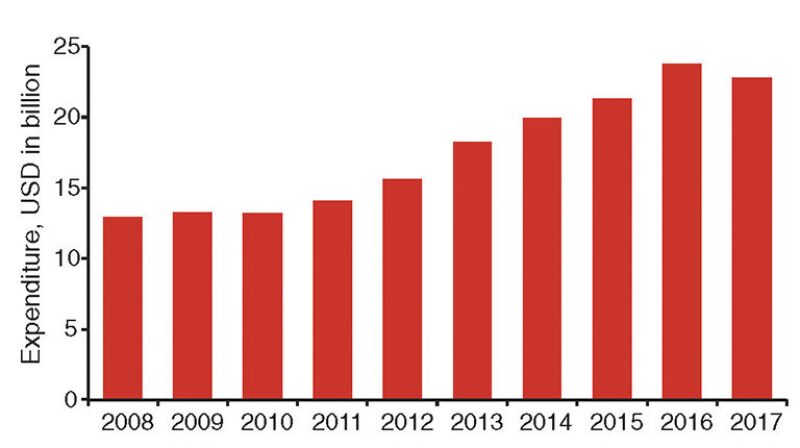

In its latest subsea vessels report, World Subsea Vessel Operations Market Forecast 2013–2017, Douglas-Westwood forecast more than USD 100 billion of expenditure on subsea vessel operations over the next 5 years (Fig. 1). Global demand is expected to increase by 23%. The increase in expenditure is expected to be higher than the growth in vessel days due to the move toward higher specification vessels to cater to deeper and more complicated field development programs.

Day rates for high specification dive support vessels (DSV) and multipurpose support vessels (MSV) are expected to increase by more than 40% by 2017. High specification flexlay day rates are expected to remain similar, while day rates for low specification flexlay vessels decrease marginally. Pipelay vessel rates are expected to increase by up to 8% for high specification, while light well intervention vessel day rates are anticipated to increase slightly.

The deepwater Golden Triangle (Africa, Gulf of Mexico, and Brazil), is expected to account for the majority of global expenditure on vessel operations over the forecast period. North America is forecast to be the largest market followed by Latin America and Africa.

Drivers and Indicators

Global energy demand has grown significantly over the past 50 years and is forecast to continue, driven by developing economies. Oil is a fuel of huge importance mainly because of its role in transportation, where it cannot be readily substituted by alternative energy sources. Oil consumption is forecast to grow from today’s 90 million B/D to 107 million B/D by 2035. Production will increasingly have to come from unconventional sources and also deeper water. This will cause all sectors of the subsea market to increase in tandem.

With the anticipated growth in offshore developments, there are more opportunities for subsea vessels to be used, and because of the move toward deep and ultradeep waters, the need for higher specification vessels is looking positive.

Market Supply

The move toward deeper water activities has rendered some older vessels inadequate. Saturation of sections of the market, particularly for some DSV/MSV, is now evident. Some retention of high demand for flexlay/pipelay vessels remains.

An upside trend of activity is expected in vessels supply. This is largely because of the move toward building higher capability vessels for deeper water activities, but also the retiring of less capable vessels and the need to meet increasing demand in Latin America, Africa, and Asia.

Market Demand

Africa

Africa will remain one of the world’s most significant regions for subsea developments. A large number are currently on-stream and more are planned for the forecast period. Deepwater projects, such as Total’s Kizomba field off Angola (2014), Shell’s Bonga South off west Nigeria (2015), and Total’s Egina field off Nigeria (2014), will increase the demand for subsea vessels.

Total vessel operations expenditure in the 2013–2017 period is approximately USD 16 billion, a significant increase from the preceding 5 years, and is anticipated to be largely driven by the requirements for higher specification vessels in the deepwater regions.

