago, Six Sigma initiatives, business process reengineering processes, and lean operations were the state-of-the-art in efforts to improve R&M. In the 1990s and early 2000s, supply chain optimization gained favor. These previous efforts improved R&M and added value to the organization.

Major oil and gas companies, for whom 2% capacity downtime due to maintenance represents a significant cost to operations, are now asking, “How can the next 1% capacity improvement be achieved with R&M?”

Citing industrial findings, MacArthur highlighted areas where improvement in R&M is needed. He said that in many operations, 10% of the asset base drives 90% of the cost and operational effects. And while studies have shown that 90% of asset/component failures are random and not based on time parameters, 90% of companies still run a predominantly time-based intrusive preventive maintenance program. The required opening and inspecting of equipment can contribute to its operational failure. He added that predictive/condition-based maintenance is nonintrusive (the equipment is not opened) and better aligned to identify pending failure. Maintenance workers in many facilities and operations average 25% wrench time during their work shifts, equivalent to 2 hours per 8-hour shift; the majority of the remaining shift-hours are spent looking for parts and seeking supervisors’ technical approval or feedback. The average maintenance, repair, and operations supply chains and storerooms are short of critical spares and overstocked by 20%.

These inefficiencies increase downtime and maintenance costs. The capability to identify shortfalls in an organization’s R&M establishes a benchmark of current performance and establishes a baseline from which needed adjustments can be made.

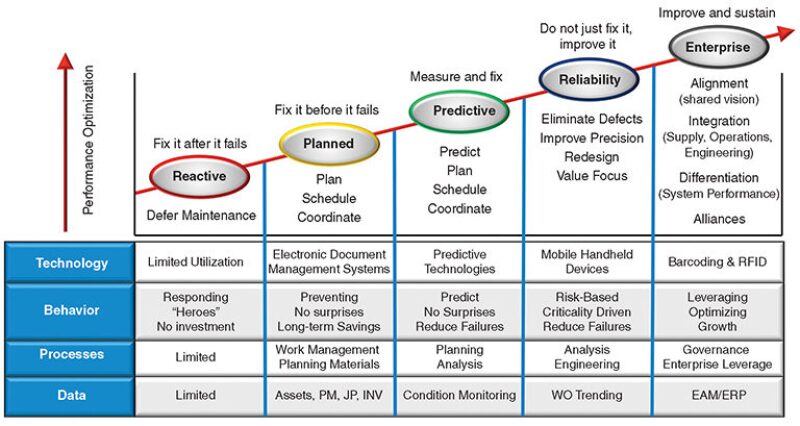

Fig. 1 represents a continuum of R&M programs, ranging from reactive to an integrated enterprise. MacArthur said that 90% of industrial organizations place their R&M in the “planned” category, but concede that from 5% to 20% of their R&M activity remains in the “reactive” category. He said the oil and gas sector generally operates in the same categories, but “offshore and subsea are in the planned category, and are becoming more aggressive and advanced in the types of predictive maintenance used.”

Enterprise Asset Management

In the late 1990s and early 2000s, asset-intensive organizations placed increased value on enterprise asset management (EAM) because of increasing global competition. The ARC Advisory Group recently identified the following business drivers for EAM: reduction of cost for maintenance labor and parts, extension of asset longevity, improvement in uptime, and management of safety and risk factors.

EAM comprises the following components:

- Strategy—includes measurement and tracking of KPIs integrated with resource and planning optimization strategies, such as total productive maintenance. Strategy determines the company’s direction toward achieving its R&M goals.

- Maintenance, repair, and operations (MRO) processes—include work management, inventory, planning, purchasing, and scheduling.

- Technologies—serve as enablers within EAM and include computerized maintenance management systems (CMMS), calibration management software, pressure vessel and valve tracking applications, predictive maintenance software, and handheld devices. These applications use engineering data to provide an automated tool set to support MRO processes while producing empirical data for analysis and KPI tracking.

- Engineering data—electronic data from equipment/assets, inventory stock, operations, resources, and maintenance procedures. Serve as the foundation for the overlaying technologies, which in turn are used to support the MRO processes. EAM strategy implementation is impossible without the engineering data, technologies, or MRO processes.

