As oil fields throughout the world are reaching maturity and requiring the use of secondary and tertiary recovery techniques, oil companies are looking for new processes and technologies to extract more oil from these aging fields.

In the next 20 years, an estimated 50% of waterflooded fields will need to shift to enhanced oil recovery (EOR). Carbon dioxide (CO2) has proved to be an almost ideal EOR medium for a broad range of reservoir types and conditions, yielding increases in recovery of up to 15% of oil initially in place.

Most of the experience with commercial CO2 EOR has been gained in onshore oil fields in the United States, particularly in the Permian Basin of Texas, where nearby sources of natural CO2 gas and an extensive CO2 transport infrastructure are available.

“Onshore CO2 flooding is economical at CO2 costs of around USD 35 to 40 per tonne and an oil price of more than USD 75 per barrel,” said Richard Doidge, director of the TriGen CO2 removal technology program at Maersk Oil. “Where natural CO2 sources are not readily available, CO2 may today be sourced from petrochemical and pre- or post-combustion capture plants, for example. However, these capture methods typically yield CO2 prices of USD 80 to 120 per tonne, which would make CO2 flooding uneconomical.”

A ready but limited source of low-cost CO2 can be obtained from facilities, such as ethanol, petrochemical, and gas-to-liquids plants, but the bulk of globally emitted industrial CO2 comes from power production and heavy industries, such as steelmaking and cement production.

There are three main approaches to removing or “scrubbing” CO2 from feed or flue gases: precombustion, post-combustion, and combustion. Because of the oxygen required in the combustion mixture, the combustion methods are usually called oxy-fuel processes. The efficiency of these processes depends on, among other factors, the concentration of CO2 in the feed or flue gas and the pressure at which the contaminated gas is treated.

Significant efforts are being made to improve the cost and energy efficiency of CO2 removal technologies. A number of pre- and post-combustion removal processes using membrane, solvent, or cryogenic technologies have proved to be technically viable to varying degrees. Post-combustion plants at industrial scale have been built that can handle large volumes of (flue) gas. The typical cost of the CO2 produced from these plants ranges from USD 80 to USD 120 per tonne (Kapteijn et al. 2012).

Of the three types of CO2 removal technology described, oxy-fuel is the least developed. A major challenge it faces is the high energy consumption of the air separation unit that generates the pure oxygen required by the process. In addition, oxy-fuel concepts that use atmospheric indirect fire methods tend to suffer from low power-cycle efficiencies. However, pressurized oxy-fuel cycles can potentially offer superior thermodynamic efficiencies because the processes operate at higher temperatures and pressures.

New Oxy-Fuel Process

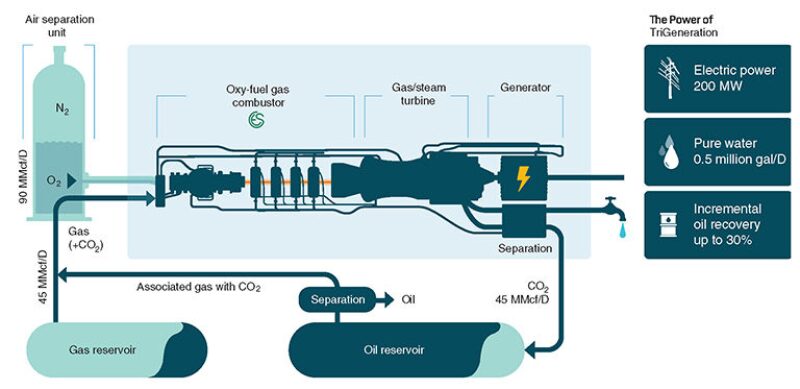

The combustor design for achieving stable combustion of oxy-fuel mixtures under pressure has proved to be a challenge, as has the materials science involved in handling the extreme temperatures. But a solution is now emerging with the Maersk Oil TriGen plant technology (Fig. 1), which burns gas with pure oxygen to produce electricity, clean water, and CO2. Because the process captures the CO2, the power generated is emission-free. The CO2 is “reservoir ready” and can be used for EOR or sequestered underground.

