In a very brief amount of time (geologically speaking), the exploration and production energy business has dramatically shifted to an unconventional universe where geologic risk is low, completion technology is arguably as important as the geology, and where favorable economics are the well-honed byproduct of cost reduction, sweet spot definition, drilling and completion efficiency, and midstream transmission.

Surprises in Success and Failure

Having spent our entire careers (more than 40 years each) in the upstream business, it is important to step back and look at the big picture every once in a while. We have seen many exploration paradigms broken—resulting in the birth of deepwater exploration, subsalt development and, most recently, unconventional shale development. We have also seen the demise of some false saviors along the way such as the Atlantic Tethyan reef play, Destin Dome off the Gulf Coast, Mukluk in the Beaufort Sea, the lowly Lodgepole play in North Dakota, and post-sanction exploration in Libya, to name a few. Whether successful or otherwise, all of these exploration concepts required creative thought and a willingness to invest capital into what could ultimately become a commercial venture.

Midstream Infrastructure Affects Upstream Viability

Incumbent with any success was the realization that whatever was discovered would need to be successfully commercialized via transmission to market. To quote an ancient industry cliché: “We are not here to find oil, we are here to make money.” The same holds true for extracting oil and gas from rocks that are so tight that 30 years ago any one of us would have been fired for bringing up the subject. Here, we attempt to look at the evolution of resource plays in light of the availability of midstream infrastructure.

It is important to realize that successful and commercial unconventional plays benefit in many cases from midstream activity that occurred decades earlier. For example, the infrastructure developed in the Permian Basin many years ago has reduced the risk in unconventional reservoir development and allowed that development to rapidly expand (and, incidentally, is also keeping prices suppressed). Without the long-dreaded geologic risk, we do not talk about dry holes anymore. We talk about noncommercial wells.

These are also our observations: Infrastructure and the midstream sector go hand-in-hand with democracy and development; the transmission of hydrocarbons (in particular gas) has been a force of stabilization and peace in the existing world; and commercial production will happen when conditions are right. What we will present here are truisms that many might feel as so self-evident that they do not need to be stated. The truth is they need to be reiterated to give a better historical and holistic context to the world we live in.

Maxim # 1: Anti-uniformitarianism

As we know, not all basins are created equal; many are genetically linked to the extent that they have similar histories and depositional sequences. When it comes to the relationship between these basins and today’s unconventional resources, we need to understand that many prospective basins were deposited as a string of pearls, the consequence of tectonic/orogenic events at a given time in geologic history.

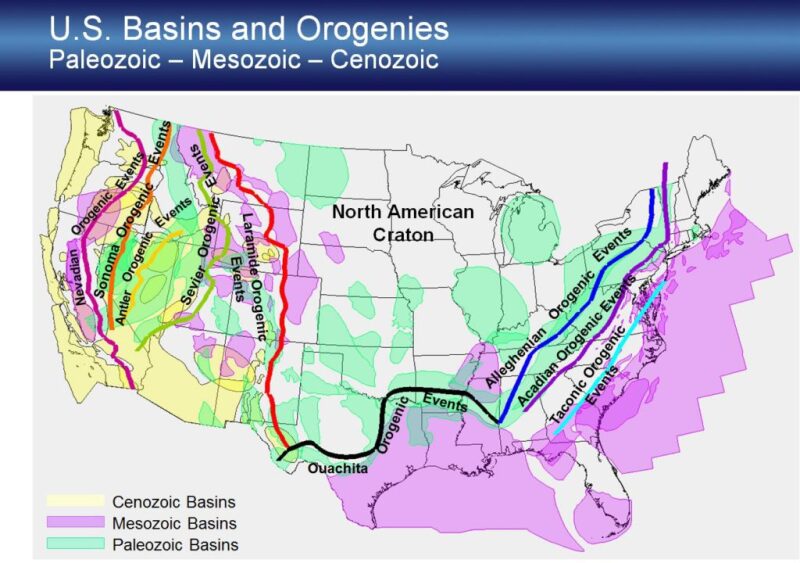

In their excellent catalog of sedimentary basins of the US, Coleman and Cahan (2012) published a list and map of all US basins by tectonic origin. If one superimposes the leading edges of major orogenies over these basins (Fig. 1), it is plain to see this link between basin position and its formative tectonic events. Case in point: The Paleozoic basins in the northern and southern Appalachians and in the Ouachitas all form trends. Without getting into the details, some basins in these trends have evolved into oil and gas provinces, while others have not. The evolution into an oil and gas province is often a function of viable conventional reservoir rocks deposited later in the basin history. Many nonproductive basins lack these conventional reservoirs, but share similar source rock deposition during the early anoxic events. Needless to say, the basins with conventional production have midstream infrastructure and the nonproductive basins do not—even though there may be unconventional potential.

