The oil and gas industry is unique: It is subject to constant scrutiny and regulation from multiple angles. It consists of two distinct cultures, one in the corporate setting and the other in the field. It can also be exceptionally lucrative at both the company and investor level. In addition, the oil and gas sector differs from other industries in the way energy companies are valued by the financial community.

A company is valued for many reasons—to determine its ideal corporate structure, to gauge its appropriate level of capital funding, or to determine its appropriate price when it is part of a merger or acquisition transaction. Establishing a company’s value is important because it allows accurate assessment of its ability to handle debt, estimation of anticipated return on investment, and approximation of its market value.

How Most Companies Are Valued

Generally, three basic approaches are used when valuing a company.

- The income approach, which attempts to estimate the present value of future cash flow

- The asset approach, which establishes the net fair market value of a company’s existing assets

- The market approach, which uses data gathered from similar companies or industry transactions to apply metrics to the subject company

Often, more than one method is used, and the eventual final value is derived from or converges on the values from all the methods used.

Two key concepts used when valuing a company are

- Earnings before interest, taxes, depreciation, and amortization (EBITDA)

- Enterprise value (EV)

There are many other applicable and useful data points, but EBITDA and EV are used throughout many applications and industries to extrapolate helpful valuation metrics.

EBITDA is typically adjusted to account for nonrecurring or unusual items, such as extraordinary expenses incurred from shutting down a division or cleaning up after a natural disaster. EBITDA is often used as a proxy for cash flow because the idea behind it is to derive a value that can be viewed on an impartial basis, neutralizing the effect of the company’s capital structure, entity structure, and asset base.

EV is essentially the company’s equity plus debt minus cash, or the market value of the company.

Both EBITDA and EV, along with other figures, are used in the valuation process to establish useful metrics and benchmarks.

Income Approach. The income approach is designed to estimate the future cash flow a firm can expect to generate.

A common income approach valuation tool is the discounted cash flow (DCF) model. A DCF model starts with determining a company’s free cash flow, which is calculated as earnings before interest and taxes (or 1−tax rate) + depreciation and amortization − increase in working capital − capital expenditures.

Once free cash flow is determined, one can project the estimated future cash flow over a certain period of time—typically 5 years because it is difficult to have earnings visibility much beyond that—and then discount the cash flow to the present value to account for risk and inflation. This is referred to as the cumulative present value of free cash flow.

The final step is to determine a terminal value by applying a multiple to the final year’s projected EBITDA. The terminal value must also be discounted to present value.

The summation of the cumulative present value of free cash flow and the present value of the terminal value yields the enterprise value.

For example, if you want to value a juice company, you may need to be familiar with the volatility of apple juice prices in China or the company’s ability to expand operations to other domestic geographies.

But, ultimately, you want to get a handle on the present value of anticipated future cash flow the company expects to generate as well as market trends for similar companies.

A DCF model could be used to determine the present value of future cash flow, which is important because a dollar of earnings today is typically worth more than a dollar of earnings tomorrow due to inflationary and other systemic risks. Also, establishing the present value of anticipated cash flow allows you to see how much debt the company can handle as well as how much cash will be available to fund growth and distribute to shareholders.

Asset Approach. If you opt to use the asset approach for valuing the juice company, you would essentially look at determining the fair market value of the company’s tangible assets less liabilities.

If a company has no liabilities and its assets consist only of 10 industrial blender tanks with a fair market value of USD 5 million each, the asset approach would yield a value of USD 50 million.

The asset approach often generates a value that is less than other methodologies, and it can fail to adequately account for intangible assets But it is more objective and relies on the concept that a rational investor will not pay more than the replacement value of the assets.

Market Approach. An evaluator may also use the market approach to value a company.

One way to do this is by looking at the company’s historical and/or projected EBITDA and then applying a multiple of EV/EBITDA derived from similar companies or industry transactions, to establish a range for the company’s enterprise value.

For example, if the subject company has an estimated EBITDA of USD 100 million for the current fiscal year and similar companies have recently sold for multiples of 9 or 10 times EV/EBITDA, you may have a proxy for the value you can expect to get in the market.

