The crude oil and natural gas markets may recover in 2020, but the speed of recovery in terms of pricing will be different. The crude oil market is rebalancing following a recent mild price recovery, but an increase in COVID-19 cases remains cause for concern. Natural gas may not recover until winter 2020/2021 as low prices, weak demand, and ample storage weigh on the industry.

“Each of (the markets) has very different dynamics going on, but they are definitely being impacted by pandemic and demand destruction trends,” said Enverus VP of Strategic Analytics Bernadette Johnson.

Speaking during the virtual 2020 Unconventional Resources Technology Conference (URTeC), Johnson outlined key drivers for the markets.

Oil Recovery and Volatility Expected

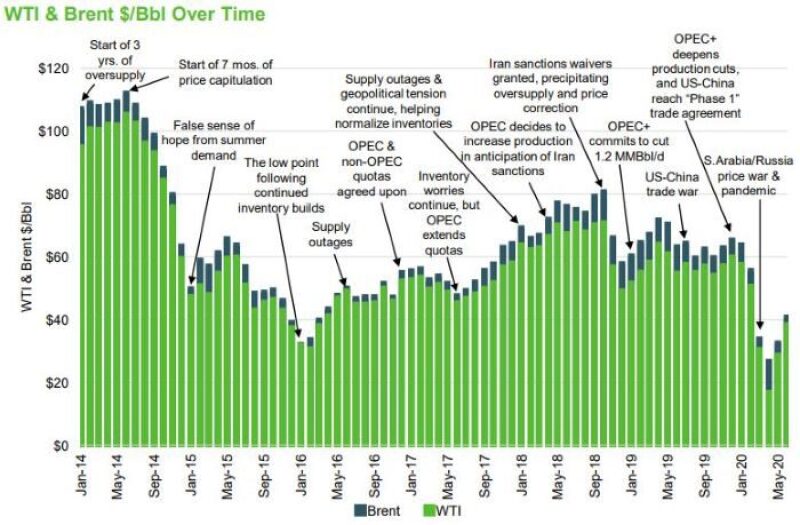

“This [oil] is one of the most volatile commodity markets in the world, so we should expect this going forward,” Johnson said. “Things like a tweet from an oil minister in a foreign country, or a change in OPEC or an OPEC meeting, or even a tweet from our own administration. Those things are going to move oil markets.”

Since trading at $100/bbl in 2014, WTI and Brent crude oil moved between a range of about $35–80/bbl through 2019. After falling into negative territory for the first time in April, WTI prices recovered to $40s/bbl in June after production cuts and a partial recovery in demand for motor fuels.

Enverus remains cautiously optimistic that the supply/demand rebalancing will continue, with much-needed inventory draws coming over Q2 2020, extending into 2021.

After nearly 30 million B/D, or a third of global oil demand, came offline due to the pandemic, OPEC+ agreed to cut production by 9.7 million B/D in May and June. The cartel subsequently agreed to further cuts of 9.6 million B/D in July, and 7.7 million B/D from August through December.

In 2021, OPEC+ cuts of 5.8 million B/D are expected from January to April.

“This is also a strong signal from OPEC that they’re not expecting demand to recover to pre-pandemic levels quickly,” Johnson said. “In the meantime, they need to manage that supply so we can get up to an equilibrium price that the major OPEC+ members can live with.”

The US rig count is another signal that the market is recovering.

In July, the US was running about 270 rigs, which is at the lower level since2016 during the last economic downturn. The Permian had the biggest decline, going from 400 rigs in January to about 150 rigs by June.

Rigs that are drilling wells mostly resulting the drilled but uncompleted (DUC) inventory count. Wells in the DUC count will not be completed until prices rebound sufficiently or crude buyers emerge.

A key question that remains, according to Johnson, is what price would producers need before they start adding rigs?

“We really haven’t seen the rig count increase yet, so the answer is not $40–42/bbl,” said Johnson.

Most US liquids demand recovered from April. Weekly gasoline demand data show a strong rebound from April’s lows, but volumes remain below season levels. Distillate demand also faces headwinds from a weak economy, while jet fuel demand has plateaued.

Transportation accounts for 70% of a barrel of oil, and unless that demand comes back, Johnson stressed there is no real recovery in the market.

Refinery margins are also a key indicator of when refiners may ramp up production.