Organic-rich shales in each of these basins have, in many cases, benefitted from the same anoxic events caused by the same eustatic (global sea level change) events or similar tectonic conditions. Hence, several heretofore unproductive basins along a trend might have potential for unconventional production.

The concept of “uniformitarianism” that all geologists first learn is that “the present is the key to the past.” With all due respect to the sacred laws of geology, we propose the concept of “anti-uniformitarianism” and the theorem, “the past is the key to the present,” to better understand the economics of unconventional plays.

Unconventional reservoirs work because they have, in principle, low geologic risk, are conformable throughout the basin and are predictable (at least according to some engineers). We know this is not entirely the case, but for the moment, let us go with that assumption. The unconventional reservoir can ultimately be understood and mastered by the drillers and petroleum engineers. The commercial goal is to progress the unconventional play into a cookie cutter development. This is certainly true in the Permian and the Williston basins and to a lesser extent in the San Joaquin Basin. However, the same principles may not apply to the North Park Basin in Colorado. Here, similar geologic conditions exist as in nearby productive Niobrara basins but the basin is subeconomic (even though it has some very good wells) because of a lack of pipeline infrastructure.

The economics work in these productive basins and plays because there are good rocks, good saturation, and best practices in drilling and completions. But are these enough? In this cookie cutter world of predictability we must consider whether infrastructure, a huge investment, is already there. Much of the infrastructure used today that makes the projects work was born in the day of old-fashioned conventional structural/stratigraphic traps associated with old-fashioned petroleum systems, conventional sand, and carbonate reservoirs. Source rock has always been the chief deity in the petroleum system pantheon, flanked by the lesser gods of trap, reservoir, and seal. In the game of inches that is unconventional shale economics and production, having existing infrastructure is a huge advantage.

Maxim #2: Oil is an International Commodity, Gas is Local

In the US, we are drowning in our own success—especially in gas. The unconventional revolution began in the US tight basin-centered gas play in the late 1990s and early 2000s. The main play was in the Cretaceous foreland basin fairway corresponding to the shedding of deltaic sands off the Laramide-formed early Rocky Mountains. As a result of this play, geologists and engineers were educated in the new concept of minimal tight gas drainage, overlying water contacts, and hydraulic fracturing. The play was the beginning of the gas revolution and quickly spread to other basins in the US.

The US is now well on its way to energy independence and lower natural gas prices. It did not matter what the Japanese or Argentines were paying for gas. Supply and demand was king on the local US gas stage. Gazprom might have been overcharging Europe, and the Argentines may have been paying a healthy rate to the Bolivia–Brazil pipeline, but this had no relevance to the US. The US has been drowning in gas ever since then.

Keep in mind that many of these plays were overlain or underlain by conventional, commercial reservoirs.

Infrastructure—especially in the Gulf Coast and East Coast—is ubiquitous. Tight sand and shale gas are abundant throughout the country, and the laws of supply and demand dominate. Gas prices are expected to stay low for the foreseeable future. If the industry is blessed with a cold winter, there will be an uptick in gas prices that is quickly squelched by oversupply. Demand will have a hard time catching up with supply.

How does liquefied natural gas (LNG) fit into all of this? In countries with huge gas reserves without a strong market either inside the country or immediately across its borders, LNG has provided a mechanism for moving gas reserves over large distances or through terrain that would not be conducive to traditional infrastructure. LNG prices have dropped considerably over the years but whether they can make a dent in the oversupplied market is problematic. Recent economic forecasts suggest that LNG will become globally more significant over the next 20 years, but LNG costs are presently too high to impact the US gas market.

Maxim #3: Gas Infrastructure and Democracy are Partners

Democracy stimulates gas production and infrastructure development. Oil is an international commodity and gas is local.

Let us consider hypothetical Country A in which a government fully controls the oil and gas market. The country is rich in oil and gas; however, oil production goes directly from the wellhead to the market in a government-protected pipeline. Government take is extremely high to subsidize the government, finance the elite, and supplement select Swiss Bank accounts. Gas reserves are more trouble than they are worth as volumes are insufficient to support a commercial LNG venture. Outside of the largest cities, electrical infrastructure is minimal and conditions are hard. The government lacks incentive to provide a nationwide electrical grid requiring pipelines, power plants, and power lines for the people, as this would divert resources from the elite. Although the leaders may pretend to be populists, very little of the nation’s resources are being diverted to the people.

Hypothetical Country B, however, has a representative government where the resources of the country are utilized for the development of the people (and the personal profit of capitalists). The government strives for transparency. Elections are scheduled. Precious oil revenues are utilized to develop gas reserves and build power plants. Ultimately, it is hoped that industry will be able to use this cheap power to make life better for the people. Without the development of the gas infrastructure, this dream of a better life for all may not exist in Country B.