Asia

Over the next 5 years, field development activities in the Asia region will also increasingly require vessels with deepwater capabilities. Production has, until recently, been restricted to shallow water fields, but there are now a number of deepwater projects producing or under way. Vessel demand is expected to see strong growth with developments such as Shell’s Gumusut (Malaysia), Chevron’s Gehem and Gendalo (Indonesia), Salamander’s Bualuang (Thailand), Reliance Industries’ MA-D6 (India), and CNOOC’s Xijiang 32-1 (China). Expenditure is expected to increase by a compound annual growth rate (CAGR) of 11% over the next 5 years.

Australasia

Australia’s offshore oil and gas reserves are found in the Bonaparte, Browse, and Canarvon basins off the west coast, as well as in the Otway, Bass, and Gippsland basins off the southern coast. Large shallow water gas developments will continue to dominate subsea activities off the west coast of Australia until 2016. There are no visible projects in 2017, but major projects are due to come on-stream beyond the forecast period. Field development will account for the largest demand for subsea vessels in the region followed by inspection, repair, and maintenance (IRM) activities.

Eastern Europe and Former Soviet Union

Vessel demand is expected to be driven by ongoing pipeline projects in the region, while field development activity is expected to remain sporadic over the next 5 years. The subsea sector is relatively small in the region with lower demand than in other regions for vessels that carry out field construction, IRM, and subsea intervention tasks. Vessel demand is expected to exceed 20,000 days over the next 5 years.

Latin America

High specification vessels are required as this region continues to develop deepwater assets and move toward ultradeepwater (depth>2000 m), such as Petrobras’ pre-salt basins. A large amount of deepwater production has already occurred in Latin America, the majority of which is off Brazil. Companies include BG, BP, Chevron, Devon Energy, Petrogal/Galp, El Paso, Pemex, PDVSA, Petrobras Repsol, Shell, Statoil, and Total. Expenditure in Latin America was left relatively unscathed by the economic downturn.

The region is expected to have the largest vessel spend, led primarily by Brazil, and is forecast to grow strongly, accelerating from 2014 onward because of an increase in field development activity. Vessel day demand from 2013 to 2017 is expected to increase by more than 65% from the previous 5-year period.

Middle East

Subsea expenditure in the region will continue to be driven by shallow pipelines and fixed platforms, with just one subsea tree slated to be installed from 2013 to 2017. Beyond that time, spend is expected to be driven by three deepwater fields, all of which are located off Israel. The Middle East has a relatively small base of subsea infrastructure, and there are no visible field development projects over the forecast period with vessel demand mainly coming from pipeline projects. The region is expected to have a relatively low spend, some 4% of the global total.

North America

Over the next 5 years, subsea expenditure in the region is expected to be dominated by deepwater developments, predominately in the US Gulf of Mexico. North America will also remain one of the world’s most significant regions for subsea vessel demand and expenditure, because of the IRM needs of the massive installed base of offshore infrastructure. Total expenditure from 2013 to 2017 is expected to be the largest of all the regions.

Norway

Norway is a mature region with much shallow water production, but little deepwater activity to date. Thus, expenditure will arise from projects in water depths of 250 m to 500 m. In total, vessel spend is set to decrease by a CAGR of 2% over the forecast period. This is because of the lack of visibility of pipeline construction projects in 2017. Vessel demand is forecast to peak in 2016 because of an anticipated increase in pipeline activity that year. Overall activity in the next 5 years is expected to be driven by IRM as field developments and pipeline activity fluctuate.

United Kingdom

The UK is a mature region with much shallow water production and field developments that use subsea trees, typically tied back to existing infrastructure. Shallow water developments will continue to dominate UK subsea expenditure. Vessel demand is driven by IRM activities on existing infrastructure in this mature market. Over the forecast 5-year period, expenditure and vessel demand for both IRM and field development will account for more than 45% of the total.

The Rest of Western Europe

The rest of western Europe is also a mature region, with shallow water production and little deepwater activity to date. However, there are potential deepwater gas developments in the waters of the eastern Mediterranean Sea. Apart from those, the maturity of the infrastructure in the region means that IRM plays a significant role in vessel demand.