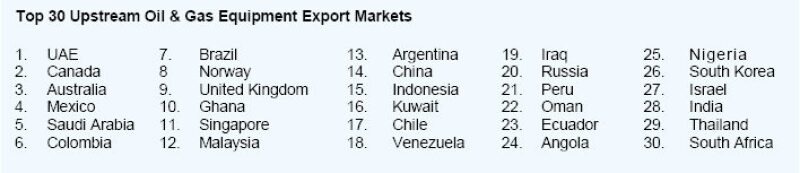

Today, the US is the world’s third largest exporter of upstream oil and gas (O&G) equipment, with nearly USD 23 billion in exports to the world. In a market assessment tool for US exporters, the US Department of Commerce’s International Trade Administration (ITA) ranked 74 markets based on export potential for US O&G equipment through 2019. The ITA defined the equipment industry as engaged in the manufacture of submersible and semisubmersible drilling platforms; O&G field machinery and equipment; O&G field production machinery and equipment; O&G field derricks; and pipe and tube.

Comprising a wide variety of products, the export profile differs considerably relative to other markets. Long-established producing markets may demand capital-intensive, high-tech seismic and drilling equipment, while other markets new to O&G resources seek to import conventional drilling equipment and services for infrastructure development.

US O&G equipment suppliers face strong competition from Chinese and South Korean manufacturers. In some strategic markets, US exporters face local content and labor requirements and other trade restrictions that increase costs and reduce competitiveness. US exports are particularly competitive in high-end sinking and boring parts and parts for derricks. South Korean exports are concentrated in vessels with derricks with few sinking or boring parts. Chinese exports are concentrated in vessels with drilling platforms and equipment and pipe.

The projected increase in demand for US exports of equipment through 2019 is driven in part by the US having been among the first in the world to develop unconventional and ultradeepwater resources. US manufacturers and service suppliers have the opportunity to take the first-mover advantage in international markets that are seeking rapid expansion in energy production.

The share of US equipment as a proportion of world O&G equipment exports has declined, which may be related to the increased consumption of US equipment within the US. It may also be due to greater competition from foreign equipment producers. The international O&G equipment market is characterized by a large presence of heavy manufacturing for ships and offshore platforms in South Korea, low-cost inputs originating from China, and high-tech components and advanced manufacturing from the US, Germany, and Japan.

The ITA forecasts that US exports in the sector will increase in the next 5 years, but the US proportion of the overall world market for O&G equipment will decrease through 2019.