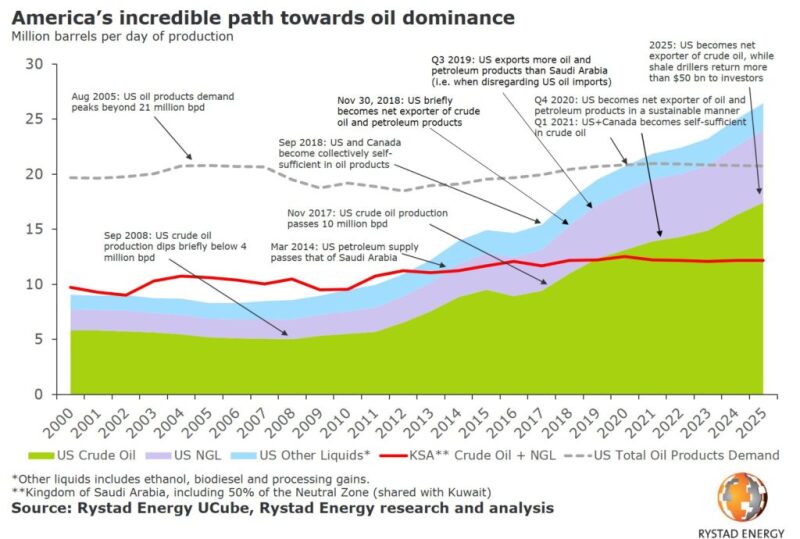

Thanks to the rise of unconventional production in the US, the country will ship more crude oil and liquid petroleum products than OPEC leader Saudi Arabia. This according to Norwegian consulting firm Rystad Energy, which describes the development as “a pivotal geopolitical shift” in a report it issued on 7 March.

The forecast calls for US exports to grow rapidly, partially spurred by competitive pricing relative to Saudi exports.

“The oil market is overly preoccupied with short-term US crude stocks, but the big picture tells a new story,” Per Magnus Nysveen, a senior partner at Rystad, said in a press statement. “Increasingly profitable shale production and a robust global appetite for light oil and gasoline is poised to bring the US to a position of oil dominance in the next few years.”

Nysveen added that the shift in supply has already introduced “dramatic” impacts to the global political and economic scene. “The US trade deficit will evaporate and its foreign debt will be paid quickly thanks to the swift rise of American oil and gas net exports. The tanker shipping industry will see the boom of the millennium, as the excess fossil fuels from America will find plenty of eager buyers in fast-growing Asia,” he concluded.

Saudi Arabia exports about 7 million B/D and an additional 2 million B/D of natural gas liquids, or NGLs, and other petroleum products. The US is exporting just over 3 million B/D and 5 million B/D of NGLs and other petroleum liquids.

There are headwinds facing the US shale sector’s ability to grow, chiefly due to the challenges being faced as most producers move steadily into infill development programs. Overly tight spacing has forced several companies to pull back from their production goals and issue downward revisions to their reserves.

In spite of this, Rystad highlights that new pipelines are bringing more crude than ever before to the export hubs in Texas and Louisiana where at least eight different export projects are in various stages of planning; though experts believe only one or two will be needed to meet demand.

Rystad has listed several other recent developments that support its prediction that the gap will soon close:

- The US Energy Information Agency reported in February that the US exported more crude and petroleum products than it imported.

- Though US crude stocks rose to 7.1 million barrels, exports will pick back up as US demand for imported heavy oil diminishes

- For the past 6 months, Canada has transported enough crude via pipeline to balance the US trade deficit in petroleum products

- US oil production has increased by 2 million B/D last year, on track to add another 1 million B/D this year

- US exports last week reached 3.6 million B/D, offsetting the 3.5 million B/D of crude brought in by tankers