We contend that too little attention has been focused on the value of international gas as an agent for stabilization, prosperity, and peace. The term “stranded gas” reflects a situation in which this resource could not be easily monetized and was subsequently ignored. Despite a discounted value compared to lighter crudes, heavy oil in our hypothetical Country A may still garner much more attention than the gas because it can be more easily monetized.

Maxim #4: In Deference to the Laws of Thermodynamics

Like thermodynamics, commercial production seeks to follow a path from high density to lower density. Where there is a lot of gas, one would want to transport it to where gas is scarce and people are willing to pay for it. This is the basis of the LNG business, but also the motivation for many important long-transmission gas projects such as the Brazil–Bolivia pipeline, West Siberian gas to Europe, and the Dolphin Gas Project that ships natural gas from North Field in Qatar to the UAE. More recent is the movement of natural gas from Texas into Mexico.

In addition to being commercial ventures, these projects reduce stranded gas, providing regional prosperity and ultimately more stability (Bolivia and Chile’s historical and confrontational relationship notwithstanding). All of these projects required creative thought, huge amounts of capital, and the confidence in regional stability. The geologists did their part and even though they had been looking for oil when they found gas, the projects evolved into commercial ventures nonetheless.

Ultimately is it difficult to determine the worldwide future of unconventional plays.

The US is farther down the road than many other oil and gas producers—a function of technology, need, and opportunity. It is a function of a society in which technology has made gas a viable and affordable energy source in the community, and governance has enabled the development of gas transmission infrastructure.

There is an overprint from decades of existing infrastructure and pipelines that make it easier to develop these resources.

The geology demonstrates that where you have producing basins, there will very often be unconventional plays, be they oil or gas. The future requires an integrated effort on the part of the geologists to understand the potential, the engineers to develop them, and the midstream people to creatively get them to market. Where the economics make sense, these resources will benefit the community; where they are currently marginal or submarginal, we will do what we always do: try to make them work.

Looking to the Future

It is important to remember that the motivation for finding and producing unconventional resources is to make money. To do that, the venture must meet or exceed some specified economic hurdles. Having infrastructure already in place is a huge step in getting there. Potential exists for unconventional plays throughout the US due to the combination of the right geology and existing infrastructure. Economics are precarious in many cases but can be positive where the geologic risk is low and a given play is predictable.

The midstream is an important and indispensable component of the economic equation. To make viable basins with unconventional potential work, operators are making great strides in lowering costs across the board.

In recent months drilling and completion costs have dropped dramatically and the learning curves are much farther along. This is probably a good time to look at these “new” basins where acreage is cheap and the rocks are favorable. These new basins will probably require a successful oil play for development to commence and would need some support from higher oil prices down the road.

As for gas, there will always be a market; however, gas prices will be suppressed for a long time. Outside of the US, the formula for commercial success dictates finding the best rocks in a basin that is already productive. This has worked in the Vaca Muerte in the Neuquen Basin of Argentina and should work for the La Luna shale in Colombia. In Argentina, gas is still a good investment as its largest gas field Loma de La Lata is in decline and the country is relying on Bolivian gas. Mexico’s unconventional potential is somewhat problematic as evidenced from the results of their recent bid round. The Burgos Basin may be their best hope for unconventional gas.

The opening up of huge oil and gas reserves found in unconventional resources should ultimately be a huge boon to civilization. In the US, we are approaching the once untenable dream of energy independence, while in the developing world oil and gas resources will provide a much needed shot in the arm for struggling economies. If gas infrastructure is created, the development of unconventional oil and gas resources will provide people with access to fuel, electricity, clean water, and ultimately, industry and jobs. In this environment there will be greater stability and prosperity.

Brian Casey is a senior research geoscientist at Texas Oil and Gas Institute. Before this, he retired from Occidental Oil and Gas (Oxy) as the exploration manager for CO2 Sourcing. Casey began his career at Uranium Exploration in 1978. After working as a development geologist on Shell’s California fields, he joined Barry Petroleum and a year later Oxy. At Oxy, he worked on offshore field developments in Aberdeen, development projects in Venezuela and Bangladesh, and geological assessments of acreage in Libya. Casey held managerial roles at Oxy and was geoscience manager for Oxy Oman, chief geologist and exploration manager in Houston, and chief geologist in Bogota. He holds an MSc in geology from the University of California, Riverside.

David DeFelice is the director of Geoscience for University Lands within the University of Texas System. His current role is to help in the development of the Lands’ 2.1 million acres in the Permian Basin. DeFelice has been a petroleum geologist for more than 35 years. He started his career at Mobil Oil Corporation as a geologist in the federal waters of the Gulf of Mexico. In 1980 DeFelice joined Occidental Petroleum and over the course of his career has served in several managerial positions, including exploration manager for US, Brazil, and South America; worldwide chief geologist; business development director; and global new ventures manager. He received BS, MS, and PhD degrees from Brooklyn College, Duke University, and Florida State University, respectively.