Monthly refinery margins in the US, Singapore, Dubai, and Northwest Europe dropped to $0/bbl in April. Daily refinery margins for those regions were negative in April, May, and June. PADD 2 margins in the US strengthened in May–June, but coastal markets remain tight, which may limit upside potential for crude prices in the immediate future.

Global crude oil supply must also stay below demand through 2020 and most of 2021 to correct the market.

In Q2, the global market was oversupplied by about 12 million B/D. Forced production cuts and shut ins led the market to be undersupplied by about 2 million B/D in Q3.

Johnson said, however, another wave of COVID-19 or another lockdown in certain US states could saturate the market again and delay recovery further.

The recovery in crude oil is already underway, but the natural gas recovery will take longer.

A Slower Recovery for Natural Gas

Natural gas did not react to the pandemic as quickly as WTI crude. The market remains very bearish, with prices averaging under $2.00/MMBtu in 2020. Demand losses due to COVID-19 have also been higher than production declines.

For US LNG, exports did not fall until May when Europe and Asia began cancelling cargoes on the back of weak demand. Before the pandemic, US LNG exports were about 9 Bcf/D in Q1. By June, LNG exports dropped to 4 Bcf/D, levels not seen since 2018.

Export demand is forecast to increase to 5 Bcf/D during Q3 before increasing further to 7.5 Bcf/D in Q4.

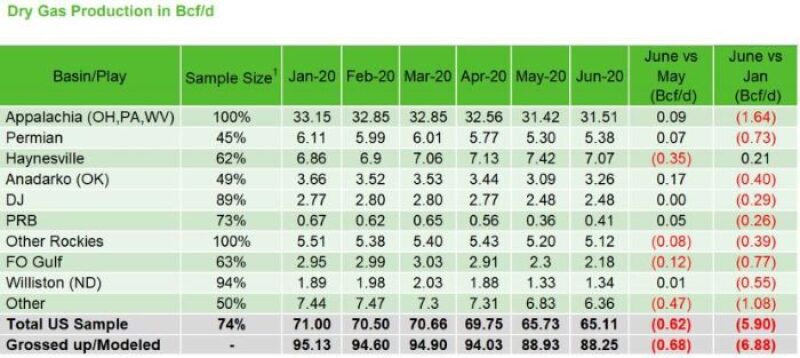

US dry-gas production did not come off until the same time when it dropped from 94.03 Bcf/D in April to 88.93 Bcf/D in May. By June, production was at 88.25 Bcf/D, which was down nearly 7% from 95.13 Bcf/D in January.

Johnson said current production levels are not enough to meet the upcoming peak-demand winter months. Therefore, Enverus expects prices to increase north of $3.50/MMBtu by winter 2020–2021, which may incentivize drilling activity.

Based on breakeven prices under $4.00/MMBtu, the company said production growth will come from the Marcellus/Utica, Haynesville, and Permian plays.

As the crude oil and natural gas sector recovers, Q2 2020 earnings reports will begin in late July with the market expected to focus on curtailments, activity, costs, and liquidity.

A Preview of Q2 Earnings Season

Q2 saw a range of budget fluctuations, bankruptcies, shut ins, and operational disruptions. After WTI hit $40/bbl in late June, Enverus expects optimistic but erratic results, with a continued focus on balance sheet health and hedges to suppress near-term ambiguity.

Johnson noted there was a surprising amount of optimism on Q1 calls amid the pandemic.

Many earning calls discussed lower capital expenditure, development, and production, and hedges providing parachutes. Q2 earnings calls may see operators highlight underspending due to cost savings, provide guidance on growing activity, and balance sheet preservation details.

Curtailments and Activity. Actual volumes shut in are unknown unless disclosed, with mixed results expected to vary by company. Higher-rate horizontal wells are expected to return to production, while vertical wells or lower-rate horizonal production may still compete with variable costs, in addition to the cost to turn production back on. Economics are also expected to be emphasized over volumes.

Costs and Liquidity. Drilling and completions costs were reduced to help restore potential future activity. Operating expenses will be lower due to the shut in of higher-cost production wells, and general and administrative expenses will be lower due to decreased headcounts and renegotiations of contracts.

The big question Johnson asked is how much operations will be able to sustain those low costs going forward.

With borrowing bases slashed and credit capacity for most operators limited, the industry is likely to see plans for potential monetization of assets, halting of buybacks or dividends, kicking debt maturities down the road, and reducing interest expenses.