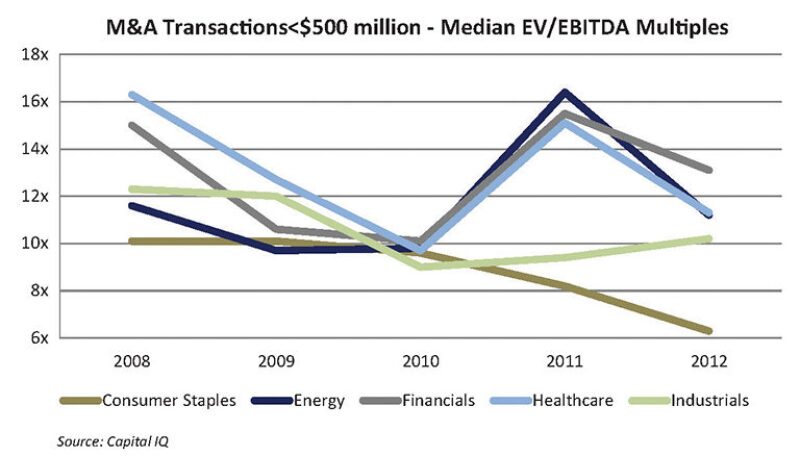

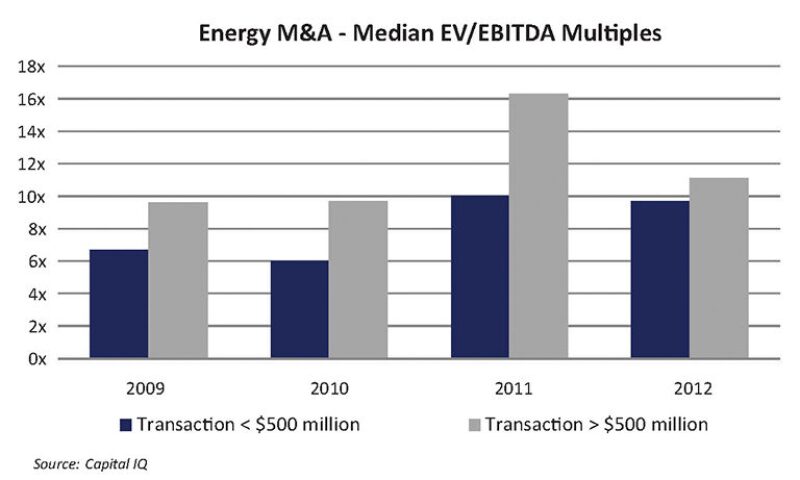

That said, each industry has its unique dynamics, and median industry values often move independently of one another.

As an example, consumer staples valuations have not rebounded over the past 2 years as they have in many other industries. However, continued mergers and acquisitions growth surrounding the expanding organic and specialty niches may ultimately reverse this trend.

Figs. 1 and 2 show charts reflective of recent median multiples in the energy sector as well other industries.

It should be noted that not all types of companies are valued using the same methodology or metrics. For instance, using EV/EBITDA multiples to value a financial institution would not be ideal. Banks use different accounting methodologies and carry much more debt than most other companies and, therefore, are more balance-sheet-centric. Financial institution valuations often rely upon equity-based metrics, such as return on equity and price/book value multiples, because a financial institution’s debt can be difficult to quantify and categorize.

Real estate investment trusts (REITS) are valued using metrics such as price/adjusted funds from operations, which accounts for depreciation, property sales, and capital expenditures.

Many industries have unique characteristics and metrics, and the oil and gas industry is no exception.

How Oil and Gas Companies Are Valued

Energy companies perform many types of work, and some energy companies are more integrated than others. As such, the way an energy company is valued varies depending on the company’s operations.

Exploration and production (E&P) companies are very capital intensive and rely heavily on their existing reserves, their ability to replace depleting reserves, and the price of natural resources. Investors will likely want to know the current and estimated future value of a producer’s reserves, which are depleting and subject to commodity price risk.

Oilfield service companies, for example, are typically valued more like traditional companies, with one main difference—commodity risk arising from the likelihood oilfield service companies’ earnings will follow the same general path as natural resource prices.

E&P

A key component of an upstream company’s continued success is its ability to replace diminishing reserves with cost-effective new reserves and resources in hopes of sustaining both production and cash flow growth. When considering how to value an E&P company, it is imperative to look at the company’s operations as well as anticipated future financial performance when compared to the metrics of peers.

Reserves. Reserves are generally viewed as either producing or nonproducing. Proven, producing reserves are currently generating EBITDAX, which is similar to EBITDA but neutralizes exploration expenses. Developed wells that are not producing are not generating EBITDAX but are expected to generate cash flow at some point in the future. Undeveloped reserves may or may not ever generate cash flow. When valuing an E&P company, it is important to get an idea about the estimated life of its proven reserves as well as estimates regarding nonproducing reserves.

As previously referenced, an important component often considered when evaluating E&P companies is EBITDAX (earnings before interest, taxes, depreciation, amortization, and exploration expenses). A common metric used to evaluate an E&P company’s cash flow is EV/EBITDAX, which yields a multiple by which comparable companies can be evaluated. Other commonly used metrics factor in the net asset value of a company’s assets and barrels of oil produced per day.

Once you have well-reasoned and defendable numbers, such as projected EBITDAX, projected reserves, and estimated production, you can start to value the company using different methodologies. For example, using the market approach, you would apply metrics derived through analyzing comparable company data to arrive at a valuation range. If you were to analyze a set of 10 comparable companies and the current EV/EBITDAX multiples for the set range from 2.25x to 2.75x, you can establish a range as a starting point to determine the subject company’s value.

Oilfield Service Companies

Oilfield service company valuation is generally similar to that for nonoilfield-related companies—the main difference being the inherent commodity risk, which may reduce the company’s value given the level of uncertainty around future earnings and natural resource prices. As such, multiples may be lower or a larger discount factor may be attributed to future estimated earnings to account for the increased risk to earnings.

In addition to other external factors that impact most other industries, oilfield service companies are often at the mercy of underlying commodity prices. For instance, pressure pumping companies must deal with oil and gas prices as significant revenue drivers because their services might not be used if a producer needs to conserve cash by slowing hydraulic fracturing efforts.

Other factors affecting company value—which can lead to capital constraints—are also present, such as contract disputes and a highly competitive landscape.

Currently, for example, pressure pumping companies are dealing with declining margins in the US because strong competition and readily available equipment drive pricing downward. As a result, capital markets have recently appeared to tighten their reins in providing equity and debt to pressure pumping companies.

Not an Exact Science

Valuing a company is sometimes more art than science, and many factors can affect value. It is difficult to predict the future prospects for any company or industry, and the oil and gas sector can be especially challenging. Pending government regulations or an incident exclusive to a specific region or company, such as the Deepwater Horizon accident, can negatively impact the entire industry.

Alternatively, a new shale discovery or advancements in production technology can ultimately lead to higher valuations due to optimism about potential future earnings.

Individuals and firms often look at many different methods when valuing a company, so they do not rely too heavily on any one method because of the uniqueness of each situation and each company. But there are tried-and-true methodologies that allow an evaluator to arrive at a value that is defensible and aligns with current market data, even when dealing with the ever-changing and multifaceted landscape of the energy sector.