“TriGen is an innovative pressurized oxy-fuel concept that has the potential to reduce CO2 cost by as much as 50%, particularly when compared with state-of-the-art post-combustion capture technologies applied to power generation,” Doidge said. This could make CO2-based EOR cost-competitive in many fields where it has not been previously, including fields where little or no CO2 has been available nearby.

Maersk acquired license rights to the pure oxygen combustor from US-based Clean Energy Systems in 2011. The combustion units used in the system burn natural gas with pure oxygen under high pressure, drawing on technology from the space industry. Since obtaining the license rights, Maersk has collaborated with other companies to find ways of significantly increasing the efficiency of the power production. “We are convinced from a technical point of view that we will have units to sell to the market in 3 to 4 years,” Doidge said.

In addition, he said that the characteristics of pressurized oxy-fuel combustors make the technology uniquely suited for CO2 EOR and enhanced gas recovery (EGR). “The combustor can efficiently handle a broad range of gas and liquid fuels of varying quality, and the CO2-contaminated associated gas from EOR production can also be used as fuel gas,” Doidge said. Fuel feed to the combustor can contain up to 90% CO2, have high water content, and vary from low to high heating value.

“The combustor can be operated at close to stoichiometric conditions, thereby producing high-quality CO2 and pure, boiler-quality water,” Doidge said.

Global Field Opportunities

Maersk believes that the new technology could fulfill promising field opportunities around the world as the company aims to enhance oil recovery, unlock stranded gas fields, and generate zero-emission electricity for local consumption.

In the Middle East, Maersk is investigating whether the low-cost CO2 generated by the system can enable EOR projects. Gulf countries have increasingly focused on clean energy, while many of their oil and gas reservoirs are suited for CO2-based EOR and nitrogen or CO2-based EGR.

In addition, many of the hydrocarbon resources in the region contain sour gas, which is difficult and expensive to extract and process. Maersk believes that the TriGen technology offers an opportunity to produce clean power and clean water. Nitrogen, a byproduct from the production of pure oxygen, and CO2 could be supplied to oil fields—nitrogen to maintain reservoir pressure and CO2 as the EOR agent to coax oil into production that otherwise would not be recovered.

Pilot Projects Sought

As its CO2 removal technology is maturing, Maersk has begun seeking locations for pilot projects and it is in discussions with a handful of potential candidates for the first project. The company’s own fields are unsuitable for the technology, Doidge said, as most are being waterflooded and are not ready for tertiary recovery.

Speaking at the Abu Dhabi International Petroleum Exhibition and Conference, Doidge said that Maersk hopes to bring the technology to Abu Dhabi. Currently, the emirate is evaluating potential partners who can help it to increase production capacity from 3 million BOPD to 3.5 million BOPD. For example, building seven TriGen units potentially would enable Abu Dhabi to boost production by 50,000 BOPD through carbon injection and thereby help the emirate meet its target.

While the plant technology has yet to be tested at a commercial scale, it is designed to be capable of producing up to 200 MW of power and a supply of clean water for industrial or agricultural use.

Aligning Stakeholders

A successful project would also require the alignment of stakeholders, such as oxygen suppliers and electricity buyers. “It’s a significant evolution of the business models that we’re used to,” Doidge said. “So one of the big challenges that we are preparing for is the commercial engineering of TriGen. You simply must have an alignment of stakeholders to ensure that you create a big enough pie for all to share.”

Reference

Kapteijn, P.K., Kutscha, E., and Perron, J. 2012. A Breakthrough Oxy-Fuel Technology for Cost-Effective CO2-Enhanced Oil Recovery. Paper SPE 162541presented at the Abu Dhabi International Petroleum Exhibition and Conference, Abu Dhabi, UAE, 11‒14 November.