EAM Implementation

Who are the decision makers for EAM implementation? “Ten years ago, a plant or asset manager made the decision in 70% of the cases. A maintenance manager would often be a champion working to convince a plant or asset manager to implement EAM. In 25% of the cases, it was decided as a corporate initiative. Today, those numbers have flipped. About 90% of the time, we are dealing with an enterprise approach to EAM, usually driven out of the corporate function of operations and production. We are seeing what may be a bellwether. Increasingly at the corporate levels of large industrial companies, there are designated vice presidents of asset management, which was never heard of 10 years ago,” MacArthur said.

Implementation of EAM takes time. In the case of large offshore operators with thousands of assets and people, from 12 to 18 months are required to move from one category to the next in Fig. 1. Moving from the planned to enterprise category is a 3- to 5-year process.

The three steps to advance an R&M program include:

- Benchmarking of the operator’s current status and identifying areas of opportunity for improvement with assessments of R&M strategy, work management, planning and scheduling, organizational readiness, EAM/CMMS functionality and utilization, inventory management, and metrics and performance improvement.

- Plotting the plan/strategy. Each organization has different constraints and conditions. For example, if a CMMS needs to be upgraded, but the company has a large-scale enterprise resource planning (ERP) implementation slated to occur in a year, it may not make sense to replace the CMMS before the ERP. If the work management processes, which are the lifeblood for the data that reliability engineers analyze, are not sound, it makes no sense to hire, train, and put in place reliability engineers. “It’s like building a house. It does not make sense to spend a lot of time on the architectural roof shingles if we haven’t poured the foundation,” he said. The plan fills the identified gaps in R&M to create and sustain the asset reliability, maintenance planning and scheduling, and MRO supply chain programs.

- Implementing EAM. The components of EAM (strategy, MRO processes, technologies, and engineering data) are integrated into the company’s infrastructure.

Case Studies

ABS Group worked with a major oil and gas producer to identify its major safety-related equipment and systems, loading the data to the CMMS, and reviewing/updating maintenance plans to assure the integrity of these assets. Because of the unavailability of the company’s maintenance and engineering resources, ABS Group provided project management, safety, discipline engineers with experience on offshore assets, and process engineers with documentation experience.

The project illustrated the complexity in the components of large-scale R&M programs. It included reviewing 220,000 offshore assets; identifying and categorizing 85,000 safety-related assets; loading information to the CMMS and linking to the producer’s desktop facility status reporting tool; developing 180 safety performance standards for equipment; and comparing and analyzing existing maintenance routines in terms of the new performance standards. All of the above information was linked to the producer’s CMMS.

The producer realized the benefits of all safety-related assets identified and maintained in the CMMS and developed and published performance standards for use in the company. Facility status reporting was functional and rolled out globally.

Another offshore operator sought assistance in the planning and scheduling of several rotating campaign teams working on the backlog and mini-projects that were outside the routine work of the core maintenance team.

The operator requested help in coordinating work packs for offshore teams, which included grouped preventive maintenance work orders for critical systems along with corrective and modification work for the same systems; daily management of team scheduling and reporting of progress against plan and backlog reduction; review and improvement of maintenance routines, scheduling, planned labor/material and maintenance effectiveness for critical systems; development of corporate maintenance strategy related to offshore asset reliability; development of new process flows for maintenance activities; and cleanup of CMMS data in preparation for upgrade of the system.

To date, the operator has achieved a 40% reduction in backlog hours and review/improvement of 20% of the critical system maintenance plans. Preparation and coordination of work packs has been completed for campaign teams through five tours.

Looking Ahead

Over the next 10 to 20 years, new technology capabilities are expected to further expand the potential of EAM, MacArthur said. Today, Web-enabled technology is commonly used, and the use of cloud network technology is growing.

Smart equipment capabilities will also expand, such as GE Measurement and Control’s recently introduced condition monitoring and sensing technologies for the subsea sector. The acoustic leak detection system detects and locates subsea oil and gas leaks by discriminating the noise of a leak from other sources of sound in a 500-m area of coverage by using passive, acoustic hydrophone technology. The company’s subsea multi-domain condition monitoring system combines electric emission monitoring and acoustic hydrophones designed for monitoring the operating condition of subsea machinery and processes. The system performs multi-domain analysis based on pattern recognition and machine learning algorithms to identify and display subsea structure, machine, and pipeline activities and